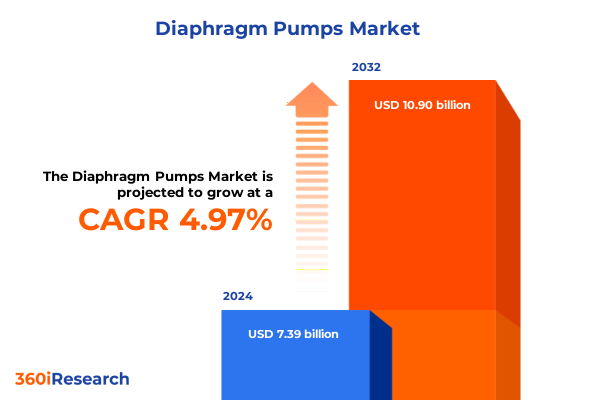

The Diaphragm Pumps Market size was estimated at USD 7.74 billion in 2025 and expected to reach USD 8.11 billion in 2026, at a CAGR of 5.00% to reach USD 10.90 billion by 2032.

Exploring the Crucial Role and Evolution of Diaphragm Pumps in Modern Industrial Processes and Applications Across Diverse Sectors and Operational Environments

Diaphragm pumps have long held a pivotal place in the industrial equipment landscape, enabling reliable fluid handling across a multitude of sectors. Rooted in simple mechanical principles, these positive displacement devices utilize a flexible membrane that oscillates to draw in and expel media with precision. Over decades, incremental engineering refinements have propelled their evolution from manual operations to air- and electric-driven systems, delivering enhanced flow control, leak-free operation, and compatibility with corrosive or viscous fluids.

Today, diaphragm pumps stand at the intersection of operational resilience and emergent performance demands. Their adaptability across industries-from chemical processing and oil & gas to pharmaceuticals and water treatment-underscores a broad utility that is reinforced by ongoing innovation. As manufacturing and process specialists seek equipment that balances durability, efficiency, and regulatory compliance, diaphragm pumps continue to answer critical requirements in both conventional and highly specialized applications.

Responding to Technological Disruptions and Environmental Imperatives That Are Redefining the Competitive Landscape for Diaphragm Pump Manufacturers Worldwide

The diaphragm pump market is experiencing a wave of transformative shifts driven by technological convergence and planetary stewardship imperatives. Automation and digitalization have ushered in advanced control architectures, such as IoT-enabled monitoring and predictive maintenance algorithms, which collectively boost uptime and reduce unplanned outages. These smart systems collect real-time performance data, enabling operators to anticipate diaphragm wear, optimize cycle frequencies, and plan supply procurement more strategically.

The sustainability agenda is also reshaping product roadmaps and procurement strategies. Driven by stringent environmental regulations and corporate net-zero commitments, manufacturers are integrating energy-efficient air-operated designs and exploring alternative materials with reduced carbon footprints. Concurrently, the advent of modular construction techniques allows rapid customization of pump configurations, shortening delivery timelines and minimizing material waste. These converging trends are recalibrating competitive dynamics and placing a premium on manufacturers that can deliver both performance excellence and eco-credentials.

Assessing How the 2025 United States Tariff Measures Have Reshaped Supply Chains Production Costs and Competitive Dynamics for Diaphragm Pump Stakeholders

In 2025, the United States government implemented a series of tariff adjustments targeting key raw materials and industrial equipment components. These measures have elevated import costs for critical inputs such as stainless steel, aluminum, polypropylene, and polyvinylidene fluoride-materials integral to diaphragm pump construction. As a result, pump manufacturers have confronted margin compression and supply chain realignments, prompting strategic shifts in sourcing and pricing practices.

Supply chain stakeholders are adapting by forging closer ties with domestic suppliers or relocating manufacturing hubs to duty-friendly regions like Mexico and Canada. Some equipment producers have passed a portion of the increased costs to end-users through tiered pricing models, while others have absorbed the impact to safeguard market share. In parallel, the heightened cost environment has accelerated vertical collaboration, with OEMs and material suppliers co-investing in process efficiencies and economies of scale to mitigate tariff-driven inflationary pressures.

Unveiling Comprehensive Segmentation Insights into Type Material Operation Capacity Application and Distribution Channels to Illuminate Market Nuances

