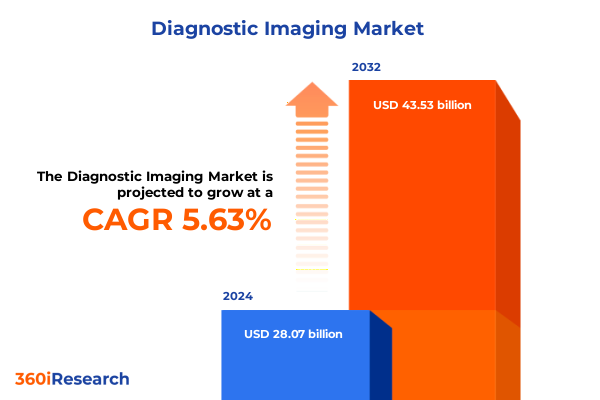

The Diagnostic Imaging Market size was estimated at USD 29.65 billion in 2025 and expected to reach USD 31.31 billion in 2026, at a CAGR of 5.64% to reach USD 43.53 billion by 2032.

Setting the Stage for Diagnostic Imaging Advancements Amid Intensifying Healthcare Needs and Rapid Technological Integration Across Clinical Settings

The global healthcare ecosystem is witnessing an unprecedented demand for advanced diagnostic solutions as providers strive to enhance patient outcomes while containing costs. Diagnostic imaging lies at the heart of this transformation, offering clinicians noninvasive visibility into human physiology and pathology that drives earlier interventions and more personalized care pathways. Rapid technological innovation, from higher-resolution modalities to integrated software analytics, is reshaping how diagnostic procedures are conceived, executed, and interpreted. These developments have profound implications for equipment manufacturers, healthcare institutions, and policy makers alike.

As regulatory environments evolve to balance patient safety with access to cutting-edge technologies, stakeholders must navigate a shifting mosaic of approval timelines and reimbursement frameworks. Concurrently, demographic pressures-such as aging populations and the rising prevalence of chronic diseases-are creating urgent demand for scalable imaging capabilities. This introduction establishes the foundation for exploring the forces propelling diagnostic imaging into new realms of clinical utility and operational efficiency. In the sections that follow, we will delve into transformative technological trends, the cumulative impact of recent tariff policies, granular segmentation insights, regional dynamics, competitive landscapes, and actionable recommendations for industry leaders.

Navigating the Transformative Shifts Reshaping Diagnostic Imaging Through AI Personalized Medicine Trends and Operational Efficiency Imperatives

Over the past decade, diagnostic imaging has undergone a fundamental metamorphosis driven by convergence of digital intelligence, miniaturization, and cloud-enabled collaboration. Artificial intelligence–powered image analytics are automating lesion detection, quantifying tissue characteristics, and helping clinicians reduce variability in interpretation. Concurrently, personalized medicine initiatives are spurring the integration of multimodal imaging biomarkers into decision support systems that tailor therapeutic strategies to individual patient profiles. The rise of point-of-care ultrasound and portable computed tomography units underscores the imperative for flexible, decentralized imaging solutions capable of supporting care delivery in ambulatory and community settings.

In parallel, the drive for operational efficiency has catalyzed the adoption of advanced software platforms that consolidate image storage, workflow orchestration, and reporting into unified environments. These platforms foster seamless collaboration across radiology, oncology, cardiology, and other specialties while maintaining compliance with stringent data privacy regulations. Meanwhile, emerging network architectures and telehealth initiatives are extending the reach of expert interpretation to rural and resource-constrained regions, further democratizing access to high-quality diagnostic services. These shifts collectively signal a new era in which technology, clinical insight, and connectivity coalesce to redefine the role of imaging within the broader healthcare continuum.

Unveiling the Cumulative Impact of 2025 United States Tariffs on Diagnostic Imaging Supply Chains, Cost Structures and Strategic Priorities

In 2025, the United States implemented a suite of tariffs targeting imported diagnostic imaging components and finished equipment, reflecting broader geopolitical dynamics and efforts to bolster domestic manufacturing. These measures have reverberated throughout global supply chains, prompting manufacturers to reassess sourcing strategies for key hardware elements such as detectors, generators, and transducers. The resultant cost pressures have been passed along to healthcare providers, challenging capital planning processes and necessitating longer equipment lifecycles or alternative financing models to offset elevated acquisition expenses.

Moreover, compliance with new tariff classifications has introduced additional administrative burdens, requiring detailed documentation of product origins and material composition. This complexity has incentivized some providers to seek local field service partnerships that can deliver installation, maintenance, and training services with reduced dependency on cross-border logistics. On the strategic front, leading vendors are exploring joint ventures and technology licensing arrangements within the U.S. to mitigate import fees while preserving market access. As a result, operational roadmaps are increasingly incorporating scenario analyses that account for potential tariff escalations and evolving trade policies to safeguard supply continuity and cost stability.

