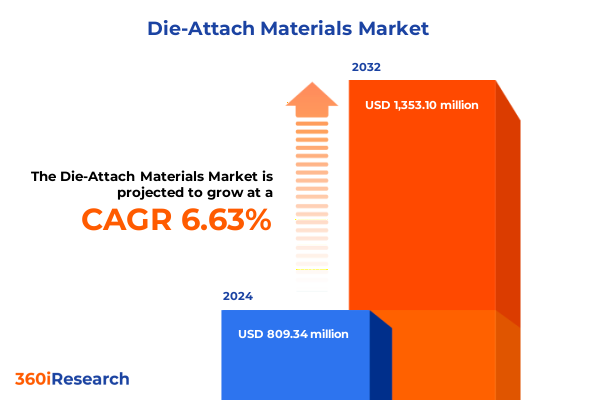

The Die-Attach Materials Market size was estimated at USD 860.69 million in 2025 and expected to reach USD 920.63 million in 2026, at a CAGR of 6.67% to reach USD 1,353.10 million by 2032.

Discover the Driving Forces and Emerging Opportunities Shaping the Die-Attach Materials Market in an Era of Rapid Technological and Economic Evolution

The exploration of die-attach materials marks a pivotal juncture for industries that depend on advanced electronic assemblies, from automotive systems to consumer devices. This analysis delves into the properties and roles of conductive polymers, epoxy adhesives, silver sinter paste, and solder materials, illuminating how each contributes to the reliability and performance of semiconductor components. Against a backdrop of miniaturization and heightened performance requirements, the die-attach layer emerges as a critical enabler of heat dissipation, electrical conduction, and mechanical stability.

Over the past decade, the die-attach materials field has undergone significant evolution, driven by the proliferation of applications in electric vehicles, renewable energy systems, and high-frequency communications. Manufacturers now demand solutions that not only meet stringent reliability standards but also align with environmental and regulatory mandates. Consequently, innovations in carbon-based and silver-filled polymers, thermosetting and UV-curing epoxies, micro- and nano-silver pastes, as well as eutectic and high-temperature solder alloys, have taken center stage.

This introduction frames the comprehensive investigation ahead, where we examine transformative shifts, policy impacts, segmentation insights, and regional dynamics, culminating in actionable recommendations. By understanding the foundational elements of die-attach materials and their evolving contexts, stakeholders can navigate complexity with confidence and position their operations for sustained success.

Understand the Transformative Technological and Market Shifts That Are Revolutionizing Die-Attach Materials Production and Application Worldwide

The die-attach materials landscape is experiencing transformative shifts as technological frontiers expand and manufacturing paradigms adapt. The ascent of electric vehicles has amplified the need for materials that can endure elevated thermal cycling and power densities, while the rollout of 5G networks compels suppliers to engineer adhesives and pastes capable of precise performance at millimeter-wave frequencies. Simultaneously, the Internet of Things revolution demands low-temperature, high-reliability solutions that support vast sensor networks without compromising energy efficiency.

Advancements in nanotechnology have redefined expectations for silver sinter pastes, enabling manufacturers to leverage micro- and nano-scale conductive pathways that optimize electrical conductivity and thermal management. At the same time, the emergence of carbon-based polymers has opened new avenues for lightweight, cost-effective alternatives to traditional metallic fillers. Epoxy chemistries have also evolved, with UV-curing formulations accelerating assembly throughput and reducing energy consumption during processing.

In parallel, global supply chain realignments and sustainability mandates are reshaping the criteria for material selection. Producers are placing greater emphasis on materials that can withstand rigorous qualification protocols while minimizing environmental impact. These concurrent technological and market forces underline the necessity for stakeholders to remain agile, adopting a forward-looking approach that balances innovation with operational resilience.

