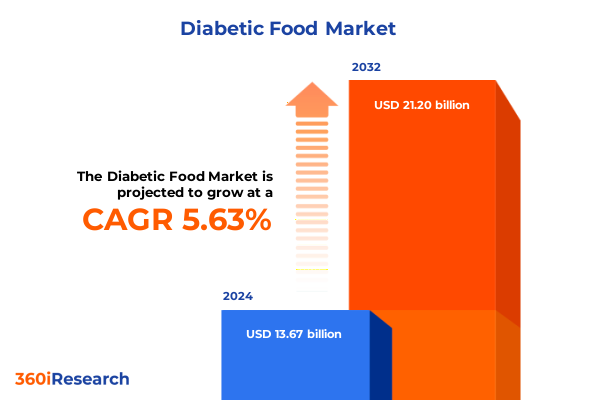

The Diabetic Food Market size was estimated at USD 14.40 billion in 2025 and expected to reach USD 15.18 billion in 2026, at a CAGR of 5.67% to reach USD 21.20 billion by 2032.

Exploring the dynamic landscape of diabetic dietary solutions and their pivotal influence on managing blood glucose levels and enhancing patient outcomes

Diabetic nutrition has evolved into a cornerstone of holistic health management, transcending traditional notions of restrictive diets. Today, food offerings designed for individuals managing blood sugar levels emphasize not only glycemic control but also taste, texture, and overall wellness. This convergence reflects a broader shift in consumer expectations, where medical efficacy must harmonize with sensory satisfaction and lifestyle integration.

Moreover, the diabetic food category now engages multiple stakeholders-including healthcare professionals, caregivers, and the patients themselves-to forge comprehensive dietary approaches. Partnerships between nutrition experts and food technologists are driving the creation of formulations that balance macronutrient profiles with functional ingredients known for their antiglycemic properties. As a result, diabetic foods are reshaping standards for nutrient density and palatability.

In this context, a deep understanding of evolving product paradigms, regulatory frameworks, and consumer mindsets is critical for industry participants. This executive summary provides a cohesive overview of major shifts affecting diabetic food, equipping decision makers with insights needed to navigate a landscape where scientific rigor meets culinary innovation.

Uncovering the transformative trends reshaping diabetic nutrition through technological innovation personalized experiences and evolving consumer health priorities

The diabetic food sector is undergoing profound transformation fueled by emerging technological advances and shifting consumer priorities. Continuous glucose monitoring platforms now link directly with digital wellness applications, enabling real-time feedback loops that inform product enhancements. This integration underscores the trend toward personalized nutrition, where data-driven recommendations guide ingredient selection and portion calibration.

Simultaneously, consumer awareness of metabolic health has broadened to encompass inflammation control, gut microbiome balance, and cardiovascular risk. These concerns are catalyzing the incorporation of functional fibers, plant-derived bioactives, and adaptogenic botanicals into diabetic formulations. As a result, product developers are moving beyond traditional sweetener substitution to embrace multi-functional ingredients that deliver targeted health benefits while maintaining sensory appeal.

Consequently, the marketplace is witnessing collaborations between food science innovators and biotechnology firms to harness alternative proteins and precision fermentation processes. This confluence of expertise is laying the groundwork for next-generation diabetic foods that strike an optimal balance between efficacy, taste, and convenience, ultimately redefining consumer experiences and market expectations.

Assessing the cumulative repercussions of recent United States tariff restructuring on the cost structure ingredient availability and value chain resilience in diabetic food sector

Recent adjustments to United States tariff policies have reverberated across the diabetic food supply chain, influencing both raw material procurement and finished good distribution. Ingredients sourced from specialized global suppliers have experienced shifts in landed costs, prompting manufacturers to reassess sourcing strategies and explore near-shoring options. This recalibration is driven by the imperative to maintain consistent ingredient quality while safeguarding pricing stability.

In turn, the added import costs have spurred investments in strategic partnerships with domestic growers of low-glycemic grains and stevia cultivators. Such alliances aim to create vertically integrated supply chains that mitigate exposure to international trade fluctuations. Moreover, regional processing facilities are being optimized to accommodate expanded volumes of alternative sweeteners and fiber concentrates, offsetting logistical complexities introduced by tariff changes.

As a result, companies are leveraging these dynamic conditions to enhance resilience-diversifying supplier networks and accelerating automation in manufacturing processes. This strategic repositioning not only addresses immediate cost pressures but also fortifies long-term value chain agility, positioning the diabetic food sector to adapt swiftly to evolving trade landscapes and regulatory shifts.

Illuminating nuanced segmentation within diabetic food offerings encompassing product composition nutritional profile packaging format distribution pathway and end-user demographics

Diabetic food offerings exhibit intricate layers of differentiation rooted in both product composition and target consumer demographics. Within baked goods, there is a distinct progression from traditional bread formulations toward cake and cookie variants enriched with fiber and protein, catering to palate preferences across meal occasions. Confectionery segments demonstrate parallel innovation, with candies and chocolates infused with plant-based sweetening agents that deliver satisfying sensory experiences without glycemic spike concerns.

