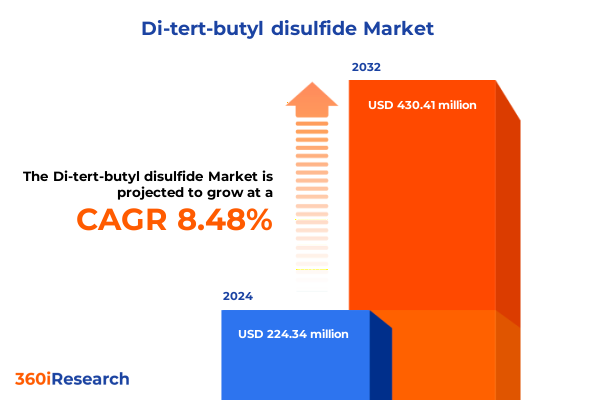

The Di-tert-butyl disulfide Market size was estimated at USD 241.55 million in 2025 and expected to reach USD 265.33 million in 2026, at a CAGR of 8.60% to reach USD 430.41 million by 2032.

Exploring the Critical Role of Di-tert-butyl Disulfide in Modern Industrial Applications Amid Shifting Regulatory, Technological, and Demand Landscapes

Di-tert-butyl disulfide occupies a unique position at the intersection of specialty chemicals and performance-driven industrial processes. Renowned for its robust sulfur–sulfur bond, the molecule acts as a pivotal ingredient in diverse applications, spanning oxidative stabilization in polymers to performance enhancement in petroleum-based formulations. Its distinct molecular structure imparts thermal stability and radical generation capabilities, making it indispensable for processes that demand precise initiation and control of chemical reactions.

Over the past decade, demand for di-tert-butyl disulfide has been influenced by the chemical industry’s transition toward sustainability, the modernization of manufacturing protocols, and the growing emphasis on high-purity specialty reagents. Innovations in synthetic pathways have improved yield and reduced byproduct formation, while regulatory scrutiny around sulfur compounds has heightened the need for stringent purity standards. Consequently, manufacturers and end users alike are reevaluating supply chains, production technologies, and performance criteria to maintain competitiveness.

This executive summary synthesizes the strategic dimensions of the di-tert-butyl disulfide market and outlines actionable insights. By examining transformative shifts, tariff impacts, and segmentation nuances, it delivers a cohesive narrative that equips decision-makers with the context needed to navigate current challenges and capitalize on emerging opportunities.

Unveiling Pivotal Transformations Reshaping the Di-tert-butyl Disulfide Market Ecosystem in Response to Technological, Regulatory, and Environmental Pressures

The di-tert-butyl disulfide market has undergone profound transformation as stakeholders respond to technological breakthroughs, environmental imperatives, and evolving regulatory frameworks. Manufacturers are increasingly leveraging green chemistry principles to minimize waste and reduce energy consumption during synthesis, incorporating alternative feedstocks and catalytic processes that align with corporate sustainability pledges. This shift not only addresses environmental concerns but also positions di-tert-butyl disulfide as a key enabler for lower-carbon formulations across plastics and lubricant segments.

Simultaneously, digitalization and advanced analytics have reshaped process optimization, enabling real-time monitoring of reaction conditions and predictive maintenance of production assets. Industry 4.0 integration has elevated product consistency and reduced downtime, fostering greater confidence among end users in the reliability of specialty chemical inputs. In tandem with operational advances, regulatory agencies in major markets have tightened the classification and handling requirements for sulfur-based compounds, raising the bar for compliance and traceability throughout the value chain.

Environmental pressures have spurred research into bio-based and renewable precursors, further diversifying the di-tert-butyl disulfide landscape. As new entrants explore niche applications-from polymer crosslinking to advanced agricultural formulations-the competitive arena has expanded beyond traditional chemical suppliers. In this dynamic environment, understanding the interplay of technological innovation, regulatory oversight, and sustainability priorities is essential for stakeholders seeking to differentiate their offerings and secure long-term market relevance.

