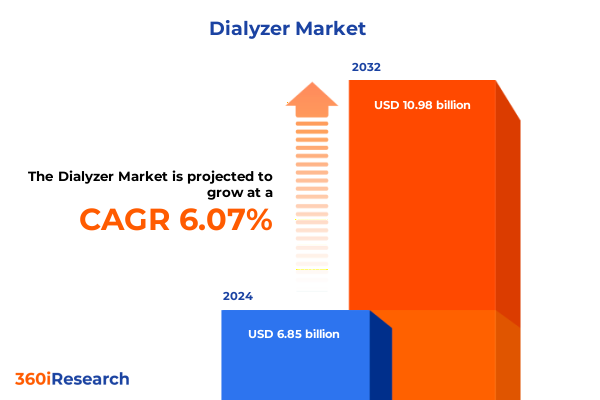

The Dialyzer Market size was estimated at USD 7.24 billion in 2025 and expected to reach USD 7.66 billion in 2026, at a CAGR of 6.13% to reach USD 10.98 billion by 2032.

A strategic orientation that frames clinical, supply chain, materials and regulatory tradeoffs shaping competitive advantage for dialyzer stakeholders

This executive summary orients senior leaders to the evolving landscape of dialyzers and associated consumables by clarifying the strategic questions that should drive investment, procurement, and clinical adoption. It frames the product class as a convergence of clinical performance, materials science, regulatory complexity, and supply-chain resilience, and it highlights how those dimensions interact to determine competitive advantage for device makers, membrane suppliers, and service providers. The purpose is not to present exhaustive quantitative estimates here, but rather to synthesize the emergent forces and decision levers that matter for C-suite and commercial leaders.

Readers will find a concise distillation of market dynamics, policy shocks, segmentation implications, and regional differentiators, followed by practical recommendations for near-term actions and medium-term capability builds. By focusing on the structural drivers of demand and the operational risks that influence continuity of supply, this introduction prepares stakeholders to evaluate opportunities through a risk-adjusted lens and prioritize where to deploy limited resources. The remainder of the summary unfolds in a way that allows immediate read-through for executives while also supporting deeper dives by functional leads.

How material innovation, care decentralization, and procurement resilience are jointly redefining competitive positioning in the dialysis supply chain

The dialyzer ecosystem is being reshaped by a set of transformative shifts that extend beyond simple product innovation and instead alter business models, procurement practices, and clinical delivery pathways. Advances in membrane chemistry and manufacturing have reduced the tradeoffs between biocompatibility and removal efficiency, allowing clinicians to re-evaluate familiar treatment algorithms and creating demand for more differentiated product portfolios. At the same time, rising expectations for patient-centric care, including more therapies delivered in home and community settings, are forcing suppliers to rethink packaging, sterilization logistics, and service models to support decentralization.

Parallel to technological evolution, regulatory and reimbursement environments are encouraging greater scrutiny of device lifecycle impacts and supplier traceability, prompting manufacturers to invest in compliance, serialization, and extended product support. Meanwhile, procurement organizations and large health systems are consolidating purchasing frameworks and inserting resilience criteria into vendor selection, meaning that scale is now measured not only in volumes but also in the ability to demonstrate supply continuity, alternative sourcing, and onshore capabilities. Taken together, these trends are raising the bar for new entrants while amplifying opportunities for incumbents who can combine material innovation with reliable, clinically validated service delivery.

Assessing the layered and asymmetric consequences of United States tariff measures in 2025 on medical device supply chains, component pricing, and sourcing strategies

The policy environment in 2025 introduced tariff and trade measures that have had layered and uneven effects on the medical device ecosystem, with observable consequences for manufacturers, raw-material suppliers, and health-system purchasers. Broad-based import tariffs and targeted Section 301 adjustments have increased cost pressures on products and inputs that are imported or rely on internationally sourced components, and have triggered tactical responses such as supplier diversification, accelerated onshoring, and contractual renegotiations. One authoritative federal notice documented increases in Section 301 duties affecting select strategic manufacturing inputs, signaling an elevated policy focus on reshoring and supply-chain security.

