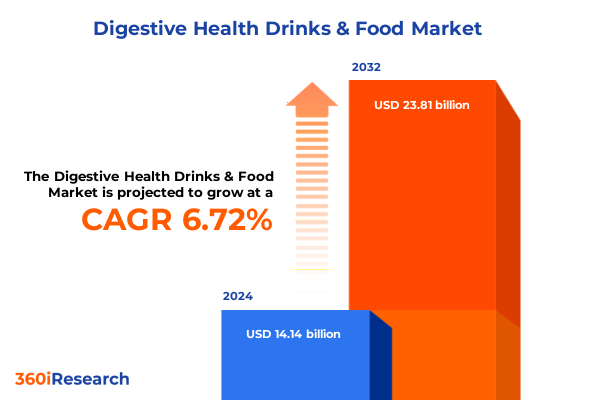

The Digestive Health Drinks & Food Market size was estimated at USD 15.02 billion in 2025 and expected to reach USD 15.95 billion in 2026, at a CAGR of 6.80% to reach USD 23.81 billion by 2032.

Setting the Stage for Digestive Health Innovation by Examining Core Consumer Motivations, Nutritional Trends, and the Evolving Landscape of Functional Beverages and Foods

Digestive health has emerged as a cornerstone of modern wellness, propelled by growing recognition of the gut’s central role in overall physical and mental well-being. Consumers are increasingly seeking products that extend beyond basic nutrition, favoring formulations proven to support microbiome balance, reduce discomfort, and bolster immune response. This surge in demand has prompted brands and innovators to explore a breadth of functional beverages and foods, marrying traditional ingredients with cutting-edge biotechnologies.

As the industry matures, stakeholders must navigate a landscape characterized by rapid product launches, sophisticated clinical claims, and heightened scrutiny over ingredient efficacy. Shifting dietary patterns, including the rise of plant-based consumption and clean label preferences, have further catalyzed the evolution of digestive health offerings. Consequently, manufacturers are compelled to harmonize sensory appeal with scientifically validated benefits, crafting solutions that resonate with both health-savvy and mainstream audiences.

This executive summary delves into the fundamental drivers shaping this dynamic sector. We examine the pivotal market shifts, explore the ramifications of recent policy changes, and present segmentation, regional, and corporate insights. Ultimately, the goal is to equip decision-makers with an authoritative overview of critical trends and actionable intelligence to inform strategic investment and innovation roadmaps.

Understanding the Rapid Transformation of Digestive Wellness Solutions Driven by Technological Advances, Scientific Discoveries, Shifting Demographics, and Emerging Consumer Expectations

The digestive health arena has undergone a profound transformation driven by breakthroughs in microbial science, novel fermentation techniques, and the advent of precision nutrition. Where once broad probiotic claims dominated marketing, today’s landscape is defined by highly targeted formulations, harnessing specific bacterial strains and prebiotic substrates tailored to diverse consumer needs. Technological advances in ingredient encapsulation, bioavailability enhancement, and taste masking have enabled more palatable and efficacious products, expanding adoption beyond niche wellness communities.

In parallel, digital health platforms and personalized nutrition services have carved out new channels for consumer education and product customization. Real-time microbiome analysis, app-based dietary tracking, and telehealth consultations have empowered individuals to make data-driven decisions about their gut health. This convergence of wellness and technology has not only increased consumer engagement but also elevated expectations for demonstrable clinical outcomes.

Moreover, sustainability considerations are reshaping supply chain strategies and ingredient sourcing. Brands are increasingly accountable for transparent procurement of dairy and non-dairy constituents, from kefir cultures to inulin-rich root extracts. This shift aligns with broader corporate social responsibility agendas and appeals to eco-conscious consumers. Taken together, these transformative shifts underscore the imperative for agile innovation and evidence-based product development in the digestive health space.

