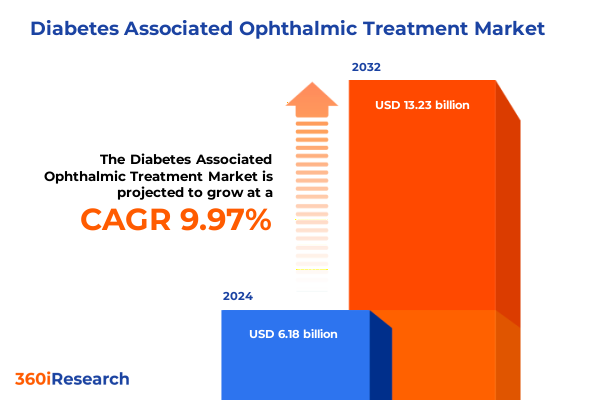

The Diabetes Associated Ophthalmic Treatment Market size was estimated at USD 6.74 billion in 2025 and expected to reach USD 7.36 billion in 2026, at a CAGR of 10.09% to reach USD 13.23 billion by 2032.

Innovations and Challenges Shaping the Future Landscape of Diabetes-Associated Ophthalmic Treatments and Patient Care

Diabetes-associated ophthalmic conditions, particularly diabetic retinopathy and macular edema, represent a profound public health challenge driven by the global surge in diabetes prevalence. In the United States alone, an estimated 9.6 million people were living with diabetic retinopathy in 2021, including 1.84 million with vision-threatening disease, underscoring the urgent need for effective screening and treatment solutions. With nearly 40 million Americans diagnosed with diabetes and at risk for vision loss, the demand for novel therapeutic modalities, diagnostic advances, and patient-centric care pathways has never been more acute.

Against this backdrop, the landscape of ophthalmic care for patients with diabetes is undergoing rapid transformation. Traditional laser photocoagulation and corticosteroid implants are increasingly complemented by targeted biologics, continuous-delivery implants, and gene-based therapies. At the same time, digital health innovations and artificial intelligence are expanding access to early detection, enabling timely intervention and reducing the burden of disease progression. As healthcare systems grapple with rising costs and supply chain complexities, stakeholders must adapt to shifting regulatory frameworks, evolving patient expectations, and emerging clinical evidence. This report synthesizes the latest clinical data, market trends, and strategic considerations, offering a comprehensive foundation for decision-makers seeking to navigate the complexities of diabetes-associated ophthalmic treatment and capitalize on high-impact opportunities.

Revolutionary Breakthroughs Are Redefining How Diabetic Eye Conditions Are Diagnosed, Monitored, and Treated Worldwide

Over the past two years, the field of diabetic eye care has witnessed groundbreaking technological advances that are redefining diagnostic standards and therapeutic paradigms. In screening, artificial intelligence systems like AEYE-DS have achieved fully autonomous detection of referable diabetic retinopathy using a single handheld image, delivering diagnostic sensitivity up to 93% and specificity between 89% and 94% in phase III studies. Concurrently, platforms such as LumineticsCore and EyeArt have extended autonomous AI screening into clinical settings, enhancing accessibility by integrating with tabletop and multiple fundus camera models.

Therapeutically, continuous-delivery implants have emerged as a transformative innovation. The U.S. Food and Drug Administration’s May 2025 approval of Susvimo for diabetic retinopathy established the first refillable ocular implant capable of maintaining ranibizumab delivery with only one refill every nine months, reducing injection frequency and improving patient adherence. At the molecular level, the approval of faricimab (Vabysmo) introduced the first bispecific antibody targeting both angiopoietin-2 and VEGF-A, offering extended dosing up to 16 weeks and demonstrating efficacy across neovascular age-related macular degeneration and diabetic macular edema.

Looking ahead, gene therapy programs are progressing through pivotal trials. AbbVie and Regenxbio’s ABBV-RGX-314, delivered via subretinal and suprachoroidal routes, has shown dose-dependent improvements in diabetic retinopathy severity scales with favorable tolerability profiles. Similarly, 4D Molecular Therapeutics’ 4D-150, designed for single-injection, multi-year expression of anti-VEGF components, has advanced toward Phase 3 based on promising interim DME data. These developments herald a new era of sustained-release and one-time therapies that could dramatically reduce treatment burden and enhance long-term outcomes.

