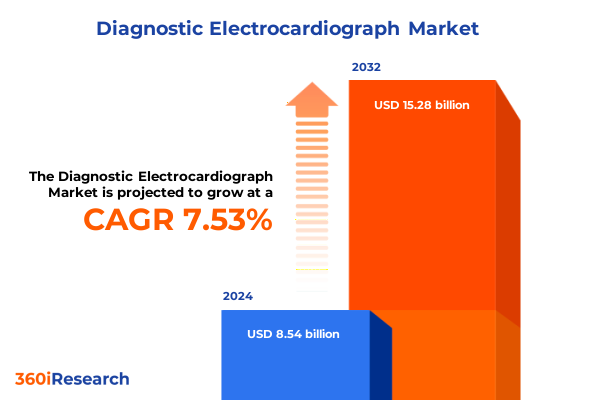

The Diagnostic Electrocardiograph Market size was estimated at USD 9.15 billion in 2025 and expected to reach USD 9.81 billion in 2026, at a CAGR of 7.59% to reach USD 15.28 billion by 2032.

Exploring the Convergence of Cutting-Edge Cardiac Monitoring Innovations and Emerging Healthcare Demands to Set the Foundation for In-Depth Market Analysis

The rapid evolution of cardiac monitoring technologies is reshaping how healthcare providers diagnose, monitor, and manage cardiovascular conditions. Electrophysiology specialists and clinical decision-makers increasingly rely on advanced diagnostic electrocardiographs to capture high-resolution electrical activity of the heart, enabling the early detection of arrhythmias and ischemic events. As population demographics shift and the prevalence of chronic cardiac diseases rises, the pressure on healthcare systems to deliver accurate, timely, and cost-effective diagnostics intensifies.

Against this backdrop, innovations in digital signal processing, miniaturization, and connectivity are transforming the traditional electrocardiograph into portable and wireless platforms that extend cardiac monitoring beyond hospital walls. These advancements underpin a broader trend toward patient-centric care models, where remote monitoring and telemetric data exchange facilitate continuous cardiovascular surveillance and proactive intervention. The introduction of patch-based monitors and insertable cardiac monitors, for example, exemplifies how product diversification addresses varying clinical needs, from episodic event detection to long-term arrhythmia management.

As we embark on an in-depth exploration of this dynamic market landscape, it is essential to adopt a structured approach that captures the converging forces shaping growth trajectories. This executive summary distills key transformative shifts, regulatory and tariff impacts, segmentation nuances, regional disparities, competitive positioning, and actionable recommendations that together chart the future of diagnostic electrocardiographs.

Unveiling the Rise of Connected, Analytics-Driven Cardiac Monitoring Platforms That Are Redefining Diagnostic Precision and Patient-Centric Care

Recent years have witnessed a profound shift from static, clinician-operated electrocardiographs to mobile solutions embedded with sophisticated data analytics. Electronic health record integration, cloud-based repositories, and artificial intelligence-driven interpretation engines are no longer futuristic concepts but integral components of modern cardiac diagnostics. These technologies streamline clinician workflows by automating artifact rejection, border tracing, and normative comparisons within seconds, thereby reducing time to diagnosis and enhancing diagnostic confidence.

Moreover, the rise of value-based healthcare reimbursement models has propelled the adoption of continuous monitoring systems that demonstrate real-world evidence of improved patient outcomes. In this context, stress ECG devices have evolved to capture multi-modality data, correlating hemodynamic metrics with electrical signals to furnish a holistic assessment of cardiac response under exertion. Simultaneously, ambulatory ECG solutions now combine event monitoring, Holter analysis, and patch-based detection in modular configurations, empowering clinicians to tailor monitoring durations and sensitivity thresholds according to individual patient risk profiles.

These transformative shifts extend to manufacturing and supply chain processes as well. The growing prevalence of contract manufacturing organizations specializing in precision electronics has accelerated the development of lightweight telemetry ECG units. This collaborative ecosystem fosters faster time-to-market for next-generation devices and invites regulatory bodies to streamline approval pathways for interoperable platforms. Consequently, the diagnostic electrocardiograph market is transitioning toward an era of seamless connectivity and personalized cardiac care.

