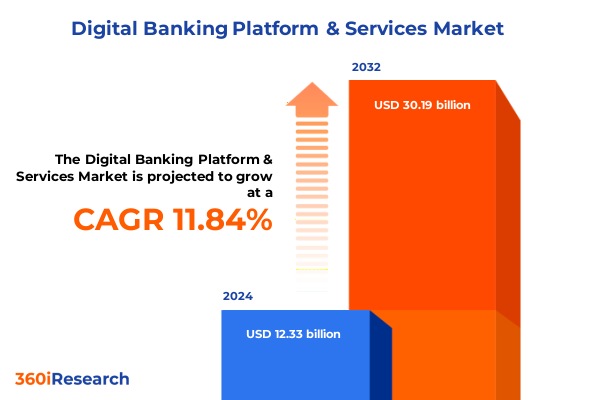

The Digital Banking Platform & Services Market size was estimated at USD 13.82 billion in 2025 and expected to reach USD 15.30 billion in 2026, at a CAGR of 11.80% to reach USD 30.19 billion by 2032.

Setting the Stage for Digital Banking Transformation in a Rapidly Evolving Global Financial Ecosystem Poised for Innovation

In an era defined by rapid technological advancement and shifting consumer expectations, the digital banking sector is undergoing transformative change at unprecedented speed. Traditional financial institutions and fintech challengers alike are racing to deploy platforms that not only facilitate seamless transactions but also deliver personalized, intuitive experiences. Fueled by the increasing ubiquity of mobile devices, rising regulatory demands for transparency and security, and evolving competitive dynamics, these platforms are emerging as critical enablers of organizational resilience and customer satisfaction.

As digitalization becomes a cornerstone of modern banking strategy, institutions are compelled to reimagine legacy systems and operational models. This foundational shift extends beyond mere channel optimization, embracing data-driven decision-making, real-time analytics, and open architecture frameworks. Consequently, market participants are forging new partnerships with technology vendors, accelerating innovation cycles, and prioritizing agile development methodologies.

Against this backdrop, the following analysis provides a concise yet comprehensive overview of the key trends shaping digital banking platforms and services. By examining the structural forces, regulatory interventions, segment-specific drivers, and regional variations that define the competitive landscape, this executive summary equips decision-makers with the insights necessary to navigate complexity, seize emerging opportunities, and achieve sustainable growth.

Unveiling the Pivotal Technological and Regulatory Shifts Redefining Digital Banking Platforms and Services Across the Financial Sector

Recent years have witnessed a convergence of technological breakthroughs and regulatory reforms that together are redefining the contours of digital banking. Advances in artificial intelligence and machine learning have enabled highly personalized customer interactions, from automated credit underwriting to predictive fraud detection. At the same time, distributed ledger technologies are facilitating secure, transparent transaction settlement, reducing operational overhead and enhancing trust.

Moreover, the emergence of open banking APIs is democratizing access to financial services by fostering collaboration among incumbents, fintech startups, and third-party developers. As a result, embedded finance models are proliferating across non-traditional channels, blurring the lines between banking and commerce. In parallel, rising cybersecurity threats and stricter data privacy regulations are compelling institutions to invest in robust security frameworks and compliance monitoring tools.

This section unpacks how these shifts are reshaping business models, driving the adoption of cloud-native architectures, and influencing platform innovation. It highlights the acceleration of digital transformation projects across the industry, underscoring the imperative for leaders to embrace flexible, scalable infrastructures that can adapt to evolving customer demands and regulatory landscapes without compromising on performance or security.

Assessing the Compounded Effects of United States Trade Policies and 2025 Tariffs on Digital Banking Technology Adoption and Infrastructure

The United States’ implementation of new tariffs in early 2025 has introduced a layer of complexity for providers of digital banking platforms and services that rely on imported hardware components and specialized software licenses. As trade duties have been applied to a range of semiconductor products, cloud infrastructure modules, and network equipment, organizations are encountering increased capital expenses for critical system upgrades and expansions.

In response, many institutions are reevaluating supply chain strategies, diversifying supplier networks, and accelerating migration to software-defined infrastructure to mitigate hardware cost inflation. At the same time, localized manufacturing partnerships have gained prominence as a means of reducing exposure to tariff-related supply disruptions. These adaptations, however, require significant planning and risk management resources, especially for larger enterprises with complex, interconnected system architectures.

Regulatory compliance costs have also risen as reporting requirements expand to cover tariff-related disclosures. Decision-makers are balancing the urgency of maintaining seamless customer experiences with the need to optimize cost structures and adhere to evolving import-export regulations. This section assesses how the confluence of trade policy and technology sourcing is reshaping investment priorities, driving operational efficiencies, and influencing the long-term strategic roadmaps for digital banking platforms.

