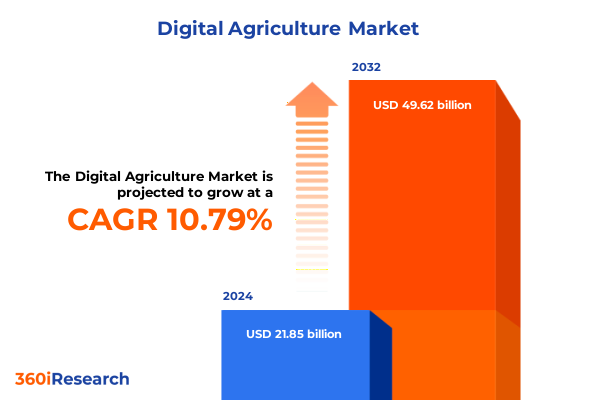

The Digital Agriculture Market size was estimated at USD 24.08 billion in 2025 and expected to reach USD 26.58 billion in 2026, at a CAGR of 10.88% to reach USD 49.62 billion by 2032.

How Advanced Digital Technologies Are Revolutionizing Agricultural Practices and Driving Unprecedented Efficiency Across Modern Farming Operations

Digital agriculture stands at the forefront of a new era in farming, harnessing the power of advanced technologies to transform traditional practices into highly efficient, data-driven processes. Farmers and agribusinesses are increasingly adopting interconnected sensors, autonomous machinery, and cloud-based platforms to monitor crop health, manage resources, and predict outcomes with unprecedented precision. As a result, irrigation scheduling can be optimized to conserve water, input applications can be tailored to specific field zones, and yield potential can be maximized through real-time decision support.

Moreover, the integration of artificial intelligence and machine learning algorithms is accelerating the analysis of vast datasets generated by drones, satellites, and in-field sensors. These insights enable proactive risk management against pests, diseases, and weather variability. In this dynamic landscape, stakeholders ranging from technology providers to policy makers must navigate shifting regulatory frameworks, evolving supply chain structures, and varying levels of digital literacy among end users. This executive summary serves as a concise guide to the critical trends, challenges, and opportunities defining digital agriculture’s future.

Exploring the Fundamental Shifts Reshaping the Digital Agriculture Landscape Through Innovative Solutions and Smart Farming Strategies

Over the past decade, digital agriculture has experienced a profound metamorphosis driven by breakthroughs in connectivity, analytics, and robotics. Initially focused on basic data collection through GPS-enabled equipment, the sector has expanded into a complex ecosystem where artificial intelligence autonomously interprets soil moisture patterns, drones perform high-resolution crop scouting, and cloud platforms deliver seamless field-to-fork traceability.

This evolution has been spurred by several key drivers. First, the convergence of IoT devices with low-power wide-area networks has extended connectivity into remote fields, enabling continuous monitoring of environmental conditions. Second, advancements in computer vision allow imaging devices to detect subtle variations in plant vigor, triggering targeted interventions that reduce input waste. Third, the proliferation of mobile applications has democratized access to sophisticated analytics, empowering smallholders and large farms alike to leverage decision-support tools.

Consequently, the landscape is shifting from siloed, reactive operations to integrated, predictive frameworks. Farmers no longer need to wait for manual scouting; instead, they receive real-time alerts when anomalies emerge. Service providers are bundling consulting, system integration, and managed services to support comprehensive digital transformations. As a result, the market encompasses a broad array of offerings-from precision planting equipment to subscription-based agronomic guidance-highlighting the unprecedented variety of solutions available to optimize every stage of the production cycle.

Assessing the Multifaceted Impact of United States Agricultural Tariffs Enacted in 2025 on Domestic Supply Chains and Technology Adoption

In 2025, new United States tariffs on imported agricultural equipment and technology components reshaped supply chain dynamics and influenced adoption rates. For equipment vendors relying on overseas manufacturing, increased duties on drones, imaging sensors, and IoT modules triggered a reassessment of sourcing strategies. Companies responded by accelerating local assembly initiatives and exploring tariff engineering to minimize duty exposure through product redesign and strategic part sourcing.

These tariff measures also exerted pressure on pricing structures. End users faced higher capital costs for cutting-edge machinery, which temporarily decelerated procurement cycles and prompted many to extend equipment lifecycles through enhanced maintenance and refurbished assets. Concurrently, domestic technology integrators and service providers capitalized on the shift by expanding their portfolios of locally assembled or developed solutions, thereby reducing dependency on imports and cushioning price inflation.

Furthermore, the ripple effects of these tariffs extended to after-sales support and maintenance markets. Technical service providers began sourcing replacement parts domestically or repurposing compatible components to ensure continuity of service agreements. This shift fostered closer collaboration between manufacturers and local distributors to maintain warranty commitments and service level agreements despite tariff-induced cost pressures. Consequently, the industry witnessed a strategic pivot toward supply chain resilience and regionalization, underscoring the importance of diversified sourcing and in-market capabilities in sustaining digital agriculture momentum.