Navigating the Complex Web of U.S. Tariff Policies in 2025 and Their Multifaceted Impact on Ophthalmic Treatment Ecosystems

In 2025, a complex array of U.S. tariff measures has reshaped the cost structure and supply chain dynamics for ophthalmic treatments. Effective April 5, 2025, a sweeping 10% global tariff on nearly all imported goods, including active pharmaceutical ingredients and medical devices, introduced immediate cost pressures across drug manufacturing and device production. Soon after, Section 301 tariffs on Chinese imports and specialized “China IEEPA fentanyl” duties further elevated levies on critical ophthalmic APIs to rates exceeding 20%, complicating sourcing strategies for generic and branded manufacturers alike.

Industry stakeholders sought relief from these burdensome duties, with the American Hospital Association petitioning for medical exemptions to safeguard healthcare delivery amid escalating expenses and potential supply disruptions. While the U.S. Court of International Trade’s May 2025 ruling struck down emergency tariff authorities under the International Emergency Economic Powers Act, appeals have maintained the status quo, requiring continued tariff payments pending final adjudication. Most recently, threats of 200% tariffs on pharmaceutical imports signaled a potential paradigm shift toward extreme protectionism, prompting urgent scenario planning by healthcare providers and drug developers to mitigate projected price increases and supply chain instability.

Collectively, these cumulative tariffs have driven companies to reevaluate global supply networks, accelerate nearshoring initiatives, and consider domestic manufacturing expansions to preserve margin stability and ensure patient access. In parallel, healthcare systems face heightened pressure to absorb or pass through cost increases, risking reduced treatment uptake in vulnerable populations. The unfolding tariff landscape underscores the strategic imperative for industry leaders to engage proactively with policymakers, diversify sourcing portfolios, and leverage innovation to offset the financial impact of trade policy disruptions.

Unveiling Critical Patient, Treatment, Administration, and End-User Dynamics That Illuminate Market Segmentation Insights

The diabetes-associated ophthalmic treatment landscape demands nuanced understanding of market segmentation to align product development and commercialization strategies with specific clinical and operational requirements. Across the spectrum of treatment modalities, anti-VEGF therapies lead the market with agents such as aflibercept, bevacizumab, brolucizumab, faricimab and ranibizumab, each distinguished by molecular structure, dosing intervals, and durability profiles. Corticosteroid implants offer alternative mechanisms of action, exemplified by dexamethasone and fluocinolone implants that target the inflammatory components of diabetic macular edema, alongside triancinolone injections for short-term edema control. Laser therapy remains integral for proliferative diabetic retinopathy, with focal and grid photocoagulation addressing macular edema and panretinal photocoagulation for advanced neovascularization, while surgical interventions provide options for vitreous hemorrhage and tractional retinal detachment.

Route of administration plays a pivotal role in patient experience and clinical logistics. Intravitreal injections, delivered via prefilled syringes or vials, represent the predominant approach for biologics and gene therapies. Systemic routes, including intravenous infusions and oral agents, continue to be explored for adjunctive roles but face challenges in achieving therapeutic ocular concentrations. Topical formulations, such as eye drops and ointments, offer non-invasive delivery but require formulation breakthroughs to overcome corneal barriers and attain relevant retinal tissue concentrations.

Patient type segmentation distinguishes between Type 1 and Type 2 diabetes, with epidemiological differences driving distinct prevalence of retinopathy severity and treatment response. End-user segmentation identifies key care settings-ambulatory surgical centers, hospitals, ophthalmology specialty clinics, and retail pharmacies-each with unique procurement channels, reimbursement pathways, and operational workflows. This multidimensional segmentation framework guides targeted product positioning, pricing strategies, and tailored support programs designed to meet the needs of diverse stakeholders across the care continuum.

This comprehensive research report categorizes the Diabetes Associated Ophthalmic Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Route Of Administration

- Patient Type

- End User

Regional Market Nuances Highlight Divergent Prevalence Trends, Treatment Access, and Healthcare Infrastructure Across Key Global Territories

Regional variations in disease burden, healthcare infrastructure, and regulatory frameworks exert a profound influence on access to and adoption of diabetes-associated ophthalmic treatments. In the Americas, where North America and the Caribbean exhibit a diabetic retinopathy prevalence of approximately 33.3%, the United States reported 9.6 million individuals living with the condition in 2021 and 1.84 million with vision-threatening forms, highlighting significant unmet needs despite advanced care networks. Latin American nations face challenges in screening and treatment coverage, with as many as 35% of diabetic patients never evaluated by an ophthalmologist and substantial disparities in rural versus urban care delivery.