Large multinational medical device firms reported measurable tariff-related expense exposure early in the implementation cycle, noting that the cumulative cost implication goes beyond direct duties to include higher freight, customs complexity, and the administrative burden of qualification for exemptions. In some documented cases major health-technology manufacturers quantified hundreds of millions in tariff-related costs, underscoring that medical-device portfolios are not immune to macro trade policy.

At the level of component materials and polymers that underpin modern dialyzer membranes, industry trade associations and materials-supply analysts highlighted the vulnerability of resin and high-performance plastics supply chains to the 2025 tariff environment. Where resins and specialty polymers face levies or where trading partners impose reciprocal measures, membrane producers encounter immediate procurement cost increases and must evaluate substitution, vertical integration, or relocation of compounding capacity to mitigate volatility. Public reporting and sector analysis have underscored plastics and resin trade flows as an acute area of concern for devices that incorporate engineered thermoplastics.

Finally, strategic buyers and manufacturers have reacted tactically: prioritizing tariff-exempt sourcing, intensifying engagement with customs counsel to identify exclusions and retroactive relief, and accelerating validation of alternative supplier footprints. These tactical moves reduce single-source dependencies but require investment in quality transfer, regulatory rework, and logistics, which collectively lengthen the lead time to full operational resilience. The net effect is a re-rating of supplier selection criteria where demonstrated supply-chain flexibility and near-shore manufacturing capability carry a premium value.

A nuanced segmentation synthesis that links reuse, flux, membrane chemistry, sterilization, clinical indications, patient cohorts, applications, end users and sales channels to strategic imperatives

Segment-level differences map directly to both clinical practice and supplier economics, creating multiple entry points for innovation and risk mitigation. Based on Reuse Type, market is studied across Reusable and Single-Use and this distinction drives divergent sterilization, inventory, and lifecycle-cost considerations that directly affect capital planning and procurement cadence. Based on Flux Type, market is studied across High Flux and Low Flux and this functional differentiation correlates with membrane selection, clearance objectives, and clinical protocols that influence product mix and training needs.

Based on Membrane Material, market is studied across Cellulose and Synthetic; the Cellulose is further studied across Acetate Cellulose and Regenerated Cellulose while the Synthetic is further studied across Polyamide, Polyethersulfone, and Polysulfone, and these material families determine manufacturing complexity, sterilization compatibility, and supplier concentration. Based on Sterilization Method, market is studied across Electron Beam, Ethylene Oxide, Gamma Irradiation, and Steam which shapes global distribution strategies, regulatory filings, and cold-chain dependencies. Based on Disease Type, market is studied across Acute Kidney Injury and Chronic Kidney Disease and each indication imposes different usage frequency, disposables consumption, and clinician training priorities that translate into differentiated purchasing patterns.

Based on Patient Group, market is studied across Adult, Geriatric, and Pediatric and these cohorts drive product-size variants, safety features, and market access considerations. Based on Application, market is studied across Hemodiafiltration, Hemodialysis, Hemofiltration, Peritoneal Dialysis, and Plasmapheresis and each application has unique membrane performance requirements and service-support needs. Based on End User, market is studied across Dialysis Centers, Home Care Settings, and Hospitals which alters distribution models and after-sales service expectations. Based on Sales Channel, market is studied across Offline and Online, influencing commercialization tactics, inventory fulfillment, and value propositions for bundled services. Synthesizing these segmentation axes illuminates where clinical demand, manufacturing capabilities, and distribution complexity intersect to create pockets of high strategic leverage.

This comprehensive research report categorizes the Dialyzer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Reuse Type

- Flux Type

- Membrane Material

- Sterilization Method

- Disease Type

- Patient Group

- Application

- End User

- Sales Channel

How regional regulatory complexity, procurement structures, manufacturing footprint, and clinical adoption pathways collectively shape differentiated market opportunities across global regions

Regional dynamics create distinct opportunities and constraints that companies must factor into market entry and expansion plans. In the Americas, procurement scale and the concentration of large dialysis providers create an environment that rewards operational efficiency, rapid product validation pathways, and strong field-service capabilities that support high-throughput centers and integrated care networks. Local regulatory frameworks and payer negotiations further shape how reimbursement incentives align with technology adoption, and geopolitical trade decisions affecting cross-border inputs can materially alter landed costs for membrane resins and sterilization supplies.

