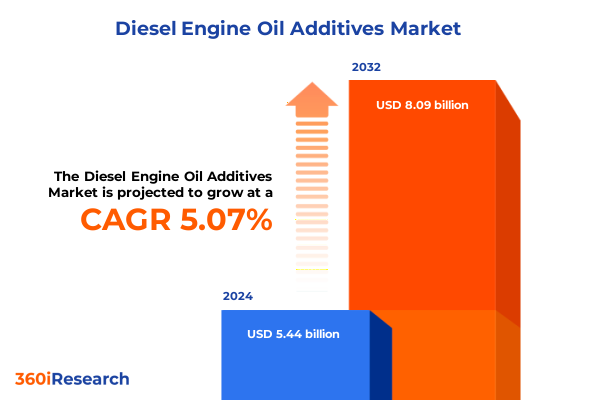

The Diesel Engine Oil Additives Market size was estimated at USD 5.76 billion in 2025 and expected to reach USD 6.12 billion in 2026, at a CAGR of 7.14% to reach USD 9.34 billion by 2032.

Discover the critical role of diesel engine oil additives in enhancing performance longevity and compliance across modern diesel equipment applications

The role of diesel engine oil additives has never been more critical to sustaining the reliability durability and environmental compliance of heavy duty powertrains. As modern diesel equipment undergoes continual performance optimization, additives serve as the molecular backbone that protects moving components under extreme temperature and pressure conditions. These specialized chemistries bolster anti wear properties mitigate corrosion risks and maintain engine cleanliness by dispersing soot and combustive residues. Moreover, antioxidants and friction modifiers work in concert to manage thermal stability and reduce mechanical losses, translating into fuel efficiency gains and extended service intervals.

Against a backdrop of increasingly stringent emissions standards and electrification trends, the diesel segment remains indispensable for applications requiring high torque and continuous operation such as commercial logistics construction machinery and marine propulsion. Consequently, the additive landscape is evolving rapidly, with formulators innovating bio based alternatives and tailoring chemistries to meet the compatibility demands of next generation ultra low sulfur fuels and biodiesel blends. This introduction lays the foundation for a detailed exploration of market dynamics, regulatory catalysts and emerging disruptive forces that are redefining how additives deliver value across the lifecycle of diesel engines.

Explore how technological advancements regulatory pressures and sustainability initiatives are transforming diesel engine oil additives for mobility demands

Innovation in diesel engine oil additives has accelerated over the past decade under the influence of digital transformation, sustainability mandates and regulatory realignment. Formulation breakthroughs leveraging nanotechnology derived friction modifiers and advanced ester based corrosion inhibitors have significantly improved engine efficiency and reliability. These novel additive packages address the challenges posed by higher combustion pressures and extreme operating conditions, enabling original equipment manufacturers to push engine performance envelopes while adhering to lower NOx and particulate limits.

Simultaneously, global regulatory bodies are imposing ever tighter specifications on lubricant performance and biodegradability, compelling additive suppliers to reengineer chemistries for compliance without sacrificing efficacy. This regulatory pressure converges with a growing demand for bio based chemistries that reduce dependency on mineral resources. As OEMs pursue net zero carbon targets, the emergence of drop in bio based additives underscores a transformative shift toward circular economy principles within the diesel lubricant value chain.

Beyond chemical innovation, advanced analytics and digital monitoring platforms are reshaping product development and service models. By integrating telematics derived engine health data with predictive maintenance algorithms, formulators can customize additive recommendations in real time, thereby optimizing oil drain intervals and minimizing unscheduled downtime. These converging trends illustrate how technological advancements regulatory pressures and sustainability initiatives are transforming diesel engine oil additives for mobility demands.

Assess the repercussions of 2025 United States tariffs on diesel engine oil additive supply chain costs competitive dynamics and market accessibility

The imposition of new United States tariffs in early 2025 has introduced a layer of complexity into the global diesel engine oil additives supply chain. With duties applied to key raw materials such as zinc dialkyldithiophosphate precursors dispersant polymers and specialty surfactants, import costs have increased for formulators reliant on overseas manufacturers. These cost pressures cascade through the value chain, influencing blending operations, inventory holding strategies and end user pricing dynamics.

In response, additive producers have revisited their sourcing strategies by onshoring critical chemical synthesis or securing alternative suppliers from duty free trade partners. Although these shifts mitigate exposure to tariff fluctuations, they require significant capital investment in local production capabilities and in establishing new quality assurance protocols. Regional blending hubs are emerging in strategic locations to reduce cross border freight impacts and ensure continuity of supply to industrial and transportation fleets.

Despite these adaptive measures, the competitive landscape has been affected by margin compression and selective product rationalization. Some global players have opted to focus on high performance niche additives less susceptible to generic competition, while others are negotiating long term fixed pricing agreements to lock in raw material costs. Ultimately, the cumulative effects of the 2025 tariffs underscore the importance of agile sourcing and strategic supply chain management in navigating an increasingly protectionist environment.

