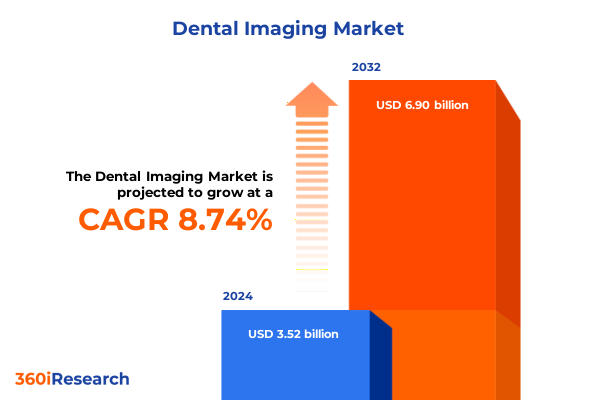

The Dental Imaging Market size was estimated at USD 3.81 billion in 2025 and expected to reach USD 4.13 billion in 2026, at a CAGR of 8.83% to reach USD 6.90 billion by 2032.

Unveiling the Future of Dental Imaging Through Advanced Technologies Redefining Patient Care and Diagnostics in the Modern Oral Health Landscape

Dental imaging has undergone a remarkable transformation over the past few decades, evolving from conventional film-based radiography to sophisticated digital systems that deliver unparalleled clarity and efficiency. This introduction explores how advancements in sensor technology, three-dimensional visualization, and artificial intelligence have converged to redefine diagnostic workflows and patient experiences. As clinics and hospitals integrate digital platforms, they unlock new capabilities for precision imaging, enabling clinicians to detect pathologies at earlier stages and plan treatments with greater confidence.

Moreover, the shift toward patient-centric care models has fueled demand for minimally invasive diagnostic procedures and real-time visual communication. Digital imaging modalities such as Cone Beam Computed Tomography (CBCT) and intraoral scanners now provide high-resolution, volumetric data that enhance both diagnostic accuracy and patient education. Consequently, clinicians are better positioned to foster informed treatment discussions and cultivate stronger practitioner–patient relationships. In addition, the integration of cloud-based storage and telehealth applications is extending the reach of specialized imaging services beyond traditional office settings, making advanced diagnostics more accessible to diverse populations.

In summary, the current landscape of dental imaging reflects a confluence of technological breakthroughs, shifting care paradigms, and growing expectations for seamless, digital-first experiences. As the industry adapts to these developments, stakeholders must navigate new operational challenges and leverage emerging tools to maintain both clinical excellence and competitive advantage.

Exploring Pivotal Transformations in Dental Imaging That Are Revolutionizing Clinical Workflows And Diagnostic Precision Across Practices

The dental imaging sector is experiencing pivotal transformations driven by the convergence of machine learning, high-resolution sensor innovation, and cloud connectivity. In recent years, artificial intelligence algorithms have proven capable of autonomously identifying anatomical landmarks, detecting carious lesions, and even predicting risk factors from volumetric scans. Consequently, practices adopting AI-enhanced platforms report accelerated diagnostic workflows, reduced human error, and improved patient throughput, which in turn bolster both clinical outcomes and operational efficiency.

Another significant shift arises from the widespread adoption of three-dimensional imaging modalities, including CBCT and advanced cephalometric systems. These technologies offer clinicians a comprehensive view of craniofacial structures, enabling precise planning for implant placements, orthodontic assessments, and surgical interventions. Furthermore, the miniaturization of hardware components has given rise to portable intraoral scanners and handheld devices that facilitate point-of-care imaging, extending diagnostic capabilities to outreach clinics and mobile dental units.

Additionally, the integration of tele-dentistry solutions and secure, cloud-based image repositories is reshaping collaboration among specialists. Dental professionals can now share anonymized scan data in real time, solicit second opinions from remote experts, and streamline referrals. As a result, multidisciplinary care teams achieve more coordinated treatment plans, and patients in underserved regions gain faster access to specialized diagnostics. Together, these transformative shifts underscore the transition toward a connected, intelligent imaging ecosystem that promises to elevate standards of care and redefine clinical workflows.

