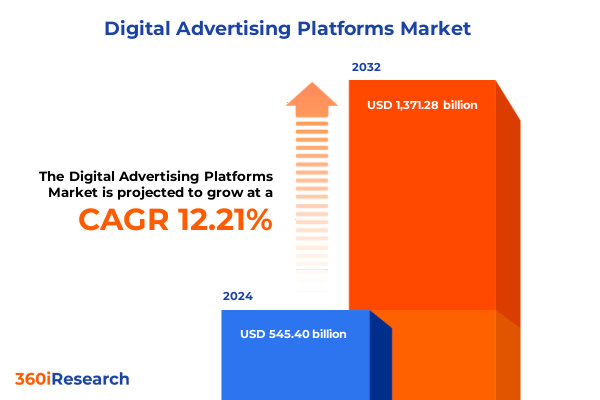

The Digital Advertising Platforms Market size was estimated at USD 612.18 billion in 2025 and expected to reach USD 681.90 billion in 2026, at a CAGR of 12.21% to reach USD 1,371.28 billion by 2032.

Setting the Stage for Future Growth: Understanding the Dynamic Digital Advertising Platforms Landscape and Its Strategic Imperatives

Digital advertising platforms have emerged as the cornerstone of modern marketing strategies, enabling brands to engage audiences across a multitude of digital touchpoints. In today’s fragmented media environment, these platforms facilitate precise targeting by harnessing data collected from user interactions, behavioral signals, and contextual indicators. By leveraging programmatic technologies, marketers can streamline the buying process, optimize real-time bidding, and dynamically tailor creative assets to maximize relevance and impact. As consumer attention increasingly migrates to mobile devices and connected TV, the imperative for platforms that seamlessly integrate multi-format capabilities has never been greater.

The competitive landscape encompasses a range of solutions, from affiliate networks that reward partners for performance to display platforms that deliver visual richness, from search engines that capture intent-driven queries to social channels that foster community-driven engagement. Native advertising has evolved into content recommendation and sponsored content streams that respect user experience, while mobile advertising subdivides into in-app, mobile web, and SMS formats that meet audiences wherever they are. Underpinning these tools, robust analytics and attribution models empower stakeholders to measure engagement, optimize spend, and demonstrate return on marketing investments. Transitioning from tactics to strategic imperatives, digital advertising platforms now serve as the connective tissue that binds customer acquisition, retention, and loyalty initiatives across digital ecosystems.

Navigating Unprecedented Transformation: How Privacy Regulations, AI Innovation, and Cross-Channel Integration Redefine Digital Advertising Platforms

The digital advertising industry is undergoing a period of transformative evolution driven by regulatory shifts, technological innovation, and changing consumer expectations. Privacy regulations such as the European Union’s GDPR and evolving state-level frameworks in the United States have compelled platforms to adopt privacy-first approaches that emphasize first-party data, contextual relevance, and user consent management. Google’s recent decision to retain third-party cookie controls and postpone standalone prompts under its Privacy Sandbox initiative underscores the tension between regulatory compliance and ecosystem sustainability. Meanwhile, antitrust scrutiny from bodies such as the United Kingdom’s CMA has prompted renewed debates over market concentration and data access, reshaping competitive dynamics across walled gardens and open exchange environments.

Simultaneously, artificial intelligence and machine learning have transcended pilot programs to become foundational capabilities for campaign optimization, creative personalization, and predictive forecasting. Major holding companies and platforms are actively acquiring or investing in specialized AI startups to bolster automated messaging, ROI prediction, and real-time creative assembly. AI-driven algorithmic bidding engines and performance advertising products, exemplified by solutions such as Google’s Performance Max and Meta’s Advantage+ Shopping Campaigns, are rapidly gaining traction by automating media mix optimization and creative testing. These shifts are further accelerated by the proliferation of connected devices and cross-channel attribution models, which demand seamless orchestration of data streams to deliver unified consumer experiences.

Assessing the Ripple Effects of New 2025 Section 301 Tariffs on Digital Advertising Ecosystems and Technology Infrastructure Costs

As of January 1, 2025, the United States Trade Representative finalized tariff increases under Section 301, notably raising duties on semiconductors from 25 percent to 50 percent and imposing similar hikes on solar wafers, polysilicon, and tungsten products imported from China. These adjustments reflect a broader strategic effort to counteract perceived unfair trade practices and bolster domestic manufacturing resilience. While direct imports of advanced chips and related wafer products constitute a fraction of overall supply chain volumes, the downstream implications for digital advertising platforms are significant. Higher hardware costs for servers, networking equipment, and end-user devices translate into increased capital expenditures for platform operators and, ultimately, elevated customer billing rates.

Early indicators suggest that major semiconductor suppliers and equipment manufacturers are recalibrating their investment plans in U.S. production facilities to mitigate tariff risks and sustain capacity expansions, yet elevated tariffs continue to introduce cost volatility and procurement uncertainties. Consequently, platforms reliant on high-performance computing infrastructure-such as programmatic exchanges, real-time analytics engines, and AI-driven creative assemblers-may encounter margin compression as supply chain expenses rise. To offset these pressures, platform providers are exploring diversified sourcing strategies, forging partnerships with alternative foundries, and accelerating cloud migration to leverage economies of scale and geographic arbitrage. These adaptive responses underscore the intricate interplay between trade policy and digital advertising economics.

