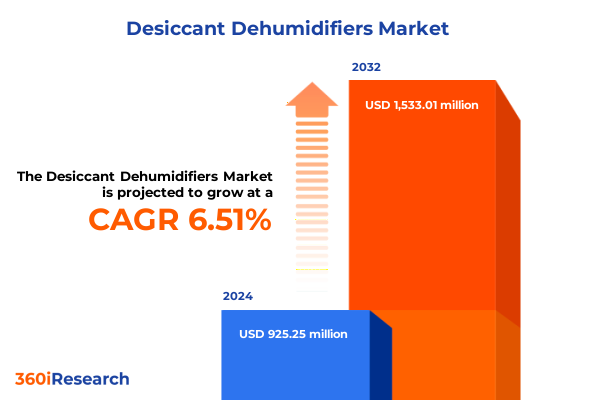

The Desiccant Dehumidifiers Market size was estimated at USD 921.80 million in 2025 and expected to reach USD 980.24 million in 2026, at a CAGR of 6.55% to reach USD 1,437.99 million by 2032.

Harnessing Desiccant Dehumidifier Innovations to Overcome Moisture Control Challenges and Meet Evolving Environmental Regulations

In environments where precise humidity regulation is critical, desiccant dehumidifiers have emerged as indispensable solutions across industrial, commercial, and residential settings. Their ability to maintain low dew points without reliance on traditional refrigeration makes them particularly effective in cold storage, data centers, pharmaceutical manufacturing, and food processing, where even slight moisture variations can compromise product quality or operational reliability. As regulated industries deepen their focus on compliant environmental control, the role of advanced dehumidification technologies continues to expand beyond conventional applications

Moreover, technological innovations in desiccant materials and system design are driving performance improvements and energy efficiency. Developments in silica gel composite wheels, activated alumina structures, and polymer-enhanced desiccant beds are boosting moisture adsorption capacity and cycle life, allowing users to achieve superior humidity control with reduced energy consumption. These material advances, coupled with optimized heat recovery and variable-speed drives, are positioning desiccant dehumidifiers as a sustainable alternative to compressor-based units, particularly in low-temperature environments where refrigerant systems underperform

Identifying Major Transformations Reshaping the Desiccant Dehumidifier Landscape Through Technological, Regulatory, and Market Dynamics

Significant strides in desiccant material science are redefining performance benchmarks for dehumidifiers. Innovations in advanced silica gel, activated alumina, and molecular sieve composites are enhancing adsorption efficiency and thermal stability, extending maintenance intervals and equipment longevity. These material breakthroughs are enabling systems to deliver consistent moisture removal across wider temperature and humidity ranges, meeting the demands of critical processes with higher reliability

The integration of IoT-enabled sensors and smart control platforms is revolutionizing operational oversight. Remote monitoring of system health, predictive maintenance alerts based on real-time humidity and temperature data, and automated adjustment of regeneration cycles are reducing downtime and operating costs. This convergence of digital technologies with dehumidification hardware is driving a shift towards more intelligent, data-driven humidity management solutions across industries

Regulatory frameworks and sustainability mandates are accelerating adoption of energy-efficient solutions. Programs such as the U.S. EPA Energy Star certification and the EU Eco-design Directive are incentivizing building owners and manufacturers to deploy lower-emission dehumidification systems. In parallel, green building certifications like LEED and BREEAM are prioritizing indoor air quality and humidity control, further embedding desiccant-based dehumidifiers into modern construction and industrial projects

Assessing the Full Spectrum of 2025 U.S Tariff Policies and Their Cumulative Effects on Desiccant Dehumidifier Supply Chains

In early 2025, the United States enacted broad trade measures, imposing a baseline tariff of 10% on virtually all imports alongside higher reciprocal levies reaching up to 50% for select trading partners. Subsequently, the extension of Section 232 steel derivative tariffs on June 23 added an additional 50% duty on the steel content of consumer appliances, including dehumidifiers, raising the effective import cost for manufacturers reliant on foreign components and finished assemblies

