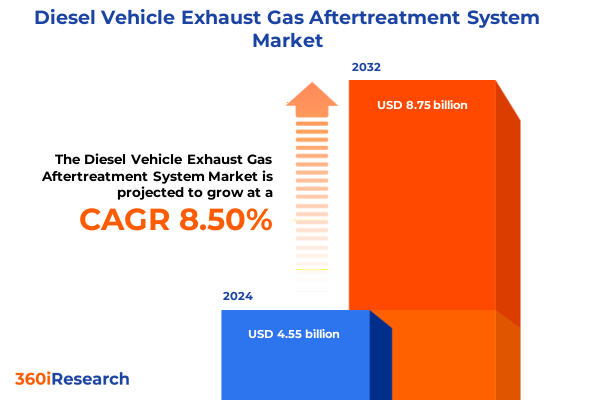

The Diesel Vehicle Exhaust Gas Aftertreatment System Market size was estimated at USD 4.94 billion in 2025 and expected to reach USD 5.36 billion in 2026, at a CAGR of 8.51% to reach USD 8.75 billion by 2032.

Transformative Role of Diesel Exhaust Gas Aftertreatment Systems in Shaping Emission Regulations and Industry Innovation for Cleaner Air Future

The evolution of diesel vehicle exhaust gas aftertreatment systems has been propelled by a global imperative to reduce harmful emissions and meet increasingly stringent regulatory requirements. As internal combustion engines continue to play a vital role in commercial transportation and logistics, the aftertreatment ecosystem has emerged as a critical enabler for achieving cleaner air standards. These advanced systems integrate a series of complementary technologies to target particulate matter and nitrogen oxides, transforming engines that historically were significant contributors to urban and regional pollution into much cleaner powertrains.

Against the backdrop of Euro VI, EPA 2010, and upcoming regulatory milestones, automobile manufacturers and component suppliers have engaged in intensive research and development to refine catalysts, filters, and dosing mechanisms. The confluence of regulatory pressure and advancements in material science has created a fertile environment for innovation, driving continuous improvements in backpressure reduction, regeneration efficiency, and sensor accuracy. This shift has not only elevated environmental performance but also enhanced vehicle reliability and fuel economy.

Understanding the strategic importance of aftertreatment systems requires recognizing their influence across the value chain. From raw material suppliers of precious metals to OEMs integrating systems on the assembly line, every stakeholder has had to adapt. Meanwhile, end users such as fleet operators are prioritizing compliance and total cost of ownership, selecting solutions that deliver regulatory assurance alongside operational efficiency. In this context, mastering the intricacies of diesel exhaust gas aftertreatment is vital for any organization intent on leading in tomorrow’s cleaner mobility landscape.

Revolutionary Shifts in Aftertreatment Landscape Driven by Technological Breakthroughs Regulatory Pressures and Sustainability Goals

Over the past decade, technological breakthroughs have dramatically reshaped the aftertreatment landscape, accelerating performance and reducing costs. Selective catalytic reduction evolved from a nascent solution to the industry standard for nitrogen oxide reduction, thanks to enhancements in catalyst formulation and the introduction of advanced urea dosing strategies. Simultaneously, continuously regenerating traps and ceramic filter media innovations have significantly lowered maintenance intervals, enabling heavier duty cycles and extended service life for particulate filters.

Digitalization has also played a crucial role, with next-generation sensors enabling real-time monitoring of temperature gradients, pressure differentials, and NOx concentrations. This data-driven approach allows predictive maintenance, minimizing downtime and ensuring compliance with near-zero emission targets. Machine learning algorithms integrated into engine control units now dynamically adjust dosing rates, optimizing reagent consumption and minimizing ammonia slip.

In parallel, the industry has witnessed a shift toward modular combined systems that integrate particulate filters, oxidation catalysts, and SCR units into compact assemblies. Packaging innovations have streamlined installation across vehicle platforms, supporting lightweight designs and reducing exhaust backpressure. Regulatory agencies worldwide continue to tighten limits, fostering a landscape where sustainable mobility solutions are no longer optional but foundational to commercial viability.