Uncover segmentation insights into additive type chemical composition distribution channels and application verticals driving strategic decision making

A nuanced understanding of market segmentation reveals where growth opportunities and competitive pressures are most pronounced. When analyzing the market based on additive type, high performance anti wear agents continue to dominate demand due to their critical role in protecting engine components under high load conditions, while antioxidants and corrosion inhibitors are gaining traction for their ability to extend oil life and prevent substrate degradation. Detergents and dispersants work synergistically to remove combustion byproducts and maintain cleanliness, and friction modifiers are increasingly adopted to reduce mechanical losses and enhance fuel economy.

Chemical composition further stratifies the landscape, as mineral based formulations remain prevalent for cost sensitive applications, synthetic chemistries deliver superior thermal stability for heavy duty and industrial engines, and bio based alternatives are emerging in response to sustainable sourcing requirements. In terms of distribution channels, the offline network of wholesalers and distributor partnerships still commands a significant share, although online sales have surged; brand websites provide direct to consumer engagement while e commerce platforms offer convenience and rapid fulfillment for aftermarket buyers.

Applications extend across agricultural equipment requiring robust protection in dusty environments, commercial vehicles subject to long haul cycles, and construction machinery that endures severe shock loads. Heavy duty diesel engines in power generation and marine propulsion demand specialized additive packages for prolonged continuous use, while light duty diesel engines used in passenger vehicles seek balanced performance and cost efficiency. Industrial machinery often necessitates custom blends optimized for hydraulic and gear lubrication, demonstrating the breadth of application driven segmentation.

This comprehensive research report categorizes the Diesel Engine Oil Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Additive Type

- Chemical Composition

- Distribution Channel

- Application

Explore regional drivers opportunities challenges influencing diesel engine oil additive adoption across the Americas Europe Middle East & Africa Asia-Pacific

Regional dynamics shape how diesel engine oil additives are formulated, distributed and consumed. In the Americas, regulatory harmonization across North and South America supports widespread use of ultra low sulfur diesel, fostering demand for detergents and antioxidants that address low temperature stability and injector cleanliness. Producers in this region leverage integrated refining and blending infrastructure to deliver cost competitive solutions to commercial fleets and mining operations.

Within Europe Middle East & Africa, stringent emissions protocols in Europe are driving rapid adoption of high performance friction modifiers and polymer dispersants, while fuel quality variations in emerging Middle Eastern and African markets require corrosion inhibitors and water separation additives. Supply chain networks here combine seaborne shipments with regional blending terminals, balancing high specification throughput in Western Europe against tailored formulations for off grid applications.

Asia Pacific markets present a dual narrative of mature industrial hubs in countries like Japan and South Korea, where synthetic additive demand is strong, and rapidly developing economies in Southeast Asia and India, where mineral based chemistries maintain cost advantages. Online distribution has made inroads in urban centers, complementing well established offline channels. Across all regions, the interplay of fuel standards infrastructure maturity and end user application profiles informs the allocation of additive portfolios and go to market models.

This comprehensive research report examines key regions that drive the evolution of the Diesel Engine Oil Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze leading industry players strategic initiatives partnerships and pipelines driving competitive advantage in diesel engine oil additives market

Leading players in the diesel engine oil additives sector are executing multifaceted strategies to secure competitive advantage. Some enterprises are investing heavily in research and development to engineer next generation anti wear agents and multifunctional additive packages compatible with higher biodiesel blend ratios. Others are forging joint ventures with feedstock providers to ensure sustainable sourcing of bio based chemistries and to control critical components of the supply pipeline.

Strategic partnerships between lubricant blenders and telematics firms have emerged, enabling co development of connected lubricant monitoring solutions. These collaborations embed real time predictive analytics into asset management programs, strengthening customer retention and creating new service oriented revenue streams. In parallel, acquisitions of specialty chemical startups are enabling established companies to expand their innovation pipelines and access emerging technologies such as nano engineered friction modifiers and advanced dispersant polymers.

Sales and marketing initiatives are increasingly data driven, leveraging digital platforms to deliver targeted technical training and virtual simulation demos directly to maintenance teams and equipment operators. This shift toward high touch digital engagement complements traditional distributor networks, allowing top companies to expand market share in both mature and emerging regions by aligning value propositions with evolving customer demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Diesel Engine Oil Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADEKA CORPORATION

- Afton Chemical Corp.

- BRB International BV

- Clariant AG

- Cosmo Oil Co., Ltd.

- Croda International Plc

- Dorf Ketal Chemicals

- ENEOS Corporation

- Evonik Japan Co., Ltd.