Evaluate the Far-Reaching Consequences of 2025 United States Tariffs on Die-Attach Materials Supply Chains Costs and Strategic Sourcing Strategies

The introduction of fresh tariff measures by the United States in early 2025 has exerted a cumulative impact across the die-attach materials sector, influencing sourcing decisions, cost structures, and strategic partnerships. Tariffs on silver-based compounds and certain epoxy precursors have elevated landed costs, prompting buyers to reassess supplier relationships and explore alternative chemistries. This shift has catalyzed a renewed focus on domestically sourced materials and the development of advanced formulations that minimize reliance on tariff-affected inputs.

Domestic manufacturers have leveraged these conditions to expand their footprint, investing in local production capabilities and forging long-term agreements that offer price stability. Meanwhile, multinational enterprises have diversified their procurement channels, establishing secondary sourcing hubs in regions with more favorable trade terms. This fragmentation of the supply chain has introduced complexity, necessitating enhanced traceability and risk management practices to ensure material integrity and uninterrupted production.

Tariff-induced cost pressures have also influenced research roadmaps. Companies are channeling resources into creating high-purity polymer systems and innovative low-temperature solder alloys that circumvent tariff categories. By proactively adapting formulations, material suppliers aim to preserve margins and deliver competitive value to electronics assemblers navigating a dynamically shifting trade environment.

Uncover the Critical Insights from Material Type Application Package Type and End-Use Industry Segmentation That Define the Die-Attach Market Landscape

A nuanced exploration of market segments reveals differentiated growth drivers and challenges across material types, applications, package formats, and end-use industries. Within the realm of conductive polymers, carbon-based polymers have shown promise for cost-sensitive consumer electronics, while silver-filled polymers address the high-reliability demands of automotive and aerospace systems. Epoxy adhesives display a similar dichotomy, with thermosetting epoxies offering robust thermal aging properties for power electronics and UV-curing variations enabling rapid throughput in LED device manufacturing.

The silver sinter paste segment illustrates the trade-offs between micro-silver and nano-silver formulations; micro-silver pastes deliver proven reliability at moderate cost, whereas nano-silver pastes unlock superior joint reliability and lower process temperatures for next-generation computing modules. Solder materials further segment into lead-free and leaded alloys, with eutectic lead-free alloys prevailing in consumer and industrial applications due to regulatory drivers, while high-temperature lead-free options serve demanding powertrain and aerospace assemblies. In contrast, the legacy leaded alloys retain a foothold through high-temperature tin-lead eutectic and specialized high-temperature leaded variants for mission-critical systems.

Across application segments, automotive electronics dominate in volume, propelled by ADAS and infotainment expansions, while consumer electronics maintain a steady cadence through smartphones, tablets, and wearable devices. Industrial electronics bolster demand in power systems and robotics, and LED devices continue to capitalize on UV-curing epoxy trends. Package type dynamics reflect a shift toward flip chip and chip scale package technologies that benefit from advanced wire bond and ball grid array die-attach solutions. Finally, end-use industries such as aerospace and defense, automotive, consumer electronics, industrial automation, and telecommunications each impose unique qualification protocols, underscoring the importance of tailored material solutions that align with specific performance and regulatory requirements.

This comprehensive research report categorizes the Die-Attach Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Package Type

- Application

- End-Use Industry

Explore Regional Dynamics Impacting Die-Attach Materials in the Americas Europe Middle East Africa and Asia-Pacific Highlighting Key Opportunities and Challenges

Regional variations play a pivotal role in shaping die-attach materials adoption and innovation trajectories across the Americas, Europe Middle East Africa, and Asia-Pacific. In the Americas, robust automotive and semiconductor manufacturing ecosystems foster a strong demand for high-reliability solder alloys and conductive polymers tailored for electric vehicle powertrains and data center modules. North American producers are increasingly focusing on sustainability initiatives, driving interest in low-temperature curing chemistries that reduce energy consumption and carbon emissions.