Analyzing the Strategic Realignments Driven by 2025 Tariff Revisions on Imported ECG Hardware Components and Their Long-Term Supply Chain Implications

In early 2025, the United States government implemented revised tariff schedules that directly affect the import of medical electronic equipment, including diagnostic electrocardiographs and their critical subcomponents. These adjustments have prompted manufacturers to reassess supply chain strategies, considering domestic assembly and component localization as mechanisms to mitigate increased landed costs. The initial consequence of higher duty rates on specialized printed circuit boards and sensor arrays has been a recalibration of manufacturer sourcing patterns, with many shifting orders to tariff-exempt trade zones and leveraging free trade agreements where applicable.

In response, a cohort of leading developers has embarked on strategic collaborations with US-based electronics suppliers to secure duty relief while maintaining quality and reliability standards. Such initiatives often involve co-development agreements that blend proprietary signal processing algorithms with locally manufactured hardware, ensuring that innovation pipelines remain uninterrupted by geopolitical headwinds. Meanwhile, distributors are increasingly adopting flexible pricing structures and consolidation programs to absorb tariff fluctuations and preserve margins for healthcare providers.

Looking ahead, stakeholders anticipate that these tariff measures will incentivize greater domestic production of core electrocardiograph modules, from lead-wire assemblies to onboard data processors. Over time, this shift may contribute to a more resilient and transparent supply chain ecosystem, fostering closer alignment between regulatory oversight, manufacturing excellence, and clinical requirements. Ultimately, the cumulative impact of United States tariffs in 2025 will catalyze strategic realignments across the diagnostic electrocardiograph value chain, balancing short-term cost pressures with long-term operational stability.

Dissecting the Multifaceted Diagnostic ECG Market Through a Layered Segmentation Lens That Illuminates Product, Technology, Lead, End-User, Application, and Channel Nuances

A nuanced appreciation of market segmentation reveals diverse usage scenarios and technology preferences that shape competitive positioning and adoption patterns. The Ambulatory ECG cohort encompasses event monitors, Holter monitors, insertable cardiac monitors, and patch-based monitors, each optimized for specific patient pathways-from short-term arrhythmia captures to long-term implantable surveillance. Resting ECG systems remain indispensable for baseline diagnostics in hospital and clinic environments, whereas stress ECG units integrate exercise protocols to evaluate ischemic thresholds under physiologic stress. In parallel, telemetry ECG platforms facilitate real-time remote monitoring for critical care and surgical settings.

Advancements in signal fidelity and portable architectures underpin the growing appeal of wireless and portable technologies, supporting clinician mobility and patient comfort without compromising diagnostic integrity. Additionally, lead configurations range from comprehensive 12-lead diagnostic solutions to streamlined single-lead wearables, each offering trade-offs between anatomical coverage and user convenience. Within healthcare delivery channels, hospitals and diagnostic centers continue to form the backbone of device utilization, yet clinics, ambulatory surgical centers, and home care settings are increasingly harnessing portable ECG solutions to extend clinical reach.

Application-driven segmentation highlights arrhythmia detection, general-purpose monitoring, myocardial infarction detection, and stroke monitoring as key use cases. Arrhythmia detection solutions are differentiated by algorithmic sophistication and battery longevity, while myocardial infarction detection systems prioritize high-resolution ST-segment analysis. Distribution channels split between traditional offline networks and burgeoning online platforms, the latter capitalizing on e-commerce growth and direct-to-consumer remote patient monitoring kits. This layered segmentation framework informs strategic prioritization for product developers, service providers, and channel partners alike.

This comprehensive research report categorizes the Diagnostic Electrocardiograph market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Lead Type

- End-User

- Application

- Distribution Channel

Navigating Distinct Regional Adoption Patterns and Regulatory Environments in the Americas, EMEA, and Asia-Pacific to Optimize ECG Device Deployment

Regional dynamics present contrasting adoption curves and regulatory climates that underscore the importance of tailored market strategies. In the Americas, robust healthcare infrastructures and reimbursement frameworks sustain demand for high-precision ECG devices in both clinical and outpatient settings. Telehealth penetration accelerates adoption in rural areas, with patch-based monitors and remote telemetry units bridging gaps in specialist access.

