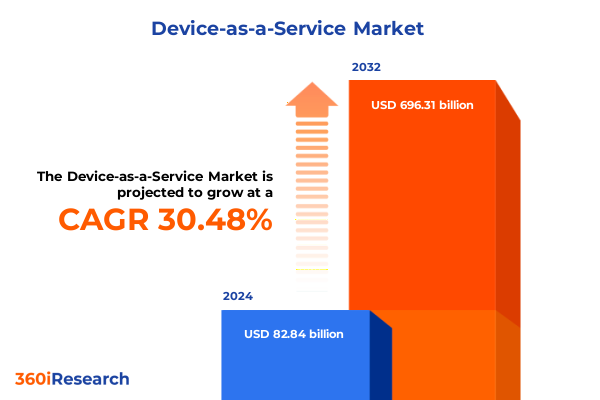

The Device-as-a-Service Market size was estimated at USD 106.68 billion in 2025 and expected to reach USD 138.19 billion in 2026, at a CAGR of 30.73% to reach USD 696.31 billion by 2032.

Unveiling the Dynamic Evolution of Device-as-a-Service as a Strategic Imperative for Modern Enterprises Embracing Digital Transformation

Device-as-a-Service represents a paradigm shift in how organizations acquire, deploy, and manage their technology assets, evolving from traditional capital expenditure models to subscription-based frameworks that deliver both flexibility and cost efficiency. As digital transformation initiatives accelerate across industries, businesses are increasingly turning to solutions that streamline procurement, standardize technology refresh cycles, and shift the burden of device lifecycle management to specialized providers. This model not only alleviates the operational complexities tied to hardware procurement, deployment, and maintenance, but also aligns device management with broader strategic objectives such as workforce agility and sustainability.

In today’s volatile economic landscape, Device-as-a-Service emerges as a compelling lever for organizations to control spending while ensuring employees have timely access to the latest technology. By bundling hardware, software, and support into a single managed offering, enterprises can optimize total cost of ownership and reallocate IT resources toward innovation rather than routine maintenance. The introduction of converged service offerings and integrated reporting platforms has further enhanced visibility into device utilization and health, empowering IT leaders to proactively address lifecycle issues and plan for seamless upgrades.

Moreover, the shift towards consumption-based IT aligns closely with hybrid work models that demand reliable remote connectivity, secure endpoint management, and consistent user experiences regardless of location. Enterprises that embrace Device-as-a-Service are better positioned to adapt to ongoing workplace transformations, delivering personalized devices that reflect individual user needs while ensuring compliance with evolving security requirements. This introduction not only underscores the strategic imperative of Device-as-a-Service, but also sets the stage for exploring the transformative forces driving its adoption.

Navigating the Parallel Forces of Hybrid Work, Sustainability, and Lifecycle Management Reshaping the Device-as-a-Service Landscape

The confluence of hybrid work demands, environmental sustainability mandates, and advanced lifecycle analytics has catalyzed a profound transformation in the Device-as-a-Service ecosystem. Organizations have moved beyond conventional lease models toward fully managed, end-to-end solutions that incorporate security monitoring, proactive maintenance, and environmentally responsible disposal practices. This holistic approach ensures that devices remain up-to-date, secure, and compliant throughout their operational lifespan, significantly reducing unplanned downtime and mitigating cybersecurity risks posed by outdated hardware.

Simultaneously, the emphasis on sustainable IT practices has prompted service providers to integrate circular economy principles into their offerings, enabling device refurbishment, component reuse, and certified e-waste recycling. This not only aligns with corporate social responsibility goals but also delivers cost savings by extending the functional life of hardware. Advances in analytics platforms now allow real-time tracking of device performance metrics, usage patterns, and security health, enabling data-driven decision-making that optimizes refresh cycles and supports predictive maintenance strategies.

Furthermore, the integration of cloud-native management consoles has streamlined remote device provisioning and policy enforcement, bridging gaps between disparate IT environments and ensuring consistent governance across on-premises and cloud-based infrastructures. As enterprises demand more agility and visibility, service providers are innovating around self-service portals and AI-powered support bots that expedite issue resolution and enhance end-user satisfaction. Collectively, these shifts are reshaping provider value propositions, raising the bar for service levels, and solidifying Device-as-a-Service as a keystone of modern IT strategy.

