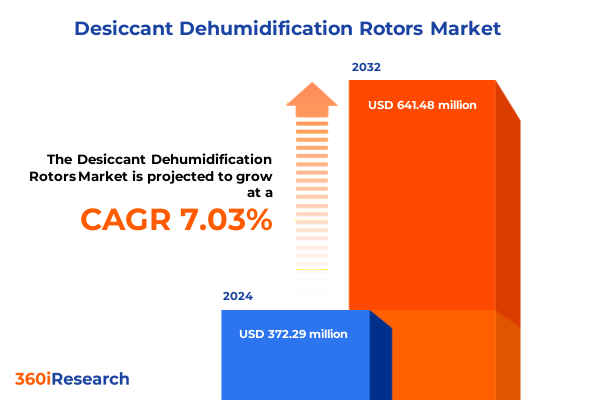

The Desiccant Dehumidification Rotors Market size was estimated at USD 398.55 million in 2025 and expected to reach USD 424.55 million in 2026, at a CAGR of 7.03% to reach USD 641.48 million by 2032.

Setting the stage for desiccant dehumidification rotors by highlighting their critical role in advancing precise moisture control across diverse industrial sectors

The technical and commercial landscape of moisture control is undergoing a rapid evolution, driven by increasing demand for precise environmental management across a wide array of sectors. Desiccant dehumidification rotors have emerged as a critical technology to deliver consistent, energy-efficient humidity reduction where traditional refrigeration-based methods fall short. In settings ranging from pharmaceutical manufacturing to food processing, and from semiconductor fabrication to archival storage, these rotors optimize process reliability, product quality, and operational costs.

This executive summary introduces the essential dynamics shaping the desiccant rotor market. It outlines the key transformational forces, examines the cumulative impact of recent trade policy changes, and presents a clear segmentation framework. Readers will gain strategic perspectives on regional variations, leading competitors, and actionable recommendations to navigate this complex terrain. The methodology underpinning these insights is also detailed, ensuring transparency and rigor. Collectively, this introduction sets the foundation for a comprehensive understanding of how desiccant dehumidification rotors will influence industrial efficiency and sustainability in the years ahead.

Exploring transformative shifts in materials, digitalization, and sustainability that are redefining the future of desiccant dehumidification rotor systems

The desiccant rotor industry is experiencing a series of transformative shifts, underpinned by a heightened focus on sustainability and operational efficiency. Advances in materials science have given rise to novel desiccant substrates with enhanced moisture uptake and selectivity, leading to rotors that deliver greater performance with lower energy consumption. Concurrently, digitalization trends are reshaping system design, enabling real-time monitoring, predictive maintenance, and remote optimization of humidity control systems.

Furthermore, stringent environmental regulations and growing corporate commitments to reducing carbon footprints have accelerated the adoption of desiccant based solutions in place of energy-intensive alternatives. Innovations in hybrid systems that integrate desiccant rotors with heat recovery and solar thermal modules are gaining traction, as are modular designs that allow scalable deployment across different facility sizes. Together, these developments are redefining best practices in dehumidification, positioning rotors as central components in efforts to achieve resilient and sustainable operations.

Analyzing the far-reaching impact of the 2025 United States tariff revisions on supply chains, sourcing strategies, and operational costs in rotor manufacturing

In 2025, the imposition of updated tariff measures by the United States has introduced a complex set of challenges for manufacturers and end users of desiccant dehumidification rotors. Increased duties on imported rotor components and specialty adsorbent materials have raised procurement costs, prompting OEMs to reassess supply chain structures. As a result, several producers have accelerated initiatives to localize production, establish alternative sourcing partnerships, and negotiate longer-term supply agreements to hedge against pricing volatility.

Consequently, distributors and system integrators are navigating a period of transition characterized by shifting lead times and elevated logistical expenses. Some players are absorbing incremental costs to preserve market share, while others are passing these through to clients, impacting project budgets and payback calculations for capital-intensive installations. Ultimately, these tariff-driven dynamics are reinforcing the importance of supply chain resilience and strategic procurement planning, foreshadowing a marketplace in which agility and cost management will be indispensable.