Over in Europe Middle East Africa, stringent environmental regulations and a growing emphasis on localized production have spurred investments in UV-curing epoxy adhesives and lead-free solder materials. Governments across this region promote circular economy principles, incentivizing research into recyclable polymer systems and alternative filler materials with reduced silver content. This regulatory landscape accelerates the adoption of innovative formulations that meet both performance and sustainability targets.

In Asia-Pacific, the convergence of consumer electronics giants and sprawling contract manufacturing capacities creates a fertile ground for silver sinter pastes and advanced epoxy systems. Manufacturers in this region often balance cost competitiveness with rapid time-to-market pressures, driving demand for micro-silver formulations that offer reliability without the premium of nano-scale alternatives. Furthermore, partnerships between material suppliers and OEMs facilitate co-development programs, ensuring that emerging package types such as flip chip and chip scale packages are matched with optimized die-attach solutions.

This comprehensive research report examines key regions that drive the evolution of the Die-Attach Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze Leading Die-Attach Materials Manufacturers Strategic Partnerships and Innovation Focus to Understand Competitive Positioning in a Fast-Evolving Market

Leading companies in the die-attach materials space are distinguished by their integrated approach to innovation, strategic collaborations, and global manufacturing footprints. Top polymer suppliers have invested heavily in R&D centers that focus on next-generation conductive materials, leveraging cross-linking chemistries and novel fillers to enhance thermal management and electrical conductivity. These efforts are often coupled with partnerships with semiconductor packaging firms to co-develop adhesives that seamlessly integrate into emerging assembly lines.

In the silver sinter paste arena, market frontrunners differentiate through proprietary particle engineering and sintering technologies that yield superior mechanical robustness and process flexibility. They have established pilot lines that validate performance under accelerated thermal cycling tests, positioning themselves as reliability partners for high-performance computing companies and advanced power electronics manufacturers.

Traditional solder material providers have navigated the transition from leaded to lead-free alloys by expanding their product portfolios to include eutectic, high-temperature, and low-activation variants. These companies maintain a strong presence in global distribution networks, ensuring rapid availability and technical support. Their collaborations with academic institutions and standards bodies help streamline qualification protocols, reinforcing their reputations as trusted suppliers across aerospace, automotive, and consumer segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Die-Attach Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AI Technology, Inc.

- Bostik SA

- Creative Materials, Inc.

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- Dexerials Corporation

- Element Solutions Inc.

- ENTEGRIS, Inc.

- Furukawa Electric Co., Ltd.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hitachi Chemical Co., Ltd.

- Indium Corporation

- Intrinsiq Materials, Inc.

- JSR Corporation

- Kyocera Corporation

- Lintec Corporation

- Namics Corporation

- Nitto Denko Corporation

- Panasonic Corporation

- Protavic America, Inc.

- Shin-Etsu Chemical Company, Limited

- Sumitomo Bakelite Co., Ltd.

Implement Strategic Actions and Optimizations to Enhance Supply Chain Resilience Material Performance and Competitive Advantage in Die-Attach Operations

Industry participants are advised to adopt a multi-pronged strategy that balances material diversification, strategic alliances, and process innovation to sustain growth and mitigate risks. Embracing a broader portfolio of conductive polymers and epoxy systems will enable assemblers to pivot efficiently between high-volume consumer channels and specialized automotive or aerospace programs. Co-development agreements with key suppliers can accelerate time-to-market for novel formulations, ensuring alignment with evolving package architectures and thermal management requirements.

Investing in enhanced supply chain visibility tools will allow procurement teams to anticipate tariff impacts and adjust sourcing strategies proactively, thereby safeguarding margins against sudden trade policy shifts. Operational leaders should also implement lean manufacturing principles in die-attach processes, integrating real-time monitoring of curing cycles and sintering parameters to reduce defects and optimize throughput.

Collaboration with research institutes and participation in industry consortia can further strengthen innovation pipelines. By sharing insights into material performance under extreme conditions, companies can drive consensus on reliability standards and foster the adoption of eco-friendly die-attach solutions. Ultimately, these strategic initiatives will fortify competitive advantage, ensuring that die-attach operations deliver both performance excellence and sustainable value creation.

