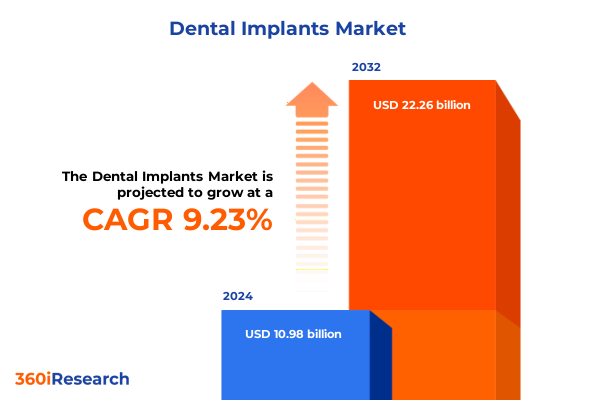

The Dental Implants Market size was estimated at USD 11.96 billion in 2025 and expected to reach USD 13.02 billion in 2026, at a CAGR of 9.28% to reach USD 22.26 billion by 2032.

Unlocking Tomorrow’s Dental Rehabilitation Through Comprehensive Strategies Embracing Innovation Clinical Excellence and Market Evolution

Implant dentistry has undergone a remarkable evolution over the past decade, establishing itself as the cornerstone of modern restorative and cosmetic oral care. Advanced techniques and materials have elevated clinical outcomes while patient demand for predictable, long-term solutions continues to accelerate. Clinicians are now leveraging digital planning, guided surgery, and immediate loading protocols to enhance precision and reduce chair time, reshaping expectations around treatment efficiency and patient comfort. As an integral pillar of comprehensive dental restorations, implants are increasingly viewed not merely as prosthetic fixtures but as catalysts for holistic oral health and aesthetic renewal.

Innovation across materials science and digital workflows has invigorated competition and fostered strategic differentiation among key market participants. Leading manufacturers have expanded beyond implant fixtures to embrace biomaterials, CAD/CAM prosthetics, and software-driven treatment planning platforms. This convergence of technology and material science underscores a broader shift toward end-to-end clinical solutions that support practitioners at every stage of patient care. With global players reporting robust gains-such as a 33% surge in Asia-Pacific implant revenues in 2024-providers and investors alike recognize the sector’s transformative potential and the critical need for data-driven insights to navigate evolving dynamics.

Revolutionizing Clinical Practice with Disruptive Technologies Material Advancements and AI-Driven Workflow Integration in Implant Dentistry

The dental implants landscape is being redefined by groundbreaking technological and procedural breakthroughs that are driving a paradigm shift in patient care. Digital dentistry now underpins every phase of the implant journey, from intraoral scanning and prosthetic design to guided surgical execution, enabling clinicians to achieve greater accuracy and predictability. Artificial intelligence-powered diagnostic tools analyze bone density and anatomical structures in real time, facilitating personalized treatment plans that optimize implant positioning and load distribution. This seamless integration of hardware and software not only elevates clinical outcomes but also streamlines workflows, reducing operative time and enhancing patient satisfaction.

Material innovations are further accelerating market transformation. Zirconia implants offer superior biocompatibility and aesthetic outcomes for patients with thin gingival biotypes, while novel surface treatments on titanium fixtures have demonstrated enhanced osseointegration rates in preclinical and clinical studies. Polymer-based implant systems are gaining traction in temporary applications, offering cost-effective transitional solutions that preserve soft tissue architecture. Meanwhile, one-stage and immediate-loading protocols are being adopted more widely, leveraging improved primary stability through tapered and threaded fixture designs. These combined shifts are fostering a patient-centric model that emphasizes quicker rehabilitation, minimally invasive techniques, and long-term functional integrity.

Navigating Layered Trade Barriers and Raw Material Cost Pressures Shaping Dental Implant Supply Chains Amid 2025 U.S. Tariff Policies

A series of U.S. trade measures enacted in 2025 has introduced new complexities to the dental implants supply chain, with both device and material costs feeling the effects. Early in the year, a tranche of reciprocal tariffs imposed by the administration levied a 20% duty on imports of European medical devices, including high-precision orthopedic and dental equipment, prompting stock declines in leading device manufacturers and raising concerns about affordable access. Despite conventional expectations that humanitarian-mission-oriented medical technologies might be exempt, the sweeping scope of these tariffs encompassed key implant components, at least until specific exclusions were negotiated.