In Europe, Middle East & Africa, prevalence figures range from a modest 20.6% in Europe to 33.8% in the Middle East and North Africa, reflecting diverse healthcare capacities and policy priorities. European markets benefit from robust reimbursement systems and widespread adoption of anti-VEGF agents, yet face pressures from cost-containment measures and evolving guidelines supporting earlier intervention in non-proliferative retinopathy. African and Middle Eastern regions confront dual hurdles of resource constraints and limited specialist availability, underscoring the need for scalable screening programs and cost-effective therapies.

The Asia-Pacific region displays stark contrasts, with Western Pacific countries (including China and Australia) reporting diabetic retinopathy prevalence as high as 36.2%, while South East Asian markets register rates near 12.5%. Rapid economic growth, urbanization, and rising diabetes incidence are driving expanded demand for advanced therapies in markets such as China, Japan, and Australia, whereas infrastructure gaps and regulatory delays continue to constrain treatment access in emerging economies. Tailoring market entry strategies to local reimbursement pathways, regulatory timelines, and healthcare delivery models is essential for optimizing regional performance and patient outcomes.

This comprehensive research report examines key regions that drive the evolution of the Diabetes Associated Ophthalmic Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Pioneers Driving Innovation from Continuous-Delivery Implants to Gene and AI Therapies in Ophthalmology

Leading pharmaceutical and biotech companies are at the forefront of innovation in diabetes-associated ophthalmic care, each leveraging distinct capabilities to address clinical unmet needs and enhance patient convenience. Roche’s Susvimo implant has set a new standard for continuous drug delivery, with U.S. approval for diabetic retinopathy marking its third indication and positioning it as the only refillable implant offering nine-month dosing intervals. Genentech’s Vabysmo (faricimab) has gained rapid uptake due to its bispecific mechanism targeting both angiopoietin-2 and VEGF-A, extending dosing intervals to up to 16 weeks across wet AMD and DME indications.

Regeneron continues to optimize its Eylea franchise, with FDA approvals confirming its efficacy in diabetic retinopathy and dosing every eight to 12 weeks following initial loading phases, while pursuing supplemental applications for extended-interval regimens. Novartis’s Beovu, recognized for six-week loading intervals and potential fluid resolution advantages, remains a key competitor in DME and is exploring indications in proliferative diabetic retinopathy through ongoing trials.

Emerging players are advancing novel modalities. AbbVie and Regenxbio’s RGX-314 gene therapy, administered via suprachoroidal delivery, has reported meaningful improvements on diabetic retinopathy severity scales with a favorable safety profile in the ALTITUDE trial. 4D Molecular Therapeutics’ 4D-150 is progressing to pivotal studies, promising multi-year anti-VEGF expression from a single intravitreal injection. Specialty biopharma firms such as EyePoint and Oculis continue to explore sustained-release implants and topical formulations, though recent trial setbacks underscore the challenges of translating early-stage innovations into clinical practice.

This comprehensive research report delivers an in-depth overview of the principal market players in the Diabetes Associated Ophthalmic Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adverum Biotechnologies, Inc.

- Aerpio Therapeutics, Inc.

- Alimera Sciences, Inc.

- Apexian Pharmaceuticals, Inc.

- Bayer AG

- Boehringer Ingelheim International GmbH

- F. Hoffmann‑La Roche Ltd

- Genentech, Inc.

- Glycadia Pharmaceuticals, Inc.

- Kodiak Sciences Inc.

- Kubota Vision, Inc.

- MingSight Pharmaceuticals, Inc.

- Novartis AG

- Ocular Therapeutix, Inc.

- Oxurion NV

- Regeneron Pharmaceuticals, Inc.

- Regenxbio Inc.

- RemeGen Co., Ltd.

- Santen Pharmaceutical Co., Ltd.

Strategic Roadmap for Industry Leaders to Capitalize on Innovation, Mitigate Geopolitical Risks, and Expand Patient Access in Ophthalmology

Industry leaders seeking to navigate the complexities of diabetes-associated ophthalmic care must adopt multifaceted strategies that integrate innovation, risk mitigation, and market expansion. First, cultivating strong partnerships with regulatory agencies is critical for accelerating product approvals and securing favorable labeling, as demonstrated by the expedited FDA clearances for AI DR screening devices and continuous-delivery implants. Collaborative engagements aimed at harmonizing clinical trial endpoints and reimbursement criteria can further streamline market entry.

Second, enhancing supply chain resilience in the face of ongoing tariff uncertainties demands proactive diversification of sourcing channels and strategic investments in domestic manufacturing capacities. Companies should consider joint ventures with contract manufacturers in lower-tariff jurisdictions to alleviate cost pressures on APIs and device components, while leveraging nearshoring incentives to ensure continuity of operations.