Detail the Research Methodology Employed to Analyze Market Trends Validate Data Sources and Ensure Comprehensive Coverage of Die-Attach Materials Dynamics

This study synthesizes insights from a rigorous framework that emphasizes data accuracy, source diversity, and methodological transparency. Primary research included in-depth interviews with material scientists, packaging engineers, and procurement executives, providing firsthand perspectives on formulation challenges and application-specific requirements. Complementary secondary research encompassed an extensive review of peer-reviewed journals, patent filings, regulatory documents, and industry white papers to validate emerging trends and technological breakthroughs.

Quantitative data points were triangulated against multiple sources to ensure consistency, while qualitative insights were subjected to thematic analysis to identify core drivers of material innovation and market adoption. The segmentation approach, structured around material type, application domains, package formats, and end-use industries, allowed for a fine-grained examination of demand patterns and qualification barriers.

Regional analyses leveraged trade data, policy reviews, and production capacity assessments to map the competitive landscape across the Americas, Europe Middle East Africa, and Asia-Pacific. Company profiling incorporated financial disclosures, R&D investment levels, and collaboration networks to gauge strategic positioning. Together, these methodological pillars underpin a holistic view of the die-attach materials market, equipping decision-makers with the intelligence needed to chart informed strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Die-Attach Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Die-Attach Materials Market, by Material Type

- Die-Attach Materials Market, by Package Type

- Die-Attach Materials Market, by Application

- Die-Attach Materials Market, by End-Use Industry

- Die-Attach Materials Market, by Region

- Die-Attach Materials Market, by Group

- Die-Attach Materials Market, by Country

- United States Die-Attach Materials Market

- China Die-Attach Materials Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesize Key Findings and Strategic Implications from the Analysis of Die-Attach Materials Market to Guide Decision-Making and Future Innovation Efforts

The assessment of die-attach materials underscores a market characterized by rapid innovation, complex trade dynamics, and diverse end-use demands. Conductive polymers, epoxy adhesives, silver sinter pastes, and solder alloys each contribute unique value propositions, addressing the thermal, electrical, and mechanical imperatives of next-generation electronic assemblies. The confluence of electric vehicle electrification, 5G deployment, and industrial automation continues to drive material evolution, while regulatory shifts and sustainability mandates reshape development pathways.

Tariff-induced cost pressures have accelerated strategic realignments, prompting stakeholders to revisit sourcing models and invest in alternative chemistries. Segmentation insights reveal that material selection must align closely with application-specific performance metrics and qualification protocols, whether in high-temperature automotive environments, precision consumer devices, or mission-critical aerospace systems. Regional nuances further influence adoption, with North America, Europe Middle East Africa, and Asia-Pacific each presenting distinct opportunities and regulatory landscapes.

In synthesizing these findings, it becomes clear that success in the die-attach materials arena hinges on collaborative innovation, adaptable supply chains, and proactive engagement with emerging market forces. Leaders who embrace these principles will be well positioned to harness the transformative potential of advanced die-attach solutions, ensuring reliable performance and competitive advantage in an increasingly complex electronics ecosystem.

Connect with Ketan Rohom Associate Director Sales Marketing to Secure Your Access to the Comprehensive Die-Attach Materials Market Research Report

I invite you to reach out to Ketan Rohom, the Associate Director of Sales and Marketing, to explore how this in-depth study can empower your strategic planning and operational excellence. By engaging directly with Ketan, you will gain tailored guidance on how this analysis applies to your unique business challenges and objectives. Secure your copy of the comprehensive market research report today to unlock exclusive insights into material innovations, supply chain optimizations, and regional dynamics that will shape your competitive positioning. Don’t miss the opportunity to leverage this critical intelligence for decisive growth in the evolving die-attach materials landscape

- How big is the Die-Attach Materials Market?

- What is the Die-Attach Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?