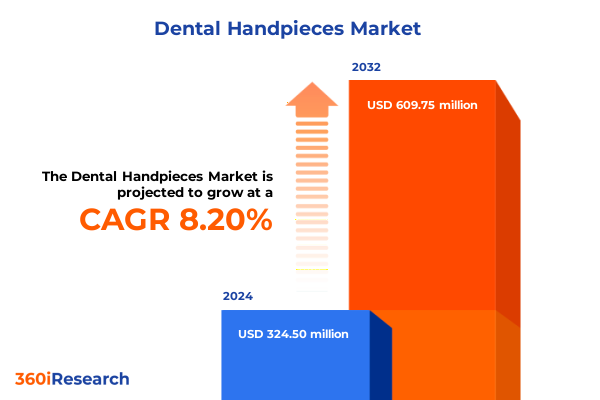

The Dental Handpieces Market size was estimated at USD 350.67 million in 2025 and expected to reach USD 377.06 million in 2026, at a CAGR of 8.22% to reach USD 609.75 million by 2032.

Emergence of Innovative Dental Handpiece Technologies Revolutionizing Clinical Procedures and Driving Operational Efficiency Across Practices Worldwide

Dental handpieces have evolved into an indispensable element of modern dentistry, serving as the cornerstone of precision, efficiency, and patient comfort in clinical applications. From routine cleanings to advanced restorative and surgical procedures, these high-performance instruments facilitate dental professionals in delivering exceptional care. The current market is characterized by rapid technological advancements, shifting regulatory landscapes, and changing practice models that collectively underscore the essential need for a holistic understanding of emerging trends and competitive strategies.

This executive summary sets the stage for stakeholders seeking a concise yet thorough overview of the dental handpiece arena. It synthesizes critical market dynamics, highlights transformative sector movements, and distills complex segmentation frameworks into actionable insights. Through this introduction, readers will gain clarity on the fundamental drivers shaping innovation and adoption patterns, as well as the strategic considerations necessary for informed decision-making and sustainable growth in an increasingly competitive environment.

Broad Adoption of Digital Integration and Ergonomic Design Innovations Redefining the Competitive Dynamics Within the Dental Handpiece Industry

The dental handpiece market has experienced a profound transformation as manufacturers accelerate the integration of digital capabilities and ergonomic enhancements. Transitioning from analog devices to smart, sensor-enabled handpieces, leading suppliers now offer real-time performance monitoring, predictive maintenance alerts, and connectivity features that seamlessly integrate with practice management software. Such innovations not only extend equipment longevity but also empower clinicians to optimize treatment protocols based on empirical data, ultimately elevating clinical precision and patient safety.

Meanwhile, material science breakthroughs have ushered in lighter, corrosion-resistant alloys and advanced polymer coatings, improving tactile feedback and reducing operator fatigue during extended procedures. The shift toward noise and vibration reduction technologies further underscores the industry’s commitment to enhancing patient comfort and clinician wellbeing. In parallel, escalating demand for eco-friendly sterilization processes and sustainable manufacturing practices is reshaping the competitive landscape. Manufacturers that strategically align product development with environmental stewardship and digital transformation are poised to capture heightened market share and establish new benchmarks for quality and reliability.

Striking Effects of Newly Enforced United States Tariffs on Import Dynamics and Cost Structures in the Dental Handpiece Industry for 2025

In early 2025, the United States implemented a revised tariff regime targeting key components and finished dental handpieces imported from major overseas manufacturing hubs. These measures, aimed at bolstering domestic production capabilities and addressing trade imbalances, introduced duty increases ranging between 10 and 25 percent on specified product categories. As a result, cost structures have shifted significantly, prompting both suppliers and end users to reassess procurement strategies and pricing models.

The elevated import duties have spurred a marked increase in localized assembly and manufacturing initiatives, with several global players expanding production footprints within the US to mitigate tariff exposure. Concurrently, supply chain partners are renegotiating contracts to incorporate tariff contingencies and rebuild margin resilience. While some incremental cost burdens have been passed on to dental practices, the long–term effect has catalyzed investment in automated manufacturing technologies and lean production methodologies domestically. Stakeholders who proactively recalibrated sourcing networks and optimized inventory levels have maintained competitive positioning despite the heightened regulatory costs.

