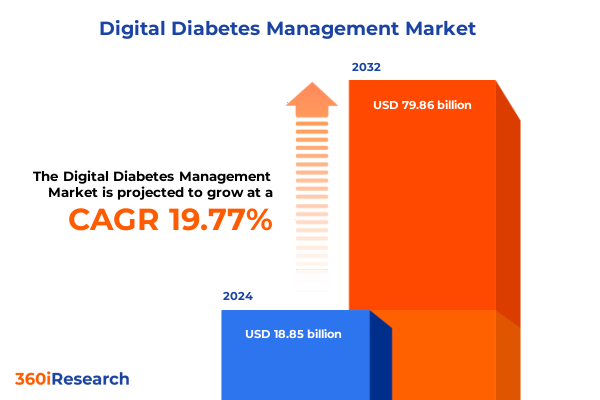

The Digital Diabetes Management Market size was estimated at USD 22.66 billion in 2025 and expected to reach USD 27.25 billion in 2026, at a CAGR of 19.71% to reach USD 79.86 billion by 2032.

Pioneering the Future of Digital Diabetes Management Through Seamless Integration of Cutting-Edge Technologies and Patient-Centric Care Models

The digital diabetes management landscape has undergone a remarkable transformation over the past decade, driven by rapid advancements in sensor technologies, data analytics, and connectivity solutions. Patient empowerment now rests at the heart of diabetes care, enabled by an ecosystem of mobile apps, wearable devices, and cloud-based platforms that deliver real-time glucose insights and personalized therapy recommendations. As healthcare providers and payers seek to improve outcomes while controlling costs, digital tools have emerged as indispensable for enabling proactive, data-driven interventions that reduce complications and enhance quality of life.

This executive summary provides a concise yet thorough exploration of the forces shaping today’s market, highlighting the innovations, regulatory changes, and consumer behaviors that are redefining standards of care. Stakeholders must grasp how the integration of artificial intelligence, telehealth services, and remote monitoring is reshaping care pathways, as well as the strategic importance of interoperability with electronic health records. By understanding these foundational elements, organizations can better position themselves to capitalize on emerging opportunities and address the evolving needs of patients, clinicians, and payers.

Navigating Transformative Shifts in Digital Diabetes Management Driven by AI, Connectivity, and Evolving Patient Engagement Strategies

The anatomy of digital diabetes management is witnessing several transformative shifts that are redefining how stakeholders approach prevention, monitoring, and therapy. Artificial intelligence algorithms are now capable of predicting glycemic trends based on multifactorial inputs such as diet, activity levels, and insulin dosing history, empowering both patients and clinicians with predictive insights that preempt adverse events. Connectivity advancements have enabled continuous glucose monitors and insulin delivery systems to communicate seamlessly, facilitating automated insulin adjustments and reducing the cognitive burden on users.

Simultaneously, patient engagement strategies are evolving from passive data collection to interactive, gamified platforms that encourage adherence through personalized nudges and social support networks. The migration to telehealth and virtual consultations has further expanded access, bridging geographic barriers and integrating diabetes care into home-based monitoring routines. As regulatory bodies worldwide introduce frameworks to standardize digital health validation, the sector is also experiencing a shift toward outcome-based reimbursement models that reward efficacy and long-term patient benefit. These converging trends underscore a new era in which technology, human-centered design, and value-based care intersect to deliver holistic diabetes management solutions.

Assessing the Cumulative Impact of United States Tariffs on Digital Diabetes Management Devices, Software, and Supply Chains in 2025

The United States’ tariff policies in 2025 are exerting multifaceted pressures on the digital diabetes management ecosystem by influencing device costs, software development, and the broader supply chain network. Medical-grade sensors, microchips, and electronic components often originate from international suppliers, making them subject to import duties that can inflate manufacturing expenses and delay product launches. Technology developers and device manufacturers are increasingly seeking alternative sourcing strategies or negotiating long-term contracts to buffer against tariff fluctuations and preserve profitability.

These duties also have downstream effects on provider adoption rates and patient affordability. Clinics and hospitals facing higher procurement costs may defer investments in the latest continuous glucose monitoring systems or automated insulin delivery platforms, while patients could experience elevated out-of-pocket expenses for self-monitoring blood glucose meters and connected health apps. Moreover, software companies that rely on hardware ecosystems find their pricing models challenged when baseline import taxes are recalibrated. To mitigate these risks, stakeholders are advocating for tariff exemptions on critical diabetes management components and exploring domestic manufacturing partnerships to insulate against future trade policy volatility.

Uncovering Actionable Insights from Comprehensive Segmentation of Product Types, Delivery Methods, Users, Applications, and Sales Channels

Segmenting the digital diabetes management market reveals nuanced demand drivers across a spectrum of product types, delivery methods, end users, applications, and sales channels, each demanding tailored strategies to maximize engagement and uptake. In the realm of glucose monitoring devices, continuous glucose monitors appeal to patients seeking real-time insights, while self-monitoring blood glucose meters continue to serve as reliable, cost-effective alternatives. Insulin delivery has bifurcated between automated insulin delivery systems, which emphasize closed-loop functionality, and traditional insulin pumps that prioritize simplicity and affordability.

