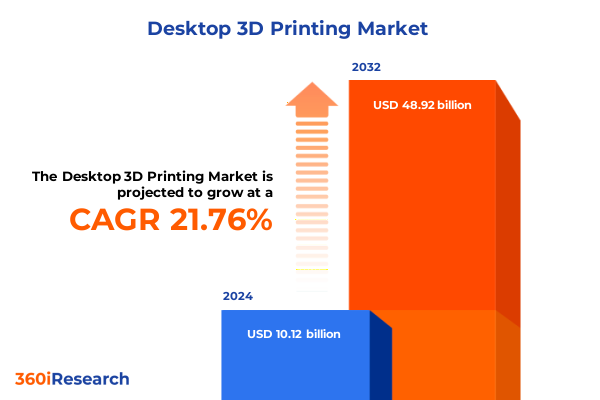

The Desktop 3D Printing Market size was estimated at USD 12.29 billion in 2025 and expected to reach USD 14.92 billion in 2026, at a CAGR of 21.81% to reach USD 48.92 billion by 2032.

Discovering the Rapid Rise of Desktop 3D Printing and Its Expanding Impact on Industry Innovation and Consumer Accessibility

Desktop 3D printing has undergone a remarkable transformation from an experimental prototyping tool to a mainstream instrument driving innovation across industries. Initially embraced by hobbyists and visionaries for rapid prototyping, it has steadily gained traction among professional users seeking cost-efficient and agile manufacturing solutions. With enhanced hardware reliability, a growing array of compatible materials, and increasingly intuitive software interfaces, the technology has become accessible to designers, educators, and entrepreneurs eager to explore complex geometries and tailored applications with unprecedented ease.

Over recent years, stakeholders across consumer electronics, healthcare, automotive, and aerospace sectors have leveraged desktop 3D printing to streamline product development cycles, minimize waste, and decentralize supply chains. The integration of advanced filament and resin formulations-coupled with cloud-based management platforms-has lowered barriers to entry and expanded the use cases from prototyping into low-volume production and on-demand spare parts fabrication. As a result, organizations are rethinking traditional manufacturing workflows and embracing additive methods to accelerate time to market and support customization strategies.

This executive summary synthesizes critical trends, regulatory shifts, and competitive dynamics shaping the desktop 3D printing landscape. It offers a holistic view of the transformative forces at play, provides granular segmentation and regional insights, evaluates leading players’ strategic initiatives, and presents actionable recommendations. This framework equips decision-makers with the clarity and direction required for informed strategic planning in an increasingly dynamic market.

Examining the Key Technological and Market Disruptions Shaping the Transformative Evolution of Desktop 3D Printing Ecosystem

The desktop 3D printing arena is experiencing an unprecedented wave of disruption fueled by technological breakthroughs, evolving market demands, and strategic realignments. Recent advancements in resin-based processes such as digital light processing have locked in higher printing resolutions, while refinements in fused deposition modeling systems have prioritized speed and build volume. At the same time, stereolithography machines have become more compact and affordable, and selective laser sintering platforms are incorporating hybrid optics to expand material compatibility beyond traditional polymers.

Concurrently, software innovations are reshaping workflow efficiencies. AI-driven slicing algorithms, cloud-enabled build preparation, and remote monitoring tools have streamlined end-to-end printing operations. These digital capabilities offer real-time analytics on print health, material usage, and cost optimization, empowering users to iterate designs rapidly and reduce trial runs. Moreover, the blending of desktop printers with robotic automation and embedded Internet of Things sensors is laying the groundwork for smart, connected manufacturing cells tailored to specific production requirements.

In parallel, sustainability considerations are gaining prominence. Manufacturers and researchers are collaborating on recyclable filaments, bio-based resins, and closed-loop material recovery systems to address environmental concerns. These shifts, coupled with growing interest in applications like bioprinting tissues and educational STEM labs, underscore the technology’s expanding relevance. As a result, desktop 3D printing is no longer confined to prototyping; it is converging with assembly-line processes and decentralized networks to redefine the future of manufacturing.