Analyzing The Cumulative Impact Of Recent United States Tariff Policies On The Dental Imaging Ecosystem And Supply Chain Dynamics In 2025

In 2025, the United States implemented a series of import tariffs on medical imaging equipment components, including those used in dental radiography systems. These new measures have exerted upward pressure on the cost of key subassemblies such as digital sensors, X-ray tubes, and specialized optics. As a consequence, manufacturers have faced the dual challenge of balancing increased production expenses with the imperative to maintain accessible pricing for end users.

Short-term effects have included inventory realignments and revisions to supply chain strategies. Industry leaders have negotiated longer-term agreements with domestic suppliers to mitigate the impact of tariff-related cost increases, while others have accelerated investments in local manufacturing capabilities. Although these adjustments have caused initial delivery delays and marginal price adjustments for some digital panoramic and cone beam devices, they have also spurred renewed interest in vertically integrated production models.

In the medium term, the tariffs may reinforce innovation incentives by encouraging companies to optimize component designs and adopt alternative materials that are not subject to the same levies. At the same time, collaboration between equipment providers and dental service organizations is deepening to explore bulk procurement strategies and co-development of tariff-resilient platforms. Ultimately, this environment of regulatory change and supply chain adaptation is reshaping competitive dynamics, compelling stakeholders to pursue both cost management and technological advancement to thrive in the evolving dental imaging marketplace.

Unlocking Strategic Insights By Examining Offering Product Type Technology Application Treatment And End User Segmentation Perspectives In Dental Imaging

A nuanced understanding of dental imaging dynamics emerges when examining the market through multiple segmentation lenses. Across instrument offerings and software solutions, the industry has witnessed differentiated investment patterns: hardware manufacturers emphasize modular design and ease of sterilization, while software developers concentrate on interoperability, user-friendly interfaces, and AI-powered diagnostic tools. Consequently, strategic choices for practitioners hinge on both clinical requirements and the seamless integration of advanced analytics into existing workflows.

Product type segmentation further illuminates market trajectories. Extraoral imaging modalities such as cone beam computed tomography, panoramic devices, and cephalometric systems now serve as foundational tools for surgical guidance and orthodontic planning. Conversely, intraoral imaging, encompassing sources like bitewing and periapical radiography, remains indispensable for routine diagnostics, decay detection, and post-treatment monitoring. A deeper dive into these categories reveals differing upgrade cycles, capital expenditures, and service requirements, underscoring the importance of tailored product roadmaps.

When assessed by imaging technology, the contrast between two-dimensional and three-dimensional modalities highlights diverging adoption curves. The former continues to offer cost-effective, high-speed solutions for standard screenings, while the latter represents a premium segment characterized by comprehensive anatomical insights. Simultaneously, application-focused segmentation shows a broadened scope of use from initial diagnosis and treatment planning to patient education, surgical guidance, and longitudinal monitoring of therapeutic outcomes. In parallel, treatment-based considerations reveal distinct imaging demands across endodontics, implantology, orthodontics, oral surgery, and general dentistry. Lastly, the distribution of dental imaging solutions spans academic and research institutes, specialized diagnostic centers, hospital environments, and private dental clinics, each requiring unique service and support models that inform vendor strategies and after-sales care offerings.

This comprehensive research report categorizes the Dental Imaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Product Type

- Technology

- Application

- Treatment

- End User

Unveiling Regional Dynamics Across The Americas Europe Middle East Africa And Asia Pacific Impacting Adoption And Innovation In Dental Imaging

Regional variations play a profound role in shaping how dental imaging technologies are adopted and commercialized. In the Americas, demand for cone beam computed tomography and digital panoramic systems is especially pronounced in metropolitan areas with robust private practice networks. Clinicians frequently cite the integration of imaging data with practice management software as a key value driver, prompting vendors to forge partnerships with electronic health record providers and dental management platforms.