These cumulative tariffs have directly increased material and production expenses for desiccant dehumidifier makers, stimulating strategic shifts in supply chain management. Companies have accelerated reshoring of final assembly, diversified their supplier networks to mitigate country-specific exposures, and intensified negotiations around free trade zone sourcing. In parallel, domestic producers are leveraging tariff cushions to invest in capacity expansions and enhance local manufacturing incentives. The net effect is a market rebalancing toward supply chain resilience, cost optimization, and transparent communication of lifecycle value to end users

Revealing Critical Segmentation Insights to Illuminate Application, Material, Installation Type, Airflow Capacity, End Use Industry, Control Type, and Distribution Channel Dynamics

Demand patterns across commercial, industrial, and residential sectors illustrate distinct dynamics. In commercial applications-ranging from hotels and hospitals to data centers and warehouses-desiccant dehumidifiers are prized for their ability to maintain tight humidity tolerances under continuous operation. Industrial environments such as food processing lines and electronics manufacturing plants require robust equipment capable of performing in low-temperature or high-moisture contexts without performance degradation. Meanwhile, the residential sector is witnessing heightened interest in portable and integrated solutions that enhance indoor air quality and prevent mold, driven by smart home connectivity and wellness trends

Material selection drives critical performance outcomes. Activated alumina is favored for rapid moisture uptake and chemical inertness, making it a mainstay in high-purity pharmaceutical and laboratory settings. Molecular sieve formulations excel in ultra-low dew point applications, such as cryogenic storage and precision electronics manufacturing, where even trace moisture can be detrimental. Silica gel remains the workhorse for versatile humidity control, offering a balance of cost efficiency and thermal stability suitable for a broad spectrum of commercial and industrial installations

When considering installation modalities, portable units provide agile deployment for construction sites, disaster response, or event management, enabling quick setup and relocation without complex ductwork. Stationary systems, whether wall-mounted or fully integrated into HVAC infrastructure, deliver higher throughput and superior energy recovery for permanent facilities, aligning with sustainable building strategies and centralized climate control objectives

Airflow capacity segmentation reflects usage intensity. Low-capacity models, often in the 10–12 L/day range, suit small rooms and utility spaces, delivering targeted humidity correction. Medium-capacity systems rated 15–20 L/day support living areas, offices, and mid-sized commercial zones with steady moisture loads. High-capacity units, exceeding 25 L/day and airflow rates above 1,500 m³/h, are engineered for manufacturing halls, data centers, and cold storage warehouses where continuous, high-volume moisture extraction is essential

End use industry demands further underscore specialized requirements. Electronics production lines rely on desiccant dehumidifiers to avert corrosion and contamination during soldering and assembly. Food and beverage processors deploy them in drying tunnels and packaging zones to extend shelf life and comply with hygiene standards. HVAC system integrators specify heat-recovery wheel designs for energy savings in large commercial buildings. Pharmaceutical manufacturers depend on ultra-precise humidity control to safeguard active ingredients and maintain Good Manufacturing Practice compliance

Control approaches are bifurcated between manual and automatic systems. Manual controls offer simplicity and cost advantages for smaller deployments, allowing operators to set thresholds and monitor performance directly. Automatic configurations, enabled by PLCs and smart sensors, adjust regeneration and process airflow dynamically, optimizing energy utilization and minimizing downtime through predictive maintenance alerts and remote diagnostics

Distribution channels encompass OEM integration, authorized aftermarket services, offline distributors and retailers, and direct online platforms. OEM partnerships drive large-scale projects by embedding dehumidifiers into complex systems. Authorized dealers and service centers deliver local support and retrofit capabilities. Distributor networks and retail chains cater to equipment procurement and installation services, while e-commerce channels and company websites streamline direct sales, customization requests, and rapid fulfillment

This comprehensive research report categorizes the Desiccant Dehumidifiers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Desiccant Material

- Installation Type

- Airflow Capacity

- Control Type

- Capacity

- Applications

- End Use Industry

- Distribution Channel

Uncovering Regional Market Nuances Across the Americas Europe Middle East & Africa and Asia Pacific for Desiccant Dehumidifier Demand Patterns

In the Americas, stringent energy efficiency programs and recent trade measures have spurred a recalibration of procurement strategies. The U.S. EPA’s Energy Star certification for dehumidification equipment prioritizes units that deliver high moisture removal per unit of energy, encouraging facility managers to replace aging compressor-based models with modern desiccant systems. Concurrently, the imposition of Section 232 steel tariffs on household appliances has elevated the cost of imported components, catalyzing domestic assembly investments and reshoring initiatives in North America