Assessing the Cumulative Impact of Recent United States Tariff Measures on Di-tert-butyl Disulfide Supply Chains, Pricing Strategies, and Competitor Dynamics

Throughout 2025, United States tariff measures targeting select chemical imports have reverberated across the di-tert-butyl disulfide supply chain, influencing procurement strategies and cost structures. As duties on certain foreign feedstocks and intermediates rose, domestic producers recalibrated sourcing models to mitigate tariff burdens, forging new alliances with regional manufacturers in North America and curtailing dependence on long-haul imports. These strategic adjustments have underscored the importance of supply chain agility in an era of unpredictable trade policies.

Pricing strategies have also evolved amid tariff impacts, with end users negotiating multi-year supply contracts to lock in favorable terms and shield operational budgets from sudden duty fluctuations. Downstream manufacturers in automotive coatings, polymer processing, and agrochemical sectors have showcased flexibility by blending feedstocks and adjusting formulation ratios, thereby managing overall cost inflation without compromising product performance.

Competitor dynamics have shifted as well, with agile mid-sized firms capitalizing on regional production advantages to capture volume previously held by larger, international suppliers. These nimble players leverage shorter lead times and localized customer support, challenging entrenched incumbents. In this context, continuous monitoring of tariff dialogues and proactive scenario planning will remain critical for all market participants aiming to sustain profitability and market share in the face of evolving trade landscapes.

Deriving Strategic Insights from Application, End Use Industry, Purity Grade, and Sales Channel Segmentation to Navigate Di-tert-butyl Disulfide Complexities

A nuanced view of di-tert-butyl disulfide emerges when dissecting its market through multiple segmentation lenses. When examined through the lens of application, the spectrum spans antioxidant additive, organic synthesis reagent, petroleum additive, polymerization initiator, and rubber vulcanization accelerator, with polymerization initiator further differentiated into polyethylene, polystyrene, and polyvinyl chloride. Each of these application domains carries unique performance requirements and regulatory considerations, driving tailored product development and service offerings.

From an end-use perspective, chemical manufacturing, oil refining, pharmaceutical manufacturing, polymer manufacturing-comprising polyethylene production, polypropylene production, and polystyrene production-and rubber manufacturing form the cornerstone industries. These end-use sectors vary in sensitivity to feedstock price swings, purity specifications, and margin pressures, underscoring the need for segmented go-to-market approaches that speak to distinct operational priorities.

Purity grade segmentation ranges from high purity grade formulations for demanding analytical and pharmaceutical applications to laboratory grade variants and technical grade offerings for broader industrial uses. The purity spectrum dictates packaging, handling protocols, and logistical considerations, influencing lead times and service models. Sales channels extend from direct sales relationships with key accounts to distributor networks in regional territories and the growing prevalence of online platforms, reflecting evolving customer procurement preferences and the digital shift in specialty chemical procurement.

This comprehensive research report categorizes the Di-tert-butyl disulfide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Purity Grade

- Sales Channel

- Application

- End Use Industry

Harnessing Regional Strengths and Opportunities Across Americas, Europe Middle East & Africa, and Asia-Pacific to Drive Di-tert-butyl Disulfide Expansion

Regional dynamics significantly shape the di-tert-butyl disulfide landscape, with each geography presenting distinct growth drivers and operational challenges. In the Americas, robust demand in polymer manufacturing and oil refining underpins steady consumption, while local production hubs benefit from proximity to key feedstock resources. Regulatory initiatives around emissions and refinement standards also foster innovation in sulfur-based additives tailored for cleaner-burning fuels.

Across Europe, Middle East & Africa, a blend of mature Western European markets and emerging economies in the Gulf Cooperation Council creates a dual-speed environment. Established chemical clusters emphasize compliance, sustainability, and circular economy integration, whereas high-growth regions in the Middle East leverage petrochemical feedstock advantages to expand capacity. The interplay of environmental regulations, high-value industrial applications, and ongoing investment in specialty chemicals defines competitive priorities in this vast region.