Shifting across to Europe, Middle East, and Africa, regulatory frameworks and reimbursement policies significantly influence uptake rates. Countries within the European Union often mandate specific safety standards and periodic device calibrations, encouraging the replacement of legacy film-based systems with digital counterparts. Meanwhile, markets in the Middle East are accelerating investments in diagnostic imaging capabilities as part of broader healthcare infrastructure expansions, and parts of Africa are witnessing the introduction of portable intraoral and mobile CBCT solutions to serve rural populations.

In the Asia-Pacific region, rapid urbanization and rising disposable incomes have catalyzed growth in dental clinics and specialized imaging centers. Nations such as China, India, and Australia are at the forefront of adopting AI-driven software for automated anomaly detection and treatment simulation. Moreover, the prevalence of dental tourism in Southeast Asian hubs is prompting providers to differentiate their services through advanced digital imaging packages, which enhance patient confidence and streamline cross-border referrals. Together, these regional dynamics underscore the importance of customizing go-to-market strategies to reflect local regulatory, economic, and clinical practice environments.

This comprehensive research report examines key regions that drive the evolution of the Dental Imaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Innovators And Established Corporations Driving Technological Advancements And Strategic Collaborations In The Dental Imaging Sector

Market leadership in dental imaging is influenced by a spectrum of established corporations and agile innovators. Global device manufacturers have expanded their portfolios to include AI-enabled imaging suites, sensor upgrades, and subscription-based software services. By contrast, emerging companies are carving niches through specialized cloud-native platforms that emphasize remote collaboration and data analytics for longitudinal patient monitoring.

Collaborations and strategic alliances are a recurring theme among key players seeking to reinforce their technological edge. For instance, hardware vendors have entered into technology licensing agreements with software developers to incorporate advanced image segmentation and virtual treatment simulation into their products. At the same time, several diagnostic imaging equipment manufacturers have formed joint ventures with leading academic centers to validate new imaging protocols and integrate machine learning models into standardized clinical workflows.

Furthermore, competitive differentiation often stems from the extent of post-market support and training. Organizations that offer comprehensive service networks and interactive e-learning modules report higher customer satisfaction scores and retention rates. As a result, the interplay between product innovation, partnership ecosystems, and value-added services continues to define the competitive hierarchy within the global dental imaging landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dental Imaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3Shape A/S

- ACTEON SA

- Align Technology, Inc.

- Carestream Health, Inc.

- Carl Zeiss AG

- Dental Imaging Technologies Corporation

- DENTSPLY SIRONA Inc.

- Detection Technology Plc

- DÜRR DENTAL India Private Limited

- e-con Systems

- Eastman Kodak Company

- Envista Holdings Corporation

- Excelitas Technologies Corp.

- GE HealthCare

- HAMAMATSU Group

- Henry Schein, Inc.

- Imaging Technologies Ltd

- J. MORITA CORP.

- KaVo Dental GmbH

- Leica Microsystems by Danaher Corporation

- Midmark Corporation

- Owandy Radiology

- Planmeca Oy

- Refine Medical

- Seiler Instrument Inc.

- Vatech Co., Ltd.

- Xline S.r.l.

Implementing Strategic Initiatives To Enhance Competitive Positioning Foster Innovation And Optimize Operational Efficiencies Within The Dental Imaging Industry

To maintain a competitive advantage in the rapidly evolving dental imaging domain, industry leaders should prioritize investments in advanced analytics and AI-driven diagnostic capabilities. By integrating machine learning models that automate image interpretation and anomaly detection, providers can significantly reduce diagnostic turnaround times and enhance clinical precision. Furthermore, cultivating strategic partnerships with software developers and academic institutions will accelerate validation of novel algorithms and ensure regulatory compliance in diverse markets.

In addition, organizations must build resilience in their supply chains by diversifying sourcing strategies and exploring localized manufacturing options. Establishing alternative procurement channels and engaging with domestic component suppliers will mitigate the impact of tariff fluctuations and logistical disruptions. Simultaneously, expanding digital training programs and virtual support services can empower dental professionals to maximize the utility of new imaging platforms, creating stronger customer loyalty and recurring revenue opportunities.

