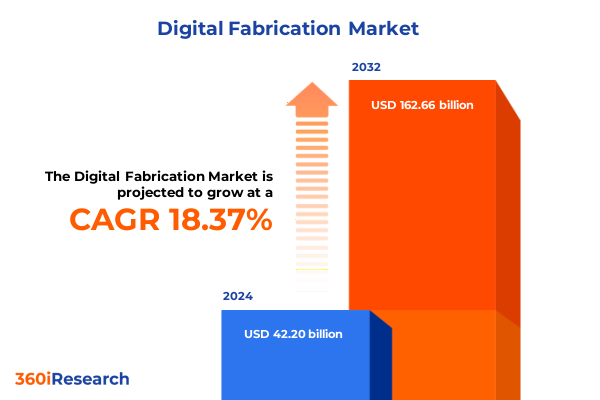

The Digital Fabrication Market size was estimated at USD 49.82 billion in 2025 and expected to reach USD 59.07 billion in 2026, at a CAGR of 18.41% to reach USD 162.66 billion by 2032.

Revolutionary Dynamics of Digital Fabrication Shaping Customized Production Efficiency and Supply Chain Resilience in Modern Global Manufacturing

Digital fabrication has rapidly transitioned from a niche manufacturing technique to a strategic imperative for companies seeking agility, precision, and customization at scale. Fueled by advancements in additive manufacturing and subtractive processes, firms across the globe are leveraging these technologies to drive product innovation and reduce time‐to‐market. As digital design files seamlessly translate into physical components, manufacturers can iterate more swiftly than ever before, thereby fostering a culture of continuous improvement. Moreover, the integration of smart sensors and data analytics within fabrication equipment has enhanced real‐time process monitoring, enabling stakeholders to optimize parameters on the fly and safeguard quality.

This convergence of digital engineering and automated production has redefined supply chain dynamics. Organizations are embracing on-demand production hubs located closer to end customers, reducing logistics complexity and supporting mass customization initiatives. Simultaneously, the rise of digital twins and virtual commissioning allows for comprehensive simulation of manufacturing workflows, minimizing the risk of costly on-floor errors. By establishing a feedback loop between physical assets and digital platforms, industry leaders can predict maintenance needs and preemptively mitigate downtime. Transitioning into this new paradigm of agile manufacturing requires a robust technological foundation and a strategic vision that aligns digital fabrication capabilities with business objectives.

Transformative Technological and Operational Shifts Propelling the Next Wave of Intelligent Digital Fabrication Processes Across Diverse Industrial and Manufacturing Ecosystems

The landscape of digital fabrication is undergoing transformative shifts driven by the relentless integration of artificial intelligence, connectivity, and automation. Companies are no longer relying solely on individual machines; they are building interconnected ecosystems where data flows seamlessly between design, simulation, and production environments. For instance, AI-powered algorithms now optimize build orientations and support structures in additive manufacturing, thereby reducing material waste and improving mechanical properties in real time. Concurrently, digital twin implementations have matured, allowing for virtual replicas of fabrication cells that facilitate continuous monitoring and predictive maintenance across entire production lines.

Decentralized manufacturing represents another seismic shift. Driven by geopolitical uncertainties and the need for supply chain resilience, enterprises are embracing microfactories that combine 3D printing, CNC machining, and laser cutting in compact, agile footprints. This approach enables local customization and rapid response to regional market demands, enhancing overall operational agility. Moreover, the growing deployment of IIoT sensors has ushered in an era of data-driven decision making to optimize inventory levels and minimize waste. As organizations adopt these digital fabrication ecosystems, they are better positioned to deliver highly differentiated products while maintaining cost discipline.

Unraveling the Multifaceted Impact of 2025 U.S. Tariff Policies on Digital Fabrication Equipment Supply Chains and Cost Structures

In 2025, U.S. trade policy has introduced a baseline 10% duty on most imports, with targeted rates that rise to 34% on Chinese-origin components and 32% for key inputs from Taiwan. These levies, coupled with lingering Section 232 restrictions on steel and aluminum, are reshaping the digital fabrication value chain. Equipment manufacturers are facing higher landed costs, which in many cases are passed downstream to end users. ASML, for example, has reported plans to allocate most of its tariff burden onto customers while exploring free trade zone strategies to mitigate the outlook for 2025 and 2026.

This tariff environment is influencing strategic investment decisions. Nearly one-third of German engineering firms have postponed U.S. investments, citing uncertainty around future trade measures. Within digital fabrication, the cost of specialized metal powders, high-precision CNC components, and laser optics has increased, prompting many businesses to reassess supplier relationships. Some operators are accelerating efforts to onshore critical production steps or to establish dual-sourced supply bases to hedge against further tariff escalation. As capital expenditures become more cautious, companies that proactively engage in tariff avoidance planning can realize competitive advantages and maintain project timelines.

