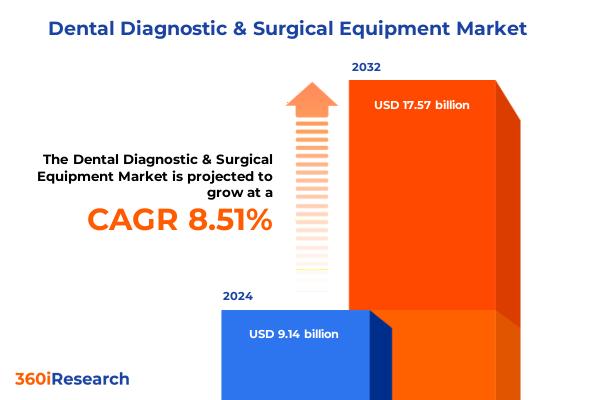

The Dental Diagnostic & Surgical Equipment Market size was estimated at USD 9.85 billion in 2025 and expected to reach USD 10.62 billion in 2026, at a CAGR of 8.61% to reach USD 17.57 billion by 2032.

Unveiling the Critical Role of Advanced Diagnostic and Surgical Equipment in Shaping the Future of Dental Care Delivery

The dental field has experienced a profound transformation as advanced imaging and surgical solutions become indispensable to practice success. Technologies such as cone beam computed tomography and high-definition intraoral cameras now allow practitioners to visualize complex oral structures in three dimensions, ushering in an era of unprecedented diagnostic precision. By integrating these sophisticated systems with digital workflows, clinicians can streamline treatment planning, reduce chair time, and minimize the need for repeat procedures. This fusion of imaging prowess and clinical application has elevated patient care standards while redefining how dental professionals approach both routine and complex cases

Exploring the Technological Revolution Transforming Dental Diagnostics and Surgeries Through AI, 3D Imaging, and Minimally Invasive Innovations

The dental equipment market is in the midst of a technological revolution, as artificial intelligence and machine learning now underpin next-generation imaging and surgical platforms. AI-enabled CBCT systems can automatically identify anatomical landmarks, detect pathologies, and generate diagnostic reports with a speed and accuracy that outperforms traditional manual interpretation. These capabilities not only enhance diagnostic confidence but also optimize clinical throughput by reducing scan times and limiting unnecessary radiation exposure.

Parallel to imaging innovations, digital restorative workflows are streamlining the design and fabrication of prosthetics and surgical guides. Cloud-based CAD/CAM solutions equipped with AI-driven margin detection and automated design proposals support same-day restorations, enabling clinicians to offer patients expedited treatment without compromising quality. The integration of 3D printing into these digital ecosystems further accelerates production of surgical guides, temporaries, and custom instrumentation, solidifying the role of digital workflows as the linchpin of modern dental practices.

Assessing the Far-Reaching Effects of 2025 United States Tariffs on Dental Diagnostic and Surgical Supply Chains and Cost Structures

In 2025, the United States implemented a series of tariffs that have reverberated across the dental diagnostic and surgical equipment sector, elevating costs and complicating supply chain logistics. A 25 percent duty on imported diagnostic and surgical instruments, including CBCT scanners and rotary instruments, has prompted manufacturers and distributors to reassess sourcing strategies. Concurrently, a 20 percent tariff on medical consumables such as surgical drills and burs, alongside a 15 percent levy on raw materials like specialized alloys and polymers, has compounded procurement challenges for dental practices and healthcare providers alike.

Trade negotiations temporarily reduced U.S. tariffs on select Chinese goods from 145 percent to 30 percent for a 90-day window, offering short-term relief to manufacturers reliant on Chinese-sourced components. Nevertheless, brands with significant exposure to high-volume, low-margin products-such as rotary burs and generic handpieces-have reported margin compression and supply delays. Conversely, premium device segments, notably CBCT imaging systems and surgical robotics, have demonstrated resilience due to diversified sourcing and stronger pricing power. U.S.-based producers, including firms with domestic manufacturing footprints, have seen opportunities to capture market share as clinics and hospitals prioritize supply chain stability.

