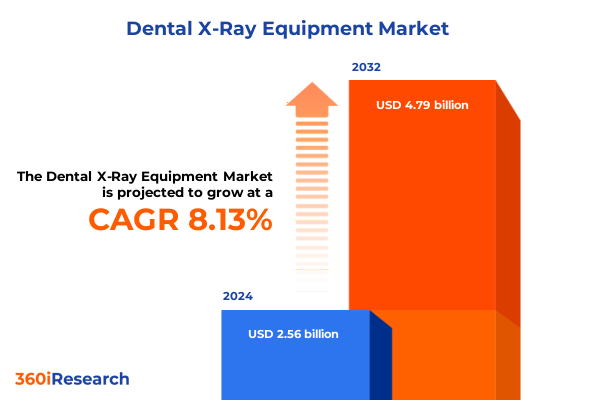

The Dental X-Ray Equipment Market size was estimated at USD 2.76 billion in 2025 and expected to reach USD 2.99 billion in 2026, at a CAGR of 8.16% to reach USD 4.79 billion by 2032.

Exploring the Critical Role and Evolution of Dental X-Ray Equipment in Shaping Precision Diagnostics and Treatment Planning Across Modern Dental Practices

Dental X-ray equipment has emerged as a cornerstone of modern dentistry, enabling clinicians to visualize hard tissue structures with exceptional clarity and precision. Traditionally anchored by film-based intraoral systems for periapical and bitewing imaging, the field has rapidly embraced advanced modalities such as panoramic imaging and cone beam computed tomography to support a wide range of diagnostic and therapeutic procedures. As dental practices seek to optimize patient outcomes and operational efficiency, the integration of digital sensors, software-driven workflows, and dose-reduction technologies has become imperative. Consequently, practitioners and healthcare administrators now view radiographic investments not merely as imaging tools but as strategic assets that enhance diagnostic confidence and patient satisfaction.

Moreover, the accelerating shift toward digital radiography has been catalyzed by evolving regulatory standards emphasizing radiation safety and image archiving. With growing concerns over cumulative patient exposure and the demand for seamless electronic health record integration, dental X-ray systems have undergone transformative upgrades in hardware and software. From complementary metal oxide semiconductor sensors in intraoral units to photostimulable phosphor plates and sophisticated image-processing algorithms, the market’s evolution reflects a convergence of engineering innovation and clinical best practices. This introduction lays the foundation for understanding how technological advances, regulatory imperatives, and shifting clinical priorities collectively shape the current outlook for dental X-ray equipment.

Unveiling the Technological Revolution Transforming Dental Radiography Through Digital Innovations, Cone Beam Computed Tomography, and AI-Driven Imaging Workflows

The dental radiography landscape has undergone transformative shifts driven by digital convergence, artificial intelligence, and three-dimensional imaging. Initially dominated by film-based intraoral systems with manual processing workflows, the sector has pivoted toward digital intraoral sensors offering immediate image acquisition, dose optimization, and integrated patient record management. Beyond two-dimensional imaging, cone beam computed tomography platforms now deliver volumetric reconstructions that have redefined treatment planning for implantology, orthodontics, and oral surgery. These innovations, when combined with cloud-enabled image sharing and machine learning-driven lesion detection, are empowering dental professionals to make more informed clinical decisions while enhancing practice efficiency.

Simultaneously, the proliferation of hybrid equipment that bridges cephalometric, panoramic, and CBCT capabilities in a single unit underscores the industry’s response to space constraints and capital expenditure pressures. Software ecosystems leveraging artificial intelligence are increasingly embedded within X-ray platforms to automate anatomical landmark identification and predict surgical outcomes. As a result, stakeholder expectations have shifted: equipment manufacturers must now deliver holistic imaging solutions that synchronize high-fidelity data capture with intuitive interfaces and robust practice management integration. These transformative shifts not only elevate diagnostic standards but also unlock new revenue streams through value-added service offerings, predictive maintenance, and subscription-based software models.