In Europe, Middle East & Africa, heterogeneous regulatory regimes and fragmented purchasing aggregates demand tailored market-access strategies that combine local clinical evidence generation with flexible commercial models. High-income European markets emphasize lifecycle cost transparency and environmental impact, while emerging markets across the region prioritize affordability and supply-chain predictability. In Asia-Pacific, advanced manufacturing capacity and vertically integrated suppliers co-exist with rapidly expanding home-therapy adoption in select markets, creating both opportunities for regional sourcing and competitive pressure on price. Across all regions, a shared theme is the premium placed on validated supply continuity and the ability to demonstrate compliance with evolving sterilization and materials standards.

This comprehensive research report examines key regions that drive the evolution of the Dialyzer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive landscape analysis highlighting how incumbents, material specialists, and agile niche suppliers win through scale, performance differentiation, and supply assurance

Competitive dynamics reflect a mix of incumbent scale advantages, material science specialization, and an emergent cohort of nimble suppliers that prioritize vertical integration and regulatory agility. Leading manufacturers that maintain deep relationships with hospitals and large dialysis networks retain advantages in contracting and field support, while material specialists that control advanced polymer compounding and membrane casting enjoy differentiated margin potential through product performance and IP protection.

Small and medium suppliers are likewise carving durable niches by focusing on faster innovation cycles for specialty membranes, targeted sterilization processes, or service models for home-care deployment. Procurement teams increasingly source not just on price but on demonstrated resilience and quality transfer capabilities, making supplier partnerships a strategic instrument. Where tariffs or trade actions raise landed costs for imported resins, suppliers with flexible sourcing or domestic compounding capacity are at an advantage, accelerating a competitive rebalancing that privileges agility and integrated assurance of supply.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dialyzer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advin Health Care

- Allmed Medical Care Holdings Limited

- AntiTeck Life Sciences Limited

- Asahi Kasei Corporation

- B. Braun SE

- BAIN MEDICAL EQUIPMENT(GUANGZHOU)CO.,LTD

- Baxter International, Inc.

- Browndove Healthcare Private Limited

- Dialife SA

- Edges Medicare Private Limited.

- Farmasol

- Fresenius Medical Care AG

- Hemant Surgical Industries Ltd.

- JiangXi Sanxin Medtec Co.,Ltd.

- JMS Co., Ltd.

- Kaneka Corporation

- Lepu Medical Technology(Beijing)Co.,Ltd.

- Medica SPA

- Merck KGaA

- Mozarc Medical Holdings LLC

- NephroCan group

- Nikkiso Co., Ltd.

- Nipro Corporation

- Pollet Medical Group

- Poly Medicure Ltd.

- SHENZHEN ALL TRUSTED MEDICAL CO., LTD

- Shinva Medical Instrument Co., Ltd.

- Sumitomo Bakelite Co., Ltd.

- SUNFORD HEALTHCARE PRIVATE LIMITED

- Toray Industries, Inc.

- WEIGAO GROUP

Actionable strategic priorities for industry leaders to convert short-term tariff and supply shocks into durable capability advantages through sourcing, process, and commercial shifts

Industry leaders should treat the current environment as a moment to convert tactical responses into strategic capability. First, prioritize supplier resilience through multi-sourcing and validated second-source qualification; this reduces exposure to single-country trade shocks while also creating operational redundancy. Second, invest in membrane and sterilization process modularity so that product lines can be adapted to different sterilization regimes and regional regulatory requirements without costly redesign cycles.

Third, accelerate programs that shift higher-value manufacturing steps and polymer compounding closer to key demand centers; this hedges against duty exposure and improves lead-time control. Fourth, refine commercial models to capture the value of supply continuity by offering bundled services, extended warranties, and rapid replenishment programs tailored for dialysis centers and home-care providers. Fifth, strengthen regulatory and customs expertise within procurement and legal functions to identify exclusions, secure retroactive relief where applicable, and shorten qualification timelines for alternative suppliers. Taken together, these actions reduce near-term operational risk while building durable advantages that are harder for competitors to replicate.

