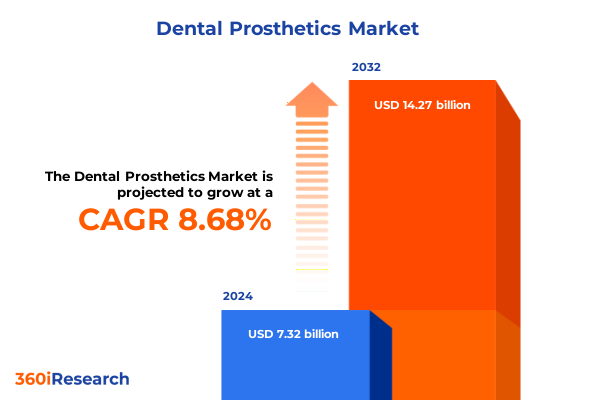

The Dental Prosthetics Market size was estimated at USD 7.96 billion in 2025 and expected to reach USD 8.56 billion in 2026, at a CAGR of 8.68% to reach USD 14.27 billion by 2032.

Overview of the Evolving Dynamics in the U.S. Dental Prosthetics Sector Highlighting Growth Drivers and Technological Milestones

The dental prosthetics industry in the United States has undergone profound evolution driven by demographic shifts, technological breakthroughs, and changing patient expectations. Recent advances in digital dentistry have accelerated the adoption of computer-aided design and computer-aided manufacturing workflows, enabling more precise, efficient, and aesthetically superior prosthetic solutions. At the same time, an aging population with growing awareness of oral health has intensified demand for both restorative and preventive measures. This dynamic environment sets the stage for an in-depth examination of market drivers, competitive forces, and regulatory influences that together shape the trajectory of fixed and removable prostheses. Understanding these fundamental forces provides a critical backdrop for stakeholders aiming to capitalize on emerging opportunities while mitigating potential risks.

Moreover, the convergence of cross-disciplinary innovations-such as biomaterials research, additive manufacturing, and telehealth diagnostics-offers pathways to redefine patient care models and streamline clinical workflows. As regulatory frameworks evolve to address safety and reimbursement considerations, manufacturers and service providers must navigate a complex landscape of compliance requirements and market access hurdles. This introduction establishes the foundational context for subsequent sections on technological shifts, tariff impacts, segmentation insights, and strategic imperatives. By framing the current state of the market in relation to both historical trends and future catalysts, decision-makers can forge a cohesive strategy aligned with long-term growth objectives.

Identification of the Key Transformative Shifts Reshaping Prosthetic Solutions through Digital Adoption and Material Innovations

In recent years, transformative shifts have redefined how dental prosthetics are conceived, produced, and delivered. The transition from traditional impression-based methods to fully digital workflows represents one of the most significant paradigm changes, reducing turnaround times while enhancing prosthetic accuracy. Concurrently, advances in additive manufacturing technologies have lowered barriers to entry for bespoke solutions, enabling clinics and laboratories to fabricate complex geometries in ceramics, metals, and polymers with unprecedented precision. These technological advances, coupled with the integration of artificial intelligence for treatment planning, are fostering a new era of personalized dentistry.

Meanwhile, material innovations continue to expand the range of aesthetic and functional possibilities. High-strength zirconia and advanced polymer composites now deliver biocompatibility alongside durability, while hybrid materials offer the strength of ceramics combined with the flexibility of polymers. In parallel, the proliferation of direct-to-consumer platforms and telehealth consultations is reshaping patient engagement models, compelling traditional providers to adapt their service portfolios. As digital adoption accelerates across clinical and laboratory settings, value chains are converging, with increased collaboration between manufacturers, software developers, and dental service organizations. This evolving ecosystem underscores the importance of agility, interoperability, and collaborative innovation in capturing growth opportunities and maintaining competitive advantage.

Assessment of the Cumulative Impact of 2025 U.S. Tariff Policies on Dental Prosthetic Supply Chains and Cost Structures and Market Accessibility Frameworks

Beginning in early 2025, newly enacted tariff policies have introduced additional layers of complexity to the dental prosthetics supply chain. Import duties on certain raw materials and finished components have increased procurement costs, compelling manufacturers to reassess supplier portfolios and inventory strategies. These tariffs, applied uniformly across ceramic powders, specialized alloys, and polymer resins, have created ripple effects from material sourcing to final assembly. As a result, cost management has become a central concern, driving organizations to explore nearshoring opportunities and alternative material blends to stabilize margins without compromising quality.

As trade dynamics continue to evolve, market accessibility frameworks are under scrutiny. Manufacturers reliant on cross-border shipments have accelerated efforts to build regional manufacturing hubs and localize critical processes. This shift toward distributed production networks aims to mitigate tariff exposure and reduce lead times, yet it requires significant capital investment and operational recalibration. At the same time, end users-clinics, laboratories, and hospitals-are reassessing purchasing agreements to secure pricing predictability and supply continuity. The combined impact of these tariff measures underscores the imperative for supply chain resilience and strategic agility, ensuring that stakeholders remain responsive to policy changes while safeguarding patient outcomes.