Decoding Market Segmentation Insights Across Equipment Types, End Users, Technologies, Distribution Channels, and Usage Modalities

Across the spectrum of diagnostic and surgical equipment, the market divides into two primary categories: diagnostic devices encompass CBCT systems, intraoral cameras, ultrasound units, and X-ray imaging platforms, while surgical offerings include electrosurgical units, laser systems, piezoelectric instruments, and rotary devices. Stakeholders must recognize that diagnostic systems dominate initial investment phases due to their central role in treatment planning, whereas surgical systems drive the procedural enhancements that define minimally invasive interventions. End users range from ambulatory surgical centers to dental clinics, hospitals, and specialty practices, each exhibiting distinct purchasing behaviors influenced by procedural volumes and clinical complexity.

Advanced technologies, including chairside and lab-based CAD/CAM systems, CBCT and intraoral imaging, Co2, diode, and Erbium lasers, as well as ultrasonic scalers and surgical tools, underpin today’s competitive landscape. Distribution pathways span direct sales, hospital distributors, and online platforms, the latter divided between manufacturer websites and third-party e-commerce channels. Furthermore, device modalities split into portable handheld and mobile trolley units versus stationary floor-mounted and tabletop configurations, offering practices the flexibility to tailor equipment portfolios according to spatial, operational, and budgetary constraints.

This comprehensive research report categorizes the Dental Diagnostic & Surgical Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Modality

- End User

- Distribution Channel

Illuminating Regional Dynamics Impacting Dental Equipment Adoption and Growth Across the Americas, EMEA, and Asia-Pacific Markets

In the Americas, robust clinical infrastructure and high per-capita healthcare spending drive accelerated adoption of advanced diagnostic and surgical solutions. The United States remains the epicenter for technology validation, yet Latin American markets are emerging as growth frontiers due to expanding dental service networks and increased public-private investments in oral healthcare. Regulatory frameworks that support expedited device approvals further incentivize manufacturers to prioritize launches in North American markets.

Europe, the Middle East, and Africa present a mosaic of opportunity, where established Western European countries lead in digital dentistry uptake, while Middle Eastern and African regions are investing in healthcare modernization projects that include high-end imaging installations and minimally invasive surgical capabilities. Collaborative partnerships between device makers and regional distributors play a pivotal role in navigating diverse regulatory landscapes and optimizing market entry strategies.

Asia-Pacific remains the fastest-growing region for dental equipment demand, propelled by rising disposable incomes, expanding urbanization, and government initiatives aimed at improving oral health services. Countries such as China and India are witnessing significant investment in digital dental infrastructure, while Southeast Asian markets are progressively adopting portable and cost-efficient solutions to serve both metropolitan and rural clinics.

This comprehensive research report examines key regions that drive the evolution of the Dental Diagnostic & Surgical Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Strategic Partnerships, and Competitive Strategies in Dental Diagnostic and Surgical Equipment

Leading equipment manufacturers continue to differentiate through relentless innovation and strategic collaborations. Planmeca has captured industry attention with its low-dose CBCT platform that merges smart positioning algorithms and adaptive noise reduction, thereby enhancing diagnostic clarity while prioritizing patient safety. Vatech’s modular dual-sensor CBCT system exemplifies the shift toward flexible imaging platforms capable of delivering panoramic and 3D scans within a unified workflow. Carestream’s pediatric-optimized imaging unit responds directly to growing demand for child-focused diagnostics, offering sub-15 μSv dose protocols suited for younger patients. Meanwhile, Meyer Dental’s AI-powered annotation tools accelerate image interpretation by dynamically labeling anatomical landmarks with near-clinical accuracy, reducing clinician workload and report turnaround times. NewTom’s voice-guided, motion-compensated scanners further underscore the industry’s commitment to user-centered design, minimizing repeat procedures and optimizing throughput in busy practices.

Beyond imaging, device portfolios are expanding to include integrated laser and ultrasonic systems that cater to both soft tissue management and precision bone cutting. Companies are forging alliances with software developers to embed cloud connectivity and AI-driven analytics into their platforms, thereby unlocking new service revenue streams and strengthening post-sale engagement through remote monitoring and predictive maintenance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dental Diagnostic & Surgical Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- A-dec, Inc.

- Acteon SAS

- Align Technology, Inc.

- Biolase, Inc.

- Coltene Holding AG

- DENTSPLY SIRONA Inc.

- Envista Holdings Corporation

- GC Corporation

- Integra LifeSciences Corporation

- Ivoclar Vivadent AG

- KaVo Dental GmbH

- Midmark Corporation

- Morita Corporation

- Nakanishi Inc.

- Nobel Biocare Holding AG

- Patterson Dental Holdings, Inc.