Informed Breakdown of Digital Fabrication Segmentation Revealing Strategic Insights into Technology, Materials, End Users, and Offerings

Analyzing digital fabrication through distinct lenses reveals critical insights for strategic positioning. When viewed through a technology prism, the market encompasses additive methods such as binder jetting, fused deposition modeling, selective laser sintering, stereolithography, and emerging directed energy processes like electron beam melting, alongside subtractive techniques including drilling, milling, and turning. Laser-based processes span CO2 and fiber lasers, which deliver precision cutting and engraving across diverse substrates. Each technological category offers unique trade-offs in terms of speed, material compatibility, and part complexity, guiding organizations toward balanced portfolios that match application needs.

Material considerations further enrich the narrative. Fabrication systems must accommodate ceramics, composites, metals, and polymers, each presenting specific thermal, mechanical, and surface finish requirements. For metal 3D printing, powder feedstock composition and particle size distribution can make the difference between a structurally sound aerospace component and a flawed prototype. In polymer-based additive production, choices among thermoplastics such as ABS or high-performance resins determine both functional viability and post-processing demands.

End consumers span sectors from aerospace and defense to automotive, consumer electronics, education, healthcare, and heavy industrial uses. This breadth of applications underscores the versatility of digital fabrication, as part geometries and complex assemblies become feasible without traditional tooling investments. Finally, offerings range from hardware systems to software platforms and professional services, a triad that supports customers across the product lifecycle. Forward-thinking firms are integrating their own service capabilities with third-party cloud platforms to deliver end-to-end production solutions.

This comprehensive research report categorizes the Digital Fabrication market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Material

- End User

- Offering

Comprehensive Regional Landscape Analysis Illuminating Digital Fabrication Trends Across the Americas, EMEA, and Asia-Pacific Markets

Regional market dynamics reveal divergent growth trajectories and strategic imperatives. In the Americas, digital fabrication adoption is propelled by large OEMs investing in domestic additive production hubs to support rapid prototyping and low-volume manufacturing. Government initiatives fostering advanced manufacturing centers have attracted both equipment makers and component suppliers, positioning North America at the forefront of industrial innovation. Transitioning from prototyping toward full-scale production lines, leading facilities are establishing integrated workflows that combine CAD design, simulation, and automated post-processing under one roof.

Across Europe, Middle East, and Africa, the emphasis lies on sustainability and resource efficiency. EMEA stakeholders are leveraging digital fabrication to reduce material waste in automotive supply chains and to deploy modular construction solutions in urban environments. Collaborative R&D consortia have emerged, linking universities, startups, and established fabricators to develop next-generation materials and machine architectures. Regulatory frameworks supporting green manufacturing and circular economy principles further incentivize regional players to adopt processes that can recycle and repurpose waste streams.

In Asia-Pacific, rapid industrialization and expanding consumer markets are fueling accelerated uptake. Governments across the region are offering tax incentives, research grants, and infrastructure investment to attract global technology suppliers. As a result, enterprises are piloting advanced materials for aerospace, precision medical devices, and electronics assembly. A strong focus on capacity expansion and workforce upskilling ensures that APAC hubs can not only serve growing local demand but also export digital fabrication expertise worldwide.

This comprehensive research report examines key regions that drive the evolution of the Digital Fabrication market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Key Stakeholders Driving Advancement and Competition in the Digital Fabrication Market Ecosystem

A cadre of leading organizations is driving innovation across the digital fabrication ecosystem. In additive manufacturing, 3D Systems and Stratasys continue to expand their hardware portfolios, introducing higher-throughput machines and advanced material platforms that serve aerospace and healthcare sectors. EOS has advanced its metal powder bed fusion lineup, enabling series production of complex stainless steel and titanium parts. HP’s multi-jet fusion technology is gaining traction among consumer electronics brands seeking rapid iterations of housing and enclosures.

In subtractive and hybrid systems, DMG Mori and Mazak have unveiled multi-tasking centers that seamlessly switch between milling, turning, and additive deposition, streamlining workflows and reducing floor space requirements. TRUMPF leads in laser technologies, deploying fiber-laser cutting cells that integrate real-time monitoring to maintain tight tolerances on sheet metal components. GE Additive and SLM Solutions are collaborating with aerospace primes to qualify electron beam melting systems for structural applications, further blurring the lines between prototyping and production.

Software and services providers complement this hardware proliferation. Siemens’ NX CAD/CAM suite and Autodesk’s Fusion 360 platform provide end-to-end digital threads that connect design, simulation, and machine code generation. Service partners such as Protolabs offer on-demand manufacturing and post-processing, enabling even small enterprises to access high-precision parts without upfront capital commitments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Fabrication market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems Corporation

- BigRep GmbH

- Carbon, Inc.

- Desktop Metal, Inc.

- EnvisionTEC, Inc.

- EOS GmbH

- ExOne Company

- Formlabs, Inc.

- Markforged, Inc.