In-depth Analysis of Market Segmentation Revealing Critical Insights across Type Material End Users and Distribution Channels

A nuanced examination of market segmentation reveals critical insights into how distinct categories contribute to overall performance. When categorized by type, fixed prosthetics and removable prosthetics emerge as primary pillars. Fixed prosthetics extends across crowns and bridges, implant-supported restorations, inlays and onlays, and veneers, each demanding specialized workflows and clinical skill sets. Conversely, removable prosthetics encompasses conventional dentures, overdentures that connect to implants, and partial dentures, which require customization to preserve residual dentition. Understanding these distinctions enables manufacturers and service providers to align product portfolios with clinical applications and patient needs.

Material segmentation further elucidates market dynamics, splitting offerings into ceramics, composites, metals, and polymers. Ceramics incorporate alumina, porcelain, and zirconia, known for their aesthetic appeal and biocompatibility, whereas composites bifurcate into hybrid and resin formulations that balance strength with workability. Metals span cobalt chrome, gold alloys, and titanium, delivering structural support for complex prostheses. Polymers, including PEEK and PMMA, find applications in temporary restorations and interim devices due to their cost-effectiveness and ease of processing. Each material class presents unique processing requirements, regulatory pathways, and pricing considerations.

When evaluating end-user segmentation, dental clinics, laboratories, and hospitals exhibit varying procurement behaviors and service models. Clinics prioritize chairside efficiency and patient satisfaction, laboratories focus on precision manufacturing capabilities, and hospitals integrate prosthetic services within broader care pathways. Turning to distribution channels, direct tenders-comprising government and hospital procurements-must satisfy stringent compliance criteria, while online sales via manufacturer websites and third-party platforms offer convenience and transparent pricing. Retail distribution through pharmacies and specialized distributors supports walk-in demand, and wholesale arrangements with national and regional distributors reinforce bulk purchasing for large networks. An integrated understanding of these segments equips industry stakeholders to tailor go-to-market strategies and optimize resource allocation.

This comprehensive research report categorizes the Dental Prosthetics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- End User

- Distribution Channel

Comparative Overview of Regional Trends Driving Adoption of Dental Prosthetic Technologies across Americas EMEA and Asia-Pacific

Regional dynamics play a pivotal role in shaping adoption patterns and competitive landscapes. In the Americas, a mature market characterized by high clinical sophistication and widespread digital infrastructure has driven robust uptake of advanced prosthetic solutions. The presence of established dental service organizations and robust reimbursement frameworks accelerates technology diffusion, while localized manufacturing centers enable rapid response to clinical demands. Moving eastward, the Europe, Middle East & Africa corridor presents a mosaic of regulatory environments and investment climates. Western Europe’s stringent quality standards contrast with emerging markets in Eastern Europe and the Middle East, where growth is fueled by expanding dental tourism and rising disposable incomes.

Across Asia-Pacific, diverse economic trajectories create both challenges and opportunities. Developed economies in Japan, Australia, and South Korea lead in research commercialization and precision manufacturing. In contrast, rapidly developing markets such as China and India prioritize cost-efficient solutions to serve vast patient populations, stimulating innovation in scalable production techniques and material sourcing. Variations in regulatory approvals, import duties, and clinical training infrastructure influence market entry strategies. Awareness of these regional contrasts is essential for companies seeking to optimize distribution networks, forge local partnerships, and tailor product offerings to distinct clinical and economic contexts.

This comprehensive research report examines key regions that drive the evolution of the Dental Prosthetics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Companies Demonstrating Innovations Competitive Strategies and Collaborations in Dental Prosthetics

Leading companies in the dental prosthetics arena are distinguished by their commitment to end-to-end innovation, strategic partnerships, and digital integration. One prominent global player has expanded its digital scanner portfolio through acquisitions of software start-ups, enabling seamless data flow from clinic to laboratory. Another major group has strengthened its material science capabilities by investing in next-generation ceramics and polymer research, positioning itself at the forefront of biocompatibility and aesthetic performance.

Strategic alliances between implant manufacturers and digital workflow providers illustrate a trend toward ecosystem-based solutions. By collaborating on surgical planning platforms and chairside milling units, these partnerships shorten treatment timelines and enhance clinical outcomes. In parallel, some companies have adopted a subscription-based service model for digital equipment, lowering upfront costs for dental practices and fostering recurring revenue streams. As competitive dynamics intensify, mergers and joint ventures are increasingly targeted at broadening geographic footprints and augmenting product portfolios. These developments underscore the significance of innovation agility and alliance building in sustaining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dental Prosthetics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Innovative Properties Company

- ADIN Dental Implant Systems Ltd.

