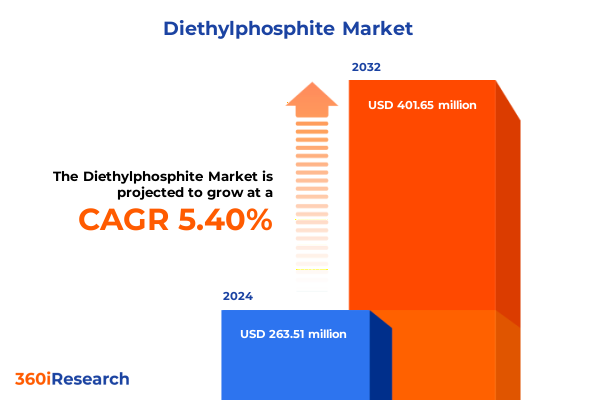

The Diethylphosphite Market size was estimated at USD 276.93 million in 2025 and expected to reach USD 291.24 million in 2026, at a CAGR of 5.45% to reach USD 401.65 million by 2032.

An In-Depth Introduction to Diethyl Phosphite Unveiling Its Unique Molecular Attributes Versatile Industrial Applications and Emerging Research Drivers

Diethyl phosphite, the organophosphorus compound with the molecular formula C₄H₁₁O₃P, stands out as a versatile liquid reagent prized for its reactivity in P–H bond transformations and moderate safety profile. Recognized under CAS number 762-04-9, it serves as a cornerstone intermediate in organic synthesis, facilitating the generation of phosphonate esters, phosphine ligands, and specialty phosphorus-based materials. Its colorless to pale yellow appearance belies its pivotal role in enabling a spectrum of chemical pathways from the Staudinger reaction to Horner–Wadsworth–Emmons olefinations.

With a boiling point of approximately 204 °C at standard atmospheric pressure and a density of 1.072 g/cm³, diethyl phosphite demonstrates excellent solubility in both polar and nonpolar organic solvents. These physicochemical attributes, combined with its stable P=O bond and accessible P–H functionality, have catalyzed its adoption across diverse end-use sectors. Today, diethyl phosphite is instrumental in formulating flame retardants, serving as a key precursor for phosphate ester plasticizers and as a reactive component in corrosion inhibitors, while its low toxicity relative to analogous organophosphorus compounds enhances its suitability for pharmaceutical intermediate synthesis.

Unprecedented Shifts Reshaping Diethyl Phosphite Through Green Chemistry Innovations Digital Supply Chains and Regulatory Evolution in 2025

The landscape of diethyl phosphite has undergone a series of transformative shifts driven by the convergence of green chemistry imperatives, digital supply chain frameworks, and evolving regulatory mandates. Industry stakeholders are increasingly prioritizing bio-based and halogen-free flame retardant formulations, recognizing the dual benefits of reduced environmental impact and enhanced recyclability. Consequently, research into renewable feedstocks and solvent-free synthetic routes has accelerated, with phosphorus-based intumescent systems emerging as leading eco-friendly alternatives in high-performance plastics and e-mobility applications.

Simultaneously, advancements in artificial intelligence and digital twin technologies are reshaping how producers forecast demand, optimize production parameters, and enhance quality control. Integrating machine learning algorithms into manufacturing operations is yielding productivity gains and reducing process variability, while blockchain-enabled traceability tools are fostering transparency across phosphorus sourcing and carbon footprint metrics. Concurrently, stringent fire safety standards and circular economy objectives are influencing investor and OEM procurement decisions, further embedding sustainability at the core of product development strategies.

Assessing the Cumulative Impact of United States Tariffs on Diethyl Phosphite with USITC Anti-Dumping Rulings Countervailing Duties and Trade Policy Shifts

United States trade policy has imposed a cumulative series of tariff measures on diethyl phosphite and related alkyl phosphate esters, materially affecting cost structures and supply chain strategies. Beginning with Section 301 duties targeting a broad range of Chinese chemical imports in 2018 and intensifying through multiple tariff lists, U.S. chemical manufacturers faced average duty rates doubling up to 25 percent on select intermediates. Despite exclusions granted for critical industrial inputs, these measures increased input costs, strained distributor margins, and prompted many downstream users to accelerate sourcing diversification efforts.

