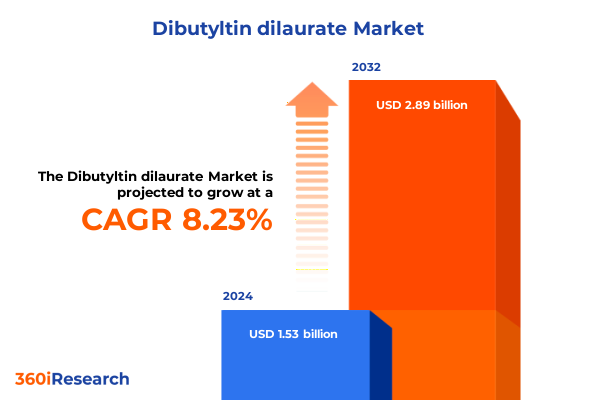

The Dibutyltin dilaurate Market size was estimated at USD 1.65 billion in 2025 and expected to reach USD 1.78 billion in 2026, at a CAGR of 8.30% to reach USD 2.89 billion by 2032.

Discovering How Dibutyltin Dilaurate Catalyzes Growth Across Polyurethane, PVC, and Silicone Industries in a Shifting Regulatory Landscape

Dibutyltin dilaurate, a versatile organotin compound, functions as a cornerstone catalyst and stabilizer within numerous specialty chemical applications. Its exceptional thermal stability and catalytic efficiency enable precise control over reaction kinetics, making it indispensable for polyurethane foam production and PVC stabilization processes. In polyurethane chemistry, dibutyltin dilaurate accelerates gelation and curing reactions, thereby enhancing material performance in foams, coatings, and adhesives. Moreover, its stabilizing properties mitigate hydrochloric acid release in PVC, ensuring product longevity and color retention. Given these multifaceted capabilities, dibutyltin dilaurate continues to support critical value-chain segments across automotive, construction, electronics, and healthcare industries

Furthermore, the compound’s efficacy extends to silicone rubber vulcanization, where it promotes cross-linking reactions that impart strength and elasticity to sealants and molded components. As end-use sectors increasingly demand high-performance materials, dibutyltin dilaurate’s role has expanded beyond traditional domains. Rapid advancements in formulation science underscore its adaptability, meeting stringent specifications for durability and process efficiency. Consequently, stakeholders from raw-material suppliers to end-product manufacturers regard this catalyst as a strategic asset in innovation pipelines, tightly integrating it within modern specialty chemical production processes

Emerging Sustainability Mandates and Technological Breakthroughs Redefining Dibutyltin Dilaurate Production and Application Strategies

The dibutyltin dilaurate market landscape is undergoing transformative shifts driven by a convergence of sustainability mandates and technological innovation. Environmental regulations, particularly Europe’s REACH framework and emerging global green chemistry initiatives, are encouraging formulators to reevaluate traditional organotin processes. In response, producers are enhancing their manufacturing protocols to reduce toxic byproducts and develop lower-toxicity alternatives. Simultaneously, the rising emphasis on sustainable materials has spurred investment in bio-based catalysts that can complement or gradually replace conventional dibutyltin dilaurate formulations. As governments and corporations set ambitious decarbonization targets, the demand for catalysts with improved eco-profiles has become a defining strategic imperative

Meanwhile, digitalization and Industry 4.0 practices are reshaping supply-chain transparency and production efficiency. Advanced process analytics and real-time monitoring tools enable manufacturers to optimize reaction conditions, minimize energy consumption, and enhance quality consistency. Additionally, collaborative research efforts between leading chemical producers and academic institutions are accelerating breakthroughs in catalyst design, such as surface-engineered organotin composites and recyclable catalytic systems. Consequently, the sector is witnessing an accelerated pace of product innovation and a redefinition of competitive advantage based on both sustainability credentials and technological leadership

Analyzing the Comprehensive Effects of 2025 United States Import Duties on Dibutyltin Dilaurate Supply Chains and Sourcing Dynamics

With the implementation of new U.S. import duties on chemical catalysts in early 2025, the dibutyltin dilaurate value chain has experienced significant adjustments. American processors have been compelled to reassess their supplier mix, increasingly prioritizing domestic partnerships to mitigate tariff-related cost pressures. Consequently, strategic stockpiling and regional inventory hubs have become common tactics to smooth procurement cycles. At the same time, foreign manufacturers have redirected exports toward Latin American and Asia-Pacific markets, where tariff regimes remain more favorable. These dynamics have prompted leading multinational corporations to adopt integrated sourcing models that balance cost efficiency with supply-chain resilience

Moreover, the tariff environment has accelerated conversations around near-shoring and technology transfer. U.S. stakeholders are evaluating localized production capabilities, including contract manufacturing and toll processing arrangements, to secure uninterrupted access to high-purity dibutyltin dilaurate. This pivot is not purely defensive; it represents an opportunity to foster closer collaboration with domestic specialty chemical manufacturers, thereby enhancing responsiveness to regulatory changes and customization demands. Consequently, the tariff measures of 2025 have reshaped both strategic planning and operational execution for industry participants across the entire supply network