Parallel to device-specific duties, steel and aluminum derivatives have faced continued Section 232 tariffs of 25% and 10%, respectively, which extend to many medical-grade alloys used in implant fixtures and abutments. An analysis of global device contract manufacturing noted that precision-grade metal inputs spiked in cost by 15–20% over the past year, squeezing margins for both large incumbents and emerging entrants alike. Meanwhile, raw materials from China continue to attract elevated duties-often exceeding 50% when combined with Section 301 levies-threatening the affordability of zirconium oxide and specialty polymers critical to certain aesthetic and transitional implant systems.

Amid these pressures, USTR maintained pandemic-related exclusions for medical-care products through mid-2025, providing temporary relief for devices explicitly categorized under COVID-related classifications. Yet the cumulative impact of layered tariffs and elevated freight costs has already driven lead-time extensions, required renegotiation of supply contracts, and encouraged an urgent pivot toward nearshoring and strategic dual sourcing. As stakeholders recalibrate their operations, balancing cost containment with uninterrupted patient access has emerged as an enduring challenge in the current trade environment.

Deciphering Multifaceted Dental Implant Segmentation Revealing Customization Clinical Protocols Patient Cohort Specificities and Distribution Dynamics

In decoding the complexity of the dental implants market, distinct segmentation frameworks reveal how provider preferences, patient cohorts, and procedural variables coalesce to shape industry dynamics. Plate-form implants and root-form designs each cater to specific anatomical and clinical requirements, driving divergent R&D priorities across product lines. Material selection further stratifies the landscape, as clinicians weigh the resilience of titanium fixtures, the aesthetic virtues of zirconium implants, and the flexible utility of polymer-based transitional systems.

Beyond the core fixture lies a modular ecosystem where abutments, crowns, and screws integrate with underlying components to form holistic restorative solutions. Age demographics introduce another layer of nuance: adult patients represent the bulk of routine implant cases, geriatric cohorts demand specialized protocols to address compromised bone density, and pediatric applications-though limited-are evolving alongside minimally invasive approaches. Procedural complexity bifurcates the field into one-stage and two-stage surgeries, each presenting distinct risk profiles, healing trajectories, and clinical workflows.

Structural variations-ranging from non-threaded geometries to parallel-walled, tapered, and threaded designs-underscore the continuous pursuit of primary stability and optimal load distribution. Distribution channels reflect an industry in transition, with traditional offline networks coexisting alongside burgeoning online platforms that democratize access to implant materials and surgical guides. Applications span cosmetic dentistry interventions aimed at restoring aesthetic harmony as well as restorative protocols focused on functional rehabilitation. Finally, diverse end-user environments-academic and research institutes pioneering new techniques, specialist dental clinics delivering high-volume care, and hospitals handling complex, multidisciplinary cases-collectively drive market momentum and shape adoption curves.

This comprehensive research report categorizes the Dental Implants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Component

- Age Group

- Structure

- Surgical Technique

- Distribution Channel

- Application

- End-User

Exploring Regional Divergence in Regulatory Environments Adoption Curves and Growth Catalysts Across Americas EMEA and Asia-Pacific Territories

Regional dynamics in the dental implants domain illuminate significant variation in adoption rates, regulatory frameworks, and growth trajectories. In the Americas, advanced healthcare infrastructure in the United States and Canada underpins a stable yet competitive market, with precision digital workflows and reimbursement schemes bolstering premium implant adoption. Latin American markets, while still nascent, are gaining traction as urbanization and dental tourism converge to expand procedural volumes beyond metropolitan centers.

Within Europe, Middle East & Africa, Western European nations benefit from stringent regulatory oversight and high clinician training standards, driving consistent demand for premium fixtures and bespoke prosthetics. Northern and Southern European markets exhibit subtle divergences in procedural preferences, informed by cultural aesthetics and varying degrees of public versus private payor penetration. In the Middle East, rapid infrastructure development and private-sector investment are catalyzing new clinic openings, whereas parts of Africa are encountering access challenges, reinforcing the importance of partnerships with academic institutions and NGOs.

