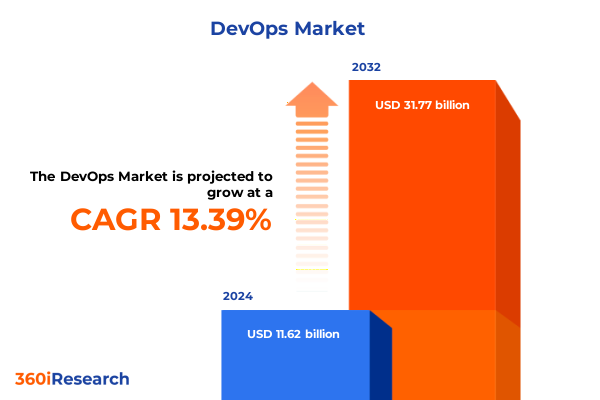

The DevOps Market size was estimated at USD 12.95 billion in 2025 and expected to reach USD 14.44 billion in 2026, at a CAGR of 13.67% to reach USD 31.77 billion by 2032.

Driving Innovation and Collaboration Through DevOps: Defining the Modern Software Delivery Imperative and Sustainable Competitive Advantage for Digital Enterprises

DevOps has emerged as the cornerstone of modern software delivery, blending development and operations to accelerate innovation and improve collaboration across the technology lifecycle. In an era defined by continuous digital disruption, organizations of all sizes must deliver features, updates, and fixes at unprecedented speed without sacrificing quality or security. By establishing a culture of shared responsibility, automation, and iterative feedback, DevOps transcends traditional departmental silos and enables cross-functional teams to innovate with agility. This foundational paradigm shift sets the stage for market leaders to harness emerging technologies and respond dynamically to evolving customer demands.

Furthermore, the integration of cloud-native architectures, microservices, and containerization forms the technical backbone of DevOps pipelines, providing the scalability and resilience required for today’s distributed systems. As enterprises increasingly migrate workloads to public, private, or hybrid clouds, the demand for robust orchestration, automated testing, and continuous monitoring intensifies. Thus, the modern DevOps journey is not merely about toolchains but encompasses cultural transformation, strategic alignment, and a relentless focus on delivering measurable business value.

Uncovering the Technological and Organizational Shifts Shaping DevOps Adoption: From Cloud-Native Architectures to AI-Powered Automation

Over the past several years, the DevOps landscape has experienced a succession of transformative shifts, each reshaping how organizations architect, deploy, and secure applications. Most notably, the rise of cloud-native development has empowered teams to decouple monolithic systems into microservices, granting unprecedented flexibility and enabling independent scaling of critical functions. Concurrently, the proliferation of containers and service meshes has streamlined application portability, allowing seamless migration across cloud environments and on-premises infrastructure. These advances have been further complemented by the integration of infrastructure as code, which transforms manual configuration tasks into repeatable, version-controlled processes.

Moreover, artificial intelligence and machine learning are redefining operational intelligence, as predictive analytics and anomaly detection optimize performance and preempt incidents before they impact users. The fusion of AI-driven automation with DevSecOps principles has also elevated the security posture of continuous delivery pipelines, embedding compliance checks, vulnerability scans, and policy enforcement at every stage of development. As a result, organizations can maintain rigorous governance without impeding velocity. In parallel, the advent of serverless computing has introduced event-driven architectures that further reduce operational overhead, allowing teams to focus on delivering business logic rather than managing infrastructure.

Assessing the Cumulative Effects of New United States Tariffs in 2025 on the DevOps Ecosystem and Global Technology Supply Chains

The introduction of new United States tariffs in 2025 has exerted a notable influence on the DevOps ecosystem, particularly in terms of hardware procurement and supply chain strategies. Tariffs targeting semiconductors, networking equipment, and data center components have driven hardware costs upwards, prompting providers to reevaluate sourcing models. Many organizations have responded by diversifying their component suppliers, nearshoring manufacturing, or accelerating investment in domestic production capabilities. These adjustments have, in turn, reshaped the economics of on-premises infrastructure and influenced the balance between cloud and edge deployments.

At the same time, the increased cost of physical infrastructure has underscored the strategic value of software-defined solutions and cloud-based managed services. Companies with extensive DevOps toolchains have moved toward consumption-based pricing models, thereby mitigating exposure to upfront capital expenditures. Simultaneously, vendors of container orchestration platforms and continuous integration servers have enhanced their offerings with optimized licensing and flexible deployment options. Consequently, the tariff environment has catalyzed a broader shift toward operational elasticity and financial agility, reinforcing the importance of automation and scalable architectures in maintaining competitive resilience.

