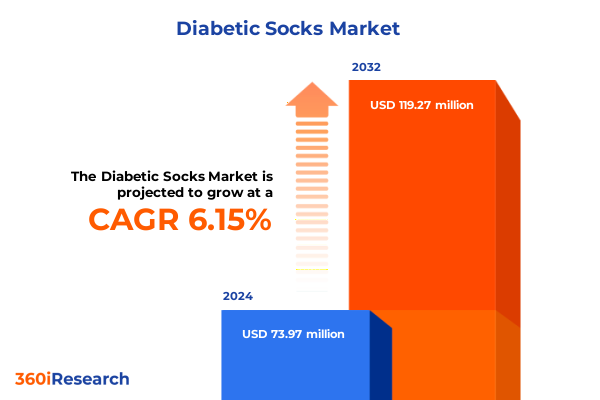

The Diabetic Socks Market size was estimated at USD 78.19 million in 2025 and expected to reach USD 88.69 million in 2026, at a CAGR of 6.21% to reach USD 119.26 million by 2032.

Pioneering the Diabetic Socks Market with Innovative Design, Patient-Centric Features, and Industry-Defining Clinical Performance Advantages

The global diabetic socks market has undergone a remarkable journey from basic protective hosiery to technologically advanced therapeutic solutions. Originally conceived to safeguard the diabetic foot against minor injuries and ulceration risks, these specialized socks have evolved to incorporate moisture-wicking yarns, antimicrobial treatments, and seamless toe designs that address the unique needs of neuropathic and circulatory-impaired patients. Over time, manufacturers have refined fit profiles and incorporated graduated compression elements to support venous return without compromising comfort.

Advancements in textile science have driven the integration of natural fibers such as bamboo for antimicrobial properties, alongside synthetic blends engineered for durability and elasticity. Regulatory frameworks and clinical guidelines have underscored the critical role of proper foot care in diabetic management, elevating socks from an ancillary accessory to an essential component of comprehensive treatment regimens. As consumer awareness and healthcare practitioner recommendations align, the demand for performance-oriented diabetic hosiery has intensified, prompting brands to innovate while maintaining cost-effectiveness.

Today’s market is shaped by the convergence of patient-centered design, clinical efficacy validation, and strategic distribution approaches. This report delves into the multifaceted landscape of diabetic socks, examining historical drivers, contemporary shifts, and actionable insights that will inform stakeholders across the value chain.

Navigating Fundamental Shifts Fueled by Technological Advances, Consumer Preferences, Strategic Partnerships, and Regulatory Changes Shaping Diabetic Hosiery

In recent years, diabetic sock manufacturers have navigated a landscape transformed by the increasing convergence of digital health technologies, sustainability imperatives, and shifting consumer expectations. Wearable sensors embedded within hosiery now enable real-time monitoring of foot temperature and pressure distribution, alerting patients and clinicians to potential ulceration hotspots before symptoms manifest. This integration of smart textiles with telehealth platforms has redefined preventive foot care, empowering remote patient management and reducing clinic visits.

At the same time, ethical sourcing and eco-friendly production processes have emerged as critical differentiators. Brands are leveraging organic cotton and responsibly harvested bamboo fibers, while adopting closed-loop dyeing systems to minimize water usage and reduce environmental footprints. This dual focus on performance and sustainability resonates not only with healthcare providers but also with end users who prioritize products with transparent supply chain credentials.

Furthermore, strategic collaborations between textile innovators, medical device companies, and academic research institutions have accelerated material breakthroughs such as phase-change temperature regulation and advanced moisture management. Regulatory bodies in key markets are also evolving standards to incorporate efficacy testing for thermoregulation and antimicrobial claims, ensuring that next-generation diabetic socks meet rigorous clinical benchmarks. These transformative forces are reshaping product portfolios, distribution approaches, and competitive positioning across the industry.