Analyzing the Far Reaching Consequences of 2025 U S Tariff Adjustments on Diesel Aftertreatment Supply Chains Operational Costs and Market Dynamics

In early 2025, the United States government implemented tariff adjustments targeting imported catalysts, sensors, and specialized filtration media integral to diesel aftertreatment architectures. These levies were intended to bolster domestic manufacturing and secure supply chains, but they also introduced cost pressures across the ecosystem. Catalyst producers reliant on precious metal sourcing found margins squeezed, prompting many to accelerate investments in domestic refining capabilities and strategic metal recycling programs.

For engine and vehicle assemblers, the increased cost of SCR catalysts and particulate filter substrates translated into higher bill of materials expenses, which risked being passed on to end customers. Fuel and fleet operators responded by extending maintenance intervals, deferring component replacements, or exploring retrofit solutions with domestic content. These adaptive measures underscored a broader trend of supply chain diversification, with manufacturers forging partnerships with North American specialty chemical firms and metal refiners to mitigate exposure to further tariff escalations.

Despite the immediate headwinds, the long-term outlook indicates potential benefits as domestic capacity expands. Investments announced by leading catalyst and sensor manufacturers promise to enhance local production capabilities, shorten lead times, and strengthen quality control. In turn, this domestic growth could foster more resilient supply networks, spur innovation in next-generation aftertreatment materials, and ultimately contribute to more stable pricing for system integrators and end users alike.

Comprehensive Insights Across Aftertreatment Technologies Vehicle Types Applications Components and Distribution Channels Revealing Diverse Market Drivers

The diesel aftertreatment market encompasses a diverse array of technology configurations that address varying emission reduction objectives. Combined systems, which integrate diesel particulate filters with oxidation catalysts and selective catalytic reduction units, represent a holistic approach, while standalone diesel particulate filters focus on trapping soot particulates. Exhaust gas recirculation modules lower in-cylinder temperatures to reduce NOx formation, whereas lean NOx traps offer a separate adsorption-regeneration cycle. Selective catalytic reduction remains the preferred choice for heavy NOx loads, converting them into nitrogen and water through precise urea dosing.

Vehicle applications span across buses and coaches that operate on urban routes requiring frequent stop-start emissions control, as well as heavy and light commercial vehicles that demand resilience under high load conditions. Passenger cars leverage compact aftertreatment assemblies to meet stringent tailpipe standards without compromising fuel efficiency. The differentiation between off-road and on-road segments further influences system design, with off-road equipment emphasizing durability under severe duty cycles and on-road platforms targeting minimal backpressure and rapid warm-up characteristics to satisfy real-world driving conditions.

Components within these systems play specialized roles: catalysts perform oxidation and NOx reduction chemistry, dosing systems meter reagent precisely, filters capture particulate matter, and an array of sensors monitor conditions in real time. Diesel oxidation catalysts and SCR catalysts each necessitate unique material formulations, while dosing systems rely solely on urea delivery precision. Filters vary from continuously regenerating traps to traditional diesel particulate filters, and sensors range from NOx analyzers to temperature and pressure monitors. These integrated assemblies reach end users through both OEM channels and aftermarket supply networks, catering to initial vehicle assembly and post-sale maintenance cycles.

This comprehensive research report categorizes the Diesel Vehicle Exhaust Gas Aftertreatment System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Aftertreatment Technology

- Vehicle Type

- Distribution Channel

- Application

Regional Variations in Diesel Aftertreatment Adoption and Market Trends Highlighting Opportunities Across Americas EMEA and Asia Pacific Regions

In the Americas, emission standards such as EPA 2010 and CARB’s low-NOx initiatives have driven widespread adoption of Urea-SCR systems and high-capacity particulate filters. Fleet operators across North America are prioritizing compliance to avoid noncommercial road restrictions and idle-reduction mandates, resulting in a surge of retrofitted aftertreatment solutions for legacy diesel fleets. In South America, evolving environmental regulations and investments in public transit infrastructure are creating new opportunities, particularly in urban centers seeking to modernize bus fleets.

Europe, Middle East & Africa presents a complex regulatory tapestry, with Euro VI across the EU complementing bespoke standards in the GCC countries and South Africa. Manufacturers are tailoring combined modular aftertreatment systems to meet both regulatory thresholds and durability requirements in extreme climates. In Western Europe, integration of onboard diagnostics with emission control systems is pervasive, while growth in North African markets is driven by infrastructure development and heavy vehicle imports.

