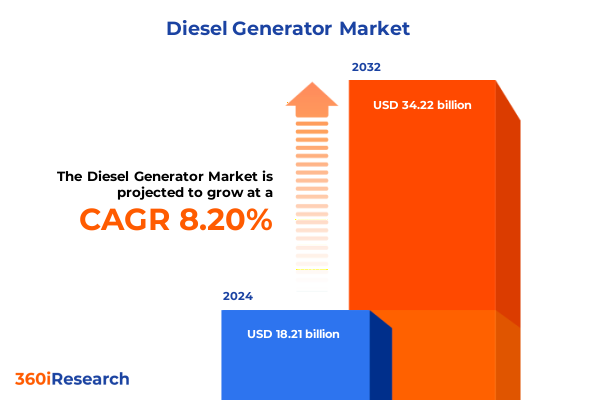

The Diesel Generator Market size was estimated at USD 19.63 billion in 2025 and expected to reach USD 21.15 billion in 2026, at a CAGR of 8.26% to reach USD 34.22 billion by 2032.

Exploring the Essential Strategic Role of Diesel Generators in Modern Infrastructure Resilience and Emergency Power Supply Sustainability

Diesel generators have long underpinned the world’s power resilience strategy, bridging critical gaps in grid reliability and emergent power outages with robust performance and proven durability. As global infrastructure networks become increasingly digitized and urbanized, the ability to deliver uninterrupted electricity in remote, emerging, and high-demand environments elevates diesel gensets from mere backup systems to strategic assets. Rapid urban expansion, coupled with climate-driven weather extremes, underscores the value of diesel power units in safeguarding communities, health facilities, data centers, and industrial operations. In tandem with emergency response initiatives, sustained operations in off-grid mining, construction, and oil and gas locales further cement the indispensability of diesel generators across diverse geographies.

Transitions toward integrated energy management amplify this role, as diesel units are now blended with renewable arrays and battery storage to create high-availability microgrids. Such hybrid deployments not only reduce lifecycle emissions and fuel consumption but also enhance the flexibility of power delivery during peak demand or unanticipated outages. In turn, stakeholders are placing greater emphasis on resilient supply chains, predictive maintenance platforms, and remote monitoring capabilities. This introduction establishes the diesel generator market as a cornerstone in global electrification and energy security strategies, setting the stage for analysis of the key forces redefining performance, cost structures, and regulatory compliance in the years ahead.

Analyzing Disruptive Technological and Regulatory Transformations Reshaping the Global Diesel Generator Landscape for Enhanced Performance

The diesel generator landscape is undergoing seismic shifts driven by technological breakthroughs and regulatory imperatives that demand cleaner, more efficient power solutions. Digital control systems embedded with IoT connectivity and artificial intelligence now enable predictive maintenance, real-time performance optimization, and remote diagnostics, fundamentally altering traditional service and support models. These platforms reduce unplanned downtime, extend equipment lifecycles, and elevate operational visibility, transforming gensets into data-rich assets that can be integrated with enterprise asset management systems.

Concurrently, stricter emissions regulations at regional and national levels are propelling manufacturers to develop low-NOx and ultra-low-sulfur diesel engines, alongside selective catalytic reduction (SCR) technologies. This regulatory momentum is complemented by mounting pressure from corporate sustainability agendas, which increasingly favor fuel alternatives such as biodiesel blends and hydrogen-diesel hybrids. As a result, diesel gensets are evolving into hybrid-compatible modules designed to coalesce with solar PV, wind turbines, and battery energy storage, thereby reducing carbon footprints without compromising reliability.

Turning to design innovation, lightweight composite materials and additive manufacturing techniques are enabling more compact, portable units that cater to the burgeoning demand for mobile power solutions in construction, events, and disaster relief. Altogether, these converging dynamics underscore a transformative era characterized by enhanced environmental stewardship, digital integration, and modular versatility-an evolution that is reshaping the competitive contours of the diesel generator market.

Assessing the Comprehensive Effects of 2025 United States Tariff Policies on Diesel Generator Manufacturing Supply Chains and Pricing Structures

The introduction of new tariffs by the United States in 2025 has generated significant ripples across diesel generator manufacturing and distribution channels. Import duties on key engine components have inflated procurement costs for offshore producers, compelling many original equipment manufacturers to reassess their global supply chain configurations. In response, several leading firms have announced onshoring initiatives, establishing or expanding domestic fabrication facilities to insulate production volumes from future tariff volatility and to maintain price competitiveness amidst rising labor and material costs.