Assessing the Cumulative Consequences of Recent United States Trade Tariffs on Imported Diabetic Footwear Hosiery and Associated Cost Structures Through 2025

The introduction and escalation of United States tariffs on imported textile goods have exerted significant pressure on cost structures throughout the diabetic socks supply chain. As tariff rates climbed into the mid-teens and beyond, consumer prices began to reflect the increased duties, with the Yale Budget Lab projecting an average effective tariff rate of 20.2% by 2025-levels not seen since the early 20th century. These elevated duties have translated into approximately a 36% rise in apparel pricing in the short term, underscoring the direct link between import levies and retail costs.

Concurrently, threats of additional tariffs of up to 35% on imports from major manufacturing hubs such as Bangladesh have prompted buyers to delay or re-evaluate purchase orders, creating inventory bottlenecks and disrupting just-in-time replenishment models. Suppliers and distributors, contending with reduced margins, have had to absorb part of the increased duties to maintain competitive pricing, effectively compressing profit pools across the value chain.

Moreover, the United States Trade Representative has extended exclusions for certain medical textile products through August 31, 2025, alleviating duties on a subset of critical healthcare goods. While these extensions provide short-term relief, stakeholders must remain vigilant as further extensions or modifications remain uncertain. Taken together, the cumulative impact of these trade measures has heightened the urgency for supply chain diversification, cost optimization, and proactive duty management strategies.

Unlocking Consumer and Distribution Profiles through Multidimensional Segmentation Revealing Nuanced Preferences and Performance Drivers in Diabetic Socks

A multidimensional segmentation framework reveals the nuanced preferences and performance drivers among diabetic sock consumers, spanning distribution pathways, material compositions, product variants, compression gradations, end-user categories, gender orientations, and price tiers. Distribution channels range from hospital procurement systems that prioritize clinically validated outcomes to digital commerce ecosystems. Within the online sphere, both omni-channel retailers and pure play platforms cater to distinct shopping behaviors, while pharmacy networks-comprising chain outlets alongside autonomous independent pharmacies-vie for professional endorsements. Specialty medical retailers further differentiate through bespoke fitting services and patient education offerings.

Material diversity underpins product positioning, with bamboo fibers prized for natural antibacterial efficacy and moisture wicking, cotton prized for breathability and familiar comfort, synthetic polymers delivering resilient stretch and shape retention, and fine-grade wool offering insulating properties for cooler climates. Product typologies likewise cater to varying anatomical and therapeutic needs: discrete ankle-length socks for mild support, crew-length variants available with padded or non-padded configurations to address neuropathic sensitivity, knee-high solutions for enhanced calf coverage, and over-the-calf designs incorporating silver-infusion or tourmaline embedding to deliver antimicrobial protection and far-infrared therapeutic benefits.

Compression levels further refine performance, from mild support suited for everyday wear to extra firm compression engineered for pronounced circulatory assistance; moderate compression options, available in gradient or uniform pressure profiles, strike a balance between comfort and efficacy, while firm compression delineates a middle ground. End users encompass adult populations and pediatric segments, the latter subdivided into toddler- and youth-oriented fits, each requiring tailored sizing and cushioning characteristics. Gender distinctions manifest in female-specific anatomical contours, male-oriented durability preferences, and unisex models designed for universal applicability. Price ranges inform positioning across entry-level affordability, mid-range performance, and premium offerings integrating the latest material and technological enhancements.

By overlaying these segmentation layers, industry participants can identify high-impact combinations-such as premium, tourmaline-embedded over-the-calf socks for adult patients distributed through pharmacy omnichannel programs-and calibrate product development, marketing narratives, and channel strategies accordingly.

This comprehensive research report categorizes the Diabetic Socks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Distribution Channel

- Material

- Product Type

- Compression Level

- End User

- Gender

- Price Range

Exploring Regional Dynamics of Diabetic Socks across the Americas and EMEA to Asia-Pacific Illuminating Growth Opportunities and Market Differentiation

Regional dynamics significantly influence product innovation, regulatory alignment, and adoption rates in the diabetic socks sector. In the Americas, the United States leads through a robust ecosystem of clinical research collaborations and reimbursement frameworks, while Canada’s universal healthcare models drive demand for validated therapeutic hosiery. Market participants in Latin America face infrastructure and access challenges, yet growing awareness and government initiatives to expand diabetic foot care services are propelling uptake of performance-oriented socks.

