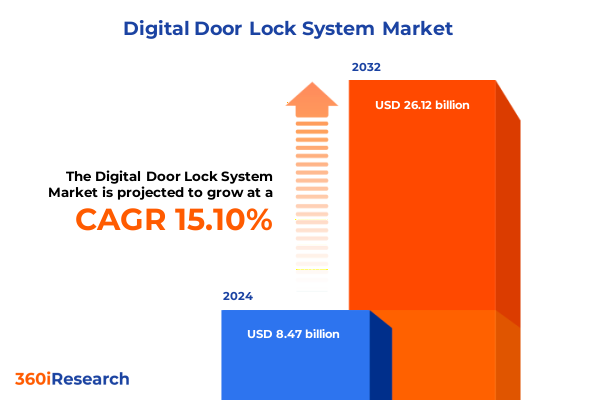

The Digital Door Lock System Market size was estimated at USD 9.71 billion in 2025 and expected to reach USD 11.14 billion in 2026, at a CAGR of 15.17% to reach USD 26.12 billion by 2032.

Unlocking the Future of Secure Access: Navigating the Evolution and Strategic Imperatives of Digital Door Lock Systems Worldwide and Market Dynamics

Digital door lock systems have rapidly emerged as a cornerstone of modern access control strategies, blending security, convenience, and technological sophistication in an era defined by connected devices. Growing concerns around safety in residential, commercial, and institutional environments are driving stakeholders to seek solutions that deliver robust authentication, remote management, and seamless integration with existing building management platforms. As property developers, security integrators, and end users place a premium on user-friendly interfaces and scalable infrastructure, the demand for advanced locking mechanisms is accelerating. Rapid urbanization and increasing investments in smart cities further amplify the imperative for reliable, networked entry systems that can be monitored and updated in real time.

Moreover, the convergence of Internet of Things (IoT) architectures with energy-efficient wireless protocols has elevated the functionality of digital entry solutions beyond basic access control. Biometric modalities, mobile credentials, and voice-command features now coexist with traditional card-based and PIN-based methods, creating multifaceted layers of protection. In addition, evolving regulatory standards around data privacy and cybersecurity are reinforcing the need for end-to-end encryption and secure firmware update pathways. Consequently, manufacturers are prioritizing R&D efforts to enhance encryption algorithms, sensor accuracy, and interoperability with smart home ecosystems, setting the stage for a new generation of connected security hardware.

Assessing the Disruptive Forces and Technological Inflection Points Reshaping the Digital Door Lock Industry Landscape and Adoption Pathways

The digital door lock industry has entered a transformative phase characterized by disruptive forces reshaping product innovation and deployment models. At the forefront, artificial intelligence–driven biometric authentication has redefined user verification accuracy, allowing facial recognition, fingerprint scanning, and iris detection to function reliably under diverse environmental conditions. Concurrently, the proliferation of Internet of Things frameworks has enabled wireless communication among door locks, mobile applications, and building management systems, delivering remote monitoring, predictive maintenance alerts, and automated access scheduling. These innovations are fueling a shift away from standalone mechanical locks toward integrated access ecosystems capable of real-time data exchange and analytics.

Furthermore, the marketplace is witnessing a rapid standardization of low-power wireless protocols such as ZigBee, Z-Wave, and Bluetooth Low Energy, which balance range, energy consumption, and network interoperability. This standardization is complemented by the advent of NFC-based mobile keys, enabling frictionless entry through smartphones without sacrificing security. At the same time, heightened awareness of cybersecurity vulnerabilities has prompted stakeholders to adopt rigorous penetration testing and certification programs, ensuring robust defense against ransomware attacks and firmware exploits. Consequently, strategic alliances between hardware vendors, software developers, and security consultants are proliferating, fostering cross-industry collaboration to deliver turnkey access management solutions.