The diaphragm pump landscape can be dissected through multiple lenses that reveal nuanced customer requirements and competitive differentiation strategies. Based on Type, market is studied across Air-Operated Double Diaphragm Pumps and Electric-Operated Diaphragm Pumps. Based on Material, market is studied across Metallic Materials and Non-Metallic Materials. The Metallic Materials is further studied across Aluminum and Stainless Steel. The Non-Metallic Materials is further studied across Polypropylene and Polyvinylidene Fluoride. Based on Operation, market is studied across Dual-Diaphragm Pumps and Single-Diaphragm Pumps. The Dual-Diaphragm Pumps is further studied across Heavy Duty Dual Diaphragm and Standard Duty Dual Diaphragm. The Single-Diaphragm Pumps is further studied across Heavy Duty Single Diaphragm and Standard Duty Single Diaphragm. Based on Capacity, market is studied across 51 To 100 GPM, Above 100 GPM, and Up To 50 GPM. Based on Application, market is studied across Automotive, Chemical Processing, Food & Beverages, Oil & Gas, Pharmaceutical, and Water & Wastewater Treatment. The Chemical Processing is further studied across Corrosive Fluids and Viscous Fluids. The Food & Beverages is further studied across Bottling Applications and Washing Processes. Based on Distribution Channel, market is studied across Offline and Online. The Offline is further studied across Direct Sales and Distributors & Retailers. The Online is further studied across B2B Marketplaces and ecommerce Websites.

This matrix framework uncovers that Air-Operated Double Diaphragm Pumps retain their dominance in sectors requiring explosion-proof operation or dry-run capability, whereas electric variants are increasingly adopted for precise dosing applications. Metallic materials, particularly stainless steel, continue to lead in regulatory-intensive industries, while polypropylene and PVDF carve out niches in ultra-corrosive environments. Dual-diaphragm configurations are prized for continuous heavy-duty processes, with standard-duty variants addressing mid-range flows. In parallel, single-diaphragm pumps are finding traction in smaller-scale or intermittent operations. Capacity segmentation reveals that pumps delivering up to 100 GPM address mainstream process flows, while larger units cater to high-volume infrastructure needs. Applications in chemical and water treatment dominate procurement, yet cross-sectoral growth in automotive and food & beverages illustrates rising demand for hygienic, precision fluid handling. Finally, distribution preferences highlight a resurgence in direct sales for high-value projects alongside accelerated digital adoption within B2B marketplaces for standardized pump models.

This comprehensive research report categorizes the Diaphragm Pumps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Operation

- Capacity

- Application

- Distribution Channel

Identifying Regional Market Dynamics and Growth Opportunities for Diaphragm Pumps Across Americas EMEA and Asia-Pacific Geographies and Industry Verticals

Regional dynamics in the diaphragm pump industry reflect varied end-user requirements, policy contexts, and infrastructural investments across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, end-users benefit from proximity to advanced oil & gas fields and mature chemical production clusters, driving demand for ruggedized diaphragm solutions and aftermarket service models. Trade agreements and near-shoring trends reinforce a preference for domestic manufacturing partnerships, while sustainability mandates fuel investments in energy-efficient air-driven pumps.

Europe Middle East & Africa presents a dual narrative: Western Europe is guided by stringent environmental standards and circular-economy targets, spurring material innovations and electrification of pump drives, whereas the Middle East’s hydrocarbon-centric economies demand high-capacity, corrosion-resistant equipment. Africa’s emerging industrial corridors signal future growth for water treatment and mining applications, with modular pump systems offering scalable deployment.

Asia-Pacific emerges as the fastest evolving region, anchored by rapid urbanization, expanding chemical process hubs, and aggressive infrastructure build-out. Manufacturing ecosystems in China, India, and Southeast Asia are driving volume adoption of cost-optimized diaphragm pumps, while Japan and South Korea’s technological prowess accelerates the uptake of automation-integrated, IoT-capable models. Regional supply chain realignments and free trade pacts further catalyze cross-border collaborations and investment flows.

This comprehensive research report examines key regions that drive the evolution of the Diaphragm Pumps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Priorities and Innovation Portfolios of Leading Diaphragm Pump Manufacturers to Highlight Competitive Strengths and Collaborative Initiatives

Leading diaphragm pump manufacturers are calibrating their strategies around innovation, service excellence, and strategic partnerships. PSG Dover, with its Wilden and Sandpiper brands, emphasizes modular air-operated designs and an expanding global service network focused on minimizing customer downtime. IDEX Corporation’s Graco and Yamada units leverage advanced electric-drive technologies and digital control platforms to cater to high-precision dosing and metering applications.

Both Verder and PCM Group are harnessing additive manufacturing to accelerate product customization and reduce lead times, particularly for niche chemical handling scenarios. Tapflo’s recent collaboration with material science developers underscores a push toward hybrid polymer-metal composite diaphragms, aiming to bridge the gap between durability and chemical resistance. Smaller specialized vendors are forging OEM alliances to embed diaphragm pump modules directly into skid-mounted process systems, enhancing plug-and-play capabilities.

Additionally, aftermarket and maintenance services have become critical differentiators. Field service agreements, remote monitoring subscriptions, and rapid replacement part logistics are increasingly packaged alongside core pump offerings, reflecting a shift from transactional sales to lifecycle partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Diaphragm Pumps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambica Machine Tools

- Avantor, Inc.

- Dellmeco GmbH

- Dong-il MT Co., Ltd.