Unlocking Deeper Market Insights Through Detailed Analysis of Formulation Types, Reaction Categories, Grades, Applications, Industries, and Distribution Channels

Insights into market segmentation reveal how dibutyltin dilaurate’s diverse characteristics align with specific end-use requirements. In terms of form, the liquid variant offers immediate reactivity and ease of integration during blending operations, while waxy crystals facilitate precise dosing and controlled release in powder-based formulations. When examining the type of chemical reaction, cross-linking reactions leverage dibutyltin dilaurate to establish robust polymer networks, whereas esterification and polycondensation processes benefit from its ability to accelerate bond formation. Polymerization reactions exploit its catalytic profile to enhance reaction rates, and transesterification pathways utilize its performance to modify polyester backbones efficiently.

Grade differentiation further refines market targeting. Industrial-grade dibutyltin dilaurate delivers reliable performance for large-scale coatings and adhesive manufacturing, while medical-grade specifications meet the stringent purity demands of pharmaceutical and biomedical applications. Application-area segmentation underscores its pivotal role as a polyurethane catalyst, driving performance in adhesives, coatings and paints, and foams. Within adhesives, hot melt and pressure sensitive formulations each capitalize on the catalyst’s reactivity to achieve optimal bonding strength. Beyond adhesives, PVC stabilization processes rely on the compound’s acid-scavenging properties, and silicone rubber vulcanization harnesses its cross-linking effectiveness.

End-use industries-from automotive through building and construction, electronics, healthcare, packaging, to textiles-each derive unique performance gains from dibutyltin dilaurate’s multifunctionality. Finally, distribution channels balance traditional offline partnerships with growing online procurement platforms, reflecting broader digital purchasing trends in specialty chemicals.

This comprehensive research report categorizes the Dibutyltin dilaurate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Type of Chemical Reaction

- Grade

- Application Areas

- End-Use Industry

- Distribution Channel

Evaluating Distinct Growth Drivers and Challenges Across the Americas, Europe Middle East & Africa, and Asia-Pacific Chemical Markets

Regional variations in dibutyltin dilaurate demand reflect distinct industrial landscapes and regulatory frameworks. In the Americas, the United States and Canada sustain stable consumption through advanced applications in specialty chemicals and coatings. The region’s focus on high-performance automotive parts, durable construction materials, and medical device components underpins steady demand, even as stakeholders navigate evolving trade policies and environmental oversight

Europe, Middle East, and Africa present a mosaic of maturity and emerging potential. Western European markets emphasize sustainability and circular-economy principles, encouraging innovation in low-toxicity catalyst alternatives. Meanwhile, the Middle East and African regions are beginning to invest in industrial expansion and infrastructure, creating new opportunities for dibutyltin dilaurate suppliers to establish footholds in coatings, sealants, and polymer processing applications. Regulatory complexity across these geographies necessitates proactive compliance strategies and localized engagement.

Asia-Pacific remains the dominant regional market, driven by the robust growth of manufacturing hubs in China, India, and Southeast Asia. Rapid urbanization and industrialization in these economies fuel escalating requirements for polyurethane, PVC, and silicone products. Consequently, suppliers tailor formulations to meet specific performance and cost parameters, reinforcing Asia-Pacific’s leadership in both volume and innovation of dibutyltin dilaurate applications

This comprehensive research report examines key regions that drive the evolution of the Dibutyltin dilaurate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Landscapes and Strategic Initiatives of Leading Dibutyltin Dilaurate Producers Driving Innovation and Market Positioning

A competitive landscape characterized by both global leaders and regional specialists defines the dibutyltin dilaurate market. Evonik has leveraged its extensive R&D capabilities to advance eco-engineered catalyst formulations, while Borchers focuses on customized solutions for automotive and construction segments. Jiusheng Chemical and Nantong Haotai Products & Chemicals concentrate on scalability and cost optimization, catering to high-volume polyurethane and PVC sectors. Simultaneously, Hangzhou Guibao Chemical and Changzhou Chemistar Chemistry Technology have expanded production capacity to address surging demand in Asia-Pacific, whereas Jilin Huaxin Chemical differentiates itself through targeted medical-grade offerings and stringent quality protocols

Across this landscape, strategic initiatives such as joint ventures, capacity expansions, and technology licensing agreements are prevalent. Leading players are increasingly forging partnerships with academic and government institutions to accelerate green catalyst research. Moreover, investments in digital supply-chain platforms are enhancing transparency and agility, enabling producers to respond swiftly to raw-material fluctuations and regulatory updates. These concerted efforts underscore the market’s evolution toward both innovation and resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dibutyltin dilaurate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ataman Kimya AS

- Avantor, Inc.

- BNT Chemicals GmbH

- Central Drug House

- Cosutin Industrial Pvt Limited

- MedKoo Biosciences, Inc.

- Merck KGaA

- Milliken & Company

- MOFAN POLYURETHANE CO., LTD.

