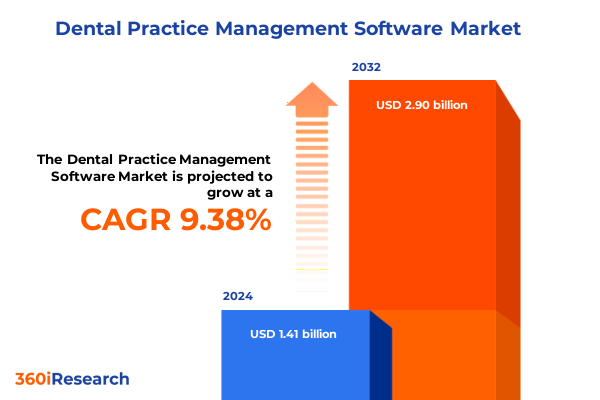

The Dental Practice Management Software Market size was estimated at USD 1.53 billion in 2025 and expected to reach USD 1.66 billion in 2026, at a CAGR of 9.54% to reach USD 2.90 billion by 2032.

Unlocking the Potential of Digital Transformation to Elevate Dental Practice Management and Operational Efficiency Across Modern Clinics

The landscape of dental practice management software has evolved at an unprecedented pace as clinics strive to integrate digital solutions that streamline operations and enhance patient care. Recent advancements in digital dentistry have introduced artificial intelligence–driven diagnostic tools, three-dimensional imaging integration, and interoperable electronic health records that expand the capabilities of software platforms. In addition, the shift toward cloud-based architectures has offered practices unparalleled accessibility, enabling dentists and staff to manage schedules, billing, and clinical workflows from any location with internet connectivity.

Central to this transformation is the growing emphasis on patient engagement, with platforms incorporating secure messaging, online booking portals, and mobile app functionalities that foster real-time communication and personalized experiences. These enhancements not only reduce administrative burdens but also support compliance and long-term oral health outcomes by keeping patients informed and involved in their care journey. Concurrently, the rise of teledentistry has extended reach to underserved communities, demonstrating the critical role of remote consultation capabilities in modern practice management software.

Moreover, heightened regulatory requirements around data security and interoperability have driven vendors to adopt robust encryption, compliance frameworks, and seamless integration with other healthcare systems. Practices now demand solutions that not only optimize internal workflows but also ensure seamless data exchange with laboratories, imaging centers, and specialist referrals. The result is a market characterized by platforms that blend administrative efficiency, clinical precision, and patient-centric features, setting a new standard for dental practice management in 2025.

Exploring the Pivotal Technological and Patient-Centric Shifts that are Redefining Dental Practice Management Software for 2025 and Beyond

The dental practice management sector is undergoing a series of transformative shifts driven by breakthroughs in automation, analytics, and patient-centric design. Artificial intelligence integration is now a core differentiator among leading platforms, augmenting everything from appointment scheduling to insurance claims processing. With AI-powered modules automating routine administrative tasks, clinical teams can reallocate time toward patient care and decision-making, resulting in more efficient chair utilization and improved case acceptance rates.

Simultaneously, predictive analytics has emerged as a powerful driver of preventive and operational strategies. By analyzing historical patient data, lifestyle variables, and treatment outcomes, sophisticated algorithms can forecast disease risk and guide targeted wellness interventions. These insights not only support early detection of periodontal issues and cavities but also optimize scheduling by anticipating appointment demand and reducing no-shows, thus enhancing both clinical outcomes and practice profitability.

Furthermore, patient engagement tools have advanced beyond basic reminders to include personalized wellness messaging and two-way communication channels. As patients increasingly expect digital convenience, features such as online intake forms, secure video consultations, and mobile portals play a vital role in elevating satisfaction and retention. Collectively, these shifts are redefining how practices operate, positioning integrated, data-driven platforms as foundational to sustainable growth in a competitive healthcare ecosystem.

Analyzing How Recent and Proposed U.S. Tariff Measures are Reshaping Cost Structures and Deployment Choices in Dental Practice Technology

Recent U.S. tariff measures have had a ripple effect on the dental practice management technology ecosystem, influencing both cost structures and deployment models. According to market observers, tariff rates are projected to stabilize between 15 and 20 percent for a broad range of imported technology components, up markedly from prior levels of around 2.5 percent in 2024. These increased duties particularly affect hardware elements such as imaging sensors, servers, and networking equipment, which are essential for on-premise software implementations.