Across Europe, Middle East & Africa, providers navigate heterogeneous regulatory pathways, making Central Europe a focal point for pilot implementations of AI-enabled ECG analytics under harmonized Union standards. Meanwhile, Middle Eastern markets invest in cutting-edge cardiac care infrastructure, while select African nations pursue mobile health initiatives to deliver ECG diagnostics via portable and wireless devices in community settings.

In Asia-Pacific, rapid urbanization and rising cardiovascular disease prevalence drive significant growth opportunities. China’s large hospital networks and government-sponsored telemedicine programs are prime channels for resting ECG and stress ECG adoption, whereas India’s private hospital groups show growing interest in cost-effective ambulatory monitoring solutions. Japan’s aging population and advanced reimbursement structures favor resting and telemetry ECG innovations, further cementing the region as a hotbed for next-generation diagnostic deployments.

These regional insights guide market entrants and established players in aligning product portfolios with local regulatory requirements, reimbursement schemes, and patient care pathways, ensuring that segmentation strategies resonate with distinct clinical environments.

This comprehensive research report examines key regions that drive the evolution of the Diagnostic Electrocardiograph market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Collaborations, Technology Diversification, and Mergers That Are Shaping Leadership Dynamics in the Diagnostic ECG Sector

Leading industry participants differentiate through continuous innovation pipelines and strategic partnerships that broaden their technology portfolios. Some key players have invested heavily in research collaborations with academic institutions to refine AI-based ECG interpretation algorithms, securing first-to-market positioning for advanced arrhythmia detection features. Concurrently, alliances with telecommunication firms have facilitated the integration of 5G-enabled telemetry ECG platforms, promising ultra-low-latency data streams for acute care settings.

Several manufacturers have diversified their offerings to include both portable wireless and benchtop resting ECG systems, enabling coverage across outpatient clinics and tertiary hospitals. By establishing relationships with central laboratories and remote monitoring service providers, these companies ensure end-to-end solutions that span device provision, data analytics, and reporting services. In distribution, some organizations leverage omni-channel strategies, combining a robust offline presence with e-commerce portals that cater to tech-savvy clinicians and patients.

Additionally, the competitive landscape is influenced by an increasing number of targeted acquisitions and mergers aimed at consolidating proprietary sensor technologies and platform interoperability standards. These M&A activities often prioritize acquiring niche businesses with specialized expertise in areas such as patch-based monitor adhesives or low-power analog front-end chips. Such transactions not only expand product roadmaps but also reinforce barriers to entry for emerging challengers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Diagnostic Electrocardiograph market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACS Diagnostics, Inc.

- AliveCor, Inc.

- Ambu A/S

- Aspel SA

- ATsens Co., Ltd.

- Auxo Medical LLC

- Bionet Co., Inc.

- BPL Medical Technologies Pvt. Ltd.

- BTL

- Cardioline S.p.A.

- CompuMed, Inc. by Sumitomo Corporation

- Custo Med GmbH

- Edan Instruments, Inc.

- Fukuda Denshi Co., Ltd.

- GE HealthCare Technologies Inc.

- Hill-Rom, Inc. by Baxter International, Inc.

- Innomed Medical Zrt.

- Koninklijke Philips N.V.

- Lepu Medical Technology(Beijing)Co.,Ltd.

- Nihon Kohden Corporation

- Norav Medical Ltd.

- OSI Systems, Inc.

- Probo Medical, LLC

- Schiller AG

- Shenzhen Comen Medical Instruments Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Positioning for Success by Building Interoperable Platforms, Forging Telehealth Partnerships, and Tailoring Regional Go-to-Market Strategies to Elevate Market Penetration

Industry leaders can capitalize on emerging opportunities by prioritizing interoperable device ecosystems and open data standards that seamlessly integrate with hospital information systems. By investing in modular hardware architectures, companies can accommodate rapid software upgrades and novel sensor integrations, future-proofing their portfolios against evolving clinical requirements.

Furthermore, forging partnerships with telemedicine providers and managed care organizations can accelerate the adoption of home-based ECG monitoring solutions, leveraging reimbursement models that reward preventive care. Leaders should also explore alliances with component manufacturers in tariff-advantaged zones, thereby stabilizing input costs and safeguarding product affordability.

