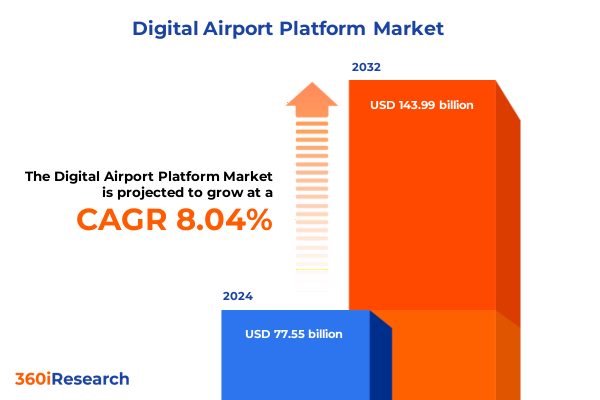

The Digital Airport Platform Market size was estimated at USD 83.56 billion in 2025 and expected to reach USD 90.04 billion in 2026, at a CAGR of 8.08% to reach USD 143.99 billion by 2032.

Charting the Next Frontier of Airport Transformation with Integrated Digital Platforms Shaping Passenger Journeys and Operational Excellence

Air travel is undergoing a profound evolution as airports transition from traditional infrastructure to fully integrated digital ecosystems. This transformation transcends simple technological upgrades, instead ushering in a new era where data, connectivity, and intelligent automation converge to reshape every facet of passenger and operational experience. Seamless check-in processes, real-time resource allocation, and predictive maintenance now form the bedrock of next-generation airport operations, fundamentally challenging long-standing paradigms of service delivery.

Against this backdrop, stakeholders find themselves at the intersection of opportunity and complexity. On one hand, the promise of enhanced efficiency, improved safety protocols, and elevated passenger satisfaction paints an attractive picture for industry leaders. On the other hand, the rapid proliferation of Internet of Things sensors, advanced software platforms, and comprehensive service offerings demands a holistic approach to integration, security, and partnership management.

In crafting a compelling digital airport strategy, decision-makers must weigh an array of interdependent variables, from infrastructure readiness and talent capabilities to regulatory compliance and capital allocation. This executive summary distills the critical insights required to navigate this dynamic landscape, offering a clear roadmap for those committed to pioneering the digital airport revolution.

Unveiling the Tectonic Shifts Driving Airport Digitalization through AI, IoT Integration, and Data-Driven Operational Intelligence

Over the past decade, a series of transformative shifts has propelled digital airport platforms from theoretical constructs to mission-critical enablers. The convergence of edge computing with robust cloud architectures has unlocked unprecedented scalability, allowing airports to process and analyze vast streams of operational data in real time. As a result, resource bottlenecks are alleviated through dynamic allocation of gates, ground vehicles, and workforce scheduling, enhancing throughput and minimizing delays.

Parallel to this technological surge, artificial intelligence algorithms have matured to support sophisticated predictive capabilities. From maintenance forecasting that averts unscheduled downtime to intelligent boarding systems that optimize gate assignments, AI fuels proactive decision-making. Meanwhile, wireless connectivity advancements, including 5G deployments, underpin a new generation of IoT-powered devices ranging from biometric kiosks to autonomous baggage robots, all seamlessly orchestrated through interoperable software frameworks.

Furthermore, rising passenger expectations for personalization and contactless interactions have catalyzed widespread adoption of smart sensors that monitor dwell times, facility usage, and security checkpoints. This data continuity not only elevates traveler convenience but also strengthens homeland security through advanced surveillance integrations. Together, these shifts underscore a relentless march toward airports that are not merely transit points, but intelligent hubs designed to adapt and anticipate.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Digital Airport Hardware, Software Supply Chains and Operational Costs

Beginning in early 2025, the United States implemented an expanded tariff regime targeting key technology imports critical to digital airport ecosystems. Hardware such as IoT devices, networking components, and security sensors now carry elevated duties, affecting major procurement pipelines for airport operators. These levies have induced a recalibration of vendor strategies, with many suppliers redistributing manufacturing footprints to alternative markets or absorbing marginal cost increases to preserve client relationships.