- Nortex Company

- Otto Chemie Pvt. Ltd.

- PMC Group

- Reaxis Inc.

- Santa Cruz Biotechnology, Inc.

- Scientific Laboratory Supplies Ltd.

- Spectrum Chemical Mfg. Corp.

- Thermo Fisher Scientific Inc.

- TIB Chemicals AG

- Tokyo Chemical Industry India Pvt Ltd.

- TRIGON Chemie GmbH

Actionable Strategies for Industry Leaders to Navigate Regulatory Complexities, Optimize Supply Chains, and Harness Sustainable Growth Opportunities

Industry leaders seeking to maintain competitive advantage must adopt multifaceted strategies that address regulatory, operational, and sustainability imperatives. First, establishing dedicated in-house capabilities or collaborative ventures for green catalyst development will ensure compliance with tightening environmental mandates while differentiating product portfolios. In parallel, diversifying supplier networks through selective near-shoring and strategic alliances can mitigate the impact of trade barriers and stabilize procurement costs.

Furthermore, integrating digital supply-chain management systems will enhance risk monitoring and inventory optimization. By leveraging predictive analytics, organizations can anticipate raw-material disruptions and adjust sourcing plans proactively, thereby safeguarding production continuity. Additionally, prioritizing modular production technologies and flexible batch processes allows rapid adaptation to shifting formulation requirements, supporting both high-volume industrial grade and niche medical grade demands.

Finally, proactive engagement with regulatory bodies and industry associations will facilitate early insight into policy trajectories. Establishing cross-functional teams that include regulatory affairs, R&D, and commercial units will drive cohesive responses to new standards. Collectively, these actionable measures will empower leadership teams to navigate complexities, capitalize on emerging growth areas, and sustain long-term market leadership

Rigorous Research Methodology Combining Primary Interviews, Technical Expert Input, and Comprehensive Secondary Data Triangulation Processes

The foundation of this analysis rests on a robust research methodology combining primary and secondary data sources. Our team conducted in-depth interviews with senior executives, technical experts, and R&D specialists across leading chemical manufacturers and end-use organizations. These conversations yielded nuanced perspectives on formulation performance, supply-chain resilience, and regulatory impact.

Simultaneously, we reviewed a breadth of secondary materials, including peer-reviewed journals, industry association reports, patent filings, and company disclosures. This extensive literature audit enabled cross-verification of market dynamics, technological developments, and competitive strategies. Data triangulation and scenario analysis were applied to reconcile potential discrepancies and ensure consistent reliability across all insights.

Finally, iterative quality checks involving cross-functional expert panels validated the relevance and accuracy of key findings. The resulting framework captures both established trends and emergent opportunities, providing stakeholders with a comprehensive, actionable intelligence base for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dibutyltin dilaurate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dibutyltin dilaurate Market, by Form

- Dibutyltin dilaurate Market, by Type of Chemical Reaction

- Dibutyltin dilaurate Market, by Grade

- Dibutyltin dilaurate Market, by Application Areas

- Dibutyltin dilaurate Market, by End-Use Industry

- Dibutyltin dilaurate Market, by Distribution Channel

- Dibutyltin dilaurate Market, by Region

- Dibutyltin dilaurate Market, by Group

- Dibutyltin dilaurate Market, by Country

- United States Dibutyltin dilaurate Market

- China Dibutyltin dilaurate Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis of Core Findings Highlighting the Pivotal Role of Dibutyltin Dilaurate Trends, Tariff Impacts, and Strategic Imperatives for Industry Success

The analysis presented underscores dibutyltin dilaurate’s pivotal role as a catalyst and stabilizer across diverse specialty chemical applications. Throughout the report, we have illuminated how evolving regulatory frameworks, technological innovations, and tariff measures have coalesced to reshape supply-chain strategies and product development priorities.

Moreover, our examination of segmentation and regional dynamics highlights the nuanced pathways through which form, reaction type, grade, and end-use industry influence market adoption. Competitive intelligence on leading producers further reveals strategic imperatives, including green chemistry investments and digital supply-chain integration.

As the dibutyltin dilaurate market continues to mature, stakeholders must balance compliance, efficiency, and innovation. By leveraging the insights within this report, decision-makers can confidently navigate emerging challenges and harness new avenues for growth, securing their position in this dynamic landscape.

Connect with Ketan Rohom to Unlock Comprehensive Dibutyltin Dilaurate Market Research Insights and Propel Strategic Decision-Making Today

For a deeper dive into how these insights translate into actionable strategies, we encourage you to connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He can guide you through tailored solutions that align with your organization’s priorities and answer any questions about our comprehensive dibutyltin dilaurate market research report. Initiating a conversation with Ketan will help you explore customized data packages, discuss exclusive add-ons, and secure timely access to the full suite of proprietary analysis. Reach out today to schedule a one-on-one consultation and ensure your team leverages the most current intelligence to drive confident, strategic decisions in this dynamic market

- How big is the Dibutyltin dilaurate Market?

- What is the Dibutyltin dilaurate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?