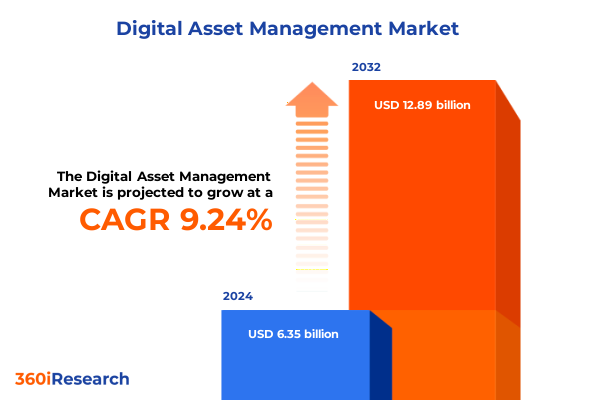

The Digital Asset Management Market size was estimated at USD 6.94 billion in 2025 and expected to reach USD 7.52 billion in 2026, at a CAGR of 9.24% to reach USD 12.89 billion by 2032.

Exploring the Evolving Imperatives of Digital Asset Management Strategies Amidst Rapid Technological Change and Rising Content Demands

The modern enterprise is undergoing a fundamental transformation driven by an exponential rise in digital content creation, mounting demands for richer customer experiences, and an evolving technological fabric that underpins organizational workflows. As organizations navigate dispersed teams, accelerated remote collaboration, and the proliferation of multimedia formats, the management of digital assets has shifted from a tactical initiative to a core strategic imperative. Amidst these pressures, digital asset management solutions have emerged as the connective tissue that binds content generation, distribution, and analytics to deliver coherent brand narratives across every channel.

This introduction examines the convergence of content volume, user personalization expectations, and regulatory requirements that collectively reshape the traditional boundaries of marketing, creative operations, and IT. Centralizing rich media through unified repositories not only enhances cross-functional visibility but also unlocks advanced capabilities such as AI-driven metadata enrichment, automated rights management, and seamless integration with complementary enterprise applications. As organizations strive to harness content as a competitive differentiator, the adoption of digital asset management frameworks becomes a reflection of their broader digital transformation aspirations, prompting leadership to reimagine how assets are governed, shared, and repurposed for maximum business impact.

Uncovering Transformative Shifts Redefining Digital Asset Management Through Automation Intelligence and Collaborative Ecosystems

In recent years, the digital asset management landscape has witnessed a series of transformative shifts that extend far beyond incremental platform enhancements. The rise of artificial intelligence has enabled automated tagging, visual recognition, and context-aware recommendations that drastically reduce manual workloads and accelerate time-to-insights for creative and marketing teams. Concurrently, cloud-native architectures have redefined scalability and uptime, ensuring global, on-demand access to high-resolution media while enabling elastic resource allocation during usage spikes.

The integration of digital asset management platforms into collaboration suites and creative toolchains has also reconfigured traditional workflows. Instead of isolated storage silos, assets now flow seamlessly between ideation, production, review, and approval stages, fostering transparency and accountability across distributed teams. Furthermore, emerging technologies such as blockchain for rights provenance and microservices-based deployment models have introduced unprecedented flexibility, allowing organizations to tailor solutions to specific use cases-whether that involves decentralized content sharing across partner networks or embedding asset management capabilities within customer-facing digital experiences. These converging vectors of automation, modularity, and integration are redefining how enterprises approach content lifecycle management and orchestration.

Analyzing the Cumulative Impact of United States Tariffs on Digital Asset Management Infrastructure and Operational Strategies in 2025

The shift toward more complex digital ecosystems has been compounded by geopolitical and trade dynamics, notably the cumulative impact of United States tariffs on essential IT infrastructure components in 2025. As duties on servers, networking equipment, semiconductors, and storage devices increased, hardware procurement costs have risen significantly. For example, price increases of up to 20 percent for leading server models have been directly attributed to stepped-up tariffs on components manufactured abroad. Similar surcharges of 10 to 15 percent on enterprise routers have created budgetary pressures for network modernization projects.

In addition to discrete hardware categories, broad levies under Section 301 investigations threaten to extend tariffs to devices embedding advanced chips and modules, such as laptops, mobile workstations, and edge appliances. The ripple effect is manifest in supply chain recalibrations, where buyers accelerate orders to lock in pre-tariff pricing or pivot toward domestic manufacturing and alternative suppliers. While on-premises deployments bear the brunt of these costs, the cloud ecosystem is not immune; pass-through pricing adjustments by major cloud providers are beginning to surface in service agreements as they grapple with higher capital expenditures. Consequently, IT and business leaders must balance near-term cost absorption against long-term strategic investments, reexamining procurement strategies and lifecycle management practices to mitigate the financial and operational impacts of an increasingly tariff-driven environment.