Unveiling Critical Segmentation Highlights That Illuminate Market Nuances Across Platform, Device, Deployment, Organizational and Vertical Dimensions

Insights drawn from a comprehensive segmentation framework reveal nuanced opportunities and challenges across multiple dimensions of the digital advertising platforms market. Platform type analysis shows that mobile advertising continues to outpace legacy channels, with in-app formats capturing deeply engaged audiences and SMS advertising offering direct, permission-based communication. Native advertising has matured beyond simple sponsored posts into sophisticated content recommendation engines that seamlessly integrate brand messages into editorial flows, while search and social channels remain indispensable for intent-driven and community-centric engagement respectively. Affiliate and display networks, though more established, are innovating through dynamic creative optimization and contextual intelligence to maintain relevance.

Device type segmentation highlights the enduring importance of smartphone and tablet ecosystems for on-the-go engagement, even as desktop experiences persist for high-consideration tasks such as research and B2B interactions. Deployment mode analysis underscores the strategic pivot toward cloud-based solutions for scalable compute resources, real-time data processing, and streamlined updates, although on-premises deployments retain appeal for organizations with stringent data residency or compliance requirements. Organizational size segmentation differentiates the agility of small and medium enterprises, which leverage turnkey platforms with self-service interfaces, from large enterprises that integrate custom APIs and bespoke data integrations. Vertical-specific segmentation points to divergent adoption trajectories: technology and retail sectors prioritize personalization and omnichannel attribution, BFSI emphasizes stringent security and compliance features, while healthcare and automotive invest in patient-centric and in-vehicle engagement use cases.

This comprehensive research report categorizes the Digital Advertising Platforms market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Device Type

- Deployment Mode

- Organization Size

- Industry Vertical

Exploring Distinct Regional Dynamics That Shape Digital Advertising Strategies Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert a profound influence on the adoption and evolution of digital advertising platforms. In the Americas, the United States leads in digital ad spend sophistication, driven by advanced programmatic ecosystems, robust measurement frameworks, and early adoption of AI-powered performance tools. Canada and Latin American markets are following suit with accelerated mobile-first strategies, localized content innovation, and regulatory frameworks aimed at data privacy harmonization.

Across Europe, Middle East, and Africa, GDPR and analogous data protection laws serve as both guardrails and catalysts for privacy-first advertising solutions, encouraging investment in identity resolution technologies and contextual targeting methods. Western European markets benefit from established cross-border media exchanges, whereas Middle Eastern and African regions demonstrate rapid growth in smartphone penetration and social media monetization, spurring localized platform partnerships and regional ad networks.

In Asia-Pacific, high growth rates are propelled by digital-native user bases, burgeoning e-commerce ecosystems, and government-led digitalization initiatives. Markets such as China, India, and Southeast Asia showcase innovative formats-live commerce, super-apps, and immersive short-form video-that are reshaping engagement paradigms. Moreover, regional players are investing heavily in AI and machine learning to tailor campaigns for diverse languages and cultural nuances, positioning the Asia-Pacific region as a pivotal frontier for next-generation digital advertising platforms.

This comprehensive research report examines key regions that drive the evolution of the Digital Advertising Platforms market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Maneuvers Driving Innovation, Partnerships, and Competitive Differentiation

The competitive landscape of digital advertising platforms is characterized by a mix of global giants, specialized innovators, and agile challengers. Leading walled-garden providers continue to invest in integrated ad ecosystems that bundle search, social, video, and programmatic capabilities, leveraging first-party data assets and proprietary AI engines. Meanwhile, independent demand-side platforms and data management platforms are differentiating through open-architecture solutions, interoperability partnerships, and advanced analytics modules that empower clients with greater transparency and control.

Strategic acquisitions remain a key avenue for market consolidation and capability enhancement, as evidenced by major holding companies’ targeted investments in AI-focused ad tech startups. At the same time, collaborations between cloud hyperscalers and ad platforms are enabling seamless scalability and real-time data processing, blurring the lines between infrastructure providers and marketing technology vendors. Emerging players are capitalizing on privacy regulatory changes by offering cookieless targeting solutions, contextual intelligence engines, and identity graph services that address fragmentation caused by device proliferation and cross-app tracking restrictions. The resulting ecosystem is dynamic and competitive, with companies vying on performance guarantees, creative personalization, compliance certifications, and end-to-end campaign orchestration features.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Advertising Platforms market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Alphabet Inc.

- Amazon.com, Inc.

- Basis Global Technologies

- Criteo S.A.

- Google LLC

- LinkedIn Corporation

- Magnite, Inc.

- MediaMath, Inc.

- Meta Platforms, Inc.

- Microsoft Corporation

- OpenX Technologies, Inc.

- Pinterest, Inc.

- PubMatic, Inc.

- Simpli.fi

- Snap Inc.

- The Trade Desk, Inc.

- TikTok Pte. Ltd.