Across Europe, Middle East and Africa, well-established medical device regulations in the European Union ensure rigorous testing standards, fostering consumer confidence in advanced compression and antimicrobial designs. The United Kingdom, following post-Brexit regulatory realignments, is forging new trade relationships that impact material sourcing and distribution pathways. In the Middle East, rising prevalence of diabetes coupled with increasing healthcare expenditure is fueling demand for specialized foot care products, while select African markets show nascent interest hindered by supply chain and logistical constraints.

Asia-Pacific presents a diverse tapestry of maturity levels: developed markets like Japan and Australia emphasize clinical validation and premium product positioning, whereas emerging economies such as India, China, and Southeast Asian nations are rapidly scaling local manufacturing capabilities to meet surging domestic and export demand. Government programs subsidizing diabetic care in these regions are catalyzing broader distribution through hospital formularies, retail pharmacies, and e-commerce portals. Cross-regional strategic partnerships are bridging gaps and enabling technology transfers, laying the groundwork for harmonized standards and accelerated innovation diffusion.

This comprehensive research report examines key regions that drive the evolution of the Diabetic Socks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Movers Driving Competitive Advantage through Product Portfolios, Strategic Alliances, and Distribution Models in Diabetic Socks

Leading innovators in the diabetic socks arena distinguish themselves through targeted research and development investments, strategic alliances, and diversified distribution footprints. Companies with established compression legacies have expanded into diabetic-specific lines by leveraging existing vascular support expertise and clinical study partnerships. Some market movers have formed joint ventures with digital health firms to incorporate sensor technologies into hosiery, unlocking new data-driven care models.

Others have pursued backward integration to control critical raw materials, securing sustainable bamboo and specialty yarn supplies to enhance quality assurance and cost stability. Strategic acquisitions have bolstered portfolios with advanced materials and proprietary antimicrobial treatments, while licensing agreements with technology firms have facilitated rapid deployment of phase-change temperature management and infrared-reflective fiber innovations.

On the distribution front, forward-thinking players have optimized omnichannel approaches, integrating healthcare professional endorsements with consumer education platforms and direct-to-patient subscription services. By aligning product roadmaps with insurer reimbursement criteria and hospital procurement norms, these companies have amplified market penetration and fostered collaborative relationships with healthcare systems. Collectively, these strategic moves underscore the importance of innovation ecosystems, supply chain resilience, and go-to-market adaptability in maintaining a competitive edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Diabetic Socks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Cardinal Health, Inc.

- Carex Health Brands, LLC

- Creswell Sock Mills

- Cupron Inc.

- DJO LLC

- Essity Aktiebolag

- Julius Zorn GmbH & Co. KG

- Medi GmbH & Co. KG

- Orthofeet Inc.

- PediFix Inc.

- SB SOX, LLC

- Sigvaris Holding AG

- Silipos, Inc.

- SIMCAN Enterprises Inc.

- Therafirm, Inc.

Translating Market Intelligence into Strategic Action with Best Practices for Innovation, Operational Efficiency, and Customer Engagement in the Diabetic Socks Industry

Industry participants must proactively translate market intelligence into strategic action to maintain competitive advantage in the diabetic socks sector. Embracing open innovation partnerships can accelerate material breakthroughs while distributing risk and leveraging complementary expertise. Companies should establish cross-functional teams that integrate clinical affairs, product development, and supply chain management to ensure alignment between therapeutic efficacy goals and operational capabilities.

Operational efficiency can be enhanced by adopting advanced planning systems that account for multi-tiered channel requirements-from hospital formularies to direct-to-consumer shipments-while embedding duty management rules to mitigate tariff exposure. Regularly reviewing material sourcing strategies against evolving trade policies, combined with maintaining alternative supply nodes, will safeguard continuity in the face of geopolitical shifts.