Deriving Actionable Insights from Comprehensive Segmentation Analysis Across Modality Component End User Application and Technology Type Dimensions

A multi-dimensional view of the diagnostic imaging market reveals distinct growth drivers and investment priorities across modality, hardware versus software offerings, end-user applications, clinical use cases, and technology sophistication. Within modality segmentation, computed tomography commands attention with its expanding suite of conventional, cone beam, and portable systems, each optimized for specialized clinical scenarios ranging from emergency stroke diagnosis to dental and orthopedic imaging. Magnetic resonance imaging is likewise diversifying, with high-field platforms addressing complex neuro and oncologic workflows while low-field and ultra-high-field systems unlock new opportunities in cardiac and advanced research protocols. Nuclear medicine’s evolution hinges on the proliferation of PET and hybrid SPECT systems, where the pursuit of molecular-level insights dovetails with emerging radiotracers.

From a component perspective, hardware excellence in coils and detectors is complemented by an accelerating shift toward AI analytics and reporting software, reflecting a broader migration from stand-alone devices to ecosystem-based solutions. Consulting and maintenance services are gaining traction as providers seek to maximize uptime and streamline adoption of digital tools. End-user analysis underscores hospitals as the primary volume driver, though specialized diagnostic centers and research institutes are carving out niches through targeted investments. Application segmentation highlights oncology and cardiology as perennial anchors, while neurology and obstetrics/gynecology imaging continue to benefit from protocol refinements. Across technology types, 3D and 4D imaging innovations are propelling advanced visualization capabilities, whereas 2D modalities maintain indispensability for routine screenings and rapid assessments.

This comprehensive research report categorizes the Diagnostic Imaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Modality

- Component

- Technology Type

- End User

- Application

Illuminating Key Regional Trends and Opportunities in Diagnostic Imaging Across the Americas, Europe Middle East and Africa, and Asia Pacific Markets

Regional dynamics in diagnostic imaging are shaped by divergent regulatory landscapes, reimbursement ecosystems, and levels of infrastructure maturity. In the Americas, North America leads in capital deployment toward hybrid operating theaters and enterprise-wide image management platforms, buoyed by established reimbursement frameworks and robust technology adoption cycles. Meanwhile, Latin American countries are pursuing public–private partnerships to expand access in underserved regions, progressively integrating portable imaging systems into community health initiatives.

In Europe, Middle East, and Africa, market trajectories vary significantly. Western Europe is characterized by stringent regulatory oversight and high penetration of ultra-high-field MRI and advanced software suites. Central and Eastern European markets are undergoing modernization drives supported by infrastructure grants and bilateral investment programs. In the Middle East, government-led healthcare megaprojects are fueling demand for large-scale imaging centers, with a focus on cancer and cardiovascular care. Across Africa, leapfrogging strategies emphasize point-of-care ultrasound and mobile radiography to address diagnostic gaps.

Asia-Pacific remains the fastest-growing region as governments and private health systems invest heavily in both hardware and AI-driven software analytics. East Asian markets prioritize ultra-high-field MRIs and next-generation CT scanners, underpinned by significant R&D commitments. South and Southeast Asian countries are leveraging telehealth networks and cloud-based PACS to bridge urban–rural divides, while Oceania emphasizes integration of 4D and Doppler imaging to enhance maternal–fetal medicine services.

This comprehensive research report examines key regions that drive the evolution of the Diagnostic Imaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Competitive Positioning of Leading Companies Steering the Evolution of Diagnostic Imaging Solutions

The competitive landscape in diagnostic imaging is defined by the strategic maneuvering of global leaders who combine comprehensive product portfolios with digital innovation roadmaps. Several established vendors have accelerated acquisitions of AI analytics start-ups, embedding machine-learning algorithms directly into scanners and cloud platforms. This approach serves to differentiate their service offerings by reducing time to diagnosis and improving quantitative assessment of disease progression.

Some industry pioneers are forging partnerships with academic institutions and healthcare delivery networks to conduct clinical validation studies, thereby strengthening market credibility for new modality extensions such as ultra-high-field MRI and photon-counting CT. Other key players are leveraging modular hardware architectures to enable scalable upgrades, allowing healthcare providers to expand system capabilities without wholesale replacements. Meanwhile, software-centric competitors are intensifying their focus on interoperability, offering open-platform solutions that integrate seamlessly with a range of modalities and electronic health record systems. Service revenue streams, including consulting, installation, maintenance, and training, are also being reimagined through subscription-based models that align vendor incentives with provider outcomes. Collectively, these strategic initiatives underscore the importance of balancing hardware excellence with software adaptability and service agility to capture emerging growth pockets in the diagnostic imaging arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Diagnostic Imaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Allengers Medical Systems Ltd.

- Analogic Corporation

- Aurora Imaging Technologies, Inc.

- BK Medical A/S

- Bracco S.p.A.

- Canon Medical Systems Corporation

- Carestream Health, Inc.