Assessing the Cumulative Impact of 2025 United States Trade Tariffs on the Dental X-Ray Equipment Supply Chain, Costs, and Strategic Sourcing Models

The cumulative impact of United States tariffs implemented through 2025 has introduced significant complexities to the dental X-ray equipment supply chain, procurement strategies, and cost structures. Initial Section 301 measures imposed 25 percent duties on a broad range of Chinese-origin medical device components, including X-ray tubes, sensors, and electronic assemblies, prompting manufacturers to reevaluate sourcing strategies. Although a subset of medical and dental devices-such as alignment and positioning apparatus valued over $5,000-received temporary exemptions, many critical components remained subject to duties. These measures have driven OEMs to diversify their supplier base, expand procurement from alternative markets, and accelerate efforts to qualify non-Chinese components under U.S. regulatory standards.

In parallel, threatened retaliatory tariffs on European imports and proposed levies of up to 50 percent on EU-sourced radiography systems have fueled uncertainty among domestic distributors. The prospect of sustained duties on panoramic units, CBCT platforms, and digital sensor modules has, in turn, led some practices to explore refurbished equipment and extended maintenance service agreements as cost-mitigation tactics. Moreover, the broader medical device industry’s call for tariff exemptions highlights the tension between trade policy and patient access to advanced imaging solutions. Ultimately, while short-term price pressures and supply chain realignments have tested market resilience, industry participants anticipate that sustained collaboration between policymakers and trade bodies will be essential to restoring tariff stability and safeguarding long-term investment in dental radiography technology.

Unlocking Comprehensive Segmentation Insights to Understand Equipment Types, End Users, Technologies, and Applications Driving Dental X-Ray Market Dynamics

Analyzing the dental X-ray market through multiple segmentation lenses reveals nuanced demand drivers and product development priorities. When considering equipment type, extraoral modalities such as cephalometric imaging, cone beam computed tomography, and panoramic units cater to practitioners requiring high-resolution, three-dimensional anatomical visualization, whereas intraoral solutions-spanning direct and indirect digital systems as well as traditional film-based workflows-address routine diagnostic and follow-up examinations. Within the intraoral category, direct digital sensors offer instant image capture and lower radiation dosage, while indirect systems employing photostimulable phosphor plates strike a balance between cost and performance. Film-based systems, though gradually diminishing in prevalence, remain relevant in regions where capital investment constraints and infrastructure limitations persist.

From an end-user perspective, academic and research institutes, comprising universities and specialized laboratories, prioritize versatile imaging platforms to support experimental protocols and training curricula. Independent and chain dental clinics demand solutions that blend rapid throughput with intuitive software controls to accommodate high patient volumes. Diagnostic imaging centers, whether standalone or integrated within multispecialty facilities, gravitate toward high-end extraoral systems that deliver advanced diagnostics for complex cases. Hospitals, in both general and specialty dental settings, require interoperable imaging units capable of interfacing with broad clinical networks and meeting stringent regulatory compliance. Likewise, technology segmentation underscores the ascendancy of digital modalities-complementary metal oxide semiconductor sensors and charged coupled devices lead developments in direct capture, while photostimulable phosphor systems and automated film processors continue to serve niche applications. Finally, in application segmentation, disciplines ranging from endodontics-focused on root canal assessment and periapical lesion diagnosis-to orthodontics, where initial assessments and treatment monitoring hinge on serial imaging, define distinct product feature sets and service requirements.

This comprehensive research report categorizes the Dental X-Ray Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Portability

- Technology

- Imaging Type

- End User

- Application

- Procurement Channel

Comparative Regional Dynamics Revealing Growth Drivers, Regulatory Landscapes, and Adoption Trends in the Americas, EMEA, and Asia-Pacific Dental Radiography Markets

Regional dynamics in the dental X-ray equipment sector reflect diverse regulatory frameworks, reimbursement policies, and adoption patterns across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, high penetration of digital intraoral systems is driven by favorable reimbursement for radiographic procedures, stringent radiation safety regulations, and well-established distribution channels. North American and Latin American markets share a common emphasis on practice efficiency, patient comfort, and integration with electronic health records, but infrastructure disparities in certain Latin American countries temper the pace of digital transition.