Evaluating the Broad Economic and Supply Chain Implications of 2025 United States Tariffs on Digital Door Lock System Imports and Production

In 2025, the United States enacted a comprehensive tariff regime targeting digital door lock components and finished products originating from key manufacturing hubs, provoking substantial ramifications across the supply chain. Elevated duties on microcontrollers, sensor arrays, and wireless communication modules have directly increased the landed cost of imported assemblies, compelling original equipment manufacturers to reassess supplier relationships and cost structures. Consequently, many companies are undertaking partial localization of component production and exploring alternative sourcing strategies in Southeast Asia and Europe to ameliorate cost pressures and maintain competitive pricing for end users.

Moreover, the tariff-induced cost escalation has triggered a recalibration of in-house manufacturing versus outsourced assembly models. Several established vendors have begun expanding domestic assembly lines to capture tariff exemptions available under certain trade agreements, while emerging players are leveraging contract manufacturing organizations in tariff-friendly jurisdictions. This redistribution of production footprints is accompanied by strategic inventory planning to mitigate lead-time volatility and ensure uninterrupted supply continuity. Ultimately, these adjustments reflect a broader realignment of manufacturing networks that prioritizes resilience and cost containment.

As a result of these dynamics, end users are witnessing incremental price adjustments for both hardware and installation services. However, the push toward regionalized production also presents a unique opportunity for local suppliers to gain market share by offering rapid fulfillment and enhanced customization options. Collectively, the 2025 tariff measures are catalyzing a new era of supply chain agility and regional ecosystem development within the digital door lock sector.

Uncovering Vital Technology and End Use Segments Shaping Growth in Digital Door Lock Solutions Across Authentication, Connectivity, Lock and Installation Types

A nuanced understanding of end-user requirements and technology preferences underscores the importance of segment-level strategies. Authentication type segmentation reveals a strong trajectory for biometric modalities, where face recognition, fingerprint scanning, and iris recognition solutions coexist alongside password- and pin-based entry, card RFID technologies, voice recognition functionalities, and Bluetooth-enabled smartphone keys. Connectivity segmentation further emphasizes the role of wireless standards, with devices running on Bluetooth, NFC, Wi-Fi, Z-Wave, and ZigBee frameworks to accommodate varying deployment scales and interoperability demands.

Lock type diversification spans traditional deadbolts and lever handle formats to specialized mortise and rim configurations, enabling compatibility with a wide array of door constructions. Meanwhile, installation types divide the market between new construction applications, which incorporate locks into building planning phases, and retrofit scenarios where existing doors receive hardware upgrades. End-use segmentation delineates commercial environments including corporate offices, hospitality venues, and retail outlets from industrial facilities and institutional settings such as educational campuses, government facilities, and healthcare centers, as well as residential properties offering smart home integrations. Distribution channels bridge offline experiences found in electronics retailers, home improvement stores, and specialty outlets with the convenience and reach of online platforms, shaping buyer journeys from initial awareness to post-sale support.

This comprehensive research report categorizes the Digital Door Lock System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Authentication Type

- Connectivity

- Lock Type

- Installation Type

- End Use

- Distribution Channel

Mapping Regional Adoption Patterns and Growth Drivers for Digital Door Lock Systems Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Regional dynamics demonstrate distinct adoption patterns and growth drivers. In the Americas, robust demand in the United States and Canada is driven by high digital literacy, strong investment in smart building initiatives, and stringent safety regulations. Commercial real estate developers prioritize integrated access control as a differentiator, while residential property managers seek scalable solutions to accommodate multiunit complexes. Meanwhile, Latin American markets are experiencing gradual uptake influenced by urban security concerns and government incentives promoting smart infrastructure projects.

In Europe, Middle East & Africa, Western European nations lead adoption through mature smart home markets and rigorous data protection norms, prompting vendors to implement advanced encryption and cloud-based management platforms. In the Middle East, luxury hospitality complexes are embracing seamless mobile entry systems, whereas African markets are in nascent stages of digital lock deployment, driven by infrastructure development and rising consumer awareness. Cross-regional collaborations and trade agreements are facilitating the transfer of technology expertise.