Analyzing the Complex Consequences of Two Thousand Twenty Five Tariff Adjustments on Ingredient Sourcing, Supply Chain Costs, and Pricing Strategies in Digestive Health Portfolios

The introduction of tariff adjustments in two thousand twenty five has exerted a significant influence on digestive health product strategies, particularly in the sourcing of specialty ingredients. Tariffs on imported cultures, botanical extracts, and probiotic concentrates have elevated raw material costs, compelling manufacturers to reassess supplier relationships and regional procurement priorities. As a result, companies are evaluating ingredient portfolios for domestic alternatives, reformulating to maintain cost effectiveness without compromising efficacy.

Supply chain costs have also been affected by elevated duties on packaging materials and ancillary components. This has prompted a reassessment of logistics networks and transportation modes, with a growing emphasis on near-shoring and consolidated shipping arrangements to mitigate financial impact. In turn, pricing strategies have required recalibration, balancing margin protection with competitive positioning in an increasingly price-sensitive environment.

Despite these headwinds, the tariff environment has spurred innovative responses. Collaborative agreements between ingredient suppliers and manufacturers are gaining traction, leveraging shared value models to spread risk. Some organizations have invested in backward integration, establishing pilot fermentation facilities closer to end-markets. These measures demonstrate the sector’s resilience and its capacity to adapt pricing, supply chain, and product development approaches in response to evolving trade conditions.

Unveiling Deep Insights into Product Type, Ingredient Composition, Delivery Form, Target Age Group, and Distribution Dynamics That Shape Digestive Health Consumption Patterns

Insights across product type reveal that drinks and foods each play distinct roles in consumer routines. Within beverages, dairy-based options featuring kefir and yogurt deliver familiar taste profiles alongside live cultures, whereas non-dairy alternatives such as kombucha and probiotic juices cater to plant-centered preferences and offer varied flavor experiences. In the food segment, dairy-derived offerings like cheese and fermented yogurt provide versatile snacking occasions, while non-dairy formats incorporating functional ingredients or nutrient-dense snack bars address on-the-go consumption needs. Recognizing these nuances is key for tailoring marketing narratives and channel strategies.

Examining ingredient composition sheds light on the interplay between prebiotics, probiotics, and synbiotics. Prebiotic substrates, including fructooligosaccharides, galactooligosaccharides, and inulin, support selective microbial growth and are often integrated into powdered or liquid concentrates. Probiotic strains such as bifidobacterium and lactobacillus form the backbone of many formulations, while combination synbiotic blends aim to deliver synergistic benefits. The strategic blending of these ingredients influences product positioning and premiumization potential.

Form factor analysis highlights the importance of delivery mode in driving consumer adoption. Concentrates and ready-to-drink liquids offer convenience, whereas drink mixes and ingredient powders provide dosage flexibility. Solid formats, from nutrient bars to encapsulated and tablet dosage forms, cater to consumers seeking incorporation into daily pill regimens or snack habits. Tailoring form factors to age demographics enhances appeal across adult, child, and geriatric segments.

Understanding distribution dynamics further refines go-to-market approaches. While supermarkets and hypermarkets remain foundational channels, specialty stores and pharmacies offer credibility for clinically oriented products. Online retail platforms provide direct access to end-users and support subscription models, and convenience stores add an immediate grab-and-go option. These overlapping routes underscore the need for omnichannel strategies that align with targeted consumer journeys.

This comprehensive research report categorizes the Digestive Health Drinks & Food market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient Type

- Form

- Age Group

- Distribution Channel

Exploring Regional Nuances in Digestive Health Adoption Across the Americas, Europe Middle East and Africa, and Asia Pacific Through Cultural Influence and Economic Drivers

In the Americas, robust clinical research infrastructure and widespread consumer trust in probiotic science underpin market momentum. Established dairy cooperatives and emerging non-dairy innovators collaborate with universities to validate product claims, further driving mainstream acceptance. Distribution networks ranging from traditional grocery to e-commerce platforms facilitate broad access, while wellness influencers cultivate strong advocacy, particularly in metropolitan hubs.