Assessing the Comprehensive Influence of 2025 United States Tariff Measures on Desktop 3D Printing Supply Chains and Cost Structures

In 2025, the imposition of additional United States tariffs on imported desktop 3D printers, filaments, and resins has had a pronounced effect on the supply chain and cost structures throughout the industry. Building upon earlier Section 301 measures targeting Chinese exports, the latest duties have elevated landed costs, prompting manufacturers and end users to reassess procurement strategies. As tariffs increased, businesses that once relied heavily on overseas suppliers began exploring nearshoring options and diversifying their material sources to mitigate exposure to import levies.

This strategic pivot has driven several desktop 3D printer vendors to establish local assembly operations or secure partnerships with domestic material producers. While such moves have softened the impact of duties on pricing, they have also introduced complexities related to capacity planning and quality assurance. In response, service bureaus and in-house manufacturing teams have recalibrated build schedules to account for longer lead times on specialized resins, while scaling up inventory buffers for high-demand filament types. These adjustments, though operationally intensive, have reinforced supply chain resilience and underscored the importance of agility in an uncertain trade environment.

Moreover, the tariff landscape has accelerated adoption of hybrid sourcing models. Organizations are combining imports of standard filaments with domestically produced high-performance materials to balance cost and performance. This nuanced approach has enabled OEMs and end users to preserve innovation pipelines without compromising fiscal discipline. As the tariff framework evolves further, stakeholders are closely monitoring policy developments and engaging in dialogue with trade associations to advocate for exemptions on critical materials used in medical, aerospace, and educational applications.

Unlocking Deeper Market Perspectives Through In-Depth Analysis of Technological Material Printer Type Sales Channel End User and Application Segmentation

A detailed segmentation analysis reveals how distinct dimensions of the desktop 3D printing market interact to shape opportunities and challenges. In terms of technology, digital light processing has garnered attention for high-resolution prototypes, while fused deposition modeling continues to dominate budgetsensitive environments. Stereolithography stands out for fine-featured dental and jewelry applications, and selective laser sintering’s powder-based approach appeals to functional parts with complex geometries.

Diving into material segmentation, polymers remain the cornerstone of desktop printing environments, offering ease of use and cost efficiency. Metal powders are increasingly finding niches in the aerospace and automotive sectors where strength and thermal performance are paramount, and ceramics are emerging in specialized medical and electronics applications that demand biocompatibility and dielectric properties. Printer type distinctions further clarify market dynamics: personal desktop units maintain appeal for hobbyists, educational institutions, and design studios, whereas professional-grade machines support manufacturing-oriented environments requiring enhanced throughput and precision.

Sales channels also influence buyer behavior, with offline distributors providing hands-on demonstrations and immediate technical support, while online platforms deliver convenience, advanced product configurators, and rapid replenishment options. End-use segmentation highlights aerospace innovators leveraging lightweight structures, automotive researchers developing tooling and fixtures, consumer electronics firms prototyping enclosures, educational entities advancing STEM curricula, and healthcare providers producing patient-specific surgical guides. Finally, application domains span educational models, custom medical devices, manufacturing aids, and rapid prototyping scenarios, reflecting the versatile capabilities of desktop 3D printing systems.

This comprehensive research report categorizes the Desktop 3D Printing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Printer Type

- Material

- Application

- Sales Channel

Exploring the Varied Market Dynamics and Growth Drivers Across the Americas Europe Middle East Africa and Asia-Pacific Regions

Regional insights into the desktop 3D printing landscape reveal distinct growth drivers and adoption patterns across major geographies. In the Americas, particularly the United States and Canada, technology adoption has been propelled by strong venture capital backing and a robust start-up ecosystem that fosters rapid innovation. Research labs and small-batch manufacturers have integrated desktop systems to accelerate product development, while academic institutions have embedded additive modules into engineering curricula, establishing a skilled talent pipeline that reinforces industry growth.

Within Europe, Middle East & Africa, regulatory emphasis on sustainability and circular economy principles has spurred investments in recyclable materials and energy-efficient printer designs. Germany and the Nordics lead in industrial applications, leveraging selective laser sintering for automotive tooling and aerospace components. At the same time, emerging markets in the Gulf Cooperation Council are piloting desktop systems for healthcare and educational use cases, supported by government initiatives to diversify economies and build technical capacity.