- Planmeca Oy

- SciCan Ltd.

- Straumann Holding AG

- Ultradent Products, Inc.

- Vatech Co., Ltd.

- W&H Dentalwerk Bürmoos GmbH

- Yoshida Dental Manufacturing Co., Ltd.

- Young Innovations, Inc.

- Zimmer Biomet Holdings, Inc.

Strategic Recommendations for Industry Leaders to Navigate Market Complexities and Capitalize on Emerging Dental Equipment Opportunities

To thrive in a complex and rapidly evolving marketplace, industry leaders must prioritize the diversification of supply chains by forging partnerships with multiple geographic suppliers and investing in near-shore manufacturing capabilities. This approach mitigates the risks associated with tariff volatility and ensures continuity of critical component availability. In parallel, accelerating the integration of AI and data analytics into product portfolios will allow companies to deliver truly value-based solutions that optimize clinical outcomes and practice efficiency.

Stakeholders should also cultivate deeper relationships with end users-ranging from high-volume dental chains to specialty clinics-by offering flexible financing options and scalable service contracts that align with diverse operational models. Engaging proactively with regulatory and trade authorities to secure exemptions or phased tariff relief can further alleviate cost pressures and preserve market competitiveness. Finally, embracing sustainable design principles, from energy-efficient imaging modalities to eco-friendly manufacturing processes, will resonate with healthcare providers and patients increasingly attuned to environmental responsibility.

Detailing the Rigorous Methodological Approach Underpinning Comprehensive Dental Equipment Market Research and Data Integrity

This research harnesses a rigorous methodology that combines extensive primary interviews with dental practitioners, technology executives, and supply chain experts, alongside comprehensive secondary analysis of industry publications, trade data, and regulatory filings. Qualitative insights derived from expert consultations are triangulated against quantitative metrics acquired through proprietary databases and publicly available import-export records to ensure accuracy and depth.

Data integrity is maintained via multiple validation protocols, including cross-referencing tariff schedules with customs declarations and verifying product specifications through manufacturer disclosures. Geospatial and end-user segmentation models are constructed using a combination of macroeconomic indicators and practice-level adoption patterns. Rigorous peer review by independent subject matter experts further bolsters the credibility of findings, ensuring that conclusions and recommendations reflect the most current market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dental Diagnostic & Surgical Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dental Diagnostic & Surgical Equipment Market, by Type

- Dental Diagnostic & Surgical Equipment Market, by Technology

- Dental Diagnostic & Surgical Equipment Market, by Modality

- Dental Diagnostic & Surgical Equipment Market, by End User

- Dental Diagnostic & Surgical Equipment Market, by Distribution Channel

- Dental Diagnostic & Surgical Equipment Market, by Region

- Dental Diagnostic & Surgical Equipment Market, by Group

- Dental Diagnostic & Surgical Equipment Market, by Country

- United States Dental Diagnostic & Surgical Equipment Market

- China Dental Diagnostic & Surgical Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Core Findings to Reinforce Strategic Imperatives in Dental Diagnostic and Surgical Equipment Market Dynamics

The convergence of advanced digital imaging, AI-driven diagnostics, and minimally invasive surgical technology is reshaping the paradigm of oral healthcare delivery. Stakeholders who understand and adapt to transformative shifts-such as the integration of CBCT with digital restorative workflows and the emergence of laser-and ultrasonic-based surgical systems-will be best positioned to meet evolving clinical demands. Meanwhile, navigating the complexities of tariff regimes and optimizing segmentation strategies across diverse geographies are essential for sustaining long-term growth.

By aligning product innovation, supply chain resilience, and customer-centric engagement, industry participants can not only mitigate emerging risks but also unlock unprecedented opportunities within the dental diagnostic and surgical equipment market, ultimately advancing patient care and strengthening competitive differentiation.

Take Action Today to Engage with Our Expert Sales Team and Secure the Definitive Dental Diagnostic and Surgical Equipment Market Report

Don’t let uncertainty hold you back from capitalizing on the rapidly evolving dental diagnostic and surgical equipment market; reach out to Ketan Rohom, Associate Director of Sales & Marketing, to gain immediate access to the full in-depth report, and empower your organization with the critical insights needed to drive growth and outperform competitors

- How big is the Dental Diagnostic & Surgical Equipment Market?

- What is the Dental Diagnostic & Surgical Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?