- CurveBeam LLC

- Esaote S.p.A.

- Fonar Corporation

- Fujifilm Holdings Corporation

- GE HealthCare Technologies, Inc.

- Hitachi, Ltd.

- Hologic, Inc.

- Hologic, Inc.

- Koninklijke Philips N.V.

- Mindray Medical International Limited

- Mindray Medical International Limited

- Neusoft Medical Systems Co., Ltd.

- Planmed Oy

- Quibim, S.L.

- Samsung Medison Co., Ltd.

- Samsung Medison Co., Ltd.

- Shimadzu Corporation

- Siemens Healthineers AG

Establishing Actionable Roadmaps for Industry Leaders to Capitalize on Technological Disruption, Regulatory Dynamics and Market Growth Opportunities

To navigate the rapidly evolving diagnostic imaging environment, industry leaders should prioritize investment in AI-enabled analytics platforms that enhance diagnostic confidence and unlock new revenue streams through value-based care initiatives. Strengthening supply chain resilience requires diversification of manufacturing and sourcing footprints, including nearshoring opportunities for critical hardware components and fostering collaborative relationships with local service partners to mitigate tariff-related risks.

Further, organizations should explore strategic alliances with specialty research institutes to validate emerging imaging biomarkers and secure early adoption pathways in areas such as oncology and neurology. Embracing modular system designs will facilitate incremental upgrades and extend equipment lifecycles, reducing capital expenditure pressures on clinical end users. Cultivating robust training and consulting services around digital solutions will also differentiate market offerings by ensuring seamless implementation and maximizing clinical utility. Finally, a focused approach to emerging markets-tailoring technology and pricing models to regional requirements-will unlock growth in underpenetrated segments while reinforcing global market positioning.

Detailing Rigorous Research Methodology Integrating Primary Expert Interviews Secondary Data Analysis and Quantitative Modeling Techniques

The research underpinning this report integrates primary qualitative insights and rigorous quantitative analysis to deliver a robust perspective on diagnostic imaging trajectories. Primary data were gathered through in-depth interviews with a cross-section of stakeholders, including C-suite executives at leading OEMs, radiology department directors, imaging center administrators, and regulatory experts. These discussions illuminated strategic priorities, adoption challenges, and anticipated technology inflection points.

Secondary research involved comprehensive review of peer-reviewed journals, regulatory agency filings, patent databases, and industry white papers to validate market trends and technology advancements. Quantitative inputs were derived from public financial disclosures, clinical utilization statistics, and healthcare expenditure databases. These data sets were triangulated using proprietary modeling frameworks that assess investment flows, capacity utilization rates, and service revenue potentials. The methodology was further strengthened by expert panel workshops that reviewed preliminary findings and provided consensus validation, ensuring the final analysis reflects both empirical rigor and real-world applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Diagnostic Imaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Diagnostic Imaging Market, by Modality

- Diagnostic Imaging Market, by Component

- Diagnostic Imaging Market, by Technology Type

- Diagnostic Imaging Market, by End User

- Diagnostic Imaging Market, by Application

- Diagnostic Imaging Market, by Region

- Diagnostic Imaging Market, by Group

- Diagnostic Imaging Market, by Country

- United States Diagnostic Imaging Market

- China Diagnostic Imaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Core Insights and Strategic Implications to Reinforce the Critical Role of Diagnostic Imaging in Advancing Global Healthcare Outcomes

This executive summary distills the critical insights driving the diagnostic imaging sector and underscores the imperative for stakeholders to adopt a proactive, technology-anchored strategy. The integration of AI-driven analytics, the resilience of supply chain frameworks amidst evolving trade policies, and the nuanced demands of varied regional markets collectively shape a landscape of both challenge and opportunity. By dissecting segmentation layers, companies can identify high-impact investment areas-from modality innovations to digital service extensions-that align with emerging clinical use cases.

Competitive dynamics favor those who blend hardware excellence with software and service agility, while regulatory and reimbursement shifts demand adaptable business models. As diagnostic imaging continues to spearhead early detection and precision medicine, organizations that act decisively on these insights will enhance patient outcomes and secure enduring market leadership. The time is now for industry participants to translate strategic vision into operational reality, leveraging the groundwork laid in this analysis to inform decisions and drive transformative growth.

Driving Informed Action with Personalized Guidance from Ketan Rohom Associate Director Sales & Marketing to Secure Comprehensive Diagnostic Imaging Insights

For tailored guidance on leveraging these insights and securing the full diagnostic imaging market research report, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His deep understanding of industry dynamics and commitment to client success will ensure you obtain the comprehensive analysis needed to inform your strategic decisions. Engaging with Ketan will streamline the acquisition process and provide personalized support to address any specific questions or requirements you may have. Take the next step toward unlocking actionable intelligence and competitive advantage by contacting Ketan today to arrange your access to the complete report.

- How big is the Diagnostic Imaging Market?

- What is the Diagnostic Imaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?