Unveiling critical segmentation insights by type, product, desiccant material, application, industry vertical, and distribution channel for comprehensive market clarity

An in-depth segmentation view reveals a multi-faceted desiccant rotor market landscape. A type-based perspective differentiates systems by their mechanism of moisture removal, contrasting solutions that employ actively regenerated dehumidification wheels with those leveraging passive rotor configurations. Equally, product segmentation delineates offerings from space-constrained compact units to household frameworks, heavy-duty industrial modules, and specialized rotors engineered for low relative humidity environments.

Delving into the desiccant substrate layer exposes variations among activated charcoal, the lithium chloride hygroscopic media, high-performance molecular sieve desiccants, and versatile silica gel, each conferring unique operational characteristics. Application-driven segmentation spans roles such as preventing condensation on critical surfaces, inhibiting corrosion in sensitive components, facilitating dry cooling cycles, controlling moisture regain, suppressing mold and fungal proliferation, and accelerating product drying. Across verticals, end uses span agricultural storage, automotive paint shops, construction site dehumidification, electronics manufacturing lines, food and beverage processing plants, pharmaceutical clean rooms, oil and gas facilities, and printing and paper operations. Finally, distribution channels encompass both established offline sales networks and burgeoning online platforms, reflecting a shift toward digital procurement and global e-commerce strategies.

This comprehensive research report categorizes the Desiccant Dehumidification Rotors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product

- Desiccant Type

- Application

- Industry Verticals

- Distribution Channel

Mapping regional dynamics across Americas, Europe Middle East Africa, and Asia-Pacific to highlight distinct growth drivers, policy impacts, and adoption trends

Regional analysis underscores divergent growth drivers and challenges across three interconnected geographies. In the Americas, robust infrastructure investment, regulatory emphasis on indoor air quality, and rising retrofit activity have underpinned strong rotor adoption for commercial and industrial projects. Market participants are capitalizing on a mature supply chain ecosystem, yet face increasing pressure to integrate renewable energy sources and meet aggressive emissions targets.

In Europe, Middle East & Africa, sustainability mandates and stringent building codes have catalyzed uptake, particularly in northern Europe and the Gulf Cooperation Council states, where humidity control is mission-critical. Meanwhile, emerging economies in Africa are gradually unlocking potential underpinned by infrastructure modernization and climate resilience programs. In the Asia-Pacific region, rapid industrialization, expanding data center capacity, and rising living standards are driving significant demand. Governments are also incentivizing energy efficient HVAC enhancements, further stimulating rotor deployments in manufacturing hubs across China, India, Southeast Asia and Oceania.

This comprehensive research report examines key regions that drive the evolution of the Desiccant Dehumidification Rotors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading companies that are advancing rotor design, desiccant innovation, and integrated digital services to dominate the dehumidification landscape

A cohort of specialized engineering firms and HVAC innovators has emerged to lead the desiccant dehumidification rotor market. These organizations distinguish themselves through investments in advanced rotor geometries, proprietary desiccant formulations, and integrated digital monitoring capabilities. Partnerships with research institutions have yielded breakthroughs in enhancing moisture adsorption kinetics and reducing regeneration energy requirements.

Competitive positioning is also shaped by the ability to offer end-to-end service portfolios, including custom rotor design, system integration, performance validation, and lifecycle support. Firms that combine manufacturing scale with localized service networks are capturing larger project pipelines, especially in sectors where uptime and reliability are paramount. Additionally, strategic alliances with HVAC contractors and OEMs are proving essential for widening distribution reach and accelerating new product rollouts. Collectively, these leading players set the pace for technological advancement and market expansion in moisture management solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Desiccant Dehumidification Rotors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Holdings AB

- Changzhou VRcoolertech Refrigeration Co., Ltd.

- Condair Group AG

- DAIKIN INDUSTRIES, Ltd.

- Dantherm Group A/S

- DEHUM

- DehuTech AB

- DESSICA

- Ebac Group

- FISAIR S.L.U.

- Fisen Corporation

- FläktGroup Holding GmbH

- Hangzhou Fuda Dehumidification Equipment Co., Ltd.

- Hangzhou Luta Electrical Appliance Co., Ltd.

- HuTek(Asia) Company Ltd.

- Innovative Air Technologies

- Jiangsu Josem Environmental Equipment Manufacturing Co., Ltd.

- Mitsubishi Corporation

- Munters Group AB

- Nichias Corporation

- NovelAire Technologies

- Pahwa Group

- Puresci Environment Technology Limited

- Rehoboth Enviro Systems Pvt. Ltd.

- Seibu Giken Co., Ltd.

- STULZ Air Technology Systems, Inc.

