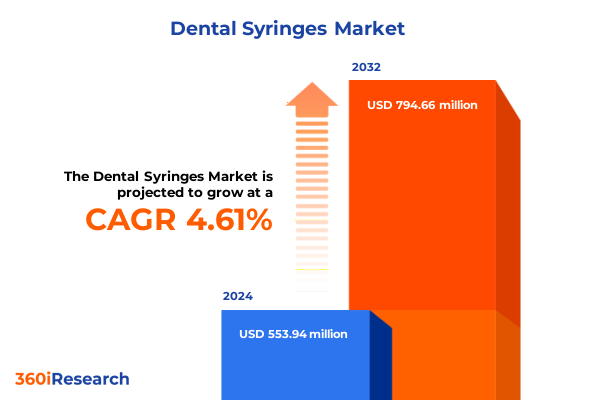

The Dental Syringes Market size was estimated at USD 575.81 million in 2025 and expected to reach USD 604.24 million in 2026, at a CAGR of 4.70% to reach USD 794.66 million by 2032.

Establishing the Strategic Context and Emerging Stakeholder Dynamics in the Rapidly Evolving Dental Syringes Market Landscape

The dental syringe market sits at the intersection of clinical precision, patient safety, and operational efficiency, making it a focal point for innovation and strategic investment. As dental practitioners and healthcare organizations navigate an environment defined by tightening regulations and evolving patient expectations, the demand for reliable delivery systems that ensure optimal dosage control and infection prevention grows ever more pronounced. Against this backdrop, stakeholders across the value chain-from manufacturers and distributors to end users in hospitals and specialized clinics-are exploring advanced technologies and materials to differentiate their offerings.

Furthermore, heightened awareness of occupational hazards and needle stick injuries has ushered in a new era of safety-oriented designs. The transition from conventional metal-and-glass assemblies to computer controlled devices and safety-engineered variants underscores a collective shift toward risk mitigation. Meanwhile, market participants are recalibrating their strategies to align with emerging reimbursement frameworks and accreditation standards that emphasize patient-centric outcomes. In this context, understanding the interplay between regulatory drivers, material innovations, and user preferences has never been more critical.

Consequently, this executive summary lays the groundwork for a holistic exploration of transformative trends, tariff impacts, segmentation dynamics, regional particularities, and competitive postures shaping the global dental syringe landscape. Grounded in rigorous qualitative and quantitative research, it equips decision makers with actionable intelligence to navigate complexity, anticipate disruption, and harness growth opportunities in a market poised for continued evolution.

Illuminating the Driving Forces Behind Technological Breakthroughs and Regulatory Shifts Redefining Dental Syringe Solutions Worldwide

Over the past few years, the dental syringe industry has undergone fundamental shifts driven by technological advances, regulatory reforms, and shifting end-user requirements. Digital integration, exemplified by computer controlled delivery units that offer programmable dosage and real-time feedback, has moved from niche adoption toward mainstream acceptance, particularly among group practices and ambulatory surgical centers seeking precision and workflow optimization. Simultaneously, safety-engineered syringes, which incorporate retractable needles and locking mechanisms, have gained traction amid more stringent mandates around sharps disposal and clinician safety.

Material science has played an equally transformative role, with plastic composites and autoclavable polymers emerging as cost-effective alternatives to traditional glass and metal assemblies. This trend coincides with growing environmental awareness and sterilization efficiency requirements, prompting manufacturers to explore chemical sterilization techniques that reduce cycle times without compromising structural integrity. Furthermore, the proliferation of minimally invasive procedures has elevated demand for micro-volume syringes and specialized irrigation fittings, reshaping product portfolios to address endodontic, surgical, and restorative applications with tailored precision.

Additionally, regulatory ecosystems in key markets have tightened standards for biocompatibility and traceability, compelling supply chain stakeholders to invest in serialization, material trace audits, and ISO-compliant documentation pipelines. As the confluence of safety, sustainability, and digitalization accelerates, the dental syringe sector stands at the cusp of a new innovation cycle that promises to redefine clinician workflows and patient experiences alike.