Critical Market Divisions Based on Motor Type Speed End User and Usage Illuminating Diverse Growth Pathways and Investment Priorities

Market segmentation by motor type reveals distinct growth vectors across air turbine and electric handpieces. Air turbine devices subdivide into high speed and low speed categories, each commanding unique performance advantages and clinical applications. Conversely, electric handpieces offer two principal configurations-brushed motor units prized for cost efficiency and proven reliability, alongside brushless motor models that deliver superior torque consistency and maintenance reduction.

When evaluating market segmentation on the basis of speed, a clear bifurcation emerges between high speed and low speed offerings. Within the high speed cohort, fiber optic-enabled instruments grant practitioners enhanced illumination directly at the operative site, while non-fiber optic variants provide a more economically accessible option without integrated lighting. In the low speed spectrum, versatile torque-controlled instruments facilitate a broad range of prophylactic and restorative uses, reinforcing their indispensability in daily practice.

End user segmentation further diversifies market demand profiles. Dental clinics represent the primary consumption channel, with general dentistry practices prioritizing cost-effective, multi-functional handpieces and specialty dentistry clinics emphasizing precision instruments tailored to orthodontic, endodontic, and periodontal procedures. Dental laboratories require specialized contra-angle handpieces for prosthetic fabrication, whereas hospital-based dental units demand sterilizable, high-durability solutions suitable for complex surgical environments. Finally, usage-based segmentation underscores the dichotomy between fixed installations-typically integrated into operatory units-and portable, handheld configurations that cater to mobile clinics and outreach programs.

This comprehensive research report categorizes the Dental Handpieces market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Motor Type

- Speed

- Usage

- End User

Regional Performance Trends Highlighting Market Expansion Drivers Across the Americas Europe Middle East Africa and Asia Pacific Territories

The Americas region remains a cornerstone of the dental handpiece market, underpinned by high per capita dental expenditure and technologically advanced clinical infrastructure. Within North America, growing acceptance of cosmetic and preventive dentistry services drives demand for premium handpiece offerings, while Latin American markets exhibit emerging adoption fueled by expanding middle-class healthcare access and rising dentist-to-patient ratios.

Across Europe, Middle East and Africa, regulatory alignment within the European Union fosters a harmonized approval process for new device introductions, accelerating product launches across member states. Concurrently, Gulf Cooperation Council countries channel significant healthcare investments into dental service expansions, and African markets demonstrate nascent growth potential as private practitioners leverage portable handpieces to reach underserved rural populations.

Asia-Pacific stands out for its dynamic interplay of mature and developing markets. In Japan and Australia, technologically sophisticated clinics adopt the latest brushless motor handpieces and IoT-enabled maintenance platforms. China and India lead the charge in volume growth, supported by domestic manufacturing advancements and government initiatives aimed at improving oral health awareness. Southeast Asia’s burgeoning medical tourism sector further boosts demand for state-of-the-art dental equipment, making the region a strategic growth frontier.

This comprehensive research report examines key regions that drive the evolution of the Dental Handpieces market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Positions and Innovation Portfolios of Leading Manufacturers Shaping the Future of Dental Handpiece Solutions

Leading manufacturers continue to fortify their market positions through innovation, partnerships, and strategic acquisitions. Key players have invested heavily in research and development, unveiling next-generation electric handpieces with integrated sensors and wireless connectivity. Collaborative alliances between equipment producers and software providers have yielded comprehensive practice management solutions that differentiate offerings in a crowded marketplace.

In addition to product innovation, companies are enhancing global distribution channels through selective dealership agreements and direct-to-consumer platforms. This omnichannel approach ensures rapid product availability and streamlined after-sales service, a critical factor as clinicians increasingly prioritize minimal downtime and predictable maintenance schedules. Furthermore, several market leaders have instituted sustainability roadmaps, targeting carbon-neutral manufacturing processes and end-of-life recycling programs to meet stringent regulatory requirements and align with environmental responsibility goals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dental Handpieces market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acteon Group

- Beyes Dental Canada Inc.

- Bicon, LLC

- Bien-Air Dental SA

- Biohorizons Implant Systems, Inc.

- Danaher Corporation

- DentalEZ, Inc.

- Dentamerica Inc.

- Dentatus

- Dentflex

- Dentsply Sirona Inc.

- Dureka Dental Ltd.

- Foshan Akos Medical Instrument Co., Ltd.

- IVORY S.R.L.

- J. Morita Corporation

- Jindell Medical Instruments Co., Ltd.

- KaVo Dental GmbH by Planmeca Group

- Lares Research

- MDK Dental

- Medidenta International Inc.

- Megagen Implant Co., Ltd.

- Nakanishi Inc.