Leveraging Comprehensive Segmentation Insights to Illuminate Market Dynamics Across Organization Sizes, Deployment Modes, Service Types, Industries and Components

In evaluating market opportunities and growth trajectories, segmentation provides nuanced insights across organizational dimensions. Enterprises at the global level continue to adopt comprehensive DevOps strategies, leveraging extensive automation frameworks and cross-functional governance structures, while smaller ventures emphasize rapid deployment and leaner toolchains to gain early market traction. When considering how solutions are delivered, cloud-based SaaS offerings dominate new adoption scenarios, yet on-premises deployments remain critical for industries with stringent data residency and regulatory requirements.

In terms of service support, managed services partners have proliferated to guide clients through end-to-end DevOps transformations, complementing professional services engagements focused on bespoke pipeline integrations and custom workflow engineering. Across industry verticals, financial services firms emphasize immutable infrastructure and audit trails, whereas healthcare and government entities prioritize security, compliance, and vendor consolidation. Meanwhile, manufacturing and retail sectors leverage DevOps for real-time analytics and supply chain integration, and telecommunications providers integrate network functions virtualization with DevOps toolchains.

Furthermore, component-level segmentation reveals that collaboration and planning modules are foundational, while configuration management, container management, continuous delivery, continuous integration, monitoring and analytics, orchestration and automation, and security and compliance tools are essential to a mature DevOps practice. Each of these components is further differentiated by optimized cloud-native or on-premises variants, allowing organizations to tailor their architectures to performance, cost, and regulatory objectives.

This comprehensive research report categorizes the DevOps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Organization Size

- Deployment Mode

- Service Type

- Industry

- Component

Evaluating Regional Variations in DevOps Adoption and Investment Priorities Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a decisive role in shaping DevOps adoption patterns and investment priorities. In the Americas, hyperscale cloud providers and leading enterprises are driving rapid migration to multi-cloud environments, supported by advanced automation platforms and robust managed services ecosystems. The vibrant start-up community also contributes to innovation in continuous delivery toolsets and microservices orchestration, reflecting a competitive landscape that prizes velocity and scalability.

Conversely, Europe, the Middle East, and Africa display a more measured adoption curve, influenced by data sovereignty regulations, multi-jurisdictional compliance requirements, and the prevalence of legacy infrastructure. Here, on-premises and hybrid solutions maintain significant uptake, and regional service providers are forging strategic alliances with global vendors to deliver localized support and compliance-centric offerings. Investment emphasis is placed on security-embedded pipelines and observability solutions that provide end-to-end visibility across complex network topologies.

Meanwhile, Asia-Pacific markets are witnessing exponential growth driven by digital transformation initiatives within government, financial services, and manufacturing sectors. Cloud-native DevOps platforms are being rapidly embraced to support high-volume microservices and AI-enabled applications. Regional cloud providers are enhancing their portfolios with developer portals, AI-powered testing tools, and integrated security controls to meet the scale requirements of emerging digital economies.

This comprehensive research report examines key regions that drive the evolution of the DevOps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Key Industry Players in the DevOps Space: Competitive Strategies, Innovation Drivers, and Ecosystem Partnerships

The competitive landscape of the DevOps market is characterized by a blend of established technology giants and specialized pure-play vendors, each contributing unique strengths to the ecosystem. Industry leaders in cloud infrastructure are extending their native DevOps services to deepen platform lock-in and simplify continuous delivery workflows. At the same time, open source vendors and container specialists continue to drive standardization around orchestration frameworks and microservices best practices.

In parallel, vendors focusing on security and compliance integrations are gaining momentum, delivering embedded policy enforcement and vulnerability scanning directly within pipelines. The consolidation trend is also apparent, as complementary acquisitions bring together source-code management, collaboration platforms, and automation engines under unified suites. Additionally, system integrators and managed service partners play a crucial role in scaling complex transformations, offering end-to-end orchestration from initial assessment through ongoing operations. Competitive differentiation increasingly hinges on AI-driven analytics, low-code/no-code pipeline builders, and extensible marketplaces that allow swift integration of third-party tools.

This comprehensive research report delivers an in-depth overview of the principal market players in the DevOps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Atlassian Corporation Plc

- BMC Software, Inc.

- Broadcom Inc.

- Buildkite Pty Ltd

- Circle Internet Services, Inc.