Analyzing the Cumulative Influence of New United States Tariff Measures on Supply Chains and Cost Structures in Dental Syringe Markets

In 2025, the United States enacted a new tranche of tariffs targeting imported glass and metal components essential for conventional syringe assemblies, with notable effects on cost structures and sourcing strategies. Manufacturers reliant on overseas suppliers of borosilicate glass have experienced increased input expenses, prompting a reevaluation of domestic production capabilities and supplier diversification. At the same time, logistics constraints and extended lead times have intensified, driving up working capital requirements for inventory buffers and accelerating just-in-time fulfillment initiatives.

Moreover, the tariff environment has catalyzed strategic realignments among multinational corporations, with several electing to nearshore production or enter joint ventures with U.S.-based plastic injection molders to mitigate exposure. These measures have uncovered opportunities for local metal fabricators and polymer specialists to expand their footprint, while also incentivizing investment in automation technologies that enhance throughput and lower per-unit manufacturing costs. Consequently, the traditional paradigm of low-cost import sourcing has given way to a hybrid model that balances offshore expertise with onshore agility.

The ripple effects extend downstream to clinical settings, where suppliers have begun to adjust pricing models and service offerings to maintain margin integrity. Dental clinics and hospital procurement teams face new budgeting challenges, mandating closer collaboration with suppliers on demand forecasting and volume commitments. As the tariff-induced realignment continues, stakeholders across the ecosystem will need to adopt proactive supply chain risk management and cost optimization strategies to uphold service levels and ensure uninterrupted product availability.

Unveiling Critical Segment-Level Insights That Illuminate Product, Material, Application, End User, and Delivery Mode Dynamics Driving Dental Syringe Adoption

Product type segmentation reveals that computer controlled syringes are commanding particular interest in ambulatory surgical environments and high-volume dental clinics, as they deliver programmable precision that reduces medication waste and enhances treatment consistency. Conventional metal-and-glass assemblies remain entrenched in settings where cost sensitivity outweighs technology premium, especially in public hospitals and outpatient departments that operate under constrained budgets. Meanwhile, safety-engineered syringes have ascended rapidly, fueled by tighter regulations around needle stick prevention and growing emphasis on clinician wellbeing.

Material-based distinctions further illustrate diverging market trajectories. Glass components maintain a foothold in specialty centers that prioritize chemical inertness and high-pressure irrigation, whereas metal housings and stainless-steel needles continue to serve demanding surgical applications. In contrast, plastic variants dominate single-use disposable segments, offering lightweight ergonomics and simplified sterilization pathways. Autoclavable polymers are gaining momentum among reusable delivery mode advocates, who value streamlined decontamination cycles and lower environmental footprints.

When observed through the lens of application, anesthesia delivery systems differentiate local infiltration syringes from specialized devices for sedative administration, addressing both general dentistry and oral surgery needs. Irrigation solutions split between endodontic canal cleansing tools and surgical irrigation fittings, each tailored to divergent fluid dynamics and tip configurations. Restorative procedures, spanning composite placement and crown cementation, require syringes with precise flow control to ensure optimal adhesive and cement dispensing.

Analysis of end-user segmentation underscores contrasting adoption patterns. Dental group practices leverage advanced computer controlled units to standardize protocols and maximize throughput, while private clinics often prioritize cost-effective, disposable solutions. Outpatient departments in ambulatory surgical centers demand robust safety features and high-capacity syringes to manage diverse caseloads. Private hospitals invest in high-end metal and glass systems to support complex surgeries, whereas public healthcare institutions balance budget constraints with regulatory compliance through entry-level safety-engineered offerings.

Finally, delivery mode segmentation highlights a strong pivot toward single-use disposables in response to infection control imperatives, yet reusable options persist in settings with strict sterilization infrastructure. Autoclavable delivery systems appeal to sustainability-focused operators, while chemical sterilizable variants offer rapid turnaround for time-sensitive workflows. Together, these segmentation insights paint a nuanced portrait of product preferences driven by clinical demands, regulatory landscapes, and economic considerations.

This comprehensive research report categorizes the Dental Syringes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Delivery Mode

- Application

- End User

Mapping the Nuanced Regional Variances in Adoption Trends, Regulatory Environments, and Growth Catalysts Across Major Global Markets for Dental Syringes

Regional disparities underscore how macroeconomic conditions, regulatory frameworks, and healthcare infrastructure converge to shape dental syringe consumption patterns. In the Americas, robust healthcare funding in the United States supports early adoption of advanced computer controlled and safety-engineered solutions, while Latin American markets exhibit a gradual shift from conventional to plastic disposable configurations driven by cost-containment initiatives and growing private dental service penetration.