- BEGO Implant Systems GmbH & Co. KG

- Candulor AG

- Dentsply Sirona Inc.

- Envista Holdings Corporation

- GEBDI Dentalproducts GmbH

- Glidewell Laboratories, Inc.

- Ivoclar Vivadent AG

- Keystone Dental Inc.

- Kulzer GmbH

- Leixir Dental Group, LLC

- Merz Dental GmbH

- Nobel Biocare Services AG

- OSSTEM IMPLANT Co., Ltd.

- Ruthinium Group S.p.A.

- Straumann Holding AG

- VITA Zahnfabrik H. Rauter GmbH & Co. KG

- Yamahama Dental Mfg. Co., Ltd.

- Zimmer Biomet Holdings, Inc.

Actionable Recommendations to Guide Industry Leaders toward Optimizing Operational Excellence and Accelerating Growth in Prosthetic Solutions

Industry participants should focus on investing in digital transformation initiatives that integrate 3D printing, intraoral scanning, and AI-driven design to enhance operational efficiency and clinical precision. By streamlining data exchange between clinics and laboratories, organizations can reduce production lead times and minimize remakes. Establishing modular manufacturing cells closer to end markets will mitigate the impact of tariff fluctuations and improve supply chain responsiveness.

Furthermore, cultivating partnerships with academic institutions and material science specialists can accelerate the development of next-generation biomaterials. Collaborative research agreements and joint innovation hubs offer pathways to co-create solutions that meet evolving patient and regulatory demands. Adopting flexible commercialization models such as equipment-as-a-service can lower barriers to technology adoption for smaller practices, expanding the addressable market. Finally, embedding sustainability considerations into product design and manufacturing-through waste reduction programs and eco-friendly material sourcing-will resonate with both clinicians and patients increasingly attentive to environmental stewardship.

Comprehensive Explanation of Research Methodology Employed to Ensure Robust Data Collection Analysis Stakeholder Engagement and Validation Processes

The research underpinning this report combined primary and secondary methods to ensure rigorous data integrity. Primary research involved structured interviews with dental professionals, laboratory managers, and procurement officers, capturing firsthand insights on technology adoption, material preferences, and supply chain challenges. Secondary research encompassed an extensive review of regulatory filings, clinical journals, patent databases, and industry publications to contextualize market developments and validate emerging trends.

Data collection progressed through a multi-stage process beginning with exploratory discussions to refine research objectives, followed by targeted surveys and in-depth interviews. Responses were triangulated against publicly available information and proprietary data feeds. Analytical techniques included qualitative thematic analysis and quantitative cross-tabulation to identify segment-specific patterns and correlations. Stakeholder engagement workshops provided additional validation, ensuring that findings reflect both macroeconomic drivers and granular operational realities. Throughout the research lifecycle, strict validation protocols were enforced, encompassing data accuracy checks, interviewer calibration, and peer review of draft insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dental Prosthetics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dental Prosthetics Market, by Type

- Dental Prosthetics Market, by Material

- Dental Prosthetics Market, by End User

- Dental Prosthetics Market, by Distribution Channel

- Dental Prosthetics Market, by Region

- Dental Prosthetics Market, by Group

- Dental Prosthetics Market, by Country

- United States Dental Prosthetics Market

- China Dental Prosthetics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Conclusive Perspectives Summarizing Key Findings Implications and Forward-Looking Considerations for Stakeholders in Dental Prosthetics

In summary, the U.S. dental prosthetics market is poised for continued evolution as digital workflows, material innovations, and strategic realignments shape future trajectories. The interplay of emerging technologies and shifting trade policies underscores the need for resilient supply chains and agile go-to-market approaches. Segmentation analysis reveals that tailored strategies addressing the unique demands of fixed and removable prosthetics, diverse material classes, and distribution channels will unlock competitive advantage. Regional insights highlight the importance of customizing market entry and expansion plans to the distinct regulatory and economic contexts of the Americas, EMEA, and Asia-Pacific.

Leading companies demonstrate that success hinges on integration of end-to-end digital ecosystems, strategic alliances, and ongoing investment in research and development. Industry leaders are advised to adopt actionable recommendations focused on digital transformation, supply chain diversification, collaborative innovation, and sustainability commitments. This holistic perspective equips stakeholders with the strategic intelligence required to navigate complexities and capture growth in a rapidly evolving market landscape. As the dental prosthetics sector continues to intersect with broader healthcare and technology trends, organizations that prioritize agility, partnership, and patient-centric innovation will be best positioned for long-term success.

Immediate Call-To-Action Encouraging Readers to Connect with Ketan Rohom for Exclusive Access to the Full Dental Prosthetics Market Research Report

To explore the full breadth of insights and strategic guidance detailed in this comprehensive analysis of the U.S. dental prosthetics market, please reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the complete report and unlock data-driven recommendations tailored to your organization’s growth objectives.

- How big is the Dental Prosthetics Market?

- What is the Dental Prosthetics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?