Concurrently, ripple effects have emerged across software and service domains. Platform providers reliant on integrated hardware bundles have encountered compressed margins, leading some to separate software licensing from hardware provisioning to maintain competitive pricing for consulting and integration services. In turn, airports are reassessing total cost of ownership models, factoring in tariff-driven price escalations and potential delays in equipment delivery due to rerouted supply chains.

Yet this environment also presents a catalyst for innovation. Regional partnerships are flourishing as domestic technology firms seek to fill gaps left by restricted imports, accelerating the development of homegrown sensors and networking equipment. Strategic alliances between airports and local integrators now prioritize modular, upgradeable designs to hedge against future trade policy volatility. Ultimately, while the 2025 tariff landscape introduces complexity, it also galvanizes resilience and supply chain diversification across the sector.

Delving into Comprehensive Segmentation Perspectives Illuminating Component, Airport Size, Application, User Type and End-User Dynamics

Understanding the multifaceted digital airport platform market requires a nuanced examination of its constituent components, operational settings, functional applications, end-user interactions, and user demographics. Hardware, encompassing IoT devices, networking infrastructure, security appliances, and sensor arrays, forms the tangible backbone that captures and transmits data throughout airport environments. Services extend this foundation through consulting, system integration, and ongoing support and maintenance, ensuring that each technological element aligns with evolving operational needs. Software orchestrates these layers via airport management suites, operational control systems, passenger engagement platforms, revenue management modules, and security oversight applications.

Airport operators at sprawling international hubs prioritize scalable solutions that handle millions of annual passengers, while medium and smaller regional airports seek cost-effective, modular deployments that can expand as traffic grows. Communication and collaboration platforms facilitate coordinated responses among ground staff, air traffic controllers, and security personnel, whereas passenger flow management tools focus on reducing queue times and enhancing wayfinding experiences. Retail and concessions management systems optimize space utilization and drive ancillary revenue, and security and surveillance applications integrate video analytics with biometric screening to fortify safety protocols.

Within this ecosystem, distinct user groups emerge: airport authorities orchestrating daily operations, travelers interacting with self-service touchpoints, and third-party service providers installing and maintaining critical infrastructure. End-user access spans airside maintenance crews overseeing runway inspections, landside personnel managing parking and transport, and terminal-side teams ensuring that departure lounges, duty-free outlets, and boarding gates function seamlessly. By synthesizing insights across these dimensions, stakeholders can tailor investments to where they yield the greatest operational, financial, and experiential returns.

This comprehensive research report categorizes the Digital Airport Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Airport Size

- Application

- User Type

- End-User

Revealing Distinct Regional Narratives Shaping Digital Airport Platform Adoption and Innovation Across Americas, EMEA and Asia-Pacific Hubs

Regional dynamics profoundly influence the pace and nature of digital airport platform adoption. In the Americas, large hubs in the United States and Canada are early adopters, channeling investment into AI-driven resource allocation, touchless biometrics, and advanced baggage handling to accommodate burgeoning passenger volumes and stringent security mandates. Latin American airports, meanwhile, focus on modular service models that can scale rapidly without substantial upfront capital, often partnering with regional integrators for localized support.

Across Europe, Middle East, and Africa, the emphasis remains on interoperability and regulatory compliance. European Union member states champion GDPR-aligned data architectures and cross-border collaboration networks that enable seamless passenger flows among Schengen area points of entry. Gulf carriers drive high-profile smart airport initiatives, incorporating robotics and 5G-enabled tracking for luxury traveler segments. Meanwhile, emerging African airports deploy cloud-native solutions to leapfrog legacy constraints, adopting mobile-first platforms tailored to low-bandwidth environments.