Meanwhile, distributors and end users are adapting contract structures to include tariff pass-through clauses or variable pricing models tied to customs duties, thereby mitigating margin volatility. Project timelines have been impacted as stakeholders navigate longer lead times associated with customs clearances and tariff compliance documentation. This has heightened the appeal of local inventory stocking strategies, with service providers increasingly investing in regional spare parts warehouses to ensure uninterrupted generator maintenance.

Despite short-term headwinds, the tariff environment has stimulated innovation and cost-optimization efforts, with manufacturers exploring lean assembly processes, strategic supplier partnerships, and design standardization to offset additional duty burdens. Collectively, these trends illustrate how the 2025 tariff landscape is not only reshaping cost structures but also driving strategic realignments in manufacturing footprints, distribution networks, and contractual frameworks.

Uncovering Critical Segmentation Dynamics Across Power Ratings End Use Application Modes and Cooling Mounting Sales Channels Influencing Market Demand

Segmentation by power output reveals that mid-range units, specifically those rated between 75 and 375 kVA, are experiencing elevated uptake due to their versatility across commercial and light industrial applications. Within this band, the 75 to 150 kVA subcategory is favored for small-scale commercial buildings and medical clinics, while the 150 to 300 kVA range serves medium-sized warehouses and data centers requiring more consistent load profiles. Conversely, models below 75 kVA find prominence in residential backup scenarios and portable applications, with the <=25 kVA types preferred for compact dwellings and remote telecom towers. At the higher end, generators above 375 kVA, especially those within the 375 to 750 kVA bracket, are integral to large mining operations, manufacturing sites, and oilfield projects, where sustained high-capacity output is indispensable.

End-use analysis shows that industrial sectors such as construction sites, manufacturing plants, mining operations, and oil and gas facilities account for the bulk of demand, driven by the need for reliable power in locations beyond the reach of stable grids. Commercial segments encompassing healthcare, hospitality, and retail are likewise adopting gensets to uphold service continuity and protect critical assets. Residential consumption, albeit smaller in volume, is surging in regions prone to storm-related grid disruptions and rural electrification drives.

When examining application modes, standby setups dominate in facilities where power interruption risks carry significant cost or safety implications, whereas prime units are attracting interest in remote sites where grid connections are economically unviable. Continuous-operation gensets are carved out for quarry operations and large data centers that mandate uninterrupted power. In terms of cooling, air-cooled systems maintain popularity for cost-sensitive deployments, yet water-cooled configurations are gaining ground in high-load, high-temperature environments due to their superior thermal efficiency. Mounting considerations reflect a split between portable generators, which cater to construction, events, and mobile clinics, and stationary counterparts that anchor industrial plants and permanent backup installations. Finally, distribution channels are bifurcated between OEM sales, which focus on new equipment integration, and aftermarket pathways that supply spare parts, service contracts, and retrofit upgrades to extend lifecycle value and performance.

This comprehensive research report categorizes the Diesel Generator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- kVA Rating

- Cooling Type

- Mounting Type

- End Use

- Sales Channel

Evaluating Regional Growth Drivers and Infrastructure Trends Shaping Diesel Generator Adoption in Americas EMEA and Asia Pacific Markets

In the Americas, infrastructure modernization programs and grid resilience investments underpin steady diesel generator adoption. The United States and Canada prioritize backup power in healthcare, data centers, and public safety institutions, while Latin American countries leverage portable and stationary units to address intermittent power supply and rural electrification needs. Market participants in this region are benefiting from policy incentives for disaster preparedness, alongside robust aftermarket service networks that reinforce customer loyalty and uptime assurance.

Turning to Europe, the Middle East, and Africa, regulatory pressure to reduce emissions stands as a primary catalyst, driving adoption of low-emission gensets compliant with stringent EU Stage V and equivalent regional standards. In mature European markets, industrial users are integrating hybrid power systems to meet corporate sustainability goals, whereas in regions of the Middle East and Africa, the focus remains on diesel generators as standalone assets to support oil and gas exploration and off-grid mining operations. Demand in these areas is buoyed by government initiatives to expand electricity access and by a growing preference for modular, containerized power solutions that accelerate deployment.

