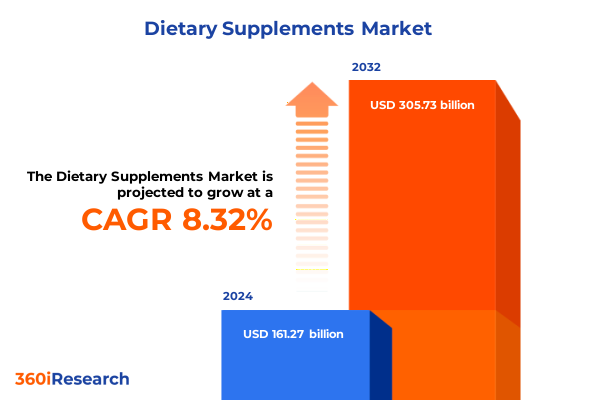

The Dietary Supplements Market size was estimated at USD 174.10 billion in 2025 and expected to reach USD 188.14 billion in 2026, at a CAGR of 8.17% to reach USD 301.83 billion by 2032.

Unveiling Core Drivers and Foundational Trends Shaping the Ever-Evolving Dietary Supplements Landscape in a Competitive Global Market

The dietary supplements industry has undergone significant expansion as consumers seek proactive approaches to health management. In the United States, the majority of adults incorporate supplements into their daily routines to support general wellness, bone health, immune function, and mental clarity. Roughly three quarters of American adults rely on vitamins, minerals, botanicals, and specialty formulations to complement dietary gaps and sustain vitality.

The global nature of the supply chain means ingredients are sourced from diverse geographies. More than sixty percent of essential raw materials for capsules, powders, and liquids are imported, requiring manufacturers to navigate complex logistics, compliance, and quality assurance protocols to secure reliable supply, ensure consistency, and safeguard product safety.

Rapid technological advancements from formulation to distribution have reshaped product innovation, e-commerce, and consumer education. Brands leverage digital platforms, social media, and personalized testing to deliver targeted solutions while regulatory bodies intensify oversight to ensure efficacy and transparency.

As emerging health challenges, demographic shifts, and lifestyle changes exert pressure on healthcare systems, public and private entities recognize supplements as integral to preventive care strategies. By understanding the forces driving industry transformation, companies can position themselves to capture growth opportunities, mitigate risks, and reinforce consumer trust.

Harnessing Technological Innovations Sustainability and Personalized Solutions Fueling Transformative Shifts in the Dietary Supplements Market

One of the most profound shifts is the rise of personalized nutrition solutions that harness artificial intelligence and biotechnologies to tailor supplement protocols to individuals’ genetic profiles, physiological markers, and lifestyle factors. Generative AI platforms analyze vast datasets to recommend precise formulations that align with each consumer’s unique health goals and risk factors, enhancing both efficacy and adherence.

Plant-based and functional ingredients have soared in popularity as consumers gravitate toward botanical adaptogens, probiotics, and nature-derived actives that offer targeted benefits from stress relief to metabolic support. Ashwagandha, medicinal mushrooms, and turmeric demand reflects a broader appetite for evidence-based ingredients that deliver tangible outcomes beyond basic micronutrient supplementation.

Sustainability and clean-label imperatives now dominate formulation, packaging, and branding, driving manufacturers to adopt eco-friendly materials, minimize waste, and guarantee ingredient traceability. Biodegradable pouches, compostable bottles, and transparent sourcing declarations have become baseline requirements for premium brands striving to earn consumer loyalty through environmental stewardship and ethical supply chain practices.

Digital health integration spanning wearable devices, mobile applications, and interactive telehealth interfaces enables real-time tracking of biometrics, dietary intake, and supplement efficacy. Combined with remote coaching and predictive analytics through continuous glucose monitors and fitness trackers, this convergence supports preventive care and empowers consumers with actionable insights into their wellness journeys.

Assessing the Comprehensive Economic and Supply Chain Consequences of Recent Tariff Measures on the U.S. Dietary Supplements Industry

In 2025, sweeping trade measures under Section 232 and reciprocal tariff actions reshaped the cost structure and supply chain dynamics for the U.S. supplement industry. While the Administration initially targeted pharmaceuticals, these tariffs risked sweeping non-pharmaceutical ingredients under identical Harmonized Tariff Schedule codes, prompting industry stakeholders to advocate for clear distinctions between supplements and prescription drugs to shield essential public health products from unintended levies.

Annex II exemptions granted in early 2025 provided temporary relief by excluding key botanicals, amino acids, and select specialty nutrients from a baseline ten percent ad valorem duty, resulting in direct cost savings estimated between two hundred eighteen and two hundred forty-seven million dollars over a two-month period. These exemptions exemplify the importance of tailored trade policy to preserve affordable access to supplements and maintain robust domestic manufacturing capacity.

Nevertheless, the broader tariff environment contributed to raw material price volatility and underscored the necessity for diversified sourcing strategies. Experts warn that without stable tariff frameworks, supply disruptions could drive up prices of over-the-counter medicines, generic ingredients, and botanical extracts, erode profit margins for smaller manufacturers, and ultimately shift higher costs to consumers. Such developments highlight critical vulnerabilities in the current trade policy landscape.