Asia-Pacific stands out as the fastest-growing region, propelled by smart city programs in China, Japan’s emphasis on elderly care solutions, and India’s burgeoning residential sector. Manufacturers in APAC are leveraging high-volume production to introduce cost-effective models and tailor protocols that integrate with regional IoT architectures. Consequently, Asia-Pacific represents both a critical manufacturing hub and a vibrant end-user market where innovation and volume converge.

This comprehensive research report examines key regions that drive the evolution of the Digital Door Lock System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Redefining Competitive Advantages in the Digital Door Lock System Ecosystem

Leading industry participants are advancing differentiated value propositions to capture market share. ASSA ABLOY has introduced modular platform architectures that empower system integrators to customize access solutions across diverse verticals. Allegion continues to invest in end-to-end access ecosystems, collaborating with technology partners to synchronize door hardware, mobile credentialing, and cloud-based management services. Dormakaba’s strategic acquisitions have broadened its product portfolio and enhanced its global distribution reach, enabling rapid delivery of turnkey solutions.

Samsung is fostering partnerships with smart home platform providers to ensure seamless interoperability and user-friendly interfaces. Yale’s design-centric approach focuses on minimalist aesthetics paired with intuitive mobile applications, emphasizing the consumer residential segment. Kwikset has prioritized retrofit-friendly kits that simplify installation, appealing to DIY enthusiasts and small-scale installers. Emerging software vendors are also influencing the competitive landscape by offering developer kits and open APIs, supporting custom integrations and third-party innovation. Through alliances with cybersecurity firms, these companies are reinforcing firmware security and compliance frameworks, positioning themselves as trusted advisors in the evolving access control domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Door Lock System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allegion PLC

- Assa Abloy AB

- August Home, Inc.

- Avent Security

- Be-Tech Asia Limited

- Cansec Systems Ltd.

- Dorma+Kaba Holding AG

- Gantner Electronic GmbH

- Guangdong AP Tenon Sci.& Tech. Co., Ltd.

- Igloohome Inc.

- iLockey

- Kaadas Group

- KEYU Intelligence Co., Ltd.

- Klevio Limited

- Latch Inc.

- LockState, Inc.

- Master Lock Company LLC

- MIWA Lock Co. Ltd.

- Motorola Solutions, Inc.

- ONE-LOCK

- Onity, Inc.

- PDQ Locks

- Salto Systems S.L.

- Samsung Electronics Co., Ltd.

- Sentrilock, LLC

- Shenzhen Omni Intelligent Technology Co., Ltd.

- Spectrum Brands Holdings, Inc.

- U-Tec Group Inc.

- Zhejiang Desman Intelligent Technology Co., Ltd.

Strategic Imperatives and Actionable Roadmap for Industry Leaders to Capitalize on Emerging Opportunities in Digital Door Lock Systems

Industry leaders should prioritize strategic investment in next-generation biometric research and development. Focusing on higher-resolution face recognition and multi-spectral fingerprint sensors will differentiate offerings and address emerging security requirements. Simultaneously, expanding support for multiple wireless protocols will future-proof products and ensure compatibility with evolving smart home and building automation ecosystems. Certification in cybersecurity standards and third-party validation will also instill confidence among enterprise and institutional buyers.

In addition, designing modular retrofit solutions that simplify upgrades in existing facilities can accelerate market penetration. Tailoring product bundles for specific end-use cases-such as hospitality check-in automation or educational campus access management-will resonate with targeted buyer segments. Strengthening omni-channel distribution strategies by integrating with leading online platforms and reinforcing relationships with electronics retailers will optimize reach and service delivery.

Finally, to mitigate tariff-related headwinds, companies should diversify their supplier base, pursue nearshoring opportunities, and engage in policy dialogues to influence trade frameworks. Exploring joint ventures or mergers and acquisitions can consolidate critical components of the supply chain, delivering operational resilience and cost competitiveness. By executing a balanced approach to innovation, go-to-market agility, and regulatory engagement, industry players can navigate the complex market environment and secure sustainable growth.