In May 2025, the U.S. International Trade Commission concluded that imports of alkyl phosphate esters, including diethyl phosphite, from China were sold below fair value and subsidized by the Chinese government, initiating countervailing and anti-dumping duty orders. The anticipated duties-ranging from 5 percent to 20 percent-are expected to be formalized by mid-2025, further elevating landed costs and catalyzing shifts toward domestic production and European supply sources. As a result, U.S. producers are revisiting capacity expansions, while end-users reassess long-term contractual terms to mitigate future tariff volatility.

Analysis of Diethyl Phosphite Market Segmentation Covering Application End Use Industry Type Grade and Sales Channel Dynamics Shaping Demand Trends

Analysis of diethyl phosphite market segmentation underscores the compound’s multifaceted role across diverse applications and industry verticals. Within the agricultural domain, its utilization pathways extend from fertilizer enhancement to precision herbicides and specialty pesticides, offering tailored performance benefits. In the flame retardant sector, polymer coatings and resin additives leverage its phosphorus content to meet stringent fire safety standards, whereas in lubrication chemistry, both engine oils and industrial lubricant formulations capitalize on its anti-wear and anti-oxidation properties. Metal treatment processes similarly deploy diethyl phosphite in corrosion inhibition and scale preventive systems, while the pharmaceutical industry integrates it into API synthesis and intermediate manufacturing. Meanwhile, plasticizer blends for PVC heavily rely on its ester functionality to improve polymer flexibility and durability.

Further dissection reveals divergent end-use demands across major sectors: agriculture, lubricants, metal processing, pharmaceuticals, and plastics. Product formats such as diesters, mixed esters, and monoesters attract distinct customer profiles based on reactivity and purity requirements. Grade preferences range from Industrial to Technical offerings, with Reagent classifications further bifurcated into Analytical and Laboratory grades to satisfy specialized research and quality assurance needs. Sales channels exhibit a tiered distribution landscape: direct engagements facilitate custom volume contracts, national and regional distributor networks ensure broad product availability, and online retail platforms serve niche research and low-volume procurement models.

This comprehensive research report categorizes the Diethylphosphite market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Grade

- Application

- End Use Industry

- Sales Channel

Regional Perspectives on Diethyl Phosphite Uncovering Demand Drivers and Growth Opportunities in the Americas Europe Middle East Africa and Asia Pacific

Regional perspectives on diethyl phosphite uncover differentiated growth narratives and strategic imperatives across the Americas, Europe, the Middle East, Africa, and Asia-Pacific. In the Americas, robust pharmaceutical and agrochemical production in the United States, Brazil, and Argentina underpins steady demand, while localized R&D initiatives in Canada are driving high-purity reagent consumption. Regulatory frameworks and sustainability mandates across key markets are shaping procurement guidelines, compelling suppliers to demonstrate traceability and environmental stewardship in supply chain operations. Meanwhile, Europe, the Middle East, and Africa collectively navigate stringent REACH regulations, harmonized fire safety standards, and emerging industrialization trends. Germany’s fine chemical sector leads in high-purity grade adoption, whereas growth corridors in the Gulf Cooperation Council and South Africa reflect rising infrastructure investments and agrochemical deployments.

Asia-Pacific remains the dominant regional hub, accounting for over 43 percent of global production capacity, anchored by China’s manufacturing scale and India’s expanding crop protection industry. Continuous capacity expansions in Jiangsu and Zhejiang provinces, coupled with government incentives for green chemical initiatives, bolster regional export competitiveness. This concentration has prompted downstream stakeholders worldwide to monitor Asia-Pacific output dynamics closely and cultivate alternative supply arrangements to manage geopolitical and logistical risks effectively.

This comprehensive research report examines key regions that drive the evolution of the Diethylphosphite market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles and Competitive Landscape Analysis of Leading Diethyl Phosphite Producers Driving Innovation and Market Growth Globally

The competitive landscape for diethyl phosphite is shaped by both global chemical conglomerates and specialized intermediates producers. Lanxess AG and BASF SE maintain leading positions through integrated production networks and continuous investments in process intensification and sustainability. Eastman Chemical Company differentiates via dual-application product lines optimized for agrochemical and polymer markets, while Merck KGaA advances high-purity grades for pharmaceutical synthesis platforms. In Asia, Shandong Shida Shenghua Chemical Co. spearheads expansion of industrial-grade capacity, supported by government-backed green chemistry programs, and a growing roster of emerging regional players, such as Kishida Chemical and Wego Chemical Group, intensifies competitive dynamics. Throughout this ecosystem, firms are leveraging strategic partnerships, technology licensing agreements, and targeted acquisitions to secure feedstock access and scale novel production technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Diethylphosphite market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema Group

- BASF SE

- Biosynth AG

- Clariant AG

- Dow Chemical Company

- Eastman Chemical Company

- Evonik Industries AG

- Hubei Jinghong Chemical Co., Ltd.