Deriving Key Segmentation Insights to Illuminate How Components Deployment and Application Verticals Are Reshaping Digital Asset Management Adoption

A nuanced understanding of market segmentation reveals how digital asset management adoption varies across component types, deployment preferences, organizational scale, application use cases, and industry verticals. The distinction between software platforms and managed services is especially salient as businesses weigh the benefits of turnkey operational support against the customization and control afforded by self-managed solutions. Managed services in hosting and support roles elevate continuity and operational resilience, while professional services in consulting and integration drive tailored implementations that align with unique enterprise architectures.

Deployment type further differentiates adopters, with cloud-first organizations prioritizing rapid time-to-value and global accessibility, while on-premises environments appeal to those with stringent data residency or performance requirements. Organization size also influences uptake: large enterprises leverage extensive governance frameworks and cross-departmental integrations to orchestrate broad-scale implementations, whereas small and medium enterprises often prioritize ease of deployment and cost efficiency in modular, out-of-the-box solutions. On the application front, analytics and reporting capabilities inform data-driven decision-making, asset library and archive functionalities ensure lifecycle governance, collaborative workflow modules enhance productivity, rights management safeguards intellectual property, and version control maintains content integrity through every creative iteration.

Industry vertical dynamics introduce further complexity, as regulatory frameworks, content types, and stakeholder ecosystems shape both functional requirements and ROI expectations. In banking, insurance, and securities, stringent compliance and brand governance demand robust auditing and approval workflows. Healthcare organizations lean heavily on asset interoperability and secure patient privacy controls to manage clinical and marketing content. Media and entertainment companies require high-performance delivery pipelines for Advertising and Marketing Agencies, Film and Television production, Gaming and Animation studios, and Music publishers, each with distinct metadata and rights licensing needs. Retailers focus on rapid merchandising updates, dynamic catalogs, and omnichannel personalization to meet evolving consumer journeys.

This comprehensive research report categorizes the Digital Asset Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Deployment Type

- Organization Size

- Application

- Industry Vertical

Revealing Critical Regional Dynamics Across the Americas EMEA and Asia-Pacific to Guide Strategic Implementation of Digital Asset Management Initiatives

Regional market dynamics underscore how strategic priorities and regulatory environments influence digital asset management implementations around the globe. In the Americas, mature technology infrastructures and advanced cloud ecosystems accelerate the adoption of AI-powered workflows and hybrid deployment models. Leading enterprises leverage centralized repositories to support multi-country brand consistency and streamline content distribution across diverse market segments, often prioritizing data sovereignty and compliance with privacy regulations.

Moving east, Europe, the Middle East, and Africa present a tapestry of regulatory frameworks and digital maturity levels. Data protection mandates such as GDPR compel organizations to invest in robust rights management and access controls. Meanwhile, multi-language and cross-border collaboration requirements drive demand for integrated translation, localization, and metadata tagging solutions. In EMEA’s emerging markets, a growing emphasis on digital transformation fuels interest in cloud-based models that reduce the need for local infrastructure investments.

In the Asia-Pacific region, rapid economic expansion and rising digital consumption spur aggressive adoption of mobile-first and omnichannel strategies. Content collaboration platforms that offer low-latency performance in high-growth markets are in high demand, as organizations strive to deliver multimedia experiences tailored to diverse cultural contexts. Asia-Pacific’s evolving data governance policies further inform deployment decisions, prompting enterprises to evaluate hybrid architectures that balance global connectivity with regional compliance.

This comprehensive research report examines key regions that drive the evolution of the Digital Asset Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Extracting Key Insights on Leading Companies Driving Innovation Evolving Business Models and Partnerships in the Digital Asset Management Ecosystem

Leading providers in the digital asset management ecosystem continue to expand their footprints through product innovation, strategic partnerships, and targeted acquisitions. Market pioneers differentiate themselves with comprehensive cloud-native platforms that integrate AI-driven metadata tagging, automated rights management, and advanced analytics dashboards. Others focus on specialized workflows tailored to creative studios, offering deep integrations with design toolchains and content production pipelines. Strategic alliances with major cloud providers and system integrators enhance solution scalability and reduce implementation complexity for global enterprises.

Partnerships with emerging technology vendors enable the extension of core asset management capabilities into adjacent domains such as e-commerce, marketing automation, and customer experience delivery. This convergence fosters unified platforms that break down silos between marketing, IT, and creative teams, enabling seamless workflows from concept to distribution. Additionally, ongoing investments in open APIs and developer toolkits facilitate custom extensions and low-code integrations, empowering organizations to adapt asset management systems to evolving business needs. As the competitive landscape continues to evolve, companies that demonstrate flexibility, security compliance, and a clear path to ROI differentiation will lead the next wave of digital asset management innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Asset Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acquia, Inc.

- Adobe Inc.

- Aprimo, LLC

- Brandfolder, Inc.

- Bynder B.V.

- Canto, Inc.

- CELUM GmbH

- Cloudinary Ltd.

- Cognizant Technology Solutions Corporation

- Extensis, Inc.

- Filecamp AG

- Frontify AG

- IntelligenceBank Pty Ltd.