- Patterson Dental

- SciCan Ltd. by Coltène Group

- Straumann AG

- W&H Group

- Western Surgical

- Young Innovations, Inc.

Strategic Imperatives for Manufacturers and Distributors to Capitalize on Technological Advances and Evolving Regulatory Environments

Industry leaders should prioritize the acceleration of digital integration across handpiece platforms, ensuring seamless data exchange between clinical instruments and practice management ecosystems. Investing in brushless motor technologies can enhance device performance and reduce service intervals, affording a compelling value proposition to discerning end users. Furthermore, establishing or expanding local assembly operations within key markets will offset tariff pressures and reinforce supply chain stability.

Collaborative ventures with sterilization equipment providers and software developers can create bundled solutions that resonate with practices focused on infection control, regulatory compliance, and operational efficiency. Emphasizing sustainability through eco-friendly material selection and recyclable packaging will strengthen brand reputation among environmentally conscious stakeholders. Finally, targeted training programs and remote maintenance support services will cultivate customer loyalty, reduce equipment downtime, and position industry leaders as trusted partners in delivering optimal patient outcomes.

Comprehensive Triangulation Approach Combining Primary Interviews Secondary Data and Quantitative Analyses to Ensure Robust Market Insights

This research leverages a multi–tiered methodology designed to deliver rigorous and unbiased market intelligence. Initially, extensive secondary research was conducted, encompassing trade journals, peer-reviewed publications, regulatory filings, and reputable financial disclosures. These sources provided foundational insights into product portfolios, patent developments, and global trade flows.

Subsequently, primary research involved in-depth interviews with dental equipment manufacturers, key opinion leaders in clinical dentistry, procurement managers at major group practices, and regulatory affairs specialists. This dialogue enabled the capture of nuanced perspectives on adoption barriers, performance expectations, and future innovation trajectories. Quantitative data was collected through structured surveys of end users across diverse geographic regions and practice settings, ensuring representativeness.

Finally, data triangulation methodologies reconciled secondary and primary findings, while sensitivity analyses assessed the impact of regulatory shifts and cost fluctuations. Each data point underwent rigorous validation through cross-referencing with industry benchmarks and proprietary transaction databases, guaranteeing a robust foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dental Handpieces market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dental Handpieces Market, by Motor Type

- Dental Handpieces Market, by Speed

- Dental Handpieces Market, by Usage

- Dental Handpieces Market, by End User

- Dental Handpieces Market, by Region

- Dental Handpieces Market, by Group

- Dental Handpieces Market, by Country

- United States Dental Handpieces Market

- China Dental Handpieces Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesis of Critical Market Drivers Challenges and Opportunities Guiding Strategic Decision Making in the Dental Handpiece Sector

In summary, the dental handpiece market stands at a pivotal juncture, shaped by accelerating technological innovation, stringent regulatory frameworks, and evolving practice models. The advent of smart, sensor-embedded handpieces and the shift toward sustainable manufacturing underscore the industry’s focus on precision, operator ergonomics, and environmental responsibility. Tariff-induced cost pressures have catalyzed growth in domestic production and reshaped supply chain strategies, while nuanced segmentation highlights differentiated demand patterns across motor types, speed categories, end users, and usage applications.

Regionally, mature markets in North America and Europe offer steady demand for high-end solutions, while Asia-Pacific and Latin America present robust growth prospects driven by infrastructure development and rising oral health awareness. Leading vendors distinguish themselves through integrated digital platforms, strategic alliances, and comprehensive service networks that reduce downtime and enhance clinician satisfaction. Stakeholders who align innovation roadmaps with regulatory trends, cost optimization strategies, and customer experience enhancements will be best positioned to capture emerging opportunities and sustain competitive advantage in the years ahead.

Connect with Ketan Rohom Today to Access Comprehensive Dental Handpiece Market Intelligence and Drive Your Business Forward

Discover how tailored market intelligence can empower strategic growth and operational excellence in the dynamic dental handpiece sector. By leveraging this comprehensive report, you will gain an unrivaled understanding of the latest technological innovations, regulatory influences, and competitive landscapes. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure access to deep-dive analyses, actionable recommendations, and proprietary data sets. Ketan stands ready to guide you through customized package options, ensuring you receive the precise insights necessary to elevate your product development, streamline supply chain resilience, and outperform competitors. Engage now to transform market intelligence into measurable business outcomes and stay ahead in an ever-evolving industry.

- How big is the Dental Handpieces Market?

- What is the Dental Handpieces Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?