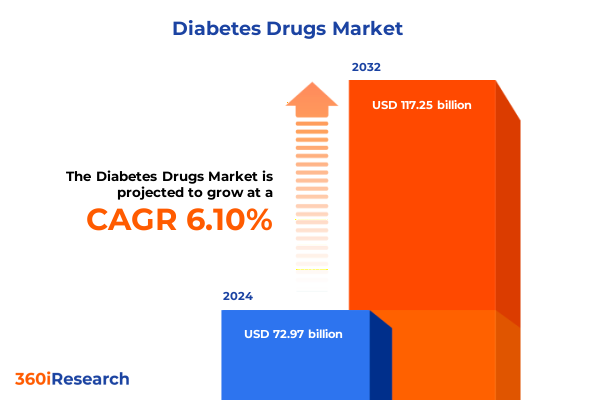

The Diabetes Drugs Market size was estimated at USD 77.40 billion in 2025 and expected to reach USD 81.64 billion in 2026, at a CAGR of 6.11% to reach USD 117.25 billion by 2032.

Emerging therapies and patient-centric innovations combined with regulatory shifts are transforming the global diabetes drug landscape in 2025

Diabetes remains a formidable global health challenge, with 589 million adults living with the condition-equivalent to 11.1% of the world’s adult population-yet over 43% of these individuals remain undiagnosed, revealing critical gaps in awareness and access to care. This burden is projected to escalate to approximately 853 million by 2050, fueled by urbanization, demographic aging, and lifestyle shifts such as sedentary behavior and dietary changes.

In recent years, pharmaceutical innovation in diabetes management has accelerated dramatically. Breakthroughs in drug classes-most notably GLP-1 receptor agonists and dual-agonist therapies-are shifting treatment paradigms toward agents that not only achieve robust glycemic control but also induce weight loss and offer compelling cardiovascular and renal benefits. Regulatory authorities have responded by expanding indications for established molecules and fast-tracking next-generation therapies, reflecting urgent clinical needs and the promise of improved long-term outcomes.

Simultaneously, digital health integration-through continuous glucose monitoring systems, connected insulin pens, and telehealth platforms-is reshaping care delivery. Real-time data sharing, personalized dosing algorithms, and virtual consultations are improving adherence, enabling earlier interventions, and fostering proactive disease management. The convergence of molecular innovation and digital tools is setting the stage for a fundamentally transformed landscape in diabetes treatment, where precision and patient-centered care take precedence.

Pivotal breakthroughs in therapy mechanisms, digital health integration, and clinical practices are reshaping long-term diabetes care and management paradigms globally

Oral formulations of peptide-based therapies are on the horizon, with investigational small-molecule GLP-1 analogs such as orforglipron promising to overcome adherence barriers associated with injectables and broaden patient acceptance. Dual-agonist agents like tirzepatide have demonstrated superior efficacy in both glycemic management and weight reduction compared to first-generation GLP-1 therapies, driving competitive dynamics among originators and biosimilar entrants alike.

Clinical development programs are extending GLP-1 receptor agonists beyond their traditional roles, exploring indications in chronic kidney disease, cardiovascular risk reduction, non-alcoholic steatohepatitis (NASH), and even neurodegenerative disorders. The U.S. Food and Drug Administration’s recent approval of semaglutide for chronic kidney disease exemplifies this trend, underscoring the repurposing potential of diabetes drugs to address multifaceted metabolic complications.

Patent expirations are catalyzing robust activity from generic and biosimilar manufacturers, particularly in India and China. Dr. Reddy’s announcement to introduce 26 semaglutide-based generics across 87 countries highlights how emerging players are gearing up to democratize access and respond to patent cliffs expected over the next decade. At the same time, compounding pharmacies and off-patent formulations are exerting downward pricing pressure, prompting originators to reinforce value propositions through clinical differentiation and patient support programs.

Strategic partnerships between large pharmaceutical companies and biotech innovators are accelerating the transition from discovery to market. Collaborations targeting combination therapies, novel delivery systems, and AI-driven drug discovery platforms are proliferating, signaling a new era of integrated, patient-centric solutions that transcend traditional insulin-centric paradigms.

The cumulative impact of newly imposed pharmaceutical import tariffs is driving cost pressures and realignments in the U.S. diabetes drug supply chain under new trade policies

Effective April 5, 2025, a 10% global tariff on imported goods-which encompasses active pharmaceutical ingredients (APIs)-has increased production costs for diabetes medications and compelled manufacturers to reevaluate supply chain strategies. Heightened duties of up to 25% on APIs sourced from China and India have further escalated the expense of core precursors, threatening to erode margins or shift cost burdens onto payers and patients.

An Ernst & Young analysis for PhRMA, reviewed by Reuters, estimated that a 25% tariff on finished pharmaceuticals could raise U.S. drug costs by nearly $51 billion annually, potentially increasing consumer prices by up to 12.9% if fully passed through. Insulin and other high-volume diabetes therapies are particularly vulnerable to these price shocks, risking further affordability challenges for chronically ill patients.