Across Europe, the Middle East, and Africa, heterogeneous regulatory regimes and variable healthcare spending shape equipment preferences. Western Europe demonstrates early adoption of CBCT technologies, underpinned by robust training programs and insurance coverage that incentivizes advanced diagnostics. By contrast, emerging economies in the Middle East and Africa balance capital investment with localized manufacturing partnerships to enhance affordability and service support. In Asia-Pacific, dynamic economic growth and expanding dental healthcare access fuel strong demand for both affordable intraoral sensors and high-end extraoral modalities. Market leaders in Japan, South Korea, and China invest heavily in research collaborations and OEM alliances to introduce next-generation imaging systems. Collectively, these regional insights highlight the imperative for tailored go-to-market strategies, strategic partnerships, and local regulatory navigation to capture growth opportunities across diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the Dental X-Ray Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Competitive Strategies and Innovation Trajectories of Leading Dental X-Ray Equipment Manufacturers Shaping the Global Market Landscape

Leading players in the dental X-ray equipment market are leveraging innovation, strategic alliances, and targeted investments to maintain competitive advantage. Global incumbents are enhancing product portfolios by integrating artificial intelligence for automated image interpretation, embedding cloud-based practice management modules, and offering modular hardware architectures that can be upgraded as clinical needs evolve. Additionally, regional specialists and emerging OEMs are forging distribution partnerships with local stakeholders to expand market reach, ensure regulatory compliance, and provide rapid technical support. Such collaborations enable smaller manufacturers to tap into established networks while multinational corporations reinforce their local presence.

Investment in research and development remains a critical differentiator, with companies channeling resources into low-dose imaging, sensor miniaturization, and software suites that facilitate tele-dentistry applications. Strategic mergers and acquisitions continue to shape the competitive landscape, as firms seek complementary capabilities in AI-driven diagnostics, advanced imaging modalities, and aftermarket service offerings. Furthermore, several market leaders are evaluating direct-to-practice subscription models, bundling equipment leases, software updates, and maintenance services into a predictable cost structure. These initiatives demonstrate a clear industry trajectory towards end-to-end imaging solutions that address the entire clinical workflow and foster long-term customer relationships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dental X-Ray Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agfa-Gevaert Group

- Air Techniques, Inc.

- Carestream Dental LLC

- Cefla S.C.

- DD Products and Services Ltd.

- Dentsply Sirona Inc.

- DÜRR Dental SE

- Genoray

- Hu-Friedy Mfg. Co., LLC

- Iatome Electric

- Koninklijke Philips N.V.

- Midmark Corporation

- Nobel Biocare Services AG

- Planmeca Oy

- Siemens AG

- Technomac Medical Systems Private Limited

- Vatech Co., Ltd.

- Yoshida Dental Mfg. Co., Ltd.

Strategic Recommendations for Dental Radiography Leaders to Enhance Innovation, Optimize Supply Chains, and Capitalize on Emerging Technologies Effectively

Industry leaders should pursue a multifaceted strategy that aligns innovation roadmaps with evolving clinical workflows and regulatory mandates. Prioritizing research into next-generation sensor technologies and AI-enabled diagnostic software will empower practitioners to achieve faster, more accurate diagnoses while reducing operational costs. Concurrently, diversifying component sourcing and qualifying alternative suppliers across multiple geographies can mitigate the impact of trade uncertainties and tariffs. Establishing strategic partnerships with local distributors and service providers will enhance market responsiveness and ensure consistent after-sales support.

Additionally, introducing flexible financing and subscription-based models can lower adoption barriers for cash-constrained practices, fostering deeper penetration of advanced imaging systems. Emphasizing robust training programs and clinical education initiatives will not only drive user proficiency but also elevate the perceived value of integrated solution offerings. Finally, engaging proactively with regulatory authorities and industry associations to advocate for stable trade policies and technology-friendly reimbursement frameworks will secure a conducive environment for sustainable growth. By executing these actionable recommendations, industry stakeholders can reinforce their market position, accelerate innovation adoption, and deliver compelling value to dental professionals and patients alike.