Similarly, the spectrum of digital tools extends from activity, diet, and sugar-tracking mobile apps to robust clinical decision support systems, where EMR-integrated solutions enable seamless data exchange and standalone platforms drive remote analytics. Delivery method differentiation underscores the importance of selecting between implantable or wearable technology, where integrated continuous glucose sensors and smart patches deliver unobtrusive monitoring and smartwatches offer convenience and lifestyle alignment. Users range from patients managing care at home to clinics and hospitals seeking population-level insights, with each environment influencing device choice, training requirements, and post-sales support needs.

Applications across type 1, type 2, and gestational diabetes present unique clinical and behavioral considerations, requiring adaptive software logic and algorithmic tuning. Finally, sales channels spanning direct partnerships, distributor networks, online retail, and pharmacy outlets shape distribution strategies and margin structures. Understanding the interplay of these layers enables stakeholders to craft targeted value propositions that resonate across professional, consumer, and institutional segments.

This comprehensive research report categorizes the Digital Diabetes Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Delivery Method

- End User

- Application

- Sales Channel

Deciphering Regional Dynamics Shaping Digital Diabetes Management Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional market dynamics are characterized by distinct regulatory environments, healthcare infrastructures, and patient behaviors across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, broad-based reimbursement frameworks and high smartphone penetration accelerate adoption of advanced digital tools, albeit with varying degrees of rural access and provider readiness. U.S. regulatory incentives for real-world evidence generation further encourage the integration of continuous glucose monitoring and telehealth into standard care pathways.

Conversely, Europe Middle East & Africa exhibits a mosaic of reimbursement systems, where some countries leverage national health services to subsidize device costs, while others depend on private insurance models. Diverse socioeconomic conditions necessitate flexible pricing strategies and multi-tiered product portfolios. In the Asia-Pacific region, rapid urbanization and escalating diabetes prevalence drive demand for scalable, low-cost monitoring solutions, while government-led digital health initiatives and public-private partnerships support large-scale deployment of remote monitoring services. Recognizing these regional idiosyncrasies is essential for formulating market entry tactics, localization efforts, and strategic collaborations that align with each geographic landscape.

This comprehensive research report examines key regions that drive the evolution of the Digital Diabetes Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategies of Leading Innovators and Market Champions Driving Advancement in Digital Diabetes Management Solutions Worldwide

Leading corporations and nimble innovators are charting diverse strategic paths to gain competitive advantage in the digital diabetes management sector. Established device manufacturers leverage extensive R&D budgets and entrenched clinical relationships to refine closed-loop systems and sensor accuracy. These incumbents also pursue software integration initiatives, acquiring specialized analytics firms to expand their digital health portfolios and bolster interoperability.

Conversely, technology-centric entrants focus on user experience and data-driven insights, optimizing mobile applications and cloud platforms to foster patient engagement and clinician collaboration. Partnerships between device makers and telehealth providers are proliferating, blending hardware expertise with virtual care capabilities to deliver end-to-end management solutions. Collaborative ventures with pharmacies and retail chains enhance distribution reach, while alliances with payer organizations drive outcomes-based reimbursement trials.

Startups play a critical role in pioneering next-generation functionalities such as personalized algorithmic dosing and AI-powered decision support, prompting larger players to explore minority investments or joint development agreements. Through a combination of modular platform approaches, open-API ecosystems, and strategic mergers, key players are positioning themselves to address emerging priorities around holistic chronic disease management and adaptive care models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Diabetes Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Ascensia Diabetes Care

- Bigfoot Biomedical, Inc.

- Dexcom, Inc.

- Glooko, Inc.

- Insulet Corporation

- Kanavital Health Technologies

- Medtronic plc

- Myriad Genetics, Inc.

- Novo Nordisk A/S

- Omada Health, Inc.

- Roche Holding AG

- Sanofi S.A.

- Tandem Diabetes Care, Inc.

- Teladoc Health, Inc.

- WellDoc, Inc.

Strategic Recommendations Empowering Industry Leaders to Capitalize on Emerging Opportunities in Digital Diabetes Management Ecosystem

To thrive amid rapid market evolution, industry leaders should establish agile cross-functional teams that integrate clinical, technical, and commercial expertise from project inception. Prioritizing partnerships with domestic manufacturers and component suppliers can reduce exposure to tariff volatility and strengthen supply chain resilience. Organizations must also invest in data interoperability by adopting standards-based API frameworks that enable seamless exchange between monitoring devices, electronic health records, and population health platforms.

Engagement tactics should shift toward behavioral science–informed design, using personalized feedback loops and adaptive goal-setting to sustain patient adherence over time. Furthermore, stakeholders should collaborate with regulatory agencies to define clear validation pathways for digital biomarkers and artificial intelligence tools, expediting market entry and payer acceptance. Implementing real-world evidence studies that demonstrate cost-effectiveness in diverse care settings will be critical to securing value-based contracts and differentiated reimbursement.