- Trane Technologies Company, LLC

- Trotec GmbH

- Vacker LLC

- Zenco Industries

Defining actionable strategic imperatives for industry leaders to innovate, digitalize operations, and fortify supply chains in the rotor market

To thrive in a competitive and evolving environment, industry leaders must prioritize a multi-pronged strategic agenda. First, accelerating research and development into next-generation adsorbent materials will drive performance differentiation and energy savings. Second, embedding IoT-enabled sensors and analytics platforms can unlock predictive maintenance, system optimization, and remote commissioning, reducing operational risks and enhancing service revenue streams.

Moreover, supply chain diversification and collaborative sourcing models will mitigate the impact of trade policy fluctuations. Companies should also refine go-to-market approaches by forging alliances with facility owners, engineering firms, and sustainability consultants to co-create turnkey solutions. Finally, targeted talent development programs focused on rotor technology, process integration, and data analytics will build critical organizational capabilities, ensuring that teams are equipped to deliver value across the product lifecycle.

Outlining a rigorous research methodology combining primary interviews, secondary data analysis, and expert validation to ensure data integrity and relevance

This study integrates both primary and secondary research methodologies to deliver a balanced and credible analysis. Primary research included structured interviews with rotor system designers, process engineers, and end-user facility managers to gather qualitative insights into performance expectations and purchase criteria. Detailed surveys were also administered to distributors and maintenance providers to capture input on logistical challenges and aftermarket support.

Secondary research involved exhaustive reviews of technical journals, patents, regulatory filings, and industry white papers to validate material properties, design advancements, and efficiency benchmarks. Data triangulation ensured consistency between interview findings and published sources, while iterative author reviews and expert validation sessions enhanced the accuracy and relevance of conclusions. This comprehensive approach guarantees that stakeholders can rely on the findings to inform strategic planning and technology adoption decisions with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Desiccant Dehumidification Rotors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Desiccant Dehumidification Rotors Market, by Type

- Desiccant Dehumidification Rotors Market, by Product

- Desiccant Dehumidification Rotors Market, by Desiccant Type

- Desiccant Dehumidification Rotors Market, by Application

- Desiccant Dehumidification Rotors Market, by Industry Verticals

- Desiccant Dehumidification Rotors Market, by Distribution Channel

- Desiccant Dehumidification Rotors Market, by Region

- Desiccant Dehumidification Rotors Market, by Group

- Desiccant Dehumidification Rotors Market, by Country

- United States Desiccant Dehumidification Rotors Market

- China Desiccant Dehumidification Rotors Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing core findings to illustrate how innovation, regulation, and regional factors converge to shape the future of desiccant dehumidification rotors

The landscape of desiccant dehumidification rotors is marked by technological innovation, shifting regulatory frameworks, and evolving customer expectations. Enhanced desiccant media, digital control architectures, and hybrid system integrations are redefining performance benchmarks, while tariff changes have underscored the importance of supply chain agility. Regional dynamics reveal opportunities in retrofit markets and emerging economies, whereas segmentation analysis highlights diverse application demands and channel preferences.

Moving forward, success in the rotor market will hinge on continuous innovation, robust partnerships, and an unwavering commitment to sustainability. Organizations that anticipate customer needs, leverage data-driven insights, and maintain adaptable procurement strategies will be best positioned to capture growth. Ultimately, the confluence of advanced materials, digital transformation, and strategic foresight offers a clear pathway to unlocking the full potential of desiccant dehumidification rotor technology.

Empower decision-makers to unlock unparalleled insights by engaging with Associate Director Ketan Rohom to secure the comprehensive desiccant rotor market report today

In today’s fast-paced decision-making environment, securing credible and actionable insights is paramount to strategic success. Connect with Associate Director, Sales & Marketing Ketan Rohom to explore how this comprehensive report can equip your organization with the competitive intelligence it needs. By engaging directly with this resource, you unlock in-depth analysis, expert commentary, and tailored recommendations designed to inform critical investments and operational strategies.

Take the next step toward optimizing moisture management systems, mitigating risk, and capitalizing on emerging technologies by scheduling a consultation. Reach out to Ketan Rohom to discuss customized research packages and unlock exclusive access to the full market study, enabling you to make data-driven decisions with confidence and clarity

- How big is the Desiccant Dehumidification Rotors Market?

- What is the Desiccant Dehumidification Rotors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?