In terms of market penetration, tailored go-to-market approaches that address regional reimbursement nuances and regulatory hurdles will prove decisive. Cultivating key opinion leader advocacy and convening user workshops can build clinician trust and demonstrate clinical efficacy. Finally, embedding robust cybersecurity protocols and compliance with data privacy regulations will reinforce device credibility and protect patient information across all deployment scenarios.

Employing a Hybrid Primary-Secondary Approach That Integrates Stakeholder Interviews, Regulatory Filings Review, and Competitive Intelligence to Illuminate Market Dynamics

The research underpinning this analysis combines primary and secondary sources to deliver a comprehensive view of the diagnostic electrocardiograph market. Primary insights were obtained through structured interviews with cardiology specialists, biomedical engineers, and procurement managers across hospitals, clinics, and home care settings. These engagements provided firsthand perspectives on device performance requirements, workflow integration challenges, and emerging clinical trends.

Secondary research encompassed a review of trade publications, regulatory filings, and clinical trial repositories to quantify technological advancements, regulatory approvals, and product launches. Regulatory databases from the US Food and Drug Administration and equivalent agencies in Europe and Asia-Pacific were consulted to track device clearances and evolving standards. Additionally, published white papers and peer-reviewed journals informed our understanding of AI-driven analytics and remote monitoring efficacy.

Market segmentation analysis leveraged product catalogs, distributor listings, and e-commerce platforms to map the spectrum of offerings by type, technology, lead configuration, end-user, application, and channel. Regional dynamics were evaluated based on healthcare expenditure data, reimbursement frameworks, and demographic projections. Competitive intelligence was gathered via public filings, press releases, and M&A announcements to profile strategic initiatives and innovation pipelines. This multi-pronged methodology ensures robust, actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Diagnostic Electrocardiograph market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Diagnostic Electrocardiograph Market, by Product Type

- Diagnostic Electrocardiograph Market, by Technology

- Diagnostic Electrocardiograph Market, by Lead Type

- Diagnostic Electrocardiograph Market, by End-User

- Diagnostic Electrocardiograph Market, by Application

- Diagnostic Electrocardiograph Market, by Distribution Channel

- Diagnostic Electrocardiograph Market, by Region

- Diagnostic Electrocardiograph Market, by Group

- Diagnostic Electrocardiograph Market, by Country

- United States Diagnostic Electrocardiograph Market

- China Diagnostic Electrocardiograph Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Innovation, Competitive Dynamics, and Regional Strategies to Chart a Future-Ready Course for Diagnostic Electrocardiograph Market Leadership

As the demand for precise and continuous cardiac monitoring intensifies, diagnostic electrocardiographs stand at the forefront of transforming cardiovascular care delivery. The interplay of device innovation, connectivity solutions, and evolving healthcare models underscores a market characterized by rapid technological convergence and strategic realignments. Stakeholders must navigate tariff-induced supply chain shifts, regulatory pathways, and regional disparities to harness growth opportunities effectively.

A comprehensive segmentation lens reveals the differentiated requirements across ambulatory, resting, stress, and telemetry ECG applications, guiding targeted investment and development. Regional insights emphasize the need for adaptive strategies that align with local reimbursement environments and patient care priorities. Competitive dynamics continue to be shaped by partnerships, M&A activity, and the race to integrate AI-enhanced analytical capabilities into device platforms.

Ultimately, the companies that succeed will be those that deliver interoperable, modular solutions, cultivate collaborative ecosystems across the telehealth continuum, and execute nuanced regional go-to-market plans. By grounding strategic decisions in rigorous research and stakeholder engagement, industry leaders can position themselves to address the rising tide of cardiovascular disease with precision, efficiency, and clinical impact.

Gain Unparalleled Market Intelligence and Strategic Insight by Engaging Directly with Ketan Rohom to Acquire the Definitive Diagnostic Electrocardiograph Market Research Report

The diagnostic electrocardiograph market is at a pivotal moment, and you can secure the comprehensive intelligence that drives confident decision-making today. Reach out to Ketan Rohom, who specializes in translating complex industry dynamics into strategic growth opportunities, to obtain the full market research report and gain exclusive insights that empower your organization to stay ahead in a competitive environment.

- How big is the Diagnostic Electrocardiograph Market?

- What is the Diagnostic Electrocardiograph Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?