Asia-Pacific emerges as the most dynamic region, fueled by aging populations in Japan and South Korea, government-sponsored oral health initiatives in China and India, and rising disposable incomes across Southeast Asian economies. Domestic champions in South Korea and Japan are increasingly exporting cost-effective implant solutions, challenging incumbents in global markets. Across the region, digital training academies and tele-planning services are proliferating, accelerating knowledge transfer and clinical standardization.

This comprehensive research report examines key regions that drive the evolution of the Dental Implants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Strategic Differentiation Collaboration Paradigms and Consolidation Trends Among Leading Global Dental Implant Manufacturers

The competitive landscape is anchored by a handful of global leaders distinguished by their breadth of portfolios, innovation pipelines, and strategic alliances. Swiss-based Straumann Group consistently drives market benchmarks through its integrated ecosystem spanning premium and value implant lines, bolstered by digital planning platforms and regenerative biomaterials that extend beyond conventional fixture offerings. Its core EBIT margin reached 26% in 2024, reinforcing its capacity to invest aggressively in R&D and digital augmentation.

Envista Holdings, through its Nobel Biocare and Implant Direct brands, executes a dual-brand strategy that addresses both specialist and general practitioner segments. Nobel Biocare’s advanced guided surgery components and CAD/CAM prosthetics complement Implant Direct’s cost-effective procedural kits, allowing Envista to capture a broad spectrum of clinical use cases. Dentsply Sirona excels in surgical guide integration and digital workflows, positioning itself at the intersection of imaging, planning, and guided surgery to offer end-to-end solutions for complex cases.

Consolidation trends continue to reshape the mid- and emerging tiers of the market. Zimmer Biomet and its successor ZimVie have pursued targeted acquisitions to broaden their premium implant portfolios and geographic reach, with ZimVie’s pending $730 million takeover deal signaling potential shifts in competitive dynamics. Asian challengers, including Osstem Implant and MegaGen, leverage cost-competitive manufacturing and aggressive market entry strategies to secure footholds in both domestic and international markets. Meanwhile, niche innovators such as BioHorizons emphasize biologically active surface treatments and implant-abutment micro-precision, seeking to carve out specialized therapeutic segments within the broader ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dental Implants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adin Dental Implants Systems Ltd.

- B. Braun Melsungen AG

- BEGO Company Group

- Bicon Dental Implants

- Blue Sky Bio, LLC

- CeramTec Group

- Cortex Dental Implants Industries Ltd.

- DENTIS Co., LTD

- Dentium Co., Ltd.

- Dentsply Sirona Inc.

- DESS Dental

- Dio Implant Co., Ltd.

- Envista Holdings Corporation

- Henry Schein, Inc.

- HIOSSEN

- Ivoclar Vivadent AG

- Keystone Dental Inc.

- KYOCERA Corporation

- MegaGen Implants Co., Ltd.

- Neobiotech

- Neoss Limited

- Noris Medical Ltd.

- Osstem Implant Co. Ltd

- Straumann Group

- T-Plus Implant Tech Co. Ltd.

- TAV Medical Ltd.

- Thommen Medical AG

- Titan Implants Inc.

- TOV Implant Ltd.

- ZimVie Inc.

Driving Innovation Supply Chain Agility and Sustainable Material Strategies to Outpace Competition and Navigate Evolving Trade Realities

To thrive amid intensifying competition and evolving trade landscapes, industry leaders must champion holistic innovation and strategic resilience. Investing in digital dentistry platforms that integrate AI-driven diagnostics with guided surgery workflows will not only enhance clinical precision but also strengthen customer lock-in through recurring software and service revenues. Concurrently, proactive supply chain diversification-incorporating nearshore manufacturing hubs and dual sourcing of critical alloys-can mitigate tariff-induced cost volatility while safeguarding production continuity.