Across Europe, Middle East & Africa, regulatory mandates under the EU Eco-design Directive and supportive measures from associations like REHVA are driving the adoption of eco-efficient dehumidification solutions. European manufacturers are innovating to comply with stringent ecodesign parameters, integrating heat recovery and variable-speed controls. In the Middle East and North Africa, megaprojects such as Saudi Arabia’s NEOM development and Qatar’s agriculture and pharmaceutical infrastructure expansions are generating demand for customized humidity control systems that perform reliably in extreme climates and critical storage environments

Asia-Pacific is emerging as the fastest-growing region, propelled by rapid industrialization in China, India, and Southeast Asia. Expanding electronics, pharmaceuticals, and food processing sectors are prioritizing precision humidity management. Government incentives for green manufacturing and incentives under regional trade agreements are fostering investments in advanced desiccant technology. As climate variability intensifies, the need for resilient humidity control in data centers, cold chains, and high-tech manufacturing continues to escalate across the Asia-Pacific landscape

This comprehensive research report examines key regions that drive the evolution of the Desiccant Dehumidifiers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players Shaping the Desiccant Dehumidifier Market Through Innovation Strategic Moves and Competitive Differentiation

The global desiccant dehumidifier market is anchored by established leaders such as Bry-Air (India), Munters (Sweden), Condair Group (Switzerland), Cotes (Denmark), Seibu Giken DST (Sweden), Trotec Laser GmbH (Austria), DehuTech AB (Sweden), Fisen Corporation (US), KAESER KOMPRESSOREN (Germany), and Atlas Copco AB (Sweden). These companies have distinguished themselves through comprehensive product portfolios, extensive service networks, and ongoing investments in R&D focused on energy efficiency and smart controls

In North America, a cohort of diversified industrial players including Honeywell International Inc., LG Electronics, GE Appliances (Haier), Whirlpool Corporation, Parker Hannifin Corporation, STULZ Air Technology Systems, Inc., and NovelAire Technologies are capitalizing on regional demand for integrated HVAC solutions and aftermarket services. Their strategies emphasize strategic partnerships, localized manufacturing, and expanded service offerings to capture rising demand in commercial and industrial segments

Competitive differentiation is often driven by targeted acquisitions and product innovation. For example, Munters’ acquisition of AIRPROTECH in March 2024 enhances its VOC abatement and clean technology portfolio in Europe, while Condair’s launch of the PureHum 1000 Pro mobile humidifier in May 2024 introduced app-based controls, UV sterilization, and multi-stage filtration to address evolving indoor air quality requirements. Such strategic moves underscore the importance of technology-led growth and expanded value-added services in maintaining market leadership

This comprehensive research report delivers an in-depth overview of the principal market players in the Desiccant Dehumidifiers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Munters Group AB

- Honeywell International, Inc.

- Pahwa Group

- Seibu Giken DST AB

- Trane Technologies Company, LLC

- Stulz GmbH

- Dantherm Group A/S

- Condair Group

- Cotes A/S

- Airwatergreen AB

- CASILICA

- DehuTech AB

- Desiccant Technologies Group

- Desicco Pty Ltd.

- Dewdry Engineers Pvt. Ltd.

- Ebac Industrial Products Ltd.

- Ecor Pro by Naomi Grills B.V.

- FISAIR S.L.U.

- Fisen Corporation

- General Filters, Inc.

- Goldair AU

- Humiscope Group Pty Ltd.

- Jiangsu Josem Environmental Equipment Manufacturing Co., Ltd.

- KAESER COMPRESSORS

- LG Electronics Inc.

- Norm Pacific Automation Corp.

- Rehoboth Enviro Systems Pvt. Ltd.