- Cisco Systems, Inc.

- CloudBees, Inc.

- Datadog, Inc.

- DBmaestro Ltd.

- Docker, Inc.

- GitLab Inc.

- Google LLC

- HashiCorp, Inc.

- Huawei Cloud

- Inedo LLC

- International Business Machines Corporation

- Micro Focus International plc

- Microsoft Corporation

- New Relic, Inc.

- Oracle Corporation

- Red Hat, Inc.

- SaltStack, Inc.

- Splunk Inc.

Actionable Recommendations for Industry Leaders to Accelerate DevOps Transformation, Enhance Resilience, and Drive Sustainable Growth

To thrive amidst technological turbulence and market complexity, industry leaders should prioritize the embedding of AI-powered automation within every stage of the software delivery lifecycle. By harnessing machine learning for anomaly detection, predictive scaling, and self-healing infrastructure, organizations can minimize downtime and optimize resource utilization. Furthermore, embracing a security-first ethos through integrated DevSecOps practices ensures that compliance and risk mitigation are intrinsic to development velocity rather than layered on as afterthoughts.

Strategic investment in cross-team skill development is also critical; upskilling programs that blend software engineering, infrastructure management, and security acumen cultivate high-performance teams capable of rapid iteration. In addition, diversifying supply chains for hardware and cloud resources enhances resilience against geopolitical and regulatory disruptions, while hybrid architectures enable workload portability and cost flexibility. Ultimately, a culture of continuous improvement-reinforced by transparent metrics, feedback loops, and executive sponsorship-will allow organizations to pivot swiftly and maintain competitive differentiation.

Outlining the Research Approach and Methodological Framework Underpinning the DevOps Market Analysis for Rigorous and Reliable Insights

This research is grounded in a mixed-methods approach, combining primary and secondary data to ensure robust market insights. Primary research included in-depth interviews with senior technology executives, DevOps practitioners, and solutions architects to capture qualitative perspectives on adoption drivers, pain points, and emerging use cases. A structured survey supplemented these insights, gathering quantitative data on deployment preferences, tool adoption rates, and investment priorities across a representative sample of organizations by size and industry.

Secondary research involved a comprehensive review of industry publications, vendor white papers, regulatory filings, and financial reports to verify market dynamics and technology trends. Data triangulation techniques were applied to validate findings and reconcile potential discrepancies between sources. Furthermore, the segmentation framework was validated through expert panel reviews, ensuring that component, service, and regional delineations accurately reflect real-world DevOps initiatives. This rigorous methodology underpins the credibility and actionable value of the analysis presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our DevOps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- DevOps Market, by Organization Size

- DevOps Market, by Deployment Mode

- DevOps Market, by Service Type

- DevOps Market, by Industry

- DevOps Market, by Component

- DevOps Market, by Region

- DevOps Market, by Group

- DevOps Market, by Country

- United States DevOps Market

- China DevOps Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Summarizing Critical Findings and Strategic Implications to Guide Stakeholders Through the Complexities of the Evolving DevOps Landscape

In summary, the DevOps landscape in 2025 is defined by rapid technological advancements, evolving regulatory frameworks, and shifting global trade policies. Organizations that embrace cloud-native paradigms, AI-enabled automation, and integrated security practices are best positioned to accelerate delivery cycles and maintain operational resilience. Meanwhile, market segmentation reveals diverse deployment models and service preferences shaped by organizational size, industry requirements, and component specialization.

Regional disparities highlight the need for tailored strategies, with hyperscale investments in the Americas, compliance-driven architectures in EMEA, and digital transformation momentum in Asia-Pacific. The combined impact of tariffs has reinforced the strategic importance of software-defined solutions and supply chain diversification. As leading vendors refine their offerings through innovation and partnerships, stakeholders must remain vigilant, continuously adapt, and pursue a culture of continuous improvement to secure a sustainable competitive edge.

Engage with Ketan Rohom to Unlock In-Depth DevOps Market Intelligence and Drive Informed Decision-Making for Competitive Advantage

To take your DevOps strategy to the next level, connect with Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through the full breadth of our in-depth market research and strategic recommendations. Ketan’s expertise in translating comprehensive intelligence into actionable roadmaps has empowered industry leaders to optimize investment decisions, accelerate innovation, and maintain competitive differentiation. Reach out now to secure your access to the complete DevOps market research report, tailor a package that meets your organizational needs, and begin driving measurable results with confidence

- How big is the DevOps Market?

- What is the DevOps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?