In the Asia-Pacific corridor, rapid industrialization and infrastructure development drive demand for di-tert-butyl disulfide in resin production and oil additives. Regional supply chains often center on large-scale manufacturing complexes in East Asia, supported by integrated petrochemical operations. However, growing emphasis on environmental stewardship and local content requirements in key markets is prompting Japanese, Korean, and Chinese producers to adopt greener processes and enhance transparency in their supply chains.

This comprehensive research report examines key regions that drive the evolution of the Di-tert-butyl disulfide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Competitive Strategies and Innovation Pathways of Leading Players Shaping the Di-tert-butyl Disulfide Landscape Through Product Development

Leading players in the di-tert-butyl disulfide arena are distinguished by their strategic emphasis on product innovation, capacity optimization, and customer-centric service models. Major specialty chemical manufacturers have intensified collaboration with academic institutions and technology startups to pioneer novel synthetic routes that reduce environmental footprint while enhancing yield. Such partnerships often focus on catalytic systems and process intensification to deliver cost-effective, high-purity offerings.

At the same time, some global producers are expanding regional footprints through joint ventures and licensing agreements, enabling closer customer engagement and faster response times. By establishing localized manufacturing or tolling arrangements, they mitigate geopolitical risk and align supply with end-user preferences. This approach is complemented by digital platforms that streamline order management, quality tracking, and technical support, reflecting a broader push toward value-added services.

Meanwhile, emerging competitors from rapidly growing chemical clusters are leveraging lower operating costs and proximity to raw material feeds to challenge incumbents. These new entrants are investing in compliance infrastructure and quality assurance systems to meet international standards, positioning themselves as reliable partners for multinational formulators. The confluence of established innovators and agile upstarts is intensifying competition, driving continuous improvement in product performance, sustainability credentials, and customer experience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Di-tert-butyl disulfide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anhui Rencheng Technology Co., Ltd

- Apollo Scientific Ltd

- Career Henan Chemical Co., Ltd

- Chemlyte Solutions

- Chemvon Biotechnology Co., Ltd

- Conscientia Industrial Co., Ltd

- Creative Dynamics Inc

- Dayang Chem (Hangzhou) Co., Ltd

- H&Z Industry Co., Ltd

- Hangzhou Keying Chem Co., Ltd

- J&K Scientific Ltd

- Merck KGaA

- Neostar United (Changzhou) Industrial Co., Ltd

- Santa Cruz Biotechnology Inc

- Shanghai Jizhi Biochemical Technology Co., Ltd

- Shanghai Nianxing Industrial Co., Ltd

- Simagchem Corporation

- Thermo Fisher Scientific Inc

- Tokyo Chemical Industry Co., Ltd

- Toronto Research Chemicals Inc

- UDDA Conier Chem and Pharma Limited

- Wuhan Fortuna Chemical Co., Ltd

- Xiamen AmoyChem Co., Ltd

Presenting Actionable Recommendations to Enhance Agility, Sustainability, and Competitive Advantage Throughout the Di-tert-butyl Disulfide Value Chain

Industry leaders seeking to excel in the di-tert-butyl disulfide market should prioritize a set of strategic actions to enhance their competitive posture. First, advancing green synthesis capabilities can reduce reliance on traditional feedstocks, lower carbon emissions, and improve cost stability. By integrating renewable precursors and efficient catalysts, organizations can align with both regulatory requirements and customer sustainability goals.

Secondly, strengthening supply chain resilience through diversified sourcing and flexible logistical networks will mitigate risks associated with trade policy shifts and raw material volatility. This may involve establishing strategic alliances with regional toll manufacturers or developing adaptive inventory management systems equipped with predictive analytics to anticipate disruptions.

Third, investing in digitalization across R&D, manufacturing, and commercial operations can accelerate time-to-market for new formulations and boost operational efficiency. Implementing advanced process controls and IoT-enabled monitoring enhances quality consistency while providing actionable data for continuous improvement. Finally, cultivating collaborative relationships with end users through technical service offerings, co-development programs, and transparent communication on purity specifications will reinforce customer loyalty and drive long-term revenue growth.