In the Asia-Pacific region, rapid urbanization and manufacturing expansion have created substantial demand for seamless power delivery. Countries such as India and Indonesia are investing heavily in industrial parks and infrastructure corridors, necessitating reliable backup and prime power solutions. Meanwhile, China and Japan are pioneering smart genset technologies integrated with renewable energy assets, optimizing fuel consumption, and reducing lifecycle costs. Across the region, a mix of domestic manufacturers and international players compete to serve diverse end users, leveraging strategic partnerships and localized assembly to meet evolving market requirements.

This comprehensive research report examines key regions that drive the evolution of the Diesel Generator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategies and Innovations of Leading Diesel Generator Manufacturers Driving Competitive Advantage and Market Expansion Globally

Major manufacturers are differentiating their portfolios through advanced engine designs that emphasize fuel efficiency and emissions compliance, alongside integrated control systems offering cloud-based monitoring. Research and development investments have focused on improving transient response capabilities and noise reduction, addressing the growing demand for deployable power in urban and noise-sensitive environments. Collaborative ventures between engine producers and technology firms have accelerated the rollout of AI-enabled diagnostic tools, enhancing preventative maintenance and reducing total cost of ownership for end users.

Strategic alliances with renewable energy providers have enabled key players to introduce hybrid diesel-solar genset bundles, broadening their addressable markets and aligning with corporate sustainability targets. Simultaneously, proprietary service platforms and extended warranty programs are becoming central to differentiation strategies, as aftermarket revenues emerge as critical profit centers. The competitive landscape also features targeted acquisitions, with leading firms absorbing regional service providers and component specialists to strengthen geographic reach and supply chain resilience.

In addition, product roadmaps are increasingly highlighting electrification-friendly designs and multi-fuel capabilities, signaling a strategic shift towards versatility and regulatory adaptability. These forward-looking approaches, coupled with an emphasis on digital sales platforms and customer-centric service models, underscore how manufacturers are leveraging innovation to maintain competitive advantage and capture incremental market share on a global scale.

This comprehensive research report delivers an in-depth overview of the principal market players in the Diesel Generator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aggreko Ltd.

- Atlas Copco AB

- Atlas Copco AB

- Briggs & Stratton, LLC

- Caterpillar Inc.

- Cummins Inc.

- Deutz AG

- Doosan Corporation

- Generac Holdings Inc.

- Gillette Generators

- Hitzinger Power Solutions GmbH

- Kirloskar Oil Engines Limited

- Kubota Corporation

- MAN Energy Solutions

- Mitsubishi Heavy Industries, Ltd.

- PowerLink

- Rehlko

- Siemens Energy AG

- Wabtec Corporation by GE Transportation

- Wartsila Corporation

- Yanmar Co. Ltd.

Formulating Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities in the Diesel Generator Sector

Industry leaders should prioritize the development and deployment of next-generation low-emission engines equipped with selective catalytic reduction and particulate filtration systems to satisfy looming regulatory deadlines and corporate sustainability commitments. By integrating IoT-enabled controls with machine-learning algorithms, firms can offer predictive maintenance contracts that reduce unplanned downtime and differentiate service offerings. Strengthening partnerships with microgrid integrators and renewable energy firms will unlock new hybrid use cases, positioning diesel generators as complementary assets within broader distributed energy ecosystems.

To counteract supply chain headwinds, companies must diversify component sourcing by establishing multiple tier-one supplier relationships and nearshoring critical assembly functions. A balanced inventory strategy-combining central warehouses with regional depots-will help mitigate tariff-induced lead time fluctuations while preserving service-level agreements. In parallel, investing in localized manufacturing facilities not only secures production continuity but also aligns with reshoring incentives and reduces transportation-related emissions.

Expanding digital sales and service channels will be essential to capturing aftermarket revenue streams. By leveraging e-commerce platforms, remote monitoring dashboards, and virtual commissioning tools, organizations can engage customers throughout the equipment lifecycle, increase capture rates for service contracts, and gather performance data for continuous product improvement. Finally, targeted market entries into underserved regions-particularly in fast urbanizing Asian economies and under-electrified African markets-will require tailored financing models and collaborative agreements with local utilities, ensuring that diesel generators remain a viable and strategic power solution for diverse end uses.