Customer engagement initiatives should blend educational content with digital tools, such as mobile applications that guide users through sizing choices and usage best practices. By fostering ongoing dialogue with healthcare professionals and patient advocacy groups, organizations can refine product features, validate performance claims, and bolster brand credibility. Ultimately, an integrated approach that combines innovation acceleration, supply chain agility, and stakeholder collaboration will drive sustained growth and resilience.

Outlining Rigorous Qualitative and Quantitative Approaches Ensuring Robust Data Collection and Analysis Underpinning the Comprehensive Diabetic Socks Market Study

This study employs a hybrid methodology combining qualitative insights from expert interviews, clinician roundtables, and primary surveys with quantitative analysis of trade data, healthcare procurement records, and consumer purchase patterns. Secondary research spans industry white papers, regulatory filings, and patent databases to map historical trends and validate emerging technologies.

Key opinion leaders-including podiatrists, vascular specialists, and textile engineers-were consulted to assess clinical performance criteria, patient adherence drivers, and unmet needs. Concurrently, supply chain audits and tariff impact simulations were conducted to quantify cost exposures and resilience benchmarks. Consumer segmentation studies utilized discrete choice experiments and conjoint analysis techniques to identify preference hierarchies across material, compression, and price attributes.

Data triangulation ensured consistency across sources, with findings cross-referenced against publicly available sales figures and national health expenditure reports. A rigorous peer review process involving industry veterans and academic advisors validated assumptions and refined the analytical framework. This comprehensive approach underpins the reliability and strategic relevance of the conclusions presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Diabetic Socks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Diabetic Socks Market, by Distribution Channel

- Diabetic Socks Market, by Material

- Diabetic Socks Market, by Product Type

- Diabetic Socks Market, by Compression Level

- Diabetic Socks Market, by End User

- Diabetic Socks Market, by Gender

- Diabetic Socks Market, by Price Range

- Diabetic Socks Market, by Region

- Diabetic Socks Market, by Group

- Diabetic Socks Market, by Country

- United States Diabetic Socks Market

- China Diabetic Socks Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Summarizing Critical Findings and Strategic Takeaways to Guide Stakeholders in Navigating Future Opportunities and Challenges within the Evolving Diabetic Socks Sector

Throughout this report, critical findings reveal how patient-centric design, technological integration, and adaptive distribution models are redefining the diabetic socks landscape. The convergence of sensor-enabled fabrics and remote monitoring platforms promises to shift the paradigm from reactive treatment to proactive management, while sustainability commitments are shaping sourcing and manufacturing priorities across regions.

Evolving trade policies have introduced cost pressures and supply chain complexities, underscoring the need for diversification strategies and tariff optimization mechanisms. Segmentation analysis highlights lucrative combinations of channel, material, and therapeutic features, guiding targeted product development and marketing efforts. Regional insights illuminate distinct adoption drivers from mature North American markets to rapidly expanding Asia-Pacific hubs, each presenting unique regulatory, infrastructure, and consumer behavior considerations.

Leading companies are leveraging strategic collaborations, vertical integration, and omnichannel distribution to solidify market positions and accelerate innovation cycles. Actionable recommendations emphasize the importance of aligning clinical validation processes with reimbursement frameworks, strengthening supply chain resilience, and nurturing stakeholder engagement through educational initiatives. Collectively, these takeaways equip decision-makers with a clear roadmap for navigating the opportunities and challenges of the evolving diabetic socks sector.

Connect with Ketan Rohom to Discover How This Comprehensive Diabetic Socks Market Report Can Empower Decision-Making and Drive Business Growth

We invite you to explore how this detailed market research report can sharpen your competitive edge by delivering in-depth insights, strategic analysis, and practical guidance tailored to address the complexities of diabetic socks. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to understand how our findings can inform your product development roadmap, distribution strategies, and go-to-market priorities. Reach out today to discuss how the report’s comprehensive analysis will support your decision-making processes and empower your organization to navigate this dynamic sector with confidence and clarity.

- How big is the Diabetic Socks Market?

- What is the Diabetic Socks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?