In the Asia-Pacific region, high-growth markets from Southeast Asia to Australasia pursue next-generation runway management and digital concierge services, while mega-hubs in China, Singapore, and Australia invest heavily in integrated ecosystem platforms. These efforts often involve multi-stakeholder consortiums that pool public-private funding to deliver end-to-end digital transformations. Collectively, these regional narratives demonstrate how localized priorities and regulatory frameworks shape the evolution of airport digitalization around the globe.

This comprehensive research report examines key regions that drive the evolution of the Digital Airport Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves, Partnerships and Technological Breakthroughs from Leading Digital Airport Platform Providers and Innovators

The digital airport platform arena is populated by a diverse array of technology and service leaders, each bringing unique strengths and strategic focus areas. Industry stalwarts specializing in airport management suites have expanded their footprints through targeted acquisitions, bolstering capabilities in revenue optimization and passenger engagement. Concurrently, network equipment manufacturers have forged alliances with cloud service providers to deliver edge-optimized connectivity that supports latency-sensitive applications such as biometric kiosks and autonomous vehicles.

Meanwhile, pure-play software vendors are intensifying investment in AI and machine learning, embedding advanced analytics within their operational control modules to predict maintenance needs and forecast passenger flows. Security technology companies have broadened their portfolios by integrating video analytics, access control, and cybersecurity services, catering to airports’ demand for holistic safety frameworks. Service integrators and consulting firms, drawing on deep domain expertise, focus on end-to-end deployment and lifecycle management, facilitating rapid rollouts and minimizing disruption.

New entrants are carving niches with disruptive offerings. Start-ups delivering mobile-first passenger engagement solutions emphasize modular APIs that integrate seamlessly with legacy systems, while hardware innovators are exploring low-power sensor networks to enhance asset tracking across expansive airside environments. These competitive dynamics drive continuous innovation, compelling established vendors to refine their value propositions and collaborate with ecosystem partners to maintain relevance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Airport Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- ALVEST Group by Ardian

- Amadeus IT Group SA

- Ascent Technology, Inc.

- Cisco Systems, Inc.

- Daifuku Co., Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- IBS Software

- Infax, Inc.

- INFORM GmbH

- International Business Machines Corporation

- Leidos, Inc.

- Move Agency

- NEC Corporation

- Passur Aerospace, Inc.

- QinetiQ Group

- Raytheon Technologies Corporation

- Siemens AG

- SITA by ATPCO

- TAV Technologies

- Thales Group

- TIBCO by Cloud Software Group, Inc.

- Veovo

- Wipro Limited

Empowering Industry Stakeholders with Targeted Strategies to Optimize Digital Airport Platforms and Drive Sustainable Competitive Advantage

To capitalize on emerging opportunities in digital airport transformation, industry leaders must pursue targeted strategies that align technology investments with operational imperatives. First, they should establish centralized governance frameworks that unify disparate data streams across hardware, software, and service domains, ensuring visibility into critical key performance indicators and facilitating rapid, data-driven decision making.

Simultaneously, organizations ought to diversify their supplier base, blending global technology vendors with regional specialists to hedge against supply chain disruptions and tariff-related cost fluctuations. By fostering competitive bid environments, airports can negotiate favorable terms for integrated solutions while maintaining agility to adopt innovative offerings from emerging challengers.

Investing in workforce upskilling is equally essential. As automation and AI permeate control centers and passenger touchpoints, personnel require new proficiencies in data interpretation, cybersecurity awareness, and cross-functional collaboration. Structured training programs, coupled with strategic partnerships with academic institutions, will cultivate the talent pipeline needed to sustain long-term digital maturity.

Finally, industry stakeholders should adopt a phased deployment approach, prioritizing high-impact pilots-such as predictive maintenance solutions for critical ground support equipment-before scaling across broader operational contexts. This incremental pathway mitigates risk, validates technology choices, and builds organizational confidence for subsequent waves of innovation.