In Asia-Pacific, rapid industrialization and a thriving electronics sector have created strong demand for desktop printers in prototyping and small-scale production. Japan’s precision engineering firms adopt high-resolution stereolithography for microfluidic devices, while South Korea’s consumer goods manufacturers leverage fused deposition modeling for customized accessories. Moreover, educational reforms in China and India have prioritized STEM education, driving desktop machine installations in training centers and vocational schools. Across all regions, partnerships between local distributors and global OEMs have facilitated tailored service models, ensuring that stakeholders receive region-specific training, maintenance support, and material supply solutions.

This comprehensive research report examines key regions that drive the evolution of the Desktop 3D Printing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Initiatives Product Innovations and Collaborative Partnerships Shaping the Competitive Landscape of Leading Desktop 3D Printing Companies

Key participants in the desktop 3D printing arena are pursuing diverse strategies to strengthen their market positions and catalyze innovation. Legacy providers have expanded their product lines to include multi-material and hybrid manufacturing platforms, integrating advanced sensors and closed-loop calibration features to enhance part quality and system reliability. Simultaneously, agile challengers have differentiated through proprietary resin chemistries, cloud-native slicing software, and subscription-based service models that bundle hardware, materials, and digital workflow tools.

Strategic partnerships are another hallmark of this competitive landscape. Established equipment makers have forged alliances with material science specialists to co-develop high-performance filaments and resins, while software vendors collaborate with printer manufacturers to optimize build preparation and remote monitoring capabilities. In parallel, several players are investing in regional service bureaus and certification programs to ensure compliance with industry-specific standards, from medical device regulations to aerospace quality frameworks.

In addition, mergers and acquisitions have diversified portfolios, enabling companies to offer end-to-end additive manufacturing solutions. These consolidation efforts streamline supply chains and accelerate time to market for novel materials and custom machine configurations. Looking forward, leading vendors are prioritizing the integration of artificial intelligence in predictive maintenance, exploring next-generation photopolymer formulations, and extending global service footprints to meet rising demand for turnkey additive applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Desktop 3D Printing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems, Inc.

- Anycubic Technology Co., Ltd.

- Bambu Lab, Inc.

- BCN3D Technologies S.L.

- Creality 3D Technology Co., Ltd.

- Fargo Additive Manufacturing Equipment, LLC

- Formlabs Inc.

- Guangzhou FlashForge 3D Technology Co., Ltd.

- Kudo3D, Inc.

- MakerBot Industries, LLC

- Monoprice, Inc.

- Peopoly Limited

- Prusa Research s.r.o.

- QIDI Technology Co., Ltd.

- Raise3D Technologies, Inc.

- Shenzhen Elegoo Technology Co., Ltd.

- Shining 3D Tech Co., Ltd.

- Snapmaker Inc.

- Stratasys Ltd.

- Tiertime Corporation

- Ultimaker BV

- XYZprinting, Inc.

- ZYYX Labs AB

Formulating Proactive Strategic Recommendations to Enhance Innovation Operational Efficiency and Market Positioning Within the Desktop 3D Printing Industry

To capitalize on emerging opportunities and navigate evolving market pressures, industry leaders must adopt a proactive strategic posture centered on innovation, agility, and collaboration. First, investing in materials research and development is paramount: advancing composite and bioresin formulations will unlock new high-value applications in healthcare, end-use manufacturing, and sustainable consumer products. By fostering partnerships with academic institutions and material science firms, organizations can accelerate formulation cycles and differentiate their portfolios.

Next, companies should augment their digital ecosystems by integrating artificial intelligence-driven process controls and cloud-based collaboration platforms. These enhancements not only optimize print success rates but also enable data-driven decision-making across distributed manufacturing networks. Coupled with robust analytics, this approach facilitates predictive maintenance, reduces downtime, and supports service-oriented revenue streams.

Furthermore, diversifying supply chains and exploring localized production hubs will mitigate tariff exposure and shorten lead times. Establishing strategic alliances with regional material suppliers and service bureaus can ensure continuity of supply for critical filaments and resins. Simultaneously, tailored training and certification programs will equip end users with the skills needed to maximize printer performance and material utilization.