By contrast, the Europe, Middle East & Africa zone presents a heterogeneous regulatory environment where the European Union’s stringent medical device directives have accelerated uptake of safety-engineered and traceable syringes, particularly in Western Europe. At the same time, emerging markets in the Middle East and North Africa remain oriented toward traditional glass-and-metal assemblies, though multinational suppliers are actively promoting mid-tier plastic disposables to meet evolving hygiene standards.

In Asia-Pacific, dynamic urbanization trends and expanding healthcare access in China, India, and Southeast Asia have fueled demand for versatile anesthesia delivery and irrigation systems. Cost-sensitive end users in emerging economies often favor single-use disposable syringe models, while advanced healthcare hubs in Japan and Australia prioritize high-precision computer controlled units and autoclavable polymer variants. Moreover, regional supply chain hubs are leveraging local manufacturing strengths in plastics and metal fabrication to serve both domestic and export markets, fostering a competitive landscape that blends global best practices with localized value propositions.

This comprehensive research report examines key regions that drive the evolution of the Dental Syringes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Collaborations That Are Shaping the Competitive Landscape of the Dental Syringe Sector

Leading players in the dental syringe field are engaging in multifaceted strategies to secure competitive advantage through product innovation, strategic partnerships, and geographic expansion. Several global medical device conglomerates have augmented their portfolios with safety-engineered offerings, integrating retractable mechanisms and tamper-evident features to meet evolving regulatory mandates. At the same time, specialized manufacturers of computer controlled delivery systems are forging alliances with dental practice management software providers to create integrated solutions that synchronize treatment planning with dosage monitoring.

Mergers and acquisitions have emerged as a key driver of consolidation, enabling established incumbents to fill portfolio gaps across material technologies and application niches. Concurrently, investments in R&D are focused on next-generation syringe platforms that incorporate sensor-based feedback and connectivity for real-time monitoring. Partnerships with academic institutions and contract research organizations are facilitating accelerated prototyping and validation of novel polymer composites designed for enhanced chemical sterilization compatibility.

Furthermore, strategic distribution agreements are extending reach into underserved markets, with companies tailoring their go-to-market approaches to align with region-specific healthcare channels. Collaborative efforts with private hospital chains and ambulatory surgical center networks are ensuring early adoption of advanced systems, while co-marketing initiatives with professional associations are reinforcing brand credibility among dental clinicians. As a result, the competitive landscape is increasingly characterized by a blend of scale-driven incumbency and agile innovation by niche specialists.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dental Syringes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ASA Dental S.p.A.

- B. Braun Melsungen AG

- Bien-Air Dental SA

- Carpule India Private Limited

- Dental Technologies Inc.

- Dentsply Sirona Inc.

- DTR Medical Ltd.

- Fourros Solingen GmbH

- G. Hartzell & Son

- Henry Schein, Inc.

- Integra LifeSciences Holdings Corporation

- J. Morita Corp.

- Kerr Corporation

- Mizzy, Inc.

- Mydent International

- Parkell, Inc.

- ProDentum

- Septodont Holding

- Ultradent Products, Inc.

Delivering Strategic Actionable Recommendations for Industry Leaders to Enhance Innovation, Efficiency, and Market Position in Dental Syringes

To remain at the forefront of the evolving dental syringe sector, industry leaders should prioritize a dual strategy of innovation investment and supply chain resilience. Establishing dedicated R&D streams for safety and digital integration can yield differentiated products that address clinician demands for precision and risk reduction. Concurrently, forging collaborative partnerships with sterilization equipment manufacturers can unlock integrated solutions that reduce cycle times and reinforce adherence to infection control protocols.

Moreover, expanding regional manufacturing footprints through joint ventures or toll manufacturing agreements can mitigate tariff exposure and accelerate delivery timelines. Stakeholders should explore opportunities within emerging Asia-Pacific production hubs for plastic components, while reinforcing domestic metal and glass fabrication capacities to navigate U.S. tariff pressures. In parallel, implementing advanced demand forecasting tools and segmentation analytics will enable more accurate alignment between production volumes and end-user requirements, reducing waste and optimizing inventory levels.