Transparent and Rigorous Methodology Overview Ensuring Reliability and Credibility of Digital Door Lock Systems Market Research Findings

The research methodology underpinning this analysis combines rigorous primary and secondary explorations to deliver credible insights. Primary data collection involved in-depth interviews with executive leadership from leading access control manufacturers, security integrators responsible for large-scale installations, distribution channel stakeholders, architectural firms, and institutional facility managers. These interviews elucidated real-world challenges, adoption drivers, and project timelines, ensuring that the report reflects practical industry perspectives.

Secondary research encompassed the review of trade associations’ publications, government and regulatory filings, academic white papers, patent databases, and industry trade press. This phase provided historical context, technology roadmaps, and regulatory frameworks, enabling a robust understanding of market evolution and compliance requirements. Quantitative data points were cross-verified against multiple sources to ensure validity and consistency.

Data triangulation was performed by aligning qualitative interview findings with secondary intelligence, followed by assessment through a proprietary analytical framework focusing on technology readiness, adoption velocity, and regulatory alignment. Validation workshops with subject-matter experts were conducted to refine assumptions and confirm emerging trends. This multi-step process guarantees that the conclusions and strategic recommendations are underpinned by comprehensive evidence and industry consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Door Lock System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Door Lock System Market, by Authentication Type

- Digital Door Lock System Market, by Connectivity

- Digital Door Lock System Market, by Lock Type

- Digital Door Lock System Market, by Installation Type

- Digital Door Lock System Market, by End Use

- Digital Door Lock System Market, by Distribution Channel

- Digital Door Lock System Market, by Region

- Digital Door Lock System Market, by Group

- Digital Door Lock System Market, by Country

- United States Digital Door Lock System Market

- China Digital Door Lock System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesis of Core Insights and Forward-Looking Perspectives for Navigating the Digital Door Lock System Transformation Journey

This study synthesizes critical insights into the technological trends, tariff impacts, segmentation dynamics, regional patterns, and competitive strategies shaping the digital door lock ecosystem. The confluence of advanced biometric authentication, diversified connectivity protocols, and heightened cybersecurity measures has reframed access control expectations across residential, commercial, and institutional applications. Concurrently, 2025 tariff measures in the United States have catalyzed supply chain realignment, presenting both challenges and opportunities for manufacturers and end users alike.

Key segmentation revelations highlight the importance of modular design approaches that accommodate a spectrum of authentication types, installation scenarios, end-use requirements, and distribution pathways. Regional analyses demonstrate heterogeneous growth patterns, with the Americas anchoring mature adoption, EMEA navigating regulatory complexities and nascent markets, and Asia-Pacific driving volume-led innovation. Competitive profiling underscores the role of strategic collaborations, product differentiation, and market-specific offerings in sustaining leadership positions.

Looking forward, organizations that embrace agile manufacturing strategies, invest in next-generation R&D, and cultivate cross-industry partnerships will be best positioned to capture emerging opportunities. By leveraging the strategic imperatives outlined in this report, decision-makers can navigate the evolving market landscape, mitigate external risks, and drive long-term value creation.

Connect with Ketan Rohom, Associate Director of Sales & Marketing to Secure Your Digital Door Lock System Market Research Report and Drive Strategic Advantage

To access the full breadth of strategic insights and technical analysis encapsulated in this report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the report’s detailed breakdown of technology trends, tariff implications, segmentation nuances, and regional outlooks. By securing a copy of this market research study, your organization will gain immediate visibility into critical decision points that can optimize supply chains, unlock new partnership opportunities, and fortify competitive positioning. Engage directly with Ketan Rohom to explore customized deliverables, premium data sets, and advisory support designed to meet your unique operational and strategic requirements. His expertise will ensure seamless onboarding to the report’s proprietary frameworks and facilitate targeted briefings for your executive team. Connect now with Ketan Rohom to transform your approach to digital door lock systems and drive measurable business outcomes.

- How big is the Digital Door Lock System Market?

- What is the Digital Door Lock System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?