Assessing the Aggregate Consequences of Recent United States Tariffs on Procurement, Supply Chains, and Cost Strategies for Device-as-a-Service Providers

The imposition of additional tariffs by the United States government in 2025 has introduced new cost considerations for organizations procuring end-user devices through Device-as-a-Service arrangements. These levies, targeting components such as integrated circuits, printed circuit boards, and peripheral assemblies, have elevated supply chain expenses and prompted service providers to reevaluate sourcing strategies. As a result, many providers have begun to diversify manufacturing partnerships and shift assembly operations to tariff‐favored regions in an effort to mitigate the direct financial impact on subscription pricing.

Beyond raw procurement costs, the tariffs have influenced global logistics and inventory management decisions. Providers have accelerated forward-buy purchasing to lock in component pricing before scheduled duty increases, while simultaneously expanding warehousing capacity to buffer against supply disruptions. This has tested the agility of traditional distribution networks, driving investments in dynamic routing technologies and nearshoring initiatives that reduce lead times and stabilize fulfillment capabilities.

Despite these headwinds, some service providers have leveraged the situation to reinforce value propositions around cost transparency and risk sharing. By embedding tariff fluctuation clauses into contractual agreements and offering tiered support packages, providers enable enterprises to better forecast their operational expenditures and protect against sudden rate hikes. These adaptive contracting mechanisms, combined with the strategic relocation of key fabrication processes, underscore the industry’s resilience and commitment to delivering predictable, end-to-end device management solutions.

Uncovering the Intricacies of Device Type, Service Offering, Industry Vertical, and Enterprise Size to Reveal Nuanced Insights into DaaS Segmentation

Insight into Device-as-a-Service segmentation reveals that end-user preferences and organizational priorities vary significantly depending on the type of technology deployed. Desktops maintain strong demand for stable office-based roles, whereas portable computing devices dominate environments requiring mobility and flexibility. Laptops-whether convertible models that transition between tablet and notebook modes, traditional notebooks for routine productivity tasks, or premium ultrabooks designed for performance and portability-each attract distinct user cohorts and support tailored service level requirements. Simultaneously, tablets and smartphones address specialized use cases such as field service operations, sales enablement, and executive mobility, necessitating bespoke support frameworks and security configurations.

Service offerings further differentiate market needs, as Hardware as a Service appeals to enterprises seeking comprehensive device provisioning and refresh services without capital outlay. Managed services expand this premise by encompassing functions such as end-of-life asset disposal, rapid break-fix support, and full lifecycle management that spans deployment through decommissioning. Meanwhile, Software as a Service modules layer critical endpoint security, device monitoring, and analytics capabilities atop hardware subscriptions, delivering a unified management experience that enhances operational oversight and controls costs associated with unplanned maintenance.

Across industry verticals, financial institutions and government agencies prioritize stringent compliance standards and robust security protocols, driving higher adoption of managed lifecycle solutions. Education sectors demand scalable, user-friendly devices that accommodate diverse learning environments, while healthcare organizations focus on secure, interoperable platforms to support telehealth and electronic records access. IT and telecom enterprises, with their technology-centric cultures, often pilot innovative edge-computing use cases, influencing broader market trends.

Organizational size shapes procurement models as well, with large enterprises leveraging their scale to negotiate customized service contracts and integrate device management into global IT strategies. Medium-sized companies prize standardized offerings that balance service depth with cost-effectiveness, while small enterprises gravitate toward turnkey packages that simplify vendor relationships and reduce administrative overhead. Recognizing these segmentation nuances allows providers to tailor solutions that resonate with the specific demands and budgetary constraints of each customer group.

This comprehensive research report categorizes the Device-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Offering

- Business Model

- Organization Size

- End User Industry

Examining Regional Variations in Adoption, Regulatory Environment, and Growth Drivers for Device-as-a-Service Across Global Markets and Key Territories

Regional dynamics play a pivotal role in shaping the adoption and maturation of Device-as-a-Service solutions, with each geographic market presenting unique drivers and constraints. In the Americas, a robust culture of subscription-based consumption and a strong emphasis on hybrid work frameworks have accelerated uptake. This region exhibits a pronounced preference for comprehensive managed services that integrate security, compliance, and sustainability considerations into device lifecycles, supported by well-developed logistics infrastructure and a competitive provider landscape.