Finally, companies should explore subscription-based service models that couple equipment usage with software updates and predictive maintenance. This approach not only stabilizes revenue streams but also facilitates continuous product improvement and real-time performance monitoring. By adopting a holistic strategy that combines technological innovation, operational agility, and service excellence, industry leaders will be well positioned to capture emerging opportunities and navigate the complexities of the global dental imaging market.

Detailing Our Comprehensive Research Approach Combining Primary Secondary Data Collection And Rigorous Analysis For The Dental Imaging Study

This study employs a rigorous, multi-pronged methodology that blends primary and secondary research to capture a comprehensive view of the dental imaging landscape. Primary data collection involved in-depth interviews with clinical directors, radiology technologists, equipment procurement specialists, and biomedical engineers. Their insights elucidated key drivers of technology adoption, barriers to clinical integration, and emerging use cases for both two-dimensional and three-dimensional imaging modalities.

Complementing primary insights, extensive secondary research was conducted through peer-reviewed journals, regulatory databases, patent filings, and publicly available financial disclosures. This phase provided historical context on innovation trajectories and enabled the identification of significant technological milestones. Data points were cross-validated through triangulation, ensuring consistency across multiple sources and minimizing potential bias.

Analytical techniques including qualitative thematic analysis and comparative benchmarking were applied to distill actionable findings. An advisory panel of industry experts guided the interpretation of complex data sets, while a series of iterative reviews ensured methodological transparency and reliability. The result is an evidence-based framework that offers decision-makers a clear understanding of market dynamics, technological opportunities, and strategic imperatives in dental imaging.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dental Imaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dental Imaging Market, by Offering

- Dental Imaging Market, by Product Type

- Dental Imaging Market, by Technology

- Dental Imaging Market, by Application

- Dental Imaging Market, by Treatment

- Dental Imaging Market, by End User

- Dental Imaging Market, by Region

- Dental Imaging Market, by Group

- Dental Imaging Market, by Country

- United States Dental Imaging Market

- China Dental Imaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing Key Takeaways And Future Directions To Propel Growth Foster Resilience And Drive Innovation In Dental Imaging Markets

The dental imaging sector is at a pivotal juncture, characterized by rapid technological innovation, shifting regulatory landscapes, and dynamic global demand patterns. Key takeaways underscore the importance of artificial intelligence as a catalyst for diagnostic accuracy and operational efficiency, while three-dimensional imaging continues to redefine clinical capabilities. At the same time, tariff policies and supply chain realignments are prompting stakeholders to pursue localized manufacturing strategies and deeper collaboration across the value chain.

Looking ahead, industry participants will need to tailor their product and go-to-market approaches to regional nuances, ensuring compliance with varying safety standards and reimbursement frameworks. Leaders who successfully integrate advanced analytics, subscription-based service models, and robust training programs will unlock significant competitive differentiation. By synthesizing segmentation insights-from offering types and imaging modalities to application areas and end-user requirements-organizations can craft precise strategies that address the unique needs of dentists, researchers, hospitals, and diagnostic centers.

Overall, this research highlights a landscape defined by both complexity and opportunity. Through proactive adaptation and strategic foresight, stakeholders across the dental imaging ecosystem can drive sustained growth, improve patient care, and pave the way for the next generation of diagnostic innovations.

Take The Next Step To Elevate Your Organization’s Strategic Advantage In Dental Imaging By Securing A Comprehensive Market Research Report From Our Expert

Engaging with an experienced strategic partner ensures your organization gains timely access to actionable insights that can guide critical investments and technology adoption decisions in dental imaging. By securing this market research report, you will be equipped to benchmark your offerings against industry best practices, identify untapped opportunities, and anticipate evolving regulatory requirements before they become obstacles. Our analysis distills complex trends into clear recommendations, empowering your leadership team to make confident, evidence-based choices that drive growth and resilience.

To obtain the full breadth of insights, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan’s deep domain expertise and consultative approach will ensure you select the report package that aligns precisely with your strategic priorities. By partnering with us, you benefit from personalized support and the most current data shaping today’s dental imaging market trajectory.

- How big is the Dental Imaging Market?

- What is the Dental Imaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?