- Verizon Media

- X Corp.

- Yahoo

Recommendations for Decision Makers to Leverage Technology Innovation, Privacy-First Practices, and Strategic Partnerships for Competitive Advantage

To thrive in a rapidly evolving environment, industry leaders must adopt a proactive and holistic approach that balances technological innovation with regulatory and consumer expectations. It is imperative to invest in AI-driven platforms that automate media buying, creative personalization, and performance optimization while retaining transparency and auditability to satisfy compliance requirements. Organizations should prioritize first-party data strategies by cultivating direct consumer relationships, deploying zero-party data capture mechanisms, and integrating customer data platforms to enrich contextual targeting.

Furthermore, diversifying channel mixes-spanning search, social, display, video, and emerging formats such as connected TV-enables marketers to mitigate single-channel risk and capitalize on cross-platform synergies. Leaders should also explore hybrid deployment models that combine cloud scalability with on-premises control for sensitive data workloads. Strategic partnerships with identity resolution vendors, privacy orchestration platforms, and advanced analytics providers will be essential to navigate cookieless landscapes and evolving consent frameworks. Finally, fostering cross-functional collaboration between marketing, legal, and IT teams ensures that innovation initiatives align with governance policies and deliver measurable business outcomes.

Detailing Robust Mixed-Method Research Methodology Integrating Primary Qualitative Insights and Secondary Data Triangulation for Comprehensive Market Analysis

This research employs a rigorous mixed-method approach to ensure analytical depth and reliability. Primary research encompassed in-depth interviews with senior executives at leading digital advertising platforms, advertising agencies, and technology vendors, providing firsthand insights into strategic priorities, investment drivers, and adoption challenges. Complementing these qualitative discussions, a series of structured surveys captured detailed feedback from brand marketers across North America, Europe, and Asia-Pacific, quantifying preferences regarding platform capabilities, deployment models, and service expectations.

Secondary research involved comprehensive reviews of regulatory filings, industry association reports, corporate press releases, and publicly available financial disclosures to contextualize market developments and validate emergent trends. Data triangulation techniques were applied throughout the analysis to reconcile insights from disparate sources, ensuring consistency and addressing potential bias. Additionally, proprietary databases were leveraged to track merger and acquisition activity, funding rounds, and technology patent filings, offering a forward-looking perspective on innovation trajectories. This methodology underpins the report’s strategic frameworks, segmentation analyses, and actionable recommendations, delivering a robust foundation for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Advertising Platforms market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Advertising Platforms Market, by Platform Type

- Digital Advertising Platforms Market, by Device Type

- Digital Advertising Platforms Market, by Deployment Mode

- Digital Advertising Platforms Market, by Organization Size

- Digital Advertising Platforms Market, by Industry Vertical

- Digital Advertising Platforms Market, by Region

- Digital Advertising Platforms Market, by Group

- Digital Advertising Platforms Market, by Country

- United States Digital Advertising Platforms Market

- China Digital Advertising Platforms Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Strategic Takeaways on Market Evolution, Segmentation Insights, and Growth Opportunities Within the Digital Advertising Platforms Universe

As digital advertising platforms continue to evolve under the influence of privacy regulation, AI advancement, and shifting consumer behaviors, stakeholders must remain agile to seize emerging opportunities. The interplay of higher hardware costs driven by trade policy, regional heterogeneity in regulatory approaches, and intensifying competition among platform providers underscores the necessity for adaptive strategies. By embracing innovation in AI-enabled automation, prioritizing privacy-compliant targeting, and leveraging nuanced segmentation insights, organizations can fortify their competitive positioning and drive sustainable growth.

Looking ahead, the convergence of advanced analytics, identity resolution, and creative personalization will define the next frontier of engagement, with platforms that deliver seamless cross-channel experiences poised to lead the market. Executives and marketers should harness the strategic recommendations and segmentation frameworks presented herein to refine investment roadmaps, optimize channel allocations, and foster collaborations that unlock new revenue streams. Ultimately, success in this dynamic landscape will be determined by the ability to integrate technological capabilities with a deep understanding of consumer expectations, regulatory compliance, and regional market nuances.

Unlock indispensable strategic intelligence by connecting with Ketan Rohom to secure the comprehensive digital advertising platforms market research report

For organizations seeking to navigate the complexities of the digital advertising ecosystem and capitalize on emerging trends, securing the full market research report offers unparalleled value. By partnering with Ketan Rohom, Associate Director of Sales & Marketing, you gain direct access to in-depth analyses, proprietary segmentation frameworks, and expert recommendations tailored to your strategic objectives. This comprehensive dossier delves into the nuances of platform evolution, regulatory impacts, regional dynamics, and competitive positioning, enabling your team to craft data-driven roadmaps and optimize investment decisions. Reach out to Ketan today to discuss customized licensing options, explore enterprise subscription models, and unlock the strategic insights that will propel your digital advertising initiatives forward.

Connect with Ketan Rohom and take the critical step toward transforming market intelligence into tangible growth and competitive advantage.

- How big is the Digital Advertising Platforms Market?

- What is the Digital Advertising Platforms Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?