- MediaBeacon, Inc.

- MediaValet Inc.

- Nuxeo S.A.

- Open Text Corporation

- Pics.io

- Scaleflex SAS

- Sitecore Holding A/S

Actionable Recommendations for Industry Leaders to Optimize Digital Asset Management Workflows Elevate ROI and Drive Sustained Competitive Advantage

To thrive in the rapidly evolving digital asset management space, industry leaders must adopt a proactive approach that aligns technology investments with overarching business objectives. First, establishing a modular architecture that supports both cloud and on-premises deployments allows organizations to optimize costs, maintain performance SLAs, and adapt to shifting regulatory requirements. By embracing containerization and microservices, enterprises can deploy new features rapidly without disrupting core workflows, ensuring continuous innovation.

Second, prioritizing AI-driven metadata enrichment and intelligent search functionalities enhances content discoverability and accelerates time to value. Automated tagging and recommendation engines reduce manual effort and improve asset reuse across campaigns, maximizing the ROI of stored media. Third, strengthening security and compliance frameworks through role-based access, encryption at rest and in transit, and audit-ready reporting protects intellectual property and safeguards customer trust. Integrating digital rights management capabilities directly into asset lifecycles prevents unauthorized usage and streamlines license tracking.

Additionally, fostering cross-functional collaboration between marketing, creative, and IT stakeholders promotes shared governance models and alignment on performance metrics. Investing in comprehensive training programs and change management initiatives ensures user adoption and sustains the operational maturity of the platform. Finally, continuously benchmarking performance, tracking utilization metrics, and soliciting user feedback enable iterative improvements that keep pace with emerging business requirements.

Illuminating Comprehensive Research Methodology Employed to Ensure Rigor Validity and Insightful Outcomes in Digital Asset Management Market Analysis

The research underpinning this analysis combines rigorous secondary data collection with targeted primary insights to ensure both depth and validity. Secondary sources including industry reports, regulatory filings, and vendor whitepapers were systematically reviewed to map the competitive landscape, technology trends, and geopolitical influences. Tangible data points around pricing impacts, deployment patterns, and adoption drivers were extracted and cross-validated against multiple publicly available sources to mitigate bias and enhance reliability.

Complementing this foundation, primary research encompassed structured interviews with IT decision makers, creative directors, and solution architects across diverse industry verticals. Discussions probed deployment experiences, functional requirements, and strategic priorities, illuminating nuances that pure secondary research may overlook. In addition, surveys of end users and procurement professionals captured attitudinal data on vendor performance, feature preferences, and satisfaction benchmarks.

Data triangulation methodologies were applied to reconcile variances and develop a holistic view of market dynamics. Quality assurance protocols including peer review, editorial oversight, and methodological audits further reinforced the integrity of findings. Finally, segmentation frameworks were constructed to align product capabilities with organizational needs, ensuring that insights remain actionable and directly relevant to key stakeholder groups.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Asset Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Asset Management Market, by Component Type

- Digital Asset Management Market, by Deployment Type

- Digital Asset Management Market, by Organization Size

- Digital Asset Management Market, by Application

- Digital Asset Management Market, by Industry Vertical

- Digital Asset Management Market, by Region

- Digital Asset Management Market, by Group

- Digital Asset Management Market, by Country

- United States Digital Asset Management Market

- China Digital Asset Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Perspectives That Synthesize Core Findings Underscore Strategic Imperatives and Highlight the Path Forward for Digital Asset Management Excellence

This report has synthesized the core drivers, market shifts, tariff impacts, and segmentation insights that define the contemporary digital asset management landscape. As organizations grapple with surging content volumes, evolving compliance mandates, and the accelerating promise of AI, digital asset management platforms emerge as foundational enablers of operational efficiency and strategic differentiation. The interplay between regional market dynamics and deployment choices underscores the need for adaptable architectures capable of balancing global scale with localized requirements.

Leading companies have demonstrated that success hinges on a synergy between technological innovation, ecosystem partnerships, and robust governance frameworks. Those who prioritize AI-driven automation, flexible deployment models, and integrated rights management will be best positioned to capture the full potential of their content assets. Moreover, actionable recommendations around architectural modularity, security hardening, and stakeholder alignment offer a blueprint for sustaining momentum and driving continuous improvement.

Engage with Ketan Rohom to Access the Definitive Digital Asset Management Report and Uncover Actionable Insights for Strategic Market Leadership

Ready to elevate your organization’s digital asset management capabilities with comprehensive insights and strategic guidance, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to explore how this in-depth research report can empower you to drive transformative growth, streamline workflows, and achieve sustained competitive advantage in an increasingly dynamic landscape. Engage in a consultative discussion to access sample chapters, discuss licensing options, and tailor solutions to your unique objectives, ensuring your team leverages actionable intelligence to optimize investments and accelerate time-to-value.

- How big is the Digital Asset Management Market?

- What is the Digital Asset Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?