Deriving Strategic Insights from Segmenting Digital Banking Platforms by Offering, Deployment, Customer Type and Diverse End-User Verticals

Insights derived from multiple dimensions of market segmentation reveal differentiated value propositions and deployment considerations for digital banking platforms. When analyzed through the lens of offering, it becomes clear that service-centric solutions excel at delivering tailored consultancy and managed operations, while software-centric models prioritize scalability, feature velocity, and licensing flexibility. This distinction informs procurement strategies, as institutions seeking rapid feature rollout may gravitate toward software subscriptions, whereas those requiring end-to-end support might favor service agreements.

Examining deployment modality highlights the strategic trade-offs between cloud-based environments and on-premise installations. Cloud-native platforms grant organizations the agility to scale resources dynamically and reduce up-front capital commitments, whereas on-premise configurations cater to entities with stringent data sovereignty mandates and legacy integration requirements. These insights guide CIOs in selecting architectures aligned with their risk profiles and performance objectives.

From the perspective of customer type, large enterprises tend to invest in comprehensive, modular ecosystems that can be customized across multiple business units, while small and medium enterprises prioritize cost efficiency and streamlined onboarding processes to minimize operational overhead. Finally, end-user segmentation underscores the nuanced requirements across verticals: banking and financial services demand regulatory reporting and liquidity management capabilities, government agencies emphasize citizen authentication and secure data sharing, healthcare providers require patient-centric privacy controls, insurers focus on automated claims processing, retailers seek loyalty and payment integration, and telecommunications firms explore embedded wallet features and network resilience. Integrating these multifaceted segmentation insights enables more precise solution design and targeted go-to-market initiatives.

This comprehensive research report categorizes the Digital Banking Platform & Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Deployment Type

- Customer Type

- Banking Type

- End-User

Examining Regional Dynamics and Growth Drivers Shaping the Adoption of Digital Banking Platforms Across the Americas, EMEA and Asia-Pacific

Regional analysis of digital banking platform adoption uncovers distinctive growth patterns and regulatory landscapes across key geographies. In the Americas, market participants benefit from mature financial infrastructures and supportive open banking mandates, which have accelerated API-driven collaboration and fintech integration. This environment fosters innovation in mobile banking, digital wallets, and peer-to-peer payment solutions, underpinning strong consumer uptake and investor interest.

Conversely, Europe, the Middle East, and Africa present a mosaic of regulatory frameworks, from the European Union’s comprehensive payment services directives to emerging digital ID initiatives in Africa. These divergent policies shape platform requirements related to authentication, cross-border remittances, and localized compliance, compelling vendors to build modular, regionally adaptive offerings to address heterogeneous market conditions.

Meanwhile, Asia-Pacific stands out as a hotbed for mobile-first financial ecosystems, with super-app architectures and government-backed sandbox environments driving rapid experimentation. In markets such as Southeast Asia and India, partnerships between telcos and banking providers are unlocking financial inclusion through low-cost digital channels. Across every region, regulatory collaboration and technological infrastructure investments remain key determinants of platform success, highlighting the need for agile strategies that accommodate local nuances while leveraging global best practices.

This comprehensive research report examines key regions that drive the evolution of the Digital Banking Platform & Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovation Trends Among Leading Providers of Digital Banking Platforms and Services in the Marketplace

A review of leading players in the digital banking platform landscape reveals a diverse array of strategic approaches. Established core banking system providers continue to strengthen their portfolios through partnerships and acquisitions, integrating advanced analytics and customer engagement modules into legacy solutions. These incumbents leverage deep institutional relationships to secure large-scale implementations and cross-sell value-added services.

At the same time, challenger banks and fintech specialists are gaining traction by prioritizing seamless onboarding, intuitive user interfaces, and rapid product iteration cycles. Their agile development methodologies and direct-to-consumer marketing tactics enable them to capture niche segments and influence broader market expectations around speed and convenience. Additionally, technology vendors offering cloud-native platform-as-a-service solutions are forging alliances with hyperscale infrastructure partners to deliver end-to-end digital banking ecosystems with embedded security and compliance controls.

This dynamic competitive environment has spurred a pattern of co-innovation, as banks, fintechs, and technology providers collaborate to pilot emerging solutions such as embedded insurance, real-time risk scoring, and cross-border settlement engines. By observing these differentiated strategies, stakeholders can identify potential partners, assess competitive threats, and refine their own value propositions in the race to deliver next-generation digital banking experiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Banking Platform & Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alkami Technology Inc

- Backbase B.V.

- Chime Financial Inc

- CREALOGIX Holding AG

- Fidelity National Information Services

- Finastra Group Holdings Limited

- Fiserv Inc

- FNZ Group

- Infosys Ltd

- Intellect Design Arena Limited

- Jack Henry & Associates Inc

- Mambu GmbH

- nCino Inc

- NCR Corporation

- Nu Pagamentos S.A.