Detailing Robust Research Methodology Employed to Ensure Data Integrity and Comprehensive Insights in Diesel Generator Market Analysis

This analysis was constructed through a rigorous methodology combining primary interviews with power generation executives, engineering specialists, and procurement leaders, alongside secondary research from publicly available technical journals, regulatory filings, and manufacturer disclosures. Quantitative data were validated via cross-references to company financials, trade associations, and government import records to ensure consistency and accuracy. A blend of top-down market mapping and bottom-up unit shipments analyses provided a holistic view of capacity demand across geographies and end-use sectors.

Structured survey instruments captured qualitative insights into customer preferences regarding fuel efficiency, service responsiveness, and digital functionality. These inputs were complemented by expert panel discussions to contextualize emerging trends and interpret the strategic implications of evolving emissions frameworks. To maintain data integrity, multiple rounds of data triangulation and fact-checking were undertaken, ensuring coherence across varied information sources.

Finally, statistical techniques were applied to analyze historical equipment replacement cycles and maintenance spending patterns, illuminating correlation themes and identifying outliers. The resulting synthesis offers decision-makers a robust foundation of evidence, enabling informed strategies for product innovation, market entry, and supply chain optimization within the diesel generator sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Diesel Generator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Diesel Generator Market, by kVA Rating

- Diesel Generator Market, by Cooling Type

- Diesel Generator Market, by Mounting Type

- Diesel Generator Market, by End Use

- Diesel Generator Market, by Sales Channel

- Diesel Generator Market, by Region

- Diesel Generator Market, by Group

- Diesel Generator Market, by Country

- United States Diesel Generator Market

- China Diesel Generator Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Imperatives to Guide Stakeholders Through the Complex Diesel Generator Market Terrain

The findings reveal that diesel generators continue to occupy a pivotal position in power resilience strategies, with a clear trajectory toward hybridization and digital integration. Regulatory developments and tariff adjustments are acting as catalysts for supply chain realignment and product innovation, compelling manufacturers to accelerate the adoption of low-emission technologies and flexible sourcing models. Regional demand patterns underscore the necessity of tailored solutions that address distinct infrastructure challenges-from grid instability in emerging markets to sustainability mandates in developed economies.

Segmentation analysis highlights the sustained importance of mid-range gensets in commercial and light industrial applications, while also pointing to burgeoning demand for portable and high-capacity units in specialized sectors. End-use dynamics reveal the evolving needs of industrial, commercial, and residential users, all of which are converging toward more intelligent, efficient, and adaptable power systems. Finally, leading companies are coalescing around strategic initiatives that emphasize digital services, hybrid power integration, and enhanced aftermarket support as core differentiators.

Stakeholders can leverage these strategic imperatives to prioritize R&D investments, refine go-to-market approaches, and strengthen operational resilience against geopolitical and regulatory uncertainties. In essence, the diesel generator market stands at the nexus of reliability and innovation, demanding a proactive stance to harness its full potential within the broader energy transition narrative.

Engaging with Associate Director Sales and Marketing to Unlock In-Depth Diesel Generator Research Insights and Drive Informed Procurement Decisions

Unlock unparalleled insights by engaging directly with Associate Director of Sales and Marketing at our firm, Ketan Rohom, who can guide you through every facet of the diesel generator research offering and facilitate immediate procurement of the comprehensive report. By connecting with this seasoned expert, your organization gains tailored advice on how to leverage in-depth market intelligence to inform critical power infrastructure investments, streamline supplier engagement, and accelerate project timelines. Ketan possesses a nuanced understanding of evolving regulatory frameworks, end user requirements across diverse sectors, and advanced technological pathways that ensure generators operate at peak efficiency and comply with emerging emissions standards. His strategic perspective will illuminate bespoke scenarios where diesel gensets intersect with renewable assets, energy storage solutions, and digital management platforms to optimize total cost of ownership.

Reaching out to Ketan unlocks access to exclusive briefing sessions, executive summaries, and interactive workshops designed to embed the report’s findings into your strategic planning process rapidly and effectively. Seize this opportunity to secure a best-in-class competitive edge in a market defined by regulatory shifts, tariff uncertainties, and accelerating innovation.

Contact Ketan Rohom today to finalize your report acquisition and embark on a data-driven journey that will fortify your decision-making and power your organization’s success.

- How big is the Diesel Generator Market?

- What is the Diesel Generator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?