- Exxon Mobil Corporation

- Idemitsu Kosan Co., Ltd.

- JAPAN CHEMICAL INDUSTRIES Co.,Ltd.

- JDA Co.,Ltd.

- Komatsu Private Limited

- KOZAKURA SHOKAI CO.,LTD.

- Kyoto Japan Tire (International) S.A

- LANXESS AG

- Mitsui O.S.K. Lines, Ltd.

- NIPPON CHEMICALS SALES CO.,LTD.

- Vanderbilt Chemicals, LLC

Drive operational excellence by optimizing additive performance aligning with regulations and enhancing stakeholder engagement in diesel engine oil additives

Industry leaders can capitalize on market momentum by prioritizing additive performance optimization, starting with precision blending protocols that tailor chemistries to specific engine architectures and operating conditions. Integrating direct feedback loops from fleet telematics data into formulation development accelerates the refinement of anti wear and friction reduction attributes, delivering quantifiable efficiency gains.

Aligning additive portfolios with the latest regulatory standards is imperative; proactive engagement with policy makers and participation in industry consortia enables suppliers to anticipate specification changes and influence test method evolution. This regulatory alignment not only safeguards market access but also positions companies as authoritative voices in environmental stewardship discussions.

Building differentiated customer experiences through digital engagement platforms fosters deeper brand loyalty. Offering virtual formulation workshops, mobile based oil condition monitoring apps and on demand technical support empowers maintenance personnel to optimize oil drain intervals and reduce unplanned downtime. By combining performance excellence with regulatory compliance and digital service enhancement, organizations can unlock sustainable growth and solidify market leadership in the diesel engine oil additives domain.

Detail a methodology combining interviews secondary data synthesis and quantitative analysis to deliver robust insights on diesel engine oil additives dynamics

This research leverages a structured approach to ensure the integrity and reliability of insights. Detailed interviews were conducted with senior technical experts across additive manufacturers, lubricant formulators and end user maintenance teams to capture firsthand perspectives on performance requirements and supply chain challenges. These qualitative inputs were complemented by secondary data synthesis from industry publications, regulatory filings and patent analyses to establish a comprehensive factual baseline.

Quantitative analysis incorporated formulation performance metrics, pricing trends and raw material cost modeling to identify key value drivers and competitive benchmarks. Supply chain mapping and tariff impact assessments were performed using trade data and logistical cost databases, providing a granular view of import duty implications on additive sourcing. All methodologies were triangulated through scenario validation workshops with domain specialists to ensure robustness and to calibrate findings against real world operational conditions in diesel engine maintenance and production environments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Diesel Engine Oil Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Diesel Engine Oil Additives Market, by Additive Type

- Diesel Engine Oil Additives Market, by Chemical Composition

- Diesel Engine Oil Additives Market, by Distribution Channel

- Diesel Engine Oil Additives Market, by Application

- Diesel Engine Oil Additives Market, by Region

- Diesel Engine Oil Additives Market, by Group

- Diesel Engine Oil Additives Market, by Country

- United States Diesel Engine Oil Additives Market

- China Diesel Engine Oil Additives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesize key findings and strategic implications to equip stakeholders with a clear roadmap for innovation in diesel engine oil additives

The analysis presented highlights the pivotal role of advanced chemistries, regulatory foresight and supply chain agility in shaping the future of diesel engine oil additives. Key findings underscore that additive type innovation, particularly in anti wear agents and friction modifiers, will drive performance benchmarks, while the shift toward bio based chemistries will redefine sustainability narratives.

Tariff induced supply chain realignments emphasize the necessity for diversified sourcing strategies and strategic production localization. Furthermore, digital engagement models and data driven service offerings are emerging as differentiators, creating long term value beyond traditional product sales.

As stakeholders navigate a landscape of evolving emission mandates and fuel formulations, a clear roadmap for additive development, regulatory collaboration and customer centric engagement will be essential. These conclusions equip industry participants with a cohesive framework to prioritize investments, align operational capabilities and pursue innovation pathways that deliver both environmental compliance and competitive growth.

Contact Ketan Rohom Associate Director Sales Marketing to access exclusive insights detailed analysis and diesel engine oil additives market research report

Ready to elevate your understanding and strategic positioning in the diesel engine oil additives arena Engage directly with Ketan Rohom Associate Director of Sales and Marketing to secure your copy of the comprehensive market research report Gain immediate access to in-depth analysis covering additive performance metrics regulatory impacts and competitive benchmarks that will enable your organization to make informed decisions and drive growth Discuss customized insights investment considerations and partnership opportunities with a senior expert who is prepared to support your journey toward innovation and market leadership in diesel engine oil additives Reserve your report today and harness actionable intelligence designed to empower your next strategic move

- How big is the Diesel Engine Oil Additives Market?

- What is the Diesel Engine Oil Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?