Unlocking Critical Segmentation Insights to Understand Product, Service, Technology, and Application Dynamics in Digital Agriculture

Deconstructing the digital agriculture arena through a product-based lens reveals a tripartite framework encompassing hardware, services, and software. Hardware innovations-including advanced cameras and imaging devices that map plant health, drones that expedite field surveillance, and precision GPS and GNSS systems-form the foundational layer for data acquisition. Meanwhile, sensor arrays capture real-time metrics on soil moisture, nutrient levels, and microclimate variables. These tangible assets coalesce to empower agronomists with actionable intelligence.

In parallel, the service segment delivers crucial expertise and operational support. Consulting engagements guide stakeholders through business strategy development, risk management frameworks, and technology implementation roadmaps. Comprehensive support and maintenance packages ensure equipment uptime, while system integration services meld disparate data streams into unified platforms. Together, these service offerings facilitate seamless adoption and maximize return on investment.

On the software front, sophisticated data analytics and AI-driven solutions process the deluge of information to identify patterns, predict disease outbreaks, and optimize input applications. Farm management platforms provide intuitive dashboards and scheduling tools, with specialized modules for livestock monitoring and precision cropping operations. By interweaving these elements, the market manifests as an ecosystem where hardware, services, and software synergize to accelerate digital transformation across diverse farming environments.

This comprehensive research report categorizes the Digital Agriculture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Services

- Technologies

- Farming Type

- Applications

- End User

Analyzing the Evolving Spectrum of Consulting, Managed Services, and Maintenance Strategies Powering Continuous Digital Agriculture Excellence

Analyzing digital agriculture through a service-oriented perspective uncovers a continuum from upfront advisory to ongoing system care. Consulting services offer in-depth analyses encompassing business strategy optimization, risk mitigation, and tailored technology roadmaps that align digital solutions with operational goals. Following implementation, managed services such as data-as-a-service models and infrastructure management deliver scalable support, enabling continuous performance tuning and agronomic insights delivered on subscription.

Subsequently, support and maintenance functions ensure that field equipment and software platforms remain operational and up-to-date. Field equipment maintenance teams perform routine calibrations and component replacements, while software updates integrate the latest analytical algorithms and security patches. Technical support channels act as a lifeline for end users navigating complex system interfaces and troubleshooting emergent issues. This layered service spectrum underscores the importance of both strategic guidance and tactical upkeep in sustaining digital progress.

This comprehensive research report examines key regions that drive the evolution of the Digital Agriculture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Strategic Moves and Innovation Strategies from Leading Digital Agriculture Technology Providers Shaping the Future of the Industry

Technological advancements drive the next frontier of digital agriculture, with artificial intelligence and machine learning leading the charge. Automated decision-making systems leverage predictive analytics to forecast yield outcomes and recommend optimal input strategies. Crop disease detection algorithms employ computer vision to identify early-stage infections, enabling targeted interventions that curtail outbreak spread.

Cloud computing infrastructures underpin these capabilities, delivering robust data storage solutions and remote management systems accessible through software-as-a-service portals. This architecture facilitates seamless collaboration between field operators and agronomists, ensuring that insights flow effortlessly across organizational boundaries. Simultaneously, the proliferation of IoT devices-ranging from autonomous drones conducting aerial surveys to field-mounted sensors and livestock monitoring wearables-continues to enrich data streams, fueling analytics engines with granular, high-frequency observations.

Robotics and automation platforms further amplify efficiency by executing tasks such as variable-rate seeding, robotic weeding, and autonomous harvesting. The synergy between these technologies heralds a future where manual labor is augmented by precision-driven machinery, and decision-making is underpinned by real-time, actionable intelligence from interconnected systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Agriculture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- AGCO Corporation

- AgGateway

- Agreena ApS

- AgriWebb Pty Ltd.

- AKVA group ASA

- Arable Labs, Inc.

- BASF SE

- Bayer AG

- Ceres Imaging, Inc.

- Cisco Systems, Inc.

- CropX Technologies Ltd.

- Deere & Company

- DeLaval by Tetra Laval Group

- DTN, LLC

- Epicor Software Corporation

- Eurofins Scientific

- Farmers Business Network, Inc.

- Farmers Edge Inc.

- Gamaya by Mahindra & Mahindra

- Hexagon AB

- International Business Machines Corporation

- Microsoft Corporation

- PrecisionHawk, Inc. by Field Group

- Raven Industries, Inc. by CNH Industrial N.V.

- Small Robot Company

- Syngenta Crop Protection AG

- SZ DJI Technology Co., Ltd.