Diverse ingredient categorizations further influence market positioning. Artificial sweeteners remain a staple for precise sweetness control, while natural sweeteners and whole grain inclusions appeal to consumers seeking minimal processing. Nuts and seeds are gaining traction as textural enhancers that provide healthy fats and micronutrients, supporting sustained energy release. Packaging variety plays a complementary role, with pouches offering on-the-go convenience and jars or cans signaling premium or family-style usage contexts.

Dietary preferences add another dimension to segmentation insights. Gluten-free, ketogenic, and low-glycemic classifications address distinct metabolic considerations, while vegan formulations meet ethical and environmental criteria. Distribution pathways straddle traditional retail environments-such as pharmacies and specialty stores-and digital storefronts that facilitate direct-to-consumer relationships. Ultimately, product developers tailor offerings to end users ranging from pre-diabetic individuals and non-diabetic wellness seekers to those with established diabetic management needs, creating a tapestry of choices that reflect varied health journeys.

This comprehensive research report categorizes the Diabetic Food market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient Type

- Packaging Type

- Diet Type

- Distribution Channel

- End-User

Examining critical regional developments across the Americas Europe Middle East Africa and Asia Pacific that drive differentiated diabetic nutrition strategies and market adoption dynamics

Regional dynamics are exerting a profound influence on diabetic food innovation and adoption patterns across the globe. In the Americas, a mature healthcare infrastructure and widespread insurance coverage underpin the integration of specialized diabetic formulations into standard care regimens. Major foodservice and retail chains are collaborating with medical institutions to offer therapeutic meal solutions, accelerating mainstream acceptance and driving experiential marketing initiatives.

Across Europe, the Middle East, and Africa, regulatory convergence on nutritional labeling and claims validation is fostering consumer trust in diabetic-friendly products. Simultaneously, government-led subsidy programs in select markets are making fortified foods more accessible to vulnerable populations. These policy frameworks are complemented by cultural diversity, leading to region-specific flavor profiles that blend traditional recipes with low-glycemic ingredients, thereby preserving culinary heritage while promoting metabolic health.

In the Asia-Pacific, rapid urbanization and rising disposable incomes are fueling demand for convenient, health-oriented snacks tailored to diabetic care. Local manufacturers are forging partnerships with global ingredient specialists to localize formulations, balancing affordability with premium positioning. This convergence of economic growth and health consciousness has positioned the region as a hotbed for agile startups and innovation accelerators focused on diabetic nutrition breakthroughs.

This comprehensive research report examines key regions that drive the evolution of the Diabetic Food market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing leading industry players pioneering advanced diabetic nutrition solutions through strategic alliances research investments and innovative product pipelines

Leading enterprises in the diabetic nutrition space are forging strategic alliances and channeling resources toward breakthrough product portfolios. Key players are leveraging proprietary research collaborations with academic institutions to validate the physiological impact of novel sweetening systems and fiber blends. These partnerships are instrumental in securing clinical endorsements that bolster product credibility among healthcare professionals and patient communities.

Innovation investments are concentrated on multifunctional platforms that integrate glycemic modulation with ancillary health benefits, such as gut microbiome support and anti-inflammatory properties. Companies are also adopting agile R&D processes to accelerate iteration cycles, enabling faster market roll-out of reformulated offerings. Furthermore, several firms have expanded their manufacturing footprints through joint ventures, optimizing production scalability for emerging bio-ingredients and specialized grain cultivars.

In parallel, distribution strategies are being refined through e-commerce collaborations and subscription-based models that deliver personalized diabetic meal kits. Personalized engagement platforms are facilitating direct communication with users, collecting feedback that informs iterative design and fosters brand loyalty. Collectively, these initiatives underscore a concerted effort by frontrunners to align technological prowess with consumer-centric product experiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Diabetic Food market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Adani Group

- Amy’s Kitchen, Inc.

- Archer Daniels Midland Company

- Beneo GmbH

- Cargill, Incorporated

- Danone

- Fifty 50 Foods, Inc.

- General Mills, Inc.

- Hain Celestial Group

- Ingredion Incorporated

- Kellogg Company

- Mars Inc.

- Mondelez International, Inc.

- Nestlé S.A.

- PepsiCo Inc.

- Sriram Diabetic Foods

- The Coca-Cola Company

- The Hershey Company

- The Kraft Heinz Company

- Tyson Foods, Inc.

- Unilever PLC

- Vitalicious, Inc.

Providing actionable strategic directions for diabetic food sector leadership to capitalize on emerging health trends strengthen supply chain and foster sustainable growth trajectories

Industry leaders should prioritize the development of modular research frameworks that align clinical evidence with consumer insights, enabling targeted product enhancements and differentiated value propositions. By investing in collaborative R&D incubators, organizations can accelerate the discovery of next-generation ingredients while sharing risk across a consortium of scientific partners.