Finally, embedding sustainability into product roadmaps-through recyclable materials, energy-efficient hardware designs, and closed-loop waste management-will address regulatory requirements and resonate with environmentally conscious customers. By executing these recommendations in concert, desktop 3D printing stakeholders can strengthen market resilience and sustain long-term growth.

Outlining Rigorous Research Methodology Incorporating Primary Data Collection Secondary Validation and Robust Analytical Frameworks for Insight Generation

This research synthesis draws upon a blend of primary and secondary data sources to ensure rigor and credibility. Primary insights were obtained through structured interviews with senior executives, application engineers, and procurement managers representing OEMs, service bureaus, and end-user organizations. These interviews provided firsthand perspectives on technology adoption drivers, supply chain challenges, and strategic priorities.

Complementing the primary research, a systematic review of secondary sources-including industry journals, patent filings, regulatory publications, and technical white papers-offered historical context and validated emerging trends. Data triangulation techniques were applied to reconcile disparate information streams, while cross-referencing with published case studies helped confirm real-world implementations and performance metrics.

Analytical frameworks such as SWOT and Porter’s Five Forces were employed to assess competitive dynamics, regulatory impacts, and market entry barriers. Regional analyses were informed by economic indicators, trade policy reviews, and local stakeholder consultations to capture nuanced demand patterns across the Americas, Europe, Middle East & Africa, and Asia-Pacific. The result is a robust, layered methodology that underpins the comprehensive insights and strategic recommendations detailed in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Desktop 3D Printing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Desktop 3D Printing Market, by Printer Type

- Desktop 3D Printing Market, by Material

- Desktop 3D Printing Market, by Application

- Desktop 3D Printing Market, by Sales Channel

- Desktop 3D Printing Market, by Region

- Desktop 3D Printing Market, by Group

- Desktop 3D Printing Market, by Country

- United States Desktop 3D Printing Market

- China Desktop 3D Printing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Critical Findings and Underscoring Strategic Imperatives for Stakeholders Navigating the Evolving Desktop 3D Printing Ecosystem

This summary has outlined the pivotal forces shaping the desktop 3D printing market-from technological breakthroughs and tariff impacts to nuanced segmentation and regional dynamics. Through an examination of evolving processes, materials, and digital ecosystems, it highlights how manufacturers and end users are harnessing additive technology to drive innovation, reduce costs, and localize production. The analysis further underscores the strategic responses to 2025 tariff measures, illustrating how diversification and near-shoring have bolstered supply chain resilience.

Segmentation insights reveal distinct value propositions across technology types, material classes, printer tiers, and application domains, offering stakeholders a granular view of opportunity spaces. Regional assessments demonstrate the interplay between market maturity, regulatory environments, and sector-specific demands, while company strategies illustrate the benefits of collaborative partnerships, product diversification, and digital platform integration.

Taken together, these findings elucidate a market in dynamic transition, where proactive investment in materials innovation, digital enhancements, and supply chain flexibility can yield sustainable competitive advantage. As organizations chart their additive manufacturing roadmaps, the evidence presented here serves as a strategic touchstone for informed decision-making and long-term value creation.

Connect Directly with Ketan Rohom to Secure Your Comprehensive Desktop 3D Printing Market Research Report and Stay Ahead of Industry Trends

To secure the depth of market intelligence and forward-looking insight essential for navigating the rapidly evolving desktop 3D printing space, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to acquire the full market research report. Engage with Ketan directly to explore tailored data on technology shifts, tariff impacts, segmentation analyses, regional breakdowns, company strategies, and actionable recommendations.

Clients who partner with Ketan benefit from expert consultation on customizing the report’s findings to specific business objectives, ensuring that strategic decisions are anchored in robust research. By leveraging this comprehensive resource, stakeholders gain an edge in identifying high-potential segments, mitigating supply chain risks, and capitalizing on emerging trends in desktop 3D printing. Contact Ketan today to discuss your information needs and initiate access to the complete study.

- How big is the Desktop 3D Printing Market?

- What is the Desktop 3D Printing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?