Finally, developing modular, scalable solutions that can be customized across clinical applications, demographic cohorts, and geographic regions will unlock new revenue streams while addressing the heterogeneity of diabetes care requirements. By aligning strategic priorities with evolving policy landscapes and consumer expectations, leaders can capture the full potential of digital innovations to improve outcomes and lower total cost of care.

Methodological Framework Detailing Rigorous Research Approaches Employed to Analyze the Digital Diabetes Management Market Landscape

The research methodology underpinning this analysis integrates both primary and secondary approaches to deliver robust and actionable insights. Primary data collection involved conducting in-depth interviews with endocrinologists, diabetes educators, and healthcare administrators to elucidate real-world adoption patterns and unmet needs. Complementing this, a quantitative survey of technology adopters and payers yielded critical data on procurement cycles, pricing sensitivities, and satisfaction drivers.

Secondary research encompassed an exhaustive review of peer-reviewed journals, industry white papers, and regulatory publications to map technological advancements and policy developments. Company filings, patent databases, and conference proceedings were analyzed to trace competitive activities and innovation trajectories. Data triangulation methods were applied to validate findings, ensuring consistency across multiple data sources and mitigating potential biases.

Segmentation analysis employed a framework that aligned product characteristics with end-user requirements and regional market conditions. Rigorous validation workshops with subject matter experts refined the analytical models, while scenario planning exercises assessed the impact of macroeconomic factors such as tariff shifts and reimbursement reforms. This multifaceted methodology assures stakeholders that conclusions and recommendations rest on a foundation of comprehensive, high-quality evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Diabetes Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Diabetes Management Market, by Product Type

- Digital Diabetes Management Market, by Delivery Method

- Digital Diabetes Management Market, by End User

- Digital Diabetes Management Market, by Application

- Digital Diabetes Management Market, by Sales Channel

- Digital Diabetes Management Market, by Region

- Digital Diabetes Management Market, by Group

- Digital Diabetes Management Market, by Country

- United States Digital Diabetes Management Market

- China Digital Diabetes Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings and Insights to Illuminate the Path Forward for Stakeholders to Drive Growth and Collaboration in Digital Diabetes Management

This report has synthesized the complex interplay of technological innovation, regulatory policy, market segmentation, regional dynamics, and competitive strategy that defines the digital diabetes management sector. By tracing the evolution of continuous monitoring platforms, closed-loop delivery systems, and advanced analytics, stakeholders gain clarity on the pathways to patient-centric care and sustainable growth. The analysis of tariff impacts illuminated the importance of supply chain agility and strategic sourcing, while the segmentation insights underscored the need for tailored value propositions across diverse user groups.

Regional assessments highlighted the critical role of reimbursement structures and public-private partnerships in accelerating adoption, particularly in emerging economies. Competitive profiling revealed that success hinges not only on technological prowess but also on the ability to forge collaborative alliances and demonstrate real-world value to payers and providers. The actionable recommendations offer a strategic blueprint for aligning innovation with market needs, emphasizing regulatory engagement, interoperability, and behaviorally informed design.

In summary, the digital diabetes management space stands at an inflection point where converging trends on data, devices, and decentralized care models promise to transform outcomes. Stakeholders who embrace a holistic, evidence-based approach and adapt swiftly to evolving policy landscapes will be best positioned to lead this next wave of healthcare innovation and deliver meaningful impact for patients worldwide.

Unlock Comprehensive Intelligence on Digital Diabetes Management Trends and Innovations by Engaging with Ketan Rohom to Acquire the Full Market Research Report

Engaging directly with Ketan Rohom will ensure access to the most comprehensive analysis of digital diabetes management trends, competitive dynamics, and actionable insights designed to inform critical business decisions. Ketan’s expertise in synthesizing complex market data into strategic recommendations means you will receive a tailored outline of growth opportunities, risk mitigation strategies, and innovation roadmaps that align with your organization’s objectives. By acquiring the full report, stakeholders will benefit from in-depth segmentation analysis, detailed regional performance overviews, and a clear understanding of emerging technologies that are poised to redefine diabetes care.

Initiating a conversation with Ketan opens the door to customized data visualizations, benchmarking tools, and executive briefings that translate research findings into practical business applications. This targeted engagement leverages qualitative and quantitative findings to support negotiations with investors, guide product development, and sharpen go-to-market strategies. The collaboration with Ketan also includes ongoing support for interpreting new market developments, ensuring your team remains agile as the digital diabetes management space continues to evolve.

Don’t miss the opportunity to equip your organization with the insights needed to lead in a rapidly changing landscape. Reach out to Ketan Rohom now to secure the definitive guide to digital diabetes management, empowering you to make confident, data-driven decisions that will shape the future of patient care.

- How big is the Digital Diabetes Management Market?

- What is the Digital Diabetes Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?