Next, embracing end-to-end supply chain transparency through blockchain or digital traceability solutions will foster consumer trust and streamline regulatory compliance. Such systems not only verify ingredient provenance but also offer real-time visibility into production workflows, enhancing agility when responding to trade policy shifts or raw material constraints.

In addition, cultivating strategic alliances with digital health platforms and telemedicine providers can unlock opportunities for integrated diabetic meal planning services. Co-creating branded experiences that synchronize dietary recommendations with glucose monitoring data will reinforce brand positioning and deepen customer engagement.

Finally, embedding sustainability principles across ingredient sourcing and packaging design will resonate with environmentally conscious consumers. Deploying biodegradable materials and partnering with regenerative agriculture initiatives both mitigates environmental impact and strengthens the ethical narrative of diabetic nutrition offerings.

Detailing comprehensive research methodology combining expert interviews qualitative analysis and rigorous secondary data validation to ensure robust industry insights

The foundation of this analysis rests on a multi-method research design that combines primary qualitative insights with disciplined secondary data triangulation. Initial exploratory interviews were conducted with endocrinologists, registered dietitians, and procurement executives to capture nuanced perspectives on unmet needs, innovation gaps, and operational challenges within the diabetic food ecosystem.

Complementing these interviews, a comprehensive review of peer-reviewed journals, regulatory filings, and industry publications was performed to validate ingredient efficacy claims and assess the evolving legislative environment. Data from trade associations, public health agencies, and nutritional science forums were synthesized to ensure a robust contextual framework.

Findings were further enriched through virtual focus groups with diabetic individuals representing diverse demographic and lifestyle profiles. Their feedback informed segmentation analysis and highlighted practical considerations around taste preferences, portion control, and packaging usability. This rigorous methodology underpins the credibility of the insights presented, ensuring that strategic directives are grounded in real-world stakeholder experiences and scientifically validated information.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Diabetic Food market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Diabetic Food Market, by Product Type

- Diabetic Food Market, by Ingredient Type

- Diabetic Food Market, by Packaging Type

- Diabetic Food Market, by Diet Type

- Diabetic Food Market, by Distribution Channel

- Diabetic Food Market, by End-User

- Diabetic Food Market, by Region

- Diabetic Food Market, by Group

- Diabetic Food Market, by Country

- United States Diabetic Food Market

- China Diabetic Food Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding critical insights on diabetic nutrition evolution and strategic imperatives to empower stakeholders in navigating complexity and fostering improved health outcomes

Through this executive summary, the complex interplay of regulatory shifts, technological advances, and shifting consumer values has been illuminated. The diabetic food sector stands at a pivotal juncture, where purposeful innovation must balance efficacy, sensory appeal, and operational resilience. As trade dynamics continue to reshape cost structures, supply chain strategies will prove vital to sustaining competitive advantage.

Segmented approaches that align with specific dietary preferences, ingredient types, and distribution channels will remain fundamental to market differentiation. Equally important are the regional nuances that demand localized product design and strategic partnerships. Leading companies are already demonstrating how agile research investments and digital engagement models can expedite time to market while deepening consumer trust.

Looking ahead, stakeholders equipped with a nuanced understanding of these dynamics will be best positioned to drive growth, enhance patient outcomes, and pioneer the next generation of diabetic dietary solutions. This conclusion underscores the imperative for ongoing collaboration across scientific, commercial, and regulatory domains to seize emerging opportunities in this transformative space.

Inviting collaboration with Ketan Rohom Associate Director Sales Marketing to secure in-depth diabetic food market intelligence for informed decision making and growth acceleration

Engaging directly with Ketan Rohom opens a pathway to harnessing exhaustive market intelligence tailored to the diabetic food sector. This conversation is designed to align research insights with your strategic priorities, ensuring that decision makers have access to granular analysis and actionable data. By initiating dialogue, stakeholders gain exclusive entry to specialized reports that distill complex industry trends into clear, pragmatic guidance.

Partnering with Ketan Rohom as your research liaison facilitates a customized exploration of themes such as ingredient innovation, regulatory implications, and shifting consumer behaviors. This personalized engagement transcends off-the-shelf studies by integrating one-on-one consultations and interactive briefings, granting you clarity on nuances that matter most to your organization.

Reach out to arrange a dedicated briefing session and outline specific intelligence requirements. This proactive step will empower your teams with the foresight needed to refine product development roadmaps, enhance go-to-market strategies, and strengthen competitive positioning. Take advantage of this opportunity to collaborate with an expert who is committed to translating sophisticated diabetic nutrition research into a catalyst for growth and market leadership.

- How big is the Diabetic Food Market?

- What is the Diabetic Food Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?