Europe, the Middle East, and Africa present a mosaic of regulatory environments and technology adoption rates. While Western European markets lead in implementing circular economy standards and stringent data protection regulations, emerging economies in Eastern Europe and the Middle East show growing interest in hybrid device models to support digital government initiatives and mobile workforces. Providers operating in this region must navigate varied tax regimes and regulatory requirements, tailoring service offerings to align with local procurement policies and cross-border data sovereignty standards.

The Asia-Pacific region continues to demonstrate rapid growth potential, driven by large populations of digitally native consumers and government programs promoting digital inclusion in healthcare and education. Adoption rates across developed Asian markets reflect an appetite for cutting-edge ultrabooks and integrated software solutions, whereas developing economies prioritize cost-efficient, scalable device packages to bridge digital divides. Regional manufacturing hubs further influence supply chain strategies, enabling providers to optimize production costs and ensure timely deployment across multiple submarkets. By understanding these regional characteristics, stakeholders can refine go-to-market approaches, calibrate service portfolios to local needs, and capitalize on emerging usage trends.

This comprehensive research report examines key regions that drive the evolution of the Device-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Market Players Driving Competitive Dynamics and Strategic Partnerships in the Device-as-a-Service Ecosystem

The competitive landscape of Device-as-a-Service is shaped by a blend of technology giants, specialized service providers, and emerging startups. Established IT leaders invest heavily in platform enhancements, leveraging global distribution networks and deep professional services capabilities to deliver turnkey solutions for multinational clients. Their broad portfolios often integrate device management with cloud infrastructure and cybersecurity stacks, positioning them as one-stop partners for enterprises seeking end-to-end digital workplace services.

Conversely, niche providers differentiate through vertical-specific expertise and agile service models. By focusing on targeted industry requirements-such as streamlined asset disposal protocols for healthcare or rapid device provisioning for education-these specialists cultivate close partnerships with ecosystem stakeholders and carve out segments where personalized support and domain knowledge drive customer satisfaction. Their lean organizational structures enable rapid iteration on service features and competitive pricing, appealing to organizations that require highly customizable solutions.

Strategic alliances and channel partnerships further amplify vendor reach and capability. Collaborations between hardware manufacturers and value-added resellers enhance local delivery competence, while integrations with software and security vendors enrich solution offerings. Technology startups focused on AI-driven analytics and IoT integrations inject innovation into the ecosystem, prompting incumbents to evolve their platforms with advanced monitoring, predictive maintenance, and user experience enhancements. This dynamic interplay of scale, specialization, and innovation fuels continuous improvement and propels the next wave of Device-as-a-Service advancements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Device-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Acer Inc.

- Amazon Web Services, Inc.

- Apple Inc.

- ASUSTeK Computer Inc.

- AT&T Inc.

- Atea Global Services, SIA

- Atos SE

- Canon Inc.

- Cisco Systems, Inc

- Cognizant Technology Solutions Corporation

- CompuCom Systems, Inc.

- Computacenter plc

- Dell Inc.

- Fujitsu Limited

- HCL Technologies Limited

- Hitachi, Ltd.

- HP Inc.

- Intel Corporation

- International Business Machines Corporation

- Lenovo Group Limited

- Microsoft Corporation

- NEC Corporation

- Panasonic Corporation

- Ricoh Company, Ltd.

- Samsung Electronics Co., Ltd.

- SHI International Corp.

- Tata Consultancy Services Limited

- Wipro Limited

- Xerox Corporation

Actionable Strategies and Tactical Roadmaps for Industry Stakeholders to Maximize Value, Optimize Procurement, and Enhance Device-as-a-Service Execution Success

Industry decision-makers seeking to harness the full potential of Device-as-a-Service should begin by aligning their procurement strategies with comprehensive lifecycle data analytics. By partnering with providers that offer transparent dashboards and predictive maintenance forecasts, organizations can anticipate refresh cycles, reduce unplanned downtime, and allocate budget more efficiently. Early collaboration on service level agreements that include tariff-sharing provisions and flexible tenure options ensures resilience against market volatility and evolving regulatory landscapes.

Furthermore, enterprises should prioritize providers with robust sustainability credentials and circular economy capabilities, integrating e-waste management and device refurbishment into their corporate responsibility agendas. This not only mitigates environmental impact but also extends device longevity and enhances total value. Cross-functional workshops involving IT, procurement, and sustainability teams can identify opportunities for process optimization and reinforce commitment to shared goals.