Uncovering Actionable Intelligence from Multifaceted Segmentation of Products Forms Applications End Users and Distribution in the Supplement Sector

The dietary supplements market reveals its complexity through multi-tiered product type segmentation where botanical supplements, mineral formulations, and vitamin blends cater to diverse consumer needs. Adaptogens, herbs, and spices within the botanical segment address stress and cognitive support, while individual minerals such as calcium, iron, and magnesium target bone health and metabolic regulation. Concurrently, a spectrum of vitamins ranging from fat-soluble A, D, E, K to water-soluble B complex and vitamin C underpins general wellness and immune resilience.

Understanding consumer preferences further requires analysis of formulation and packaging. Supplements delivered as capsules, gummies, liquids, powders, softgels, and tablets reflect both efficacy considerations and user convenience, whereas blister packs, bottles, jars, and sachets influence dosage accuracy, shelf life, and product perception. Packaging innovations aimed at enhancing portability and sustainability drive differentiation among competing brands seeking to meet evolving consumer expectations.

Application insights reveal that supplements for bone health, digestion, energy and vitality, heart health, immune support, and mental well-being dominate demand, with specialized offerings for memory enhancement and stress relief emerging as high-growth niches. End users span clinical settings, fitness centers, hospitals, and household consumers, illustrating broad adoption across professional and everyday contexts. Meanwhile, distribution channels balance offline retail footprints including pharmacies, health food shops, and modern grocery formats with online direct-to-consumer websites and e-commerce platforms that broaden market reach.

This comprehensive research report categorizes the Dietary Supplements market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Formulation

- Packaging Type

- Ingredient Source

- Application

- End User

- Distribution Channels

- Consumer Group

Deriving Strategic Perspectives from Regional Dynamics and Consumer Demands Across the Americas EMEA and Asia-Pacific Supplement Markets

The Americas market stands as a mature and highly regulated environment where consumer demand emphasizes scientifically validated formulations and personalized wellness experiences. In the United States, approximately three quarters of adults use supplements for preventive health and vitality while Canada’s market growth is propelled by aging demographics and a supportive regulatory framework that differentiates supplements from pharmaceuticals.

European, Middle East, and African markets demonstrate significant regulatory sophistication and diversity, exemplified by the European Union’s recent authorization of calcidiol monohydrate as a novel vitamin D source and impending restrictions on monacolins from red yeast rice under EFSA guidance. These developments reflect a commitment to ingredient safety and harmonized labeling requirements that influence product innovation and market entry strategies across the region.

Asia-Pacific continues to outpace other regions in growth, driven by rapidly expanding middle class segments and strong consumer affinity for traditional botanicals and functional ingredients. Companies such as Blackmores leverage localized innovation centers and e-commerce expansion to reach consumers in China, India, and Southeast Asia, capitalizing on a market where supplements account for nearly half of global spending and digital channels accelerate product discovery and adoption.

This comprehensive research report examines key regions that drive the evolution of the Dietary Supplements market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Differentiators Innovations and Growth Strategies Deployed by Leading Global Dietary Supplement Companies

Leading industry players have adopted differentiated strategies to capture market share through innovation partnerships and targeted product portfolios. Multinational corporations leverage extensive R&D capabilities to launch evidence-based formulations incorporating novel actives, while nimble specialty brands focus on niche applications such as cognitive health, adaptogenic support, and beauty from within. This dynamic competitive landscape drives continual investment in clinical trials, ingredient traceability systems, and strategic collaborations.

In parallel, technology providers and direct-to-consumer model companies are integrating digital platforms to personalize consumer engagement and drive recurring revenue streams. By utilizing AI-enabled recommendation engines integrated into mobile applications, companies deliver customized regimens that adapt in real time to user feedback and biometric data. These capabilities enhance consumer loyalty and allow companies to differentiate on service as well as product efficacy.

Sustainability and corporate responsibility have emerged as critical differentiators, prompting established firms to adopt eco-friendly packaging, carbon-neutral operations, and transparent supply chain audits. Specialty brands are securing certifications such as organic and non-GMO verification to reinforce brand credibility and address consumer expectations for ethical sourcing. Looking ahead, companies that align business models with environmental and social governance principles are positioned to benefit from long-term consumer trust.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dietary Supplements market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Nestlé S.A

- Amway Corporation

- Kerry Group plc

- Abbott Laboratories

- Unilever PLC

- Bayer AG

- Archer-Daniels-Midland Company

- Herbalife Nutrition Ltd.

- NOW Health Group, Inc.

- Himalaya Wellness Company

- American Healthcare REIT, Inc.

- ARKOPHARMA Laboratories, Company Limited

- Dr. Willmar Schwabe GmbH & Co. KG

- DuPont de Nemours, Inc.

- Glanbia PLC

- GlaxoSmithKline PLC

- Nature’s Sunshine Products, Inc.

- Nutraceutical International Corporation

- NutraScience Labs

- Otsuka Holdings Co. Ltd.