Detailing the Rigorous Research Methodology Underpinning the Dental X-Ray Equipment Market Analysis Through Primary Interviews and Data Triangulation

The research methodology underpinning this market analysis integrates primary interviews, secondary research, and data triangulation to ensure comprehensive coverage and accuracy. Primary insights were gathered through structured discussions with dental practitioners, radiology technicians, procurement managers, and industry experts, enabling nuanced perspectives on equipment performance, adoption barriers, and regional market dynamics. Secondary data sources included peer-reviewed journals, regulatory filings, patent databases, and company disclosures to validate technological advancements and competitive strategies.

Market segmentation was applied across equipment type, end user, technology, and clinical application to dissect granular end-use patterns and investment priorities. Quantitative data were cross-verified through industry databases and revenue reports, while qualitative assessments were corroborated via expert panels and advisory board reviews. Regional analyses incorporated government policies, reimbursement schedules, and import-export statistics to contextualize demand drivers. Rigorous triangulation of multiple data streams and iterative validation cycles with stakeholders has ensured that the findings presented in this report reflect both current realities and emerging trends shaping the dental X-ray equipment sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dental X-Ray Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dental X-Ray Equipment Market, by Product Type

- Dental X-Ray Equipment Market, by Portability

- Dental X-Ray Equipment Market, by Technology

- Dental X-Ray Equipment Market, by Imaging Type

- Dental X-Ray Equipment Market, by End User

- Dental X-Ray Equipment Market, by Application

- Dental X-Ray Equipment Market, by Procurement Channel

- Dental X-Ray Equipment Market, by Region

- Dental X-Ray Equipment Market, by Group

- Dental X-Ray Equipment Market, by Country

- United States Dental X-Ray Equipment Market

- China Dental X-Ray Equipment Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3975 ]

Synthesizing Core Findings and Future Outlook to Highlight Emerging Opportunities and Strategic Imperatives in the Dental X-Ray Equipment Sector

This executive summary has elucidated the multifaceted evolution of dental X-ray equipment, from the transition to digital imaging and three-dimensional modalities to the navigational challenges posed by international trade dynamics. Key segmentation insights have underscored how equipment type, end user, technology, and clinical application converge to define the diverse needs of dental professionals. Regional assessments have revealed the critical importance of localized strategies in navigating regulatory frameworks and capturing growth across the Americas, EMEA, and Asia-Pacific.

Competitive landscape analysis highlights the central role of innovation in driving differentiation, with leading manufacturers advancing AI-integrated imaging platforms and flexible service models. Actionable recommendations emphasize the necessity of supply chain diversification, strategic partnerships, and targeted investment in R&D. This report’s robust methodology ensures that stakeholders are equipped with accurate, actionable intelligence. As the sector continues to evolve, the ability to anticipate emerging clinical demands, regulatory shifts, and technological breakthroughs will determine the leaders in dental radiography.

Engage with Ketan Rohom to Secure Exclusive Insights and Access the Comprehensive Dental X-Ray Equipment Market Research Report Today

Don’t miss the opportunity to transform your strategic vision with data-driven insights into the evolving dental radiography landscape. Ketan Rohom, Associate Director, Sales & Marketing, stands ready to guide you through our comprehensive market research report, which delves into technological breakthroughs, regulatory shifts, and competitive strategies shaping the dental X-ray equipment sector. By engaging directly with Ketan, you will uncover tailored perspectives on segmentation dynamics, regional growth patterns, and actionable recommendations tailored to your organization’s goals. Connect with him to discover how this report can inform your next product development roadmap, supply chain optimization, or business expansion plan. Secure unrivaled market intelligence today to maintain a competitive edge and drive long-term success in the dynamic world of dental diagnostics.

- How big is the Dental X-Ray Equipment Market?

- What is the Dental X-Ray Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?