To accelerate adoption, leaders must cultivate strong partnerships across the technology ecosystem, engaging hardware manufacturers, software vendors, and logistics specialists in unified governance frameworks. Leveraging self-service portals and automated support channels reduces administrative burden, while embedding user-centric design principles into device selection drives end-user engagement. Finally, continuous feedback loops and periodic service reviews enable organizations to refine service configurations, negotiate performance-based incentives, and ensure that Device-as-a-Service deployments remain aligned with strategic business objectives.

Outlining Comprehensive Data Collection, Expert Validation, and Analytical Frameworks Underpinning Rigorous Device-as-a-Service Market Research Methodology

This research framework commenced with an extensive review of secondary data sources, including industry publications, regulatory filings, and public company disclosures, to establish foundational context around Device-as-a-Service trends and market influences. A detailed mapping of tariff schedules and trade policy updates informed the analysis of cost headwinds, while white papers and sustainability reports shed light on evolving environmental mandates. These insights guided the subsequent design of primary research instruments and stakeholder interview protocols.

Primary research involved structured discussions with senior IT executives, procurement leaders, and service provider executives to validate market developments, assess provider capabilities, and quantify the impact of workflow transformations. Open-ended interviews were complemented by an online survey to capture broader perspectives on segmentation preferences, service adoption barriers, and regional deployment strategies. Respondent data were rigorously cleaned and triangulated against secondary findings to mitigate bias and ensure representativeness.

Analytical methodologies encompassed qualitative thematic analysis of interview transcripts and quantitative cross-tabulation of survey responses. Segmentation models were refined through iterative data validation and expert panel reviews, ensuring alignment with observed industry dynamics. The resulting framework synthesizes multiple data streams to deliver robust, actionable insights. Quality assurance measures, including peer reviews and consistency checks, underpin the integrity and reliability of the report’s conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Device-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Device-as-a-Service Market, by Device Type

- Device-as-a-Service Market, by Offering

- Device-as-a-Service Market, by Business Model

- Device-as-a-Service Market, by Organization Size

- Device-as-a-Service Market, by End User Industry

- Device-as-a-Service Market, by Region

- Device-as-a-Service Market, by Group

- Device-as-a-Service Market, by Country

- United States Device-as-a-Service Market

- China Device-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesizing Core Findings to Highlight Strategic Imperatives and Concluding Insights on the Future Trajectory of the Device-as-a-Service Paradigm

In summary, Device-as-a-Service has emerged as a pivotal model for modern enterprises striving to balance agility, security, and cost efficiency in a rapidly evolving technology landscape. The migration toward subscription-based hardware and integrated support services addresses fundamental challenges associated with device procurement, maintenance, and end-of-life management. As hybrid work models, sustainability imperatives, and advanced analytics converge, organizations that proactively embrace this paradigm will secure operational resilience and unlock strategic value across their digital ecosystems.

Despite the headwinds introduced by shifting tariff regimes, the underlying value proposition of predictable expenses, streamlined workflows, and enhanced employee experiences remains compelling. Providers that demonstrate agility in supply chain operations, offer transparent cost mechanisms, and integrate circular economy practices will continue to differentiate their offerings and capture market momentum. Strategic alignment between enterprise objectives and provider capabilities is essential to navigating regulatory complexities and capitalizing on emerging opportunities.

Ultimately, the insights distilled from this research underscore the importance of tailored approaches, whether through device-type specialization, service-level customization, or regional market adaptation. By synthesizing segmentation intelligence with actionable recommendations, decision-makers can chart a clear path toward sustainable, scalable Device-as-a-Service deployments that support long-term growth and innovation.

Inviting Industry Decision Makers to Engage with Ketan Rohom for Exclusive Access to In-Depth Device-as-a-Service Market Insights and Bespoke Deliverables

To gain a comprehensive understanding of Device-as-a-Service market dynamics and obtain tailored insights that address your organization’s unique requirements, reach out to Ketan Rohom, the Associate Director of Sales & Marketing. Engaging with Ketan offers you the opportunity to explore exclusive analyses on emerging trends, deep dives into tariff impacts, and proprietary segmentation intelligence. His expertise will guide you through the report’s extensive findings and support personalized recommendations for strategic deployment. Secure your organization’s competitive advantage by partnering directly with Ketan to customize deliverables that align with your operational goals and strategic roadmap. Unlock the full potential of this research and empower your decision-making process by contacting Ketan today to discuss next steps and subscription options

- How big is the Device-as-a-Service Market?

- What is the Device-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?