Outlining Rigorous Multi-Method Research Approaches Ensuring Data Integrity, Triangulation and Comprehensive Coverage for Digital Airport Platform Analysis

Our research methodology blends rigorous primary and secondary approaches to deliver a holistic understanding of the digital airport platform landscape. We conducted structured interviews with C-level executives, operations managers, technology integrators, and regulatory representatives to capture firsthand perspectives on strategic priorities and deployment challenges. These qualitative insights were complemented by in-depth dialogues with software architects, hardware engineers, and cybersecurity specialists to examine technological roadmaps and integration paradigms.

Simultaneously, we performed comprehensive secondary research, reviewing industry white papers, regulatory filings, and published case studies to map evolving policy frameworks, interoperability standards, and benchmark deployments. This process allowed us to validate primary data against documented implementations, ensuring consistency and credibility.

Quantitative analysis involved triangulating financial disclosures, procurement records, and publicly available performance metrics to identify adoption patterns and cost drivers without relying on proprietary market sizing estimates. Advanced data analytics techniques were applied to detect emerging technology clusters, supplier relationships, and regional adoption variances. Together, these research elements underpin the insights presented in this executive summary, delivering an evidence-based foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Airport Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Airport Platform Market, by Component

- Digital Airport Platform Market, by Airport Size

- Digital Airport Platform Market, by Application

- Digital Airport Platform Market, by User Type

- Digital Airport Platform Market, by End-User

- Digital Airport Platform Market, by Region

- Digital Airport Platform Market, by Group

- Digital Airport Platform Market, by Country

- United States Digital Airport Platform Market

- China Digital Airport Platform Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Core Insights and Strategic Imperatives Guiding Decision-Makers toward the Next Wave of Airport Digitalization Excellence

As airports worldwide strive to enhance capacity, security, and passenger satisfaction, digital platforms have emerged as the linchpin of operational transformation. The integration of IoT hardware, advanced software suites, and specialist services enables a seamless flow of information, empowering stakeholders to anticipate disruptions and optimize resource utilization. This confluence of technologies not only improves day-to-day efficiency but also unlocks new avenues for revenue generation and customer engagement.

Key shifts, from the maturation of AI-driven analytics to the impact of geopolitical trade policies, underscore the importance of adaptive strategies that balance innovation with resilience. Segmentation insights reveal that tailored solutions-whether focused on large international hubs or regional connectors, driven by security or passenger experience imperatives, or tailored to airside versus landside operations-deliver the greatest value. Regional narratives highlight that local regulatory frameworks and infrastructure readiness shape adoption trajectories across the Americas, EMEA, and Asia-Pacific.

Ultimately, industry leaders who embrace a data-centric governance model, diversify their technology partnerships, and cultivate the necessary talent will be best positioned to thrive. By adhering to these strategic imperatives and leveraging the research methodologies outlined, decision-makers can chart a course toward the next wave of airport digitalization excellence.

Engage with Ketan Rohom to Unlock Comprehensive Digital Airport Platform Intelligence and Propel Your Strategic Decisions with Tailored Market Insights

To explore how digital airport technology can redefine your organization’s operational efficiency and enrich passenger satisfaction, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep expertise in customizing research frameworks to address strategic challenges in airport operations. Engaging with him opens the door to a tailored dialogue that aligns your objectives with actionable insights derived from extensive market analysis and stakeholder interviews.

Through a collaborative consultation, you will gain clarity on how to prioritize investments in hardware innovation, software integration, and service models that drive sustainable value. Ketan’s guidance ensures that each recommendation resonates with your organizational goals, whether that involves accelerating self-service deployment, enhancing hands-off baggage processes, or intensifying data-driven decision making in real time.

Take this opportunity to secure a competitive edge in a rapidly evolving landscape. By partnering with Ketan Rohom, you can unlock targeted strategies and in-depth intelligence to inform C-suite discussions, investment decisions, and roadmap prioritization. Reach out today to initiate a focused conversation that will elevate your digital airport transformation journey to new heights.

- How big is the Digital Airport Platform Market?

- What is the Digital Airport Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?