- Oracle Corporation

- Plaid Inc

- Revolut Ltd

- SAP SE

- Sopra Steria Group SA

- Stripe Inc

- Tata Consultancy Services Limited

- Temenos Headquarters SA

- Thought Machine Group Ltd

- Worldline SA

Formulating Actionable Strategic Initiatives for Industry Leaders to Capitalize on Emerging Opportunities in Digital Banking Platforms and Services

Industry leaders poised to capitalize on digital banking’s evolving landscape must embrace a set of targeted strategic initiatives. First, investing in artificial intelligence and data analytics capabilities will enable hyper-personalized customer journeys, real-time risk assessment, and operational cost efficiencies. Building a centralized data lake can serve as the foundation for advanced machine learning applications.

Furthermore, establishing open API ecosystems can expand product portfolios through third-party integrations, driving customer stickiness and unlocking new revenue streams. Equally critical is the implementation of a robust cybersecurity framework that incorporates continuous monitoring, threat intelligence sharing, and proactive incident response to safeguard both customer data and institutional reputation.

To balance innovation with regulatory compliance, organizations should consider forming dedicated governance councils that engage directly with policy makers and standard-setting bodies. These forums can accelerate time-to-market for new offerings while ensuring alignment with evolving legal requirements. Finally, fostering a culture of agile product development, supported by cross-functional squads and continuous deployment pipelines, will enhance responsiveness to market feedback and emerging trends, thereby securing competitive advantage over time.

Detailing the Comprehensive Research Methodology and Analytical Framework Employed to Derive Robust Insights into Digital Banking Market Dynamics

This study employs a multi-layered research methodology designed to deliver both breadth and depth of market understanding. Primary research was conducted through structured interviews with senior executives and domain experts, including technology architects, compliance officers, and digital product managers. These conversations provided qualitative insights into strategic priorities, operational challenges, and technology adoption drivers.

Secondary research efforts involved analyzing a broad array of public filings, regulatory publications, and peer-reviewed journals to contextualize industry trends within macroeconomic and policy frameworks. This was complemented by a systematic review of use cases, white papers, and technology vendor disclosures to map out emerging solution capabilities and partnership models.

Quantitative analysis leveraged data normalization techniques and benchmarking to identify performance differentials across deployments and regions. Triangulation of findings was performed to validate insights, supported by an expert advisory panel that reviewed preliminary conclusions and contributed real-world perspectives. The resulting analytical framework integrates trend analysis, competitive mapping, and regional profiling to ensure a comprehensive and actionable portrayal of the digital banking ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Banking Platform & Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Banking Platform & Services Market, by Offering

- Digital Banking Platform & Services Market, by Deployment Type

- Digital Banking Platform & Services Market, by Customer Type

- Digital Banking Platform & Services Market, by Banking Type

- Digital Banking Platform & Services Market, by End-User

- Digital Banking Platform & Services Market, by Region

- Digital Banking Platform & Services Market, by Group

- Digital Banking Platform & Services Market, by Country

- United States Digital Banking Platform & Services Market

- China Digital Banking Platform & Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Core Findings and Strategic Considerations to Illuminate the Path Forward for Stakeholders in the Digital Banking Landscape

Through an integrated examination of technological innovation, regulatory evolution, trade policy impacts, market segmentation, regional variations, and competitive behavior, several key themes emerge. The imperative to modernize legacy infrastructures is underscored by shifting customer expectations for seamless, omnichannel experiences. At the same time, the agility afforded by cloud-based and API-driven architectures is accelerating time-to-value, while maintaining stringent security and compliance postures.

Moreover, differentiated approaches to segmentation highlight the need for flexible platform design, capable of addressing the distinct requirements of varied customer cohorts and end-user verticals. Regional analysis further reinforces that success hinges on local adaptation, guided by regulatory nuances and technological maturity.

Collectively, these findings illuminate a clear path forward for organizations seeking to harness the potential of digital banking platforms: prioritize strategic partnerships, foster innovation through data-driven insights, and implement governance structures that balance speed with compliance. By adhering to these principles, industry participants can position themselves to thrive in a landscape defined by rapid change and intense competition.

Compelling Call to Action for Engaging with Associate Director of Sales and Marketing to Secure the Definitive Digital Banking Market Intelligence Report

To explore the full depth of insights, tailored data, and actionable intelligence on digital banking platforms and services, we invite you to engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise and guidance will ensure you receive a customized overview of how this report can address your organization’s strategic priorities. By connecting with Ketan, you will gain clarity on key market drivers, competitive landscapes, and regional dynamics to support informed decision-making. Don’t miss the opportunity to leverage this comprehensive research for driving growth, enhancing customer experience, and strengthening your technological roadmap in the rapidly evolving digital banking domain.

- How big is the Digital Banking Platform & Services Market?

- What is the Digital Banking Platform & Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?