Third, expanding patient access through value-based care models and tiered pricing schemes can drive adoption across diverse healthcare settings. Integrating AI-driven telemedicine platforms with existing care pathways will facilitate screening outreach in underserved regions, optimizing resource utilization and enabling early intervention. Tailored patient support programs, including adherence tracking and home-delivery services, can enhance long-term treatment persistence.

Finally, investing in real-world evidence generation and health economics research can substantiate product value propositions and support formulary inclusion. Stakeholders should prioritize longitudinal studies that capture clinical outcomes, quality of life metrics, and cost offsets attributable to reduced injection frequency or improved visual preservation, thereby strengthening payer negotiations and sustaining competitive differentiation.

Transparent and Rigorous Research Protocols Underpinning Comprehensive Analysis of Diabetes-Associated Ophthalmic Treatment Trends

This analysis integrates primary and secondary research methodologies to deliver a robust, data-driven perspective on diabetes-associated ophthalmic treatments. Primary research involved structured interviews with key opinion leaders, including retina specialists, health system procurement officers, and payers, to validate market trends, assess clinical preferences, and identify emerging reimbursement models. Quantitative surveys of endocrinologists and ophthalmology practice managers provided additional insights into prescribing behaviors and operational challenges.

Secondary research encompassed exhaustive reviews of peer-reviewed journals, regulatory databases, clinical trial repositories, and government health statistics. Key sources included FDA public documents, ClinicalTrials.gov, and incidence and prevalence data from the Centers for Disease Control and Prevention and global meta-analyses. Trade press and financial disclosures were analyzed to capture corporate developments and tariff policy impacts.

Data triangulation was performed to reconcile disparate information streams, ensuring accuracy and consistency across epidemiological, clinical, and economic dimensions. Findings were validated through peer review by an advisory panel of academic and industry experts, providing additional rigor and mitigating potential biases. This methodological framework underpins the credibility of the insights presented and supports informed strategic decision-making by stakeholders across the ophthalmic treatment landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Diabetes Associated Ophthalmic Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Diabetes Associated Ophthalmic Treatment Market, by Treatment Type

- Diabetes Associated Ophthalmic Treatment Market, by Route Of Administration

- Diabetes Associated Ophthalmic Treatment Market, by Patient Type

- Diabetes Associated Ophthalmic Treatment Market, by End User

- Diabetes Associated Ophthalmic Treatment Market, by Region

- Diabetes Associated Ophthalmic Treatment Market, by Group

- Diabetes Associated Ophthalmic Treatment Market, by Country

- United States Diabetes Associated Ophthalmic Treatment Market

- China Diabetes Associated Ophthalmic Treatment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesis of Core Findings Underscores Rapid Evolution, Ongoing Challenges, and Strategic Imperatives in Diabetic Eye Care

The convergence of scientific breakthroughs, evolving patient needs, and shifting regulatory and geopolitical forces marks a pivotal era for diabetes-associated ophthalmic care. Continuous-delivery implants and bispecific antibodies are redefining treatment paradigms, significantly reducing dosing burdens while maintaining visual outcomes. Simultaneously, autonomous AI screening platforms and gene therapy candidates promise to extend early detection and long-term disease control beyond traditional care settings.

However, the trajectory of innovation faces headwinds from tariff volatility, supply chain disruptions, and uneven global access. Strategic responses must balance the pursuit of breakthrough therapies with pragmatic risk management and market entry tactics tailored to regional healthcare ecosystems. Robust segmentation analysis reveals distinct requirements for treatment modalities, administration routes, and end-user channels, guiding targeted investments and stakeholder collaborations.

Ultimately, the capacity to translate clinical innovation into real-world impact will hinge on the agility of industry players to navigate policy landscapes, cultivate multi-stakeholder partnerships, and demonstrate compelling value propositions through real-world evidence. As the therapeutic toolkit expands, a coordinated approach that unites clinical excellence, operational efficiency, and patient-centric models will be essential for preserving vision and enhancing quality of life for millions at risk of diabetes-related blindness.

Connect with Ketan Rohom to Unlock In-Depth Market Intelligence and Secure Your Comprehensive Diabetes-Associated Ophthalmic Treatment Report

To explore the complete spectrum of diabetes-associated ophthalmic treatment innovations, market dynamics, and strategic opportunities, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing) to secure your comprehensive market research report. This tailored resource offers in-depth analyses and actionable intelligence designed to empower your organization’s decision-making process and drive sustainable growth in an evolving therapeutic landscape.

- How big is the Diabetes Associated Ophthalmic Treatment Market?

- What is the Diabetes Associated Ophthalmic Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?