A mixed-method research approach integrating primary stakeholder interviews, policy review, materials supply mapping, and scenario-based impact assessment for robust findings

The research underpinning this summary combined a structured review of primary interviews, secondary policy documents, materials-industry commentary, and targeted supplier diligence. Primary sources included interviews with clinical leaders, procurement executives, polymer and membrane manufacturers, sterilization service providers, and regulatory specialists to capture operational realities and validation timelines. Secondary sources included government policy notices, trade association analyses, and reputable news reports focused on tariff and materials supply developments; these provided the factual context for observed cost and sourcing pressures.

Analytical methods comprised qualitative triangulation of stakeholder perspectives, materials-supply chain mapping to identify single points of failure, and scenario-based impact assessment to evaluate supplier responses under different tariff and regional disruption outcomes. Quality controls included cross-validation of interview claims with regulatory filings and public financial disclosures where available, anonymized citation of primary respondents to protect commercial confidentiality, and iterative peer review of findings by domain experts. This mixed-method approach balanced real-world operational insight with documentary evidence to provide robust, decision-ready conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dialyzer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dialyzer Market, by Product Type

- Dialyzer Market, by Reuse Type

- Dialyzer Market, by Flux Type

- Dialyzer Market, by Membrane Material

- Dialyzer Market, by Sterilization Method

- Dialyzer Market, by Disease Type

- Dialyzer Market, by Patient Group

- Dialyzer Market, by Application

- Dialyzer Market, by End User

- Dialyzer Market, by Sales Channel

- Dialyzer Market, by Region

- Dialyzer Market, by Group

- Dialyzer Market, by Country

- United States Dialyzer Market

- China Dialyzer Market

- Competitive Landscape

- List of Figures [Total: 22]

- List of Tables [Total: 2067 ]

Bringing together strategic implications from materials, delivery model evolution, and trade policy to prioritize resilience and capability investments in the dialyzer value chain

In conclusion, the dialyzer landscape in 2025 is defined by the interplay of material innovation, shifting care delivery models, and policy-driven supply-chain stressors that together recalibrate competitive advantage. Companies that combine membrane performance with demonstrable supply resilience and regulatory agility will be better positioned to capture durable relationships with large purchasers and emergent home-care channels. The tariff environment of 2025 has elevated the strategic importance of sourcing flexibility and near-shore capabilities, and the firms that invest now in vertical integration, sterilization adaptability, and validated secondary sourcing will reduce operational risk while creating commercial differentiation.

Executives should approach the coming planning cycles with a dual lens: protect continuity through immediate supplier and logistics actions, and simultaneously invest in medium-term capabilities-materials engineering, flexible manufacturing, and service-led commercial propositions-that will sustain growth as care models evolve. The insights and recommendations in this summary are intended to accelerate those choices and to provide a pragmatic framework for prioritizing capital and commercial allocation in an environment where policy shifts and clinical needs will continue to interact dynamically.

Secure expert access and a private briefing with Ketan Rohom to acquire the comprehensive dialyzer market research report and tailored analytic add-ons

To request the full market research report and receive a tailored briefing, please contact Ketan Rohom (Associate Director, Sales & Marketing). He will coordinate a private consultation to walk through the report’s structure, explain the data sources and segmentation logic, and tailor a delivery package aligned with your strategic priorities. During the consultation you can request additional custom analyses, competitor benchmarking, or procurement-ready lists of suppliers and regulatory considerations for specific geographies or product classes.

A one-on-one briefing with the Associate Director will also outline subscription options, licensing terms, and the scope of optional add-on modules such as bespoke scenario modelling and supplier resilience scoring. Engaging directly will accelerate access to the study’s annexes, including the underlying primary interview excerpts, methodological appendices, and a directory of stakeholders involved in the research. Reach out to arrange a confidential briefing and to obtain the licensing agreement needed to secure immediate access to the report and supporting data files.

- How big is the Dialyzer Market?

- What is the Dialyzer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?