Compounding this impact, think tanks have highlighted the broader economic consequences of sustained technology tariffs. A modeled 25 percent levy on semiconductor imports, for instance, could shrink U.S. GDP growth by nearly 0.76 percent over the next decade and raise downstream costs for data centers and medical device manufacturers. Within dental practices, these pressures translate into higher capital expenditures for local server installations and ancillary hardware upgrades, driving many providers to explore cloud-hosted alternatives.

Indeed, to mitigate tariff-related cost increases, practices and vendors are accelerating their shift toward cloud-based subscription models. This strategy reduces upfront investment in equipment subject to import duties and leverages remote infrastructure maintained by global providers. In addition, technology solutions are being leveraged to analyze trade lanes and optimize sourcing strategies, helping practices manage inventory and anticipate supply-chain disruptions amid evolving trade policies.

Uncovering the Multiple Dimensions through Which Offering, Functionality, and User Preferences are Segmenting the Dental Practice Management Software Market

The dental practice management software market can be viewed through multiple segmentation dimensions that reveal distinct patterns of adoption and investment. When examining the market by offering, it becomes clear that while core software platforms continue to attract significant attention for their workflow and analytics capabilities, ancillary services such as implementation and integration, support and maintenance, and ongoing training and consulting remain critical for practice success. Practices that invest in comprehensive service packages often experience smoother transitions to new software and higher long-term satisfaction with vendor partnerships.

Turning the lens to functionality, solutions that excel in appointment scheduling and reminders, billing, payment and insurance management, clinical charting and treatment planning, and patient records management are commanding the market narrative. The interplay between intuitive scheduling modules and robust insurance verification tools, for example, can greatly reduce administrative bottlenecks and streamline revenue cycles. Meanwhile, the emphasis on detailed clinical charting and treatment planning underscores how software has become integral to supporting evidence-based patient care.

Additional segmentation by category, user type, end user, and deployment mode further enriches this picture. Administration-focused platforms cater to practice managers and billing teams, while clinical categories serve dental professionals with advanced charting and imaging workflows. Multi-user solutions address group practices and DSOs, whereas single-user offerings often target smaller clinics seeking simplicity. Finally, choices between cloud-based and on-premises deployments continue to hinge on considerations of upfront costs, data control, and regulatory compliance, reflecting the diverse requirements of end users in academic and research institutes, dental clinics, and laboratories alike.

This comprehensive research report categorizes the Dental Practice Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Category

- User Type

- Application

- End User

- Deployment Mode

Examining Regional Dynamics and Adoption Variances in the Americas, Europe and Asia-Pacific Regions Within Dental Practice Management Solutions

Regional dynamics exert a profound influence on the adoption and customization of dental practice management software solutions. In the Americas, particularly the United States and Canada, high levels of digital infrastructure and supportive regulatory frameworks have fostered early and widespread software uptake. Practices in North America often lead the way in integrating advanced features such as AI-driven analytics and cloud-based patient engagement tools, driven by a competitive healthcare environment and a focus on operational efficiency.

Across Europe, Middle East and Africa, the landscape is more varied. Western European countries such as Germany and the United Kingdom demonstrate robust adoption rates, with compliance requirements like GDPR catalyzing the use of secure, interoperable platforms. Meanwhile, emerging markets in the Middle East and Africa are experiencing steady growth as government-led health reforms and targeted digitalization initiatives encourage clinics to modernize their workflows. Despite challenges around connectivity and data sovereignty, localized partnerships and regulatory incentives are accelerating software penetration.

In the Asia-Pacific region, rapid urbanization, rising disposable incomes, and expanding healthcare access are driving the fastest market growth globally. Nations like China and India have witnessed significant investments in cloud-based solutions that reduce infrastructure burdens and expedite deployment. At the same time, more mature markets such as Japan and Australia prioritize interoperability and high security standards, reflecting a balanced approach to leveraging innovative software features while safeguarding patient data.