- Sharp Corporation

- Zenco Industries

Delivering Actionable Recommendations Empowering Industry Leaders to Enhance Resilience Optimize Costs and Drive Sustainable Growth in Desiccant Dehumidification

Industry leaders should prioritize diversification of their supplier networks and consider strategic reshoring opportunities to buffer against tariff volatility and global logistics disruptions. By integrating local component manufacturing with agile sourcing strategies, companies can maintain margin stability while meeting service-level commitments to end users. Moreover, active engagement with government incentive programs and free trade frameworks can unlock cost savings and capacity expansion benefits

Embracing digital transformation through IoT-enabled monitoring and predictive maintenance platforms will enhance operational efficiency and reduce total cost of ownership for both manufacturers and end users. Deploying data analytics to optimize regeneration cycles, track energy consumption, and forecast maintenance requirements can significantly extend equipment lifespan and reinforce value propositions in competitive bids

Collaborations between OEMs, HVAC integrators, and aftermarket service providers can facilitate turnkey solutions that address project-specific humidity challenges. By bundling dehumidification equipment with installation, commissioning, and maintenance packages, industry players can differentiate their offerings and create recurring revenue streams. Additionally, targeted product development-such as compact wall-mounted units for urban facilities and hybrid systems combining desiccant and refrigeration technologies-will capture new segments and drive sustainable growth.

Detailing the Rigorous Research Framework Employing Comprehensive Primary Secondary and Analytical Techniques for Unbiased Market Insights

This analysis synthesizes insights drawn from a multi-tiered research framework combining exhaustive secondary research and extensive primary data collection. Secondary inputs included regulatory publications, industry white papers, corporate reports, and reputable news sources. Primary research involved in-depth interviews with C-level executives, directors, and senior managers across Tier 1, Tier 2, and Tier 3 companies, ensuring a balanced perspective on market drivers and strategic priorities. Data triangulation and validation were applied through comparative modeling and cross-verification with regional trade statistics to ensure methodological rigor and unbiased conclusions

Quantitative analysis employed established analytical tools to assess competitive landscapes, tariff impacts, and technology adoption rates. Qualitative assessments leveraged expert panels to interpret emerging trends and forecast strategic inflection points. The combination of these complementary methodologies has produced a comprehensive view of current market dynamics, segmentation opportunities, and actionable strategies for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Desiccant Dehumidifiers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Desiccant Dehumidifiers Market, by Desiccant Material

- Desiccant Dehumidifiers Market, by Installation Type

- Desiccant Dehumidifiers Market, by Airflow Capacity

- Desiccant Dehumidifiers Market, by Control Type

- Desiccant Dehumidifiers Market, by Capacity

- Desiccant Dehumidifiers Market, by Applications

- Desiccant Dehumidifiers Market, by End Use Industry

- Desiccant Dehumidifiers Market, by Distribution Channel

- Desiccant Dehumidifiers Market, by Region

- Desiccant Dehumidifiers Market, by Group

- Desiccant Dehumidifiers Market, by Country

- United States Desiccant Dehumidifiers Market

- China Desiccant Dehumidifiers Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2226 ]

Summing Up Strategic Takeaways and Critical Reflections on Desiccant Dehumidifier Trends Market Drivers and Future Opportunity Pathways

Throughout this executive summary, the critical importance of desiccant dehumidification for maintaining precise environmental conditions in sensitive applications has been underscored. Technological advancements in desiccant materials, automation, and energy recovery are redefining performance and sustainability standards. Concurrently, evolving regulatory landscapes and tariff measures are reshaping supply chain priorities, while segmentation-driven insights reveal tailored opportunities across applications, materials, and distribution channels.

Regional dynamics indicate that while North America and Europe continue to prioritize efficiency and compliance, Asia-Pacific’s rapid industrialization presents high-growth prospects. Leading companies are distinguishing themselves through strategic acquisitions, product innovations, and integrated service offerings. By following the recommendations outlined-spanning supply chain resilience, digital integration, and collaborative solutions-industry stakeholders can effectively navigate disruptions, optimize operational efficiencies, and capitalize on emerging demand pathways in the evolving desiccant dehumidifier market.

Engage with Ketan Rohom to Secure the Comprehensive Executive Market Research Report and Advance Your Desiccant Dehumidifier Strategy Today

To access the full-depth analysis encompassing market dynamics, transformative trends, detailed segmentation, and regional and competitive insights, connect with Ketan Rohom, Associate Director of Sales & Marketing, to obtain your comprehensive executive market research report and empower your strategic decision-making in the desiccant dehumidifier sector today.

- How big is the Desiccant Dehumidifiers Market?

- What is the Desiccant Dehumidifiers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?