- Pfizer Inc.

- Pragati Biocare Pvt. Ltd.,

- Procter & Gamble Health Limited

- Sabinsa Corporation

- Somafina

- Suntory Group

- Taisho Pharmaceutical Co., Ltd.

Implementing Targeted Actions to Enhance Innovation Optimize Supply Chains and Strengthen Market Position in Nutritional Supplements

To navigate the evolving landscape, industry leaders must prioritize diversified supply chains that balance domestic manufacturing capabilities with strategic global partnerships, thereby mitigating tariff risk and ensuring consistent ingredient availability. By establishing multiple sourcing hubs and maintaining inventory buffers, companies can safeguard against sudden policy shifts and logistical disruptions.

Companies should invest in emerging digital health ecosystems by integrating wearables, mobile apps, and telehealth platforms, enabling data-driven insights that optimize supplement protocols and foster ongoing consumer engagement. Collaborative development with healthcare professionals and technology partners can extend brand reach and underpin evidence-based value propositions.

Embracing sustainable practices across product life cycles is essential to meet escalating environmental and regulatory requirements. Initiatives such as adopting recyclable or compostable packaging materials, implementing renewable energy use, and pursuing verified sourcing certifications will reinforce brand integrity and improve appeal among eco-conscious consumers.

Finally, organizations should enhance their innovation pipelines through cross-sector alliances, academic partnerships, and consumer co-creation models that accelerate the translation of cutting-edge research into market-ready solutions. Leveraging predictive analytics to identify emerging health trends will position companies to launch first-to-market products that address unmet consumer needs and drive differentiated growth.

Outlining Rigorous Mixed Research Methodology Integrating Primary Secondary Data Sources and Expert Validations to Ensure Insight Accuracy

This report is grounded in a rigorous mixed methodology approach combining primary interviews with industry executives, formulation scientists, and policy experts alongside comprehensive secondary research of regulatory publications, trade association reports, and peer-reviewed literature. Such triangulation ensures a balanced and robust perspective on market dynamics and policy shifts.

Data acquisition included extensive engagement with subject matter experts across manufacturing, retail, and technology functions to validate key findings, clarify terminology, and contextualize emerging trends. Input from regulatory bodies and trade organizations was integrated to capture the nuances of international tariff developments and compliance frameworks.

Secondary sources encompassed official government documents, scientific journals, and reputable industry publications to ensure regulatory and technical accuracy. Additionally, a systematic review of patent filings, clinical study registries, and digital health platforms provided insight into innovation pipelines and adoption trajectories.

Quantitative data was analyzed using standardized frameworks for SWOT and PESTLE assessments, while qualitative insights were coded to identify recurring themes and strategic imperatives. The iterative validation process with advisory board members reinforced the credibility and applicability of the conclusions presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dietary Supplements market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dietary Supplements Market, by Product Type

- Dietary Supplements Market, by Formulation

- Dietary Supplements Market, by Packaging Type

- Dietary Supplements Market, by Ingredient Source

- Dietary Supplements Market, by Application

- Dietary Supplements Market, by End User

- Dietary Supplements Market, by Distribution Channels

- Dietary Supplements Market, by Consumer Group

- Dietary Supplements Market, by Region

- Dietary Supplements Market, by Group

- Dietary Supplements Market, by Country

- United States Dietary Supplements Market

- China Dietary Supplements Market

- Taiwan Dietary Supplements Market

- Poland Dietary Supplements Market

- Competitive Landscape

- List of Figures [Total: 22]

- List of Tables [Total: 3059 ]

Summarizing Core Findings and Reflections to Guide Strategic Decision Making in the Global Dietary Supplements Ecosystem

In conclusion, the dietary supplements industry stands at an inflection point where technological innovation, regulatory evolution, and shifting consumer values converge to create both opportunities and challenges. The imperative for agility is underscored by digital transformation, trade policy uncertainty, and sustainability demands.

Stakeholders who effectively harness personalized nutrition platforms, diversify supply chains, and uphold rigorous standards for product safety and transparency will be best positioned to thrive in this competitive landscape. As the convergence of health and technology accelerates, companies must remain vigilant to emerging trends and responsive to evolving regulatory environments.

Ultimately, collaboration across scientific, policy, and commercial domains will define the next phase of growth, enabling the development of novel formulations and business models that deliver tangible health benefits and reinforce consumer trust. By adopting the actionable recommendations outlined, industry participants can chart a path to sustained success and meaningful impact.

Engage with Ketan Rohom to Secure Your Comprehensive Market Research Report and Uncover Actionable Insights for Sustained Growth

To secure full access to comprehensive market insights, custom analysis and in-depth strategic guidance, readers are encouraged to contact Ketan Rohom Associate Director Sales & Marketing. His expertise can facilitate tailored solutions that align with your organization’s specific objectives and unlock pathways for growth.

Engage now to explore how this research can support your strategic planning, product development and market expansion efforts. The robust data and expert perspectives contained in the full report provide a foundation for informed decision making and enduring competitive advantage.

- How big is the Dietary Supplements Market?

- What is the Dietary Supplements Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?