This comprehensive research report examines key regions that drive the evolution of the Dental Practice Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Disruptors Delivering Advanced Dental Practice Software Solutions Through Innovation, Scalability, and Strategic Partnerships

A handful of established players and innovative disruptors are shaping the competitive contours of the dental practice management software industry. Long-standing vendors such as Henry Schein, through its Dentrix platform, and Patterson Companies with Eaglesoft have built reputations rooted in comprehensive scheduling, billing, and clinical charting capabilities. These incumbents leverage their extensive distribution networks and deep integration with dental supply offerings to maintain significant footholds in both solo and multi-site practices.

Concurrently, cloud-native challengers like Planet DDS, with its Denticon solution, and Curve Dental have emerged as preferred options for practices seeking scalability and user-friendly interfaces. These vendors emphasize centralized data management, enterprise-grade scalability, and streamlined revenue cycle services, resonating strongly with DSOs and growing clinic networks. Open Dental’s open-source model and DentiMax’s flexible deployment options further diversify the competitive landscape, delivering cost-effective alternatives for smaller practices.

Meanwhile, new entrants such as Oryx Dental are carving niches by offering dentist-built platforms that incorporate AI-driven diagnostics and intuitive workflows. By focusing on modern UX design and rapid onboarding, these innovators have captured the attention of tech-savvy practitioners. Across the industry, the fusion of established brand equity and agile, cloud-first startups drives continuous innovation, ensuring that buyers have access to a range of solutions tailored to varying operational needs and growth objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dental Practice Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABELDent Inc

- ACE Dental Software

- ADSTRA SYSTEMS INC.

- Archy

- Benco Dental Supply Co.

- BestoSys Solutions Private Limited.

- CareStack by Good Methods Global Inc.

- Carestream Dental, LLC by Envista Holdings Corporation

- Clear Dent by Prococious Technology Inc

- Curve Dental, LLC

- Dentally, Inc.

- Dentiflow

- DentiMax, Inc.

- Dentisoft Technologies

- Doctible Inc..

- DSN Software, Inc.

- eClinicalWorks, LLC

- Emitrr Inc.

- Henry Schein, Inc.

- iDentalSoft, Inc.

- MOGO, Inc.

- NexHealth, Inc.

- NextGen Healthcare, Inc.

- Open Dental Software, Inc.

- Oryx Dental Software

- Patterson Dental Supply, Inc.

- PDDS Buyer, LLC

- Pearl Dental Software by Baker Heath Associates Limited

- Practice-Web Inc.

- Praktika by Lizard Software Pty. Ltd.

- Solutionreach, Inc.

- Thryv, Inc.

- Ultimo Software Solutions Inc.

- vcita Inc.

- Weave Communications, Inc.

- XLDent by Valsoft Corporation Inc.

- Yapi Inc.

Strategic Imperatives and Practical Steps for Dental Software Vendors and Practice Executives to Capitalize on Emerging Market Opportunities

Industry leaders must adopt a multifaceted strategy to navigate supply-chain disruption, regulatory complexity, and evolving customer expectations. First, diversifying sourcing and manufacturing footprints is essential. As tariff-related cost pressures intensify, vendors should explore nearshoring options and multi-regional distribution hubs to reduce dependence on high-duty import routes. Early engagement with customs experts and trade-compliance technology solutions can also streamline cross-border logistics and inventory management.

Second, investing in embedded intelligence and automation will differentiate software offerings. Integrating AI agents for automated patient reminders, claims adjudication, and clinical decision support not only enhances efficiency but also fosters stronger patient engagement. Vendors that develop seamless APIs for third-party imaging, teledentistry platforms, and electronic health record systems can deliver compelling end-to-end experiences that appeal to modern practices.

Third, partnerships with value-added service providers will be critical to expanding customer value. Aligning with training organizations, cybersecurity specialists, and data-analytics consultancies enables software companies to offer holistic implementations and post-go-live support. These alliances reinforce customer success and build long-term loyalty, as practices increasingly seek turnkey solutions that address both technical and operational challenges.