Asia-Pacific remains the fastest-growing region, propelled by China’s stringent China VI emission standards and India’s Bharat Stage regulations. Rapid urbanization in Southeast Asia has spurred demand for city buses with advanced particulate filtration, while mining and construction equipment in Australia adopt robust SCR systems to comply with national environmental benchmarks. Across all regions, local content regulations and incentives for cleaner technologies are shaping procurement strategies and encouraging collaborations between global suppliers and regional OEMs.

This comprehensive research report examines key regions that drive the evolution of the Diesel Vehicle Exhaust Gas Aftertreatment System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Positioning and Innovation Profiles of Leading Aftertreatment System Manufacturers Shaping Industry Evolution

The competitive landscape in diesel aftertreatment is anchored by global engineering specialists and diversified powertrain suppliers that continually innovate catalyst formulations and system architectures. Enterprises with deep expertise in precious metal chemistry have expanded their portfolios to include next-generation SCR and diesel oxidation catalysts, while agile component manufacturers are scaling production of dosing systems and advanced sensors to meet evolving emission norms.

Collaborative partnerships between engine OEMs and technology providers have become increasingly common, facilitating co-development of integrated exhaust solutions that optimize space utilization and thermal management. Strategic alliances with academic institutions and government research bodies are accelerating the commercialization of emerging materials, such as nano-structured washcoats and low-temperature oxidation catalysts, which promise to enhance cold-start performance and reduce warm-up delays.

To maintain competitive differentiation, leading companies are investing in digital platforms that analyze in-field emission data to refine dosing algorithms and predictive maintenance schedules. This convergence of hardware innovation and software intelligence enables service providers to offer performance-based contracts, aligning component lifecycle costs with emission reduction guarantees. As consolidation continues through mergers and acquisitions, organizations capable of delivering end-to-end aftertreatment solutions are best positioned to capture the growing demand for cleaner diesel technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Diesel Vehicle Exhaust Gas Aftertreatment System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albonair GmbH

- AP Emissions Technologies

- BASF SE

- Cataler Corporation

- Continental AG

- Corning Incorporated

- Cummins Inc.

- DCL International Inc.

- Delphi Technologies by BorgWarner Inc.

- Denso Corporation

- Donaldson Company, Inc.

- FORVIA Faurecia

- Futaba Industrial Co., Ltd.

- Hitachi, Ltd.

- IBIDEN Co., Ltd.

- Johnson Matthey Plc

- MAHLE Powertrain Limited.

- NGK Insulators, Ltd.

- NORMA Group SE

- Robert Bosch GmbH

- Sango Co., Ltd.

- Tenneco Inc.

- UMICORE, NV/SA

- Weifu High-Technology Group Co., Ltd.

- Yutaka Giken Co., Ltd.

Targeted Strategic Recommendations Empowering Industry Leaders to Optimize Aftertreatment Deployment Enhance Sustainability and Drive Competitive Advantage

To navigate the complex dynamics of the diesel aftertreatment market, stakeholders should align their product development roadmaps with anticipated regulatory milestones. By investing in modular platform architectures, OEMs can reduce customization lead times and accelerate time to market, ensuring compliance with future emission standards. Suppliers should prioritize metal recovery and recycling initiatives to mitigate the impact of volatile precious metal prices and potential trade policy shifts.

Operational efficiency can be enhanced by implementing predictive maintenance frameworks that leverage real-time sensor data. Service networks should be equipped with advanced diagnostic tools and standardized training programs to minimize downtime and optimize component lifecycles. In parallel, forging strategic partnerships with regional manufacturing hubs will strengthen supply chain resilience and allow rapid response to localized demand fluctuations.

Industry leaders are also encouraged to explore circumnavigating tariffs through joint ventures that establish local catalyst production and urea synthesis capabilities. Engaging proactively with regulatory bodies and participating in standards committees will enable companies to shape forthcoming emission protocols and certification processes. By integrating digital service offerings and performance-based contracts, stakeholders can differentiate on total cost of ownership, driving both environmental outcomes and customer loyalty.

Rigorous Research Approach Combining Expert Interviews Data Triangulation and Market Mapping to Ensure Comprehensive and Reliable Findings

This research employs a multi-layered approach that begins with in-depth interviews of senior executives, technical experts, and policy specialists across the aftertreatment value chain. These qualitative insights form the foundation for mapping current technology adoption patterns, emergent material science breakthroughs, and regional regulatory frameworks. Complementing these primary insights, a comprehensive review of publicly available patents, technical journals, and white papers was conducted to identify innovation hotspots and benchmark competitive activities.