- Dover Corporation

- Dr. JESSBERGER GmbH

- Finish Thompson, Inc.

- Flowserve Corporation

- GemmeCotti Srl

- Graco Inc.

- Grundfos Holding A/S

- IDEX Corporation

- John Brooks Company Limited

- KNF Group

- LEWA GmbH by Atlas Copco AB

- Murzan

- Numatic Pumps

- Pfeiffer Vacuum GmbH

- Price Pumps Pvt. Ltd.

- SPX Flow, Inc.

- Tapflo Group

- Thermo Fisher Scientific Inc.

- Verder Liquids BV

- Wanner Engineering, Inc.

- Xylem Inc.

Formulating Actionable Strategies for Industry Leaders to Navigate Regulatory Complexities Supply Chain Disruptions and Emerging Technological Trends Effectively

Industry leaders should prioritize diversifying supply chains by cultivating relationships with tariff-neutral material suppliers and exploring alternative polymer formulations to mitigate cost volatility. Investing in local assembly hubs-not only addresses duty exposure but also aligns with customer preferences for rapid delivery and regional service support. Such near-shoring tactics, combined with digital procurement platforms, will enhance responsiveness and transparency.

Simultaneously, embedding IoT sensors and predictive analytics within new pump designs will enable manufacturers to transition from product vendors to solution providers, capturing recurring revenue through condition-based maintenance subscriptions. Collaboration with automation integrators and cloud service providers can streamline data sharing and accelerate the adoption of smart pump ecosystems. Leaders who galvanize cross-functional teams around sustainability, modularity, and connected services will outpace peers in securing long-term customer loyalty and higher profitability.

Outlining the Robust Research Methodology Employed to Ensure Data Integrity Insightful Analysis and Comprehensive Coverage of the Diaphragm Pump Landscape

This research integrates a two-pronged approach built on rigorous secondary intelligence and targeted primary investigations. The secondary phase encompasses an exhaustive review of industry publications, regulatory filings, corporate financial disclosures, patents, and technical journals to map current technology trends, material innovations, and regional policy shifts. Competitive benchmarking leverages public company reports and third-party analyses to construct a robust view of market positioning and differentiation strategies.

Primary research is conducted through in-depth interviews with select pump manufacturers, material suppliers, and end-user procurement specialists, complemented by expert panel discussions with process engineers and maintenance technicians. Data from these engagements are triangulated against supply chain performance indicators and aftermarket service metrics. Structured data validation ensures analytical integrity, while scenario-based analysis illuminates the potential impacts of tariff realignments and technological disruptions under varying macroeconomic conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Diaphragm Pumps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Diaphragm Pumps Market, by Type

- Diaphragm Pumps Market, by Material

- Diaphragm Pumps Market, by Operation

- Diaphragm Pumps Market, by Capacity

- Diaphragm Pumps Market, by Application

- Diaphragm Pumps Market, by Distribution Channel

- Diaphragm Pumps Market, by Region

- Diaphragm Pumps Market, by Group

- Diaphragm Pumps Market, by Country

- United States Diaphragm Pumps Market

- China Diaphragm Pumps Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Drawing Key Takeaways from Market Shifts Regulatory Impacts and Segmentation Discoveries to Reinforce Industry Preparedness and Strategic Focus

The diaphragm pump industry stands at a strategic inflection point, shaped by technological breakthroughs, geopolitical recalibrations, and intensifying environmental mandates. Automation and digitalization have created new avenues for predictive performance management, while tariff adjustments compel stakeholders to reevaluate sourcing, manufacturing footprints, and pricing strategies.

Segmentation and regional analyses underscore the importance of a nuanced go-to-market strategy that aligns product portfolios with customer priorities-whether that entails corrosion-resistant polymers, explosion-proof air drives, or integrated IoT solutions. Leading companies are differentiating through lifecycle services and strategic collaboration, reinforcing that success hinges on agility, innovation, and holistic value delivery. As the industry navigates this dynamic landscape, those who embrace adaptive supply chains and modular, connected offerings will define the next chapter of diaphragm pump excellence.

Driving Your Strategic Decisions with an Exclusive Invitation to Engage with Ketan Rohom for Tailored Insights and Access to the Full Market Research Report

Engaging directly with Ketan Rohom, Associate Director, Sales & Marketing provides a strategic gateway to unlock the full potential of the diaphragm pump market research report. By leveraging his deep industry expertise and tailored insights, you gain an insider’s perspective on emerging trends, competitive benchmarks, and actionable takeaways that can be seamlessly integrated into your growth roadmap.

Contacting Ketan facilitates a bespoke consultation where your organization’s unique challenges and objectives are mapped against the report’s comprehensive analysis. This collaborative engagement ensures you extract maximum value from every data point and recommendation, elevating your decision-making confidence and positioning you to capitalize on new market opportunities.

- How big is the Diaphragm Pumps Market?

- What is the Diaphragm Pumps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?