Finally, prioritizing compliance and data governance is non-negotiable. As global privacy regulations continue to evolve, vendors must adopt stringent encryption, certification, and audit frameworks. Proactive engagement with regulatory bodies and transparent communication around data-security practices will instill confidence in end users, particularly those in highly regulated markets such as North America and Europe.

Outlining Rigorous Qualitative and Quantitative Methodologies Employed to Ensure Comprehensive and Reliable Dental Practice Management Software Insights

This research utilizes a rigorous mixed-methods approach to ensure depth, accuracy, and relevance. Primary data were gathered through structured interviews with senior executives, practice managers, and IT leads from a representative sample of dental clinics, academic institutes, and laboratory facilities. These qualitative insights were supplemented by in-depth surveys to quantify adoption trends, feature preferences, and strategic priorities across various practice sizes and geographies.

Secondary research entailed a comprehensive review of industry publications, governmental trade reports, and technology whitepapers. Publicly available data from trade associations, regulatory filings, and market analytics platforms were systematically triangulated to validate and contextualize primary findings. To capture evolving competitive dynamics, vendor presentations, product roadmaps, and recent partnership announcements were closely monitored throughout the research period.

Data synthesis involved advanced analytical techniques, including cross-segment comparisons and regional benchmarking. A proprietary scoring model evaluated software features against criteria such as automation, interoperability, user experience, and security compliance. All quantitative outputs were subjected to peer review by domain experts to ensure methodological robustness and mitigate biases.

This structured yet adaptive research process delivers a holistic view of the dental practice management software market, equipping stakeholders with reliable, actionable insights for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dental Practice Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dental Practice Management Software Market, by Offering

- Dental Practice Management Software Market, by Category

- Dental Practice Management Software Market, by User Type

- Dental Practice Management Software Market, by Application

- Dental Practice Management Software Market, by End User

- Dental Practice Management Software Market, by Deployment Mode

- Dental Practice Management Software Market, by Region

- Dental Practice Management Software Market, by Group

- Dental Practice Management Software Market, by Country

- United States Dental Practice Management Software Market

- China Dental Practice Management Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Imperatives Highlighting the Future Trajectory of Dental Practice Management Software in an Evolving Healthcare Landscape

In summary, the dental practice management software market stands at the nexus of technological innovation and evolving practice needs. Platforms are increasingly characterized by embedded intelligence, cloud-native architectures, and patient engagement features that redefine operational efficiency and clinical quality. While established vendors continue to leverage brand equity and integrated service portfolios, disruptive entrants are driving competition through agility, open architectures, and AI-enhanced workflows.

At the same time, macroeconomic factors such as U.S. tariff policies are reshaping capital allocation and deployment strategies, incentivizing a shift toward subscription-based cloud solutions. Segmentation analysis underscores how offering, functionality, category, user type, and end-user considerations influence purchasing decisions, highlighting the importance of customization and service excellence.

Regionally, North America leads in adoption, Europe demonstrates steady growth under stringent regulatory frameworks, and Asia-Pacific emerges as the fastest-growing frontier fueled by healthcare investment and digital initiatives. These dynamics, paired with strategic recommendations around diversification, intelligence embedding, and ecosystem partnerships, provide a roadmap for vendors and practices to navigate the competitive landscape.

Looking ahead, continued emphasis on data security, interoperability, and personalized patient experiences will define market leadership. Stakeholders who translate these insights into agile product development and targeted go-to-market strategies will be best positioned to capture value as the dental software market matures and expands.

Connect with Our Associate Director to Secure Your Dental Practice Management Software Market Intelligence Report and Propel Your Strategic Decisions

Don’t miss the opportunity to elevate your strategic vision with the definitive dental practice management software market research report. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing, for personalized insights and a comprehensive understanding of the trends, challenges, and growth drivers shaping this dynamic industry. Whether you’re looking to benchmark your product roadmap against competitive offerings or refine your market entry strategy, Ketan can guide you through the report’s depth of analysis and help you secure the data you need to make informed decisions. Reach out today to explore customized packages, discuss licensing options, or request a tailored executive briefing that will empower your organization to thrive in an increasingly digital dental landscape.

- How big is the Dental Practice Management Software Market?

- What is the Dental Practice Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?