- Taranis Visual Ltd.

- TELUS Agriculture Solutions Inc.

- Trimble Inc.

- Vodafone Group PLC

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in Digital Agriculture

When viewed through the lens of farming type, digital solutions branch into two primary arenas-indoor and outdoor cultivation. Indoor farming environments, such as vertical farms and hydroponic operations, rely on environmental control systems, artificial lighting protocols, and nutrient delivery automation to maximize yield per square foot. Data analytics platforms optimize temperature, humidity, and nutrient cycles, ensuring consistent crop quality and minimizing resource consumption.

By contrast, outdoor farming operations contend with variable weather, expansive acreage, and heterogenous soil compositions. Here, geospatial analytics, drone-based scouting, and sensor networks monitor field conditions, enabling segmentation of plots into distinct management zones. Precision farming techniques, such as variable-rate technology, apply seed, fertilizer, and water inputs tailored to each zone’s unique requirements. These approaches enhance resource utilization, reduce environmental impact, and support sustainable production practices across vast landscapes.

Overview of Rigorous Research Methodology Ensuring Data Integrity, Comprehensive Analysis, and Insightful Market Perspectives

Effective adoption of digital agriculture technologies necessitates a multi-pronged strategy. First, invest in interoperability standards that enable seamless integration of devices from different manufacturers. Prioritizing open architectures and common data formats ensures that new solutions can be grafted onto existing systems without costly overhauls. Next, cultivate strong partnerships across the value chain-from equipment makers and software developers to research institutions and extension services-to foster collaborative innovation and accelerate best-practice dissemination.

In parallel, industry leaders should bolster workforce capabilities through targeted training programs. Equipping agronomists, farm managers, and technical teams with digital literacy skills will unlock the full potential of advanced analytics and automated systems. Additionally, embedding sustainability metrics into performance dashboards aligns digital initiatives with environmental stewardship goals, building resilience amid regulatory pressures and societal expectations. Finally, conduct pilot deployments in representative environments to validate technology efficacy and refine deployment models before large-scale rollouts. This iterative approach mitigates implementation risks and ensures that investments deliver measurable operational improvements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Agriculture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Agriculture Market, by Product Type

- Digital Agriculture Market, by Services

- Digital Agriculture Market, by Technologies

- Digital Agriculture Market, by Farming Type

- Digital Agriculture Market, by Applications

- Digital Agriculture Market, by End User

- Digital Agriculture Market, by Region

- Digital Agriculture Market, by Group

- Digital Agriculture Market, by Country

- United States Digital Agriculture Market

- China Digital Agriculture Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3339 ]

Concluding Reflections on the Evolution of Digital Agriculture and the Path Forward for Sustainable, Tech-Driven Farming Solutions

Regional dynamics profoundly influence the adoption and development of digital agriculture solutions. In the Americas, robust investment in precision farming technologies and strong supportive policies drive rapid uptake, particularly in South American grain belts and North America’s specialty crop regions. Meanwhile, Europe, the Middle East, and Africa present a tapestry of maturity levels: European nations focus on advanced automation and sustainability integration, the Middle East emphasizes water-efficient cultivation techniques, and African markets prioritize low-cost, scalable sensor networks to improve smallholder productivity.

In the Asia-Pacific, diverse agricultural landscapes-from high-tech rice paddies in East Asia to vast grain farms in Australia-spur a broad spectrum of digital implementations. Here, public–private partnerships are instrumental in deploying satellite-based monitoring and mobile advisory services across remote regions. Furthermore, multinational technology providers are forming regional hubs to localize solutions, ensuring that climate variability, crop diversity, and regulatory frameworks are accounted for in system design. These regional variations highlight the necessity for agile strategies that align global innovation with localized agricultural realities.

Connect with Ketan Rohom to Secure Your Comprehensive Digital Agriculture Market Research Report and Drive Strategic Growth Today

Engaging with Ketan Rohom, who leads sales and marketing initiatives, provides an opportunity to empower your organization with specialized insights tailored to the unique challenges and opportunities within digital agriculture. By securing this comprehensive market research report, decision-makers gain access to a rich compilation of qualitative and quantitative data, in-depth analyses, and strategic guidance designed to inform technology investments, operational planning, and stakeholder collaboration.

To proceed, connect directly with Ketan Rohom, Associate Director of Sales and Marketing, who will guide you through the report features, customized deliverables, and various licensing options. This conversation will ensure that you receive the targeted intelligence necessary to drive growth, optimize resource allocation, and strengthen competitive positioning within the rapidly evolving digital agriculture landscape. Reach out today to purchase the report and unlock the actionable insights that will shape tomorrow’s farming innovations.

- How big is the Digital Agriculture Market?

- What is the Digital Agriculture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?