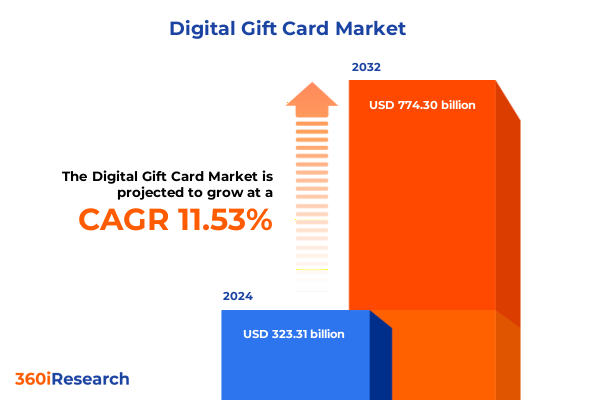

The Digital Gift Card Market size was estimated at USD 358.90 billion in 2025 and expected to reach USD 398.85 billion in 2026, at a CAGR of 11.61% to reach USD 774.30 billion by 2032.

Unveiling the Rise of Digital Gift Cards Amidst Evolving Consumer Preferences, Accelerated Digital Transformation, and Cutting-Edge Technological Innovations

Digital gift cards have emerged as a pivotal instrument within the broader payments landscape, fundamentally altering the way consumers express generosity and brands cultivate loyalty. Fueled by an unwavering shift toward digital-first experiences, these virtual instruments have transcended their original function as mere proxies for cash, evolving into sophisticated tools that foster customer engagement, reinforce brand affinity, and generate valuable consumer data streams. As mobile adoption reaches saturation in mature markets and smartphone penetration accelerates in emerging economies, the digital gift card paradigm has become deeply interwoven with omnichannel retail strategies, enabling seamless redemption across e-commerce platforms, physical storefronts, and mobile wallets.

Amid heightened expectations for immediacy and convenience, digital gift cards now serve as conduits for personalized interactions, granting brands the ability to tailor value propositions in real time. This evolution has coincided with the rising prominence of corporate gifting and employee recognition programs, which have leveraged virtual cards to streamline procurement, distribution, and tracking. Concurrently, the social commerce revolution has unlocked new avenues for peer-to-peer gifting, with embedded gift card solutions enabling seamless transactions within messaging apps, social networks, and digital marketplaces. Together, these factors have catalyzed unprecedented innovation in the digital gift card space, underscoring the imperative for stakeholders to understand the forces reshaping consumer behavior, technological capabilities, and competitive dynamics within this dynamic ecosystem.

Decoding the Transformative Shifts Redefining Digital Gift Card Ecosystems and Elevating Consumer Engagement Dynamics

The digital gift card landscape has undergone seismic shifts in recent years, propelled by rapid technological advancements and evolving consumer behaviors. The proliferation of mobile wallets and contactless payment infrastructure has elevated the role of virtual cards from supplementary offerings to central pillars of brand engagement strategies. This transformation has been further accelerated by the adoption of open-loop digital gift cards, which offer universal acceptance across multiple merchant networks, thereby addressing consumer demand for flexibility and convenience. In parallel, closed-loop digital gift cards have advanced through heightened integration with loyalty programs, enabling brands to capture granular insights into redemption patterns and tailor promotional campaigns with surgical precision.

Moreover, the integration of blockchain and distributed ledger technologies has begun to address longstanding challenges around fraud prevention and traceability, laying the groundwork for more secure and transparent gift card transactions. Personalization algorithms fueled by artificial intelligence now dynamically adjust gift card recommendations based on purchasing history, contextual triggers, and social data signals, creating bespoke gifting experiences that deepen emotional connections. As subscription services and digital entertainment platforms continue to expand, bundling digital gift cards with streaming memberships, in-app credits, and virtual goods has introduced novel revenue streams. These transformative shifts not only reflect the maturation of the digital gift card market but also underscore the growing imperative for stakeholders to innovate across both technical and experiential dimensions.

Assessing the Cumulative Consequences of 2025 United States Tariffs on Gift Card Production and Digital Distribution Dynamics

Although digital gift cards are inherently intangible products, the broader gift card landscape has not been immune to the ripple effects of United States tariff adjustments implemented in early 2025. Tariffs imposed on plastic substrates, packaging materials, and related printing supplies have driven up costs for physical gift card manufacturers, prompting a notable shift in corporate procurement strategies toward virtual offerings. As organizations seek to mitigate the impact of increased production and logistics expenditures, many have accelerated their migration to digital issuance platforms, thereby reinforcing the growth trajectory of purely digital solutions.

In addition, import duties on imported hardware tokens and card readers have reverberated through vendor ecosystems, increasing the total cost of ownership for merchants reliant on turnkey gift card kiosks and in-store distribution points. This has incentivized the adoption of cloud-based issuance models and software-centric solutions that circumvent hardware bottlenecks. While some regional gift card processors have negotiated exemptions or tariff suspensions for specific raw materials, the cumulative effect has underscored the resilience of digital-only constructs, as stakeholders recalibrate their product mixes to favor virtual codes and mobile-first redemption flows. Ultimately, these 2025 tariff interventions have served as a catalyst for deeper digital transformation across the gift card industry, confirming the primacy of virtual over physical channels in a post-tariff environment.

Unearthing Key Segmentation