In response to these policy shifts, major global players have announced substantial onshore investments to build domestic manufacturing capacity. AstraZeneca’s commitment of $50 billion by 2030 exemplifies how companies are balancing immediate cost pressures with long-term resilience strategies, despite the multi-year timeline required to operationalize new facilities.

To mitigate supply disruptions and tariff impacts, stakeholders are diversifying sourcing models, exploring alternative API origins, and adopting modular production technologies. Simultaneously, industry coalitions are advocating for phased tariff implementation and targeted exemptions to safeguard essential medication availability and stabilize pricing dynamics under evolving trade policies.

Insightful segmentation analysis revealing how drug classes, administration routes, diabetes types, origins, and distribution channels are influencing treatment strategies

The diabetes drugs domain is governed by drug class dynamics, where peptide-based therapies such as GLP-1 receptor agonists have surged ahead in both glycemic control and weight management, while long-acting insulin analogs remain indispensable for basal glucose regulation and short-acting formulations address mealtime spikes. Amylin analogs and a spectrum of oral antidiabetic agents continue to play auxiliary roles, reflecting a diversified therapeutic architecture calibrated to patient-specific treatment pathways.

Route of administration segmentation highlights evolving preferences: injectables maintain a stronghold driven by effective peptide therapies, yet the pending arrival of oral GLP-1 analogs is poised to reshape adherence landscapes. Inhalation-based insulin delivery, though clinically validated, has yet to achieve widespread uptake, underscoring persistent challenges in patient convenience and device acceptance.

Disaggregation by diabetes type reveals distinct imperatives: type 1 populations rely on precise insulin delivery innovations, including closed-loop pump systems, whereas type 2 cohorts benefit from an expanded portfolio of oral and injectable therapies that address metabolic syndrome components and facilitate comprehensive risk factor mitigation.

Drug origin insights delineate a dynamic interplay between branded pharmaceutical leaders securing premium valuation through intellectual property and generic manufacturers harnessing cost-efficiency post-patent expiry; this balance is exemplified by imminent generic GLP-1 launches that promise to broaden access while intensifying pricing competition.

Distribution channel analysis illustrates the ascent of decentralized care modalities: home healthcare and remote pharmacy services are complementing traditional hospital and retail pharmacies, while online pharmacy platforms and telehealth-enabled dispensing models are increasingly critical for repeat refill adherence and seamless patient engagement.

This comprehensive research report categorizes the Diabetes Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route Of Administration

- Diabetes Type

- Drug Origin

- Distribution Channel

Complex regional dynamics in the Americas, Europe, Middle East & Africa, and Asia-Pacific are shaping differentiated opportunities and challenges in diabetes management

In the Americas, advanced healthcare infrastructure and mature reimbursement frameworks have propelled the United States to lead in adoption of innovative diabetes therapies, particularly GLP-1 receptor agonists with weight-loss indications. Policy measures incentivizing domestic production under new trade regimes are reshaping investment flows, while Canada and Brazil are rapidly preparing for generic and biosimilar launches following patent expirations, promising broader regional access and competitive pricing dynamics.

Europe, the Middle East, and Africa present a heterogeneous landscape: Western Europe remains a stronghold for premium branded treatments under centralized reimbursement pathways, whereas Central and Eastern Europe, the Middle East, and North Africa are fertile ground for cost-effective generics and biosimilars. Regulatory fragmentation and geopolitical uncertainty in several markets have prompted flexible market entry and adaptive pricing strategies by global and local stakeholders.

Asia-Pacific is registering the fastest growth trajectory, driven by rising diabetes prevalence, government-led screening initiatives, and expanding healthcare access. China’s burgeoning middle-class demand for next-generation therapies and India’s aggressive generics expansion are key growth engines, while Southeast Asian and Australasian markets leverage digital distribution channels and public–private collaborations to enhance disease management infrastructure and patient outreach.

This comprehensive research report examines key regions that drive the evolution of the Diabetes Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading pharmaceutical innovators and emerging challengers are driving competitive dynamics through novel pipelines, strategic alliances, and manufacturing expansions in diabetes care

Novo Nordisk continues to dominate the sector, leveraging its semaglutide franchise with expanded indications into chronic kidney disease and cardiovascular risk reduction, while pioneering combination therapies such as semaglutide-cagrilintide to reinforce clinical differentiation and patient value.

Eli Lilly has emerged as a significant challenger through its tirzepatide dual-agonist portfolio, achieving robust uptake in both obesity and type 2 diabetes segments. Strategic capacity investments and planned launches in India, Brazil, and Mexico underscore its commitment to global market expansion and supply chain resilience.

Sanofi sustains a comprehensive insulin portfolio and is advancing next-generation basal insulin analogs and fixed-dose combinations, concurrently forging alliances to integrate digital monitoring solutions. AstraZeneca’s $50 billion U.S. manufacturing investment, driven by evolving trade incentives, bolsters its operational footprint in metabolic disease R&D and production capacity.

Emerging players like Dr. Reddy’s and Biocon are mobilizing to introduce biosimilars and generic GLP-1 therapies across emerging markets, leveraging cost-efficient manufacturing and impending patent expirations to accelerate market penetration and democratize access.