Across Europe Middle East and Africa, regulatory harmonization efforts and stringent health claim frameworks elevate quality standards. Localized flavor preferences and dairy consumption patterns vary significantly from the Mediterranean basin to northern European markets, necessitating region-specific formulations. In the Middle East, traditional fermented beverages maintain cultural resonance, offering opportunities for reinvention with modern ingredient blends. Africa’s developing retail ecosystems present nascent but growing demand, driven by urbanization and health education initiatives.

Asia Pacific remains the fastest evolving region, balancing deep-rooted fermented food traditions with a surge in modern functional formats. Markets in East Asia exhibit high receptivity to kefir-style drinks and synbiotic supplements, whereas Southeast Asian consumers show growing interest in non-dairy fruit blends enriched with inulin and lactobacillus cultures. Rapid expansion of online grocery and social commerce channels accelerates product discovery, and regional manufacturing hubs support cost-effective production and agile distribution.

This comprehensive research report examines key regions that drive the evolution of the Digestive Health Drinks & Food market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Innovators Driving Strategic Partnerships, Product Development, Investment Trends, and Competitive Positioning in the Digestive Health Sector

Leading dairy producers have leveraged their fermentation expertise to introduce probiotic-enriched drink lines, positioning these SKUs as extensions of their core portfolios. Strategic partnerships between ingredient innovators and established food conglomerates have accelerated go-to-market timelines and facilitated access to premium retail channels. A parallel surge of start-ups focused on synbiotic powders and encapsulated solutions underscores the sector’s entrepreneurial dynamism.

Pharmaceutical companies are also making inroads by applying rigorous clinical development processes to functional foods and beverages, elevating credibility among healthcare professionals. Collaborative research agreements are increasingly common, bridging the gap between medical and nutritional sciences. Private equity investors have shown heightened interest in scalable brands with digital direct-to-consumer models, fueling consolidation activity and fueling capital availability for R&D investments.

Joint ventures between regional manufacturers and global ingredient suppliers are diversifying supply chains and ensuring consistency of live culture potency. This network of alliances spans prototyping labs to pilot production facilities, enabling rapid iteration on novel strain combinations and prebiotic blends. These collaborative approaches illustrate how industry leaders are aligning technical capabilities with market needs to maintain competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digestive Health Drinks & Food market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arla Foods Ingredients Group P/S

- Bayer AG

- BioGaia AB

- Chr. Hansen Holding A/S

- Danone S.A.

- DuPont de Nemours, Inc.

- Fonterra Co-operative Group Limited

- FrieslandCampina N.V.

- General Mills, Inc.

- Herbalife Nutrition Ltd.

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Lactalis S.A.

- Lallemand Inc.

- Meiji Holdings Co., Ltd.

- Mondelez International, Inc.

- Nestlé S.A.

- PepsiCo, Inc.

- Probi AB

- The Coca-Cola Company

- The Kraft Heinz Company

- Yakult Honsha Co., Ltd.

Providing Pragmatic Strategies for Industry Leaders to Capitalize on Emerging Consumer Behaviors, Regulatory Evolutions, and Distribution Channel Innovations in Digestive Health

To capture emerging consumer behaviors, industry leaders should prioritize agile product development frameworks that integrate real-time feedback from digital platforms and health practitioners. Early involvement of microbiome researchers and clinical testing partners ensures robust claims and minimizes time to market. Adopting modular production processes allows swift iteration on formulations and efficient scale-up for successful new launches.

Given the evolving tariff environment and supply chain disruptions, companies must diversify ingredient sourcing through regional supplier networks and consider strategic investments in localized manufacturing assets. Strengthening relationships with co-packers can mitigate capacity constraints, while implementing blended cost-accounting models supports margin stability. Transparent communication of sourcing and sustainability credentials further enhances brand trust.

Finally, leaders should expand omnichannel distribution by integrating online subscription services with retail activations. Leveraging data analytics to personalize consumer engagement and loyalty initiatives will drive repeat purchases. Forming alliances with digital health platforms and wellness influencers can amplify educational efforts and brand visibility, ensuring that digestive health innovations resonate in a crowded marketplace.