Sustainable material development represents another leverage point for differentiation. Bioceramic and polymer composites engineered for faster osseointegration and reduced carbon footprints resonate with both clinicians seeking performance gains and patients prioritizing environmental stewardship. Cultivating partnerships with research institutes and forging co-development agreements with innovative start-ups can accelerate the pipeline for next-generation surface technologies and adaptive fixture geometries.

Finally, targeted market expansion in high-growth regions demands a nuanced approach. Customized training academies, tele-mentoring programs, and tiered financing models can unlock latent demand in emerging economies, while strategic alliances with local distributors can streamline regulatory approvals and bolster after-sales support. By embracing a balanced mix of technological leadership, supply chain agility, and regional insight, leading players can convert market disruptions into sustainable opportunities.

Employing Rigorous Mixed-Methods Analysis Including Secondary Research Primary Interviews Quantitative Modeling and Expert Validation

This research employs a rigorous mixed-methods approach to ensure the robustness of its insights. It begins with an exhaustive secondary analysis of peer-reviewed journals, regulatory filings, and trade association reports to map historical trends, technological breakthroughs, and policy shifts affecting dental implants. Key data points are then corroborated through primary interviews with clinical opinion leaders, distribution executives, and procurement directors across multiple regions, providing qualitative depth and context.

Quantitative modeling integrates these findings with proprietary shipment and sales databases, enabling cross-validation through triangulation across supply chain nodes and end-user feedback. Statistical analyses identify correlations between material innovations, procedural adoption rates, and regional penetration metrics to highlight growth drivers and potential bottlenecks. Expert panels-comprising dental surgeons, biomedical engineers, and trade policy analysts-review interim findings to refine assumptions and validate emerging narratives.

Finally, the study synthesizes its findings into actionable frameworks, leveraging scenario-planning techniques to evaluate the impact of potential tariff fluctuations, technological disruptions, and demographic shifts. This systematic methodology ensures that recommendations are grounded in empirical evidence, reflective of real-world complexities, and strategically aligned with stakeholder priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dental Implants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dental Implants Market, by Type

- Dental Implants Market, by Material

- Dental Implants Market, by Component

- Dental Implants Market, by Age Group

- Dental Implants Market, by Structure

- Dental Implants Market, by Surgical Technique

- Dental Implants Market, by Distribution Channel

- Dental Implants Market, by Application

- Dental Implants Market, by End-User

- Dental Implants Market, by Region

- Dental Implants Market, by Group

- Dental Implants Market, by Country

- United States Dental Implants Market

- China Dental Implants Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2067 ]

Synthesizing Innovation Segmentation Regional Dynamics and Strategic Imperatives to Guide Stakeholder Decision-Making

The dental implants sector stands at a pivotal juncture defined by rapid technological innovation, shifting regulatory landscapes, and evolving patient expectations. Multi-dimensional segmentation illuminates the nuanced interplay between implant designs, materials, and clinical protocols, while regional insight underscores diverse growth trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Trade-related pressures and raw material cost fluctuations have introduced fresh supply chain complexities, prompting industry participants to accelerate nearshoring initiatives and diversify sourcing strategies. Amid these challenges, leading companies continue to differentiate through end-to-end digital ecosystems, strategic acquisitions, and material science breakthroughs. For stakeholders, the convergence of innovation and supply chain resilience offers a clear path to sustaining competitive advantage.

By synthesizing segmentation, regional dynamics, and corporate strategies, this executive summary distills critical imperatives for the year ahead: prioritize integrated digital workflows, expand sustainable material portfolios, and cultivate regional partnerships that align with local clinical and regulatory environments. Through these lenses, organizations can navigate volatility and harness growth opportunities in a market that remains fundamental to restorative and aesthetic dentistry.

Drive Strategic Growth and Market Leadership with Expert Guidance—Connect with Ketan Rohom for Tailored Dental Implants Market Intelligence

Seize the opportunity to stay ahead in the dynamic dental implants arena by securing our full market research report. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to gain deeper insights, tailored analysis, and strategic guidance essential for informed decision-making and sustainable growth. Contact Ketan to explore customized packages and unlock the full potential of this comprehensive study.

- How big is the Dental Implants Market?

- What is the Dental Implants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?