- Huntsman Corporation

- Johoku Chemical Co.,Ltd.

- Lanxess AG

- Merck KGaA

- Mitsubishi Chemical Corporation

- Muby Chem Ltd.

- Nippon Chemical Industrial Co., Ltd.

- NSR Laboratories Pvt Ltd.

- Otto Chemie Pvt. Ltd

- Solvay SA

- Tokyo Chemical Industry Co., Ltd.

- UPL EUROPE LTD

Actionable Recommendations for Industry Leaders Seeking to Navigate Regulatory Challenges Supply Chain Volatility and Sustainability in the Diethyl Phosphite Market

Industry leaders must prioritize strategic initiatives to navigate the evolving diethyl phosphite environment effectively. Actions include diversifying raw material sourcing to mitigate tariff exposures and supply disruptions, while investing in modular production capabilities to scale grades rapidly in response to shifting end-use requirements. Embracing green chemistry principles-such as bio-derived feedstocks and solvent‐minimized processes-can unlock new market segments in electronics, construction, and e-mobility. Moreover, harnessing digital platforms for real-time supply chain visibility and predictive maintenance will foster resilience against logistical bottlenecks. Finally, proactive engagement with regulatory bodies and industry consortia will ensure alignment with upcoming environmental and safety standards, fortifying competitive positioning and long-term sustainability.

Comprehensive Research Methodology Outlining Data Collection Analysis and Validation Processes Underpinning the Diethyl Phosphite Market Research Findings

This analysis synthesizes primary and secondary research methodologies to ensure robust and actionable findings. Secondary sources comprised trade data, tariff schedules, regulatory filings, and peer-reviewed literature, providing quantitative benchmarks and contextual trends. Primary research involved in-depth interviews with industry executives, technical experts, and procurement managers across major end-use sectors, yielding qualitative insights on purchasing behaviors and innovation drivers. Data validation was achieved through triangulation across multiple sources and statistical cross-checks. Analytical frameworks, including PESTLE and SWOT assessments, underpinned strategic interpretations, while segmentation models were calibrated using historical shipment volumes and projected demand indicators. Rigorous quality control measures, including peer reviews and audit trails, guarantee the credibility of all conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Diethylphosphite market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Diethylphosphite Market, by Type

- Diethylphosphite Market, by Grade

- Diethylphosphite Market, by Application

- Diethylphosphite Market, by End Use Industry

- Diethylphosphite Market, by Sales Channel

- Diethylphosphite Market, by Region

- Diethylphosphite Market, by Group

- Diethylphosphite Market, by Country

- United States Diethylphosphite Market

- China Diethylphosphite Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Conclusion Synthesizing Key Insights on Diethyl Phosphite Market Dynamics Strategic Shifts and Future Outlook for Stakeholders Decision Makers and Innovators

This executive summary has elucidated the multifaceted dimensions of the diethyl phosphite market, from its foundational chemical attributes and application breadth to the strategic undercurrents of tariffs, regulatory paradigms, and sustainability transformations. A segmented lens has highlighted how application domains, end-use industries, product types, grades, and sales channels shape demand patterns. Regional analyses underscore the primacy of Asia-Pacific production prowess, tempered by resilient opportunities in the Americas and EMEA. Competitive insights reveal a dynamic field where incumbents leverage scale and innovation, and new entrants drive process and formulation advancements. As industry stakeholders contemplate investment, capacity planning, and partnership strategies, the confluence of digitalization, green chemistry, and trade policy will decisively influence market trajectories.

Empowering Strategic Decisions Contact Ketan Rohom Associate Director Sales Marketing to Secure Your Diethyl Phosphite Market Research Report Today

Engaging with a seasoned market research expert can transform your strategic planning and operational execution. By securing a comprehensive report tailored to the diethyl phosphite landscape, you will gain unparalleled insights into supply chain resiliency, regulatory trajectories, and competitive positioning. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to request a personalized overview of how this research can empower your next decision and drive sustainable growth in the evolving organophosphorus chemicals sector.

- How big is the Diethylphosphite Market?

- What is the Diethylphosphite Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?