Detailing a Robust Research Methodology Combining Primary Data Collection, Expert Consultations, and Secondary Sources to Ensure Quality and Credibility

This analysis is underpinned by a robust research methodology that blends qualitative and quantitative approaches to deliver a comprehensive market perspective. Primary data collection included in-depth interviews with senior executives across production, application, and regulatory functions, as well as expert consultations with academic and industry specialists to validate emerging trends. These firsthand insights were instrumental in contextualizing the strategic shifts and operational practices observed in the field.

Complementing this primary research, an extensive review of secondary sources provided a broad understanding of global trade policies, environmental regulations, and technological advancements. Industry publications, patent filings, and filings from regulatory agencies were systematically analyzed to identify key drivers and potential barriers. Data triangulation techniques were employed to cross-verify findings and ensure the reliability of conclusions drawn.

The combination of primary interviews, expert advisory input, and rigorous secondary analysis affords a nuanced and credible market assessment. This multi-tiered methodology ensures that the recommendations and insights presented are both actionable and reflective of on-the-ground realities in the di-tert-butyl disulfide value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Di-tert-butyl disulfide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Di-tert-butyl disulfide Market, by Purity Grade

- Di-tert-butyl disulfide Market, by Sales Channel

- Di-tert-butyl disulfide Market, by Application

- Di-tert-butyl disulfide Market, by End Use Industry

- Di-tert-butyl disulfide Market, by Region

- Di-tert-butyl disulfide Market, by Group

- Di-tert-butyl disulfide Market, by Country

- United States Di-tert-butyl disulfide Market

- China Di-tert-butyl disulfide Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Takeaways and Strategic Imperatives to Close the Analysis of Di-tert-butyl Disulfide Market Trends, Risks, and Growth Opportunities

In closing, di-tert-butyl disulfide represents a strategically significant specialty chemical whose value proposition is shaped by evolving regulations, sustainability imperatives, and technological innovation. As stakeholders navigate complex supply chains and shifting trade landscapes, a nuanced understanding of segmentation, regional dynamics, and competitive strategies becomes paramount. This report distills those insights, highlighting the transformative shifts redefining market boundaries and the tactical approaches required to maintain an edge.

Key takeaways include the critical importance of green synthesis pathways, the agility to respond to tariff fluctuations, and the value of segmentation-based go-to-market strategies that align with distinct application and end-use requirements. Regional analysis underscores the need to adapt strategies to the Americas, Europe Middle East & Africa, and Asia-Pacific environments, each presenting unique growth levers and compliance landscapes.

Ultimately, sustained success in the di-tert-butyl disulfide sector will hinge on proactive collaboration across the value chain, continuous innovation in production techniques, and a strategic focus on customer-driven solutions. By synthesizing these imperatives, stakeholders can forge resilient, future-ready operations that capitalize on emerging market opportunities.

Engaging with Leadership to Secure Your Comprehensive Di-tert-butyl Disulfide Market Intelligence Report Through a Direct Consultation with Ketan Rohom

To gain a deeper understanding of the market dynamics influencing di-tert-butyl disulfide, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Through a personalized consultation, you can explore how the insights and strategic guidance in our comprehensive report align with your organization’s goals. By partnering with Ketan, you will receive tailored recommendations designed to address your unique challenges, whether they relate to supply chain resilience, innovation pipelines, or regulatory compliance.

Securing the full market intelligence report ensures you stay ahead of emerging trends, leverage competitive benchmarking, and pinpoint actionable growth opportunities. Our report combines rigorous research with expert analysis, presenting you with a clear roadmap for navigating evolving market conditions. A direct consultation with Ketan Rohom will not only clarify any questions you have but will also help you customize the findings to drive tangible business results.

Take the next step today by reaching out to Ketan Rohom to purchase the complete di-tert-butyl disulfide market research report. This one-on-one engagement will set the foundation for a strategic partnership that empowers your team to turn insights into impactful decisions and sustainable growth.

- How big is the Di-tert-butyl disulfide Market?

- What is the Di-tert-butyl disulfide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?