Quantitative data was aggregated through a structured survey of system integrators, component manufacturers, and vehicle OEMs, capturing design preferences, cost structures, and maintenance practices. These real-world findings were cross-verified with secondary sources, including government emission statistics and trade data, to ensure consistency. A data triangulation process aligned divergent inputs, refining key assumptions and confirming market movement trajectories.

To validate supply chain dynamics and material flow, a mapping exercise was undertaken that traced precious metal inputs from refineries to catalyst formulation plants and onto final system assembly lines. Regional workshops brought together local stakeholders to review early findings and calibrate market segmentation assumptions. This rigorous methodology provides stakeholders with credible, actionable insights grounded in empirical evidence and industry expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Diesel Vehicle Exhaust Gas Aftertreatment System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Diesel Vehicle Exhaust Gas Aftertreatment System Market, by Component

- Diesel Vehicle Exhaust Gas Aftertreatment System Market, by Aftertreatment Technology

- Diesel Vehicle Exhaust Gas Aftertreatment System Market, by Vehicle Type

- Diesel Vehicle Exhaust Gas Aftertreatment System Market, by Distribution Channel

- Diesel Vehicle Exhaust Gas Aftertreatment System Market, by Application

- Diesel Vehicle Exhaust Gas Aftertreatment System Market, by Region

- Diesel Vehicle Exhaust Gas Aftertreatment System Market, by Group

- Diesel Vehicle Exhaust Gas Aftertreatment System Market, by Country

- United States Diesel Vehicle Exhaust Gas Aftertreatment System Market

- China Diesel Vehicle Exhaust Gas Aftertreatment System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings Clarifying Industry Trajectories Regulatory Trends and Strategic Imperatives for the Diesel Aftertreatment Ecosystem

The analysis highlights a convergence of factors reshaping the diesel aftertreatment ecosystem. Regulatory tightening across major markets is driving accelerated adoption of advanced catalyst and filter technologies, while digital sensor integration is enhancing system performance and maintenance efficiency. Trade policy shifts, particularly the 2025 U.S. tariff adjustments, have underscored the importance of supply chain agility and local production capacity for critical components.

Market segmentation reveals distinct dynamics by technology configuration, vehicle class, application, and distribution channel, with combined systems and urea-based SCR dominating heavy-duty applications, while compact oxidation catalysts and continuously regenerating traps are preferred in passenger vehicles. Regional insights underscore differential growth trajectories, as mature markets focus on retrofit and emission enforcement, and emerging regions expand new vehicle installations to meet urban air quality goals.

In response, industry leaders are pursuing modular system architectures, strategic partnerships, and digital service models to capture value across the lifecycle. Investments in material innovation and predictive maintenance are poised to reduce total cost of ownership, strengthen emission compliance, and unlock new revenue streams. Ultimately, mastering these interdependent trends will be pivotal to achieving both environmental objectives and commercial success in the evolving diesel aftertreatment landscape.

Unlock Exclusive Diesel Aftertreatment Market Intelligence by Connecting with Ketan Rohom Associate Director Sales to Secure Comprehensive Research Insights

For organizations seeking a nuanced understanding of the shifting dynamics of this market, our full diesel vehicle exhaust gas aftertreatment systems research report offers unmatched depth and clarity. Reach out directly to Ketan Rohom, Associate Director of Sales, who brings extensive expertise in translating complex data into actionable strategies. By collaborating with Ketan Rohom, you can secure tailored insights that align with your company’s objectives, gain early access to the latest findings on technology advancements, trade policy impacts, and competitive positioning, and position your business at the forefront of innovation. Don’t miss the opportunity to leverage this comprehensive intelligence to guide investment decisions, optimize product development roadmaps, and strengthen your supply chain resilience. Connect today with Ketan Rohom to unlock exclusive market intelligence and ensure your organization capitalizes on emerging opportunities in the diesel aftertreatment sector.

- How big is the Diesel Vehicle Exhaust Gas Aftertreatment System Market?

- What is the Diesel Vehicle Exhaust Gas Aftertreatment System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?