Finally, adopting a consultative sales approach that educates dental practitioners on the clinical and economic benefits of advanced systems will drive penetration and foster long-term customer relationships. Tailored training programs and digital support portals can facilitate seamless technology adoption, while value-added service offerings-such as preventative maintenance plans and data-driven performance reviews-will enhance supplier differentiation and loyalty. By executing these strategies, industry leaders can unlock sustainable growth and reinforce their market leadership positions.

Explaining the Rigorous Research Methodology Including Qualitative and Quantitative Approaches That Underpin the Dental Syringe Market Analysis

This market analysis is underpinned by a robust, multi-stage research methodology combining both qualitative and quantitative approaches to ensure comprehensive and reliable insights. Primary research comprised in-depth interviews with key opinion leaders-including dental surgeons, procurement heads at hospitals, and device safety officers-providing firsthand perspectives on clinical needs, purchasing drivers, and operational challenges. Supplementary engagement with manufacturing experts and distribution partners enriched the understanding of supply chain dynamics and material sourcing considerations.

Secondary research activities involved systematic reviews of regulatory filings, patent databases, and peer-reviewed journals to identify technological advancements and compliance benchmarks. Publicly available company documents, such as annual reports and investor presentations, were scrutinized to map strategic initiatives, competitive positioning, and R&D investments. Furthermore, trade association publications and conference proceedings were analyzed to capture evolving best practices and emerging product profiles.

Quantitative data were collected through structured surveys targeting a representative sample of end users across ambulatory surgical centers, private practices, and hospital networks. Statistical analyses-including cross-segmentation correlation and trend extrapolation-ensured the reliability of comparative insights across product types, materials, and delivery modes. Finally, triangulation of primary feedback, secondary evidence, and survey outputs was conducted to validate findings, while a peer review process involving independent industry advisors provided an additional layer of methodological rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dental Syringes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dental Syringes Market, by Product Type

- Dental Syringes Market, by Material

- Dental Syringes Market, by Delivery Mode

- Dental Syringes Market, by Application

- Dental Syringes Market, by End User

- Dental Syringes Market, by Region

- Dental Syringes Market, by Group

- Dental Syringes Market, by Country

- United States Dental Syringes Market

- China Dental Syringes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Insights and Emphasizing the Strategic Imperatives for Stakeholders to Capitalize on Evolving Dental Syringe Opportunities

The synthesis of technological trajectories, tariff implications, segmentation nuances, and regional dynamics presented herein underscores a market at the convergence of safety, precision, and cost optimization imperatives. Stakeholders equipped with these insights can more effectively anticipate shifts in end-user preferences, regulatory landscapes, and competitive behaviors. Looking ahead, the integration of digital feedback mechanisms and eco-conscious material innovations will continue to redefine performance benchmarks for dental syringes.

Strategic imperatives for decision makers include deepening collaborative engagements with clinical end users to co-develop differentiated solutions, as well as accelerating investments in flexible manufacturing frameworks that can pivot rapidly in response to geopolitical or regulatory disruptions. Embracing a data-driven approach to segmentation analysis will enable more nuanced product positioning and tailored sales strategies, mitigating the risk of commoditization in price-sensitive segments.

In conclusion, the collective trends shaping the dental syringe sector present a compelling opportunity for growth and transformation, provided that industry participants remain agile, innovation-focused, and customer-centric. By leveraging comprehensive market intelligence and strategic partnerships, organizations can secure a competitive edge and drive sustained value creation in this critical domain of dental care delivery.

Compelling Call to Engage Associate Director of Sales & Marketing for Immediate Acquisition of Comprehensive Dental Syringe Market Report

To gain comprehensive, data-driven perspectives on competitive strategies, regional variances, and segmentation nuances that are critical for precise decision making, reach out without delay to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His expertise will facilitate direct access to the full market research report, unlocking in-depth analysis, proprietary insights, and tailored advisory support that empower your organization to capitalize on emerging trends and tackle evolving challenges in the dental syringe arena. Engage now to secure your copy and leverage critical intelligence that will inform strategic investments and product development roadmaps.

- How big is the Dental Syringes Market?

- What is the Dental Syringes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?