- Nano Dimension Ltd.

- Optomec, Inc.

- Prodways Group

- Raise3D Technologies, Inc.

- Renishaw plc

- SLM Solutions Group AG

- Stratasys Ltd.

- Ultimaker B.V.

- Voxeljet AG

- Zortrax S.A.

Strategic Actionable Recommendations Empowering Industry Leaders to Navigate Digital Fabrication Challenges and Capitalize on Emerging Opportunities

To capitalize on digital fabrication’s potential, industry leaders should prioritize developing resilient supply chains that incorporate dual-sourcing strategies and nearshoring hubs. Building collaborative partnerships with raw material producers ensures consistent access to high-quality feedstocks, particularly for specialized metal alloys and advanced polymer powders. Simultaneously, investing in AI-driven analytics platforms can illuminate hidden bottlenecks in machine utilization, allowing for predictive maintenance and optimized scheduling.

Leaders must also cultivate cross-functional teams that bridge design, engineering, and operations. By embedding additive design for manufacturability principles at the concept phase, companies can unlock the full benefits of complex geometries and part consolidation. Upskilling programs that equip staff with proficiency in CAD tools, IoT systems, and quality validation protocols will be essential to maintain a competitive workforce.

Finally, executives should engage proactively with policy developments to navigate tariff environments and leverage incentive programs. Thoughtful scenario planning-examining variables such as duty rates and labor costs-can guide capital allocation decisions and mitigate financial risk. By aligning strategic investments with emerging technologies and market trends, organizations can secure leadership positions in the evolving digital fabrication landscape.

Rigorous Research Methodology Combining Primary and Secondary Analysis Ensuring Robust Insights into Digital Fabrication Market Dynamics

This analysis synthesizes insights gathered through a rigorous, multi-phase research process. We began with an extensive secondary review of peer-reviewed journals, technical white papers, and reputable industry publications to map the landscape of digital fabrication technologies and materials. This stage provided a foundational understanding of historical developments and established baseline parameters.

In the primary research phase, we conducted structured interviews with over twenty senior executives from OEMs, equipment vendors, and service providers across North America, Europe, and Asia-Pacific. These discussions probed strategic priorities, investment rationales, and operational challenges. We further augmented these qualitative insights through surveys targeting engineering and R&D professionals to quantify adoption drivers and inhibitors.

To ensure analytical robustness, our team employed data triangulation techniques, cross-verifying findings against customs trade databases, corporate financial disclosures, and macroeconomic indicators such as industrial output indices. Scenario planning exercises evaluated the sensitivity of digital fabrication adoption rates to variables including tariff regimes, energy costs, and workforce skill levels.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Fabrication market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Fabrication Market, by Technology

- Digital Fabrication Market, by Material

- Digital Fabrication Market, by End User

- Digital Fabrication Market, by Offering

- Digital Fabrication Market, by Region

- Digital Fabrication Market, by Group

- Digital Fabrication Market, by Country

- United States Digital Fabrication Market

- China Digital Fabrication Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Conclusive Reflections on the Evolutionary Trajectory of Digital Fabrication Paving the Way for Future Innovation and Competitive Advantage

Digital fabrication stands at a pivotal juncture, with technologies maturing from prototyping to full-scale production across industries. The convergence of AI, IIoT, and automated systems has created unprecedented opportunities for customization, efficiency, and supply chain agility. However, the evolving tariff landscape underscores the importance of strategic risk management and diversified sourcing approaches.

By embracing segmented strategies-tailored by technology, material, application, and offering-organizations can precisely align their investments with core business objectives. Regional market dynamics further highlight the need for geographic diversification, as mature markets prioritize sustainability and APAC regions accelerate capacity expansions. Profiles of leading firms demonstrate that innovation thrives at the intersection of hardware advances, software intelligence, and service integration.

As companies navigate this dynamic environment, the imperative is clear: those who adopt a holistic approach to digital fabrication-melding advanced technologies with resilient business models-will secure significant competitive advantages. Staying ahead requires continuous learning, agile execution, and strategic foresight.

Engage with Ketan Rohom to Unlock Exclusive Access to the Definitive Digital Fabrication Market Research Report and Accelerate Strategic Growth

To explore how these insights can translate into actionable strategies tailored to your organization, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engaging in a conversation with Ketan opens the door to personalized guidance on leveraging the full breadth of digital fabrication capabilities. Through a collaborative dialogue, you can uncover customized opportunities to streamline operations, optimize supply chains, and accelerate innovation. This Call‐To‐Action invites you to secure comprehensive access to the definitive market research report, equipping your leadership team with the data-driven intelligence required to stay ahead of competitors. Act now to schedule a strategic briefing and gain priority access to detailed analyses, proprietary forecasts, and expert recommendations designed to elevate your organization’s digital fabrication roadmap.

- How big is the Digital Fabrication Market?

- What is the Digital Fabrication Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?