Additionally, biotech startups and contract manufacturing organizations are forging partnerships with established firms to expedite next-generation programs, ranging from oral peptide formulations to smart delivery devices, thereby diversifying the competitive landscape and driving innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Diabetes Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Astellas Pharma Inc

- AstraZeneca plc

- Bayer AG

- Biocon Limited

- Boehringer Ingelheim International GmbH

- Bristol Myers Squibb Company

- Cipla Limited

- Daiichi Sankyo Company Limited

- Eli Lilly and Company

- GlaxoSmithKline plc

- Johnson and Johnson

- Merck and Co Inc

- Novartis AG

- Novo Nordisk A S

- Pfizer Inc

- Roche Holding AG

- Sanofi S A

- Sun Pharmaceutical Industries Ltd

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd

Actionable strategic recommendations to navigate evolving regulations, optimize supply chains, and leverage technological innovations for sustained growth in diabetes therapies

Industry leaders should diversify API sourcing networks by integrating near-shoring strategies and alternative supplier partnerships, thereby mitigating tariff-induced cost volatility and reinforcing supply chain resilience. Embracing modular, flexible manufacturing platforms can further cushion against abrupt trade‐policy shifts and ensure uninterrupted delivery of critical diabetes therapies.

Investing in holistic digital health ecosystems is essential: by leveraging real-world data and remote monitoring tools, companies can refine dosing algorithms, enhance patient adherence, and substantiate value-based care models that align with payer priorities. Telemedicine and connected devices not only drive engagement but also enable predictive analytics for demand forecasting and clinical optimization.

Portfolio diversification beyond traditional insulin and GLP-1 categories-into combination treatments targeting comorbidities such as NASH, cardiovascular disease, and renal dysfunction-will secure future growth. Strategic alliances with biotech innovators and academic centers can accelerate the translation of early-stage research into clinical candidates and novel delivery systems.

Health-system stakeholders and payers should collaborate to implement outcome-based reimbursement frameworks that link pricing to long-term patient outcomes. Simultaneously, robust patient support programs encompassing financial assistance and educational initiatives will drive product loyalty and reduce total cost of care while enhancing access.

Rigorous research methodology combining primary stakeholder interviews and extensive secondary data analysis ensures comprehensive insights into diabetes drug market trends and drivers

This research integrates qualitative insights from comprehensive interviews with senior executives across pharmaceutical companies, contract manufacturing organizations, payers, and regulatory agencies, ensuring a holistic understanding of market dynamics, strategic imperatives, and policy impacts.

Secondary data was sourced from authoritative public repositories, including international health agency publications, peer-reviewed journals, reputable news outlets, and corporate disclosures, with an emphasis on information current through July 2025 to capture emerging trends and policy shifts.

A rigorous triangulation methodology was employed, cross-referencing primary interview insights with quantitative data-such as global prevalence figures from the International Diabetes Federation and tariff impact analyses by leading consulting firms-to validate findings and bolster analytical robustness.

Scenarios were constructed using sensitivity analysis and expert peer review to assess potential outcomes under varying technological, regulatory, and competitive scenarios, ensuring that the insights presented are both actionable and resilient across diverse market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Diabetes Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Diabetes Drugs Market, by Drug Class

- Diabetes Drugs Market, by Route Of Administration

- Diabetes Drugs Market, by Diabetes Type

- Diabetes Drugs Market, by Drug Origin

- Diabetes Drugs Market, by Distribution Channel

- Diabetes Drugs Market, by Region

- Diabetes Drugs Market, by Group

- Diabetes Drugs Market, by Country

- United States Diabetes Drugs Market

- China Diabetes Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Conclusive insights summarizing key trends, challenges, and opportunities that underline the critical direction for stakeholders in the evolving diabetes treatment landscape

The diabetes treatment landscape is undergoing transformative evolution, propelled by innovative therapeutic classes, digital health integration, and shifting trade policy dynamics. Stakeholders who proactively adapt to evolving cost structures, supply chain complexities, and regulatory frameworks will be positioned to capitalize on emerging opportunities.

The ascendance of GLP-1 receptor agonists, dual-agonist platforms, and new delivery modalities heralds a more holistic era of metabolic therapy, where glycemic control, weight management, and comorbidity reduction are integrated within unified treatment regimens. Yet tariff-driven cost pressures and impending generic competition necessitate balanced strategies that safeguard both profitability and patient affordability.

Regional disparities in healthcare infrastructure, market access, and payer policies demand customized commercial approaches, while collaborative models-encompassing outcome-based reimbursement, public–private partnerships, and cross-sector alliances-will be instrumental in optimizing clinical and economic value. Ultimately, a data-driven, agile mindset that embraces innovation and collaboration will define success in the rapidly evolving diabetes treatment market.

Unlock comprehensive market intelligence and strategic guidance by purchasing the full diabetes drugs research report with expert consultation

To acquire the full market research report and leverage in-depth strategic analysis for competitive advantage, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engage our experts for a personalized consultation and ensure your organization is equipped with the actionable intelligence required to excel in the evolving diabetes drug market.

- How big is the Diabetes Drugs Market?

- What is the Diabetes Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?