Detailing a Robust Research Framework Combining Primary Stakeholder Interviews, Secondary Data Compilation, and Analytical Validation to Ensure Rigor and Credibility

This analysis is grounded in a multi-facet research framework that combines qualitative and quantitative techniques to ensure analytical depth. Primary research comprised in-depth interviews with senior executives, R&D directors, and distribution channel specialists, capturing firsthand perspectives on strategic priorities, innovation pipelines, and market challenges. These insights were triangulated with secondary data drawn from peer-reviewed journals, industry publications, and public trade disclosures to validate emerging trends.

A rigorous data validation process involved cross-referencing proprietary databases and conducting comparative analyses of regional regulatory filings to ensure consistency and reliability. Statistical modeling techniques were employed to detect patterns across segmentation dimensions, while scenario planning workshops with industry experts tested the resilience of key assumptions. The methodological approach emphasizes transparency and replicability, with clear documentation of data sources, interview protocols, and analytical frameworks.

Adherence to ethical research standards and confidentiality agreements with participating stakeholders underpins the credibility of the findings. Continuous peer review and expert panel consultations throughout the project lifecycle have further refined the insights, resulting in a robust, evidence-based foundation for strategic decision-making within the digestive health market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digestive Health Drinks & Food market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digestive Health Drinks & Food Market, by Product Type

- Digestive Health Drinks & Food Market, by Ingredient Type

- Digestive Health Drinks & Food Market, by Form

- Digestive Health Drinks & Food Market, by Age Group

- Digestive Health Drinks & Food Market, by Distribution Channel

- Digestive Health Drinks & Food Market, by Region

- Digestive Health Drinks & Food Market, by Group

- Digestive Health Drinks & Food Market, by Country

- United States Digestive Health Drinks & Food Market

- China Digestive Health Drinks & Food Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Summarizing Key Strategic Takeaways from Market Dynamics, Segmentation Patterns, Regional Variations, and Actionable Imperatives for Digestive Health Investment Decisions

This executive summary has illuminated the dynamic forces reshaping the digestive health beverages and foods landscape. The convergence of scientific innovation, shifting consumer expectations, and regulatory complexities underscores the importance of evidence-driven product strategies. Segmentation analyses reveal diverse opportunities across product type, ingredient blends, delivery formats, age demographics, and distribution channels, highlighting the need for nuanced go-to-market approaches.

Regional evaluations emphasize the importance of tailoring offerings to cultural preferences and regulatory environments, from clinical validation in the Americas to traditional beverage reinvention in the Middle East and high-growth trajectories across Asia Pacific. Company-level insights underscore the value of collaborative R&D partnerships, strategic sourcing alliances, and capital investments in digital engagement models.

Moving forward, industry participants must adopt agile operational and innovation frameworks that accommodate evolving tariff conditions, supply chain volatility, and heightened consumer demands. By integrating the actionable recommendations and leveraging the methodological rigor described herein, decision-makers can craft resilient strategies that capture growth, maximize consumer trust, and establish sustained competitive advantage in the flourishing digestive health market.

Inviting Direct Engagement with an Associate Director to Facilitate Access to the Comprehensive Digestive Health Drinks and Foods Market Insights Report

We invite you to take the next step toward unlocking comprehensive insights and strategic guidance for the rapidly evolving digestive health beverages and foods market by connecting directly with Ketan Rohom, Associate Director, Sales & Marketing. Engaging with this report provides unparalleled access to an in-depth analysis of transformative consumer trends, detailed segmentation evaluations, and regional and company-level intelligence that will empower your decision-making.

Whether you are seeking to refine your product portfolio, optimize supply chain resilience, or launch innovative solutions that address emerging wellness demands, Ketan can guide you through tailored licensing and enterprise subscription options. His expertise in translating complex research findings into actionable strategies ensures you will derive maximum value from the market study. Reach out today to learn how this report can inform your competitive positioning, support stakeholder presentations, and drive sustainable growth in your digestive health business.

- How big is the Digestive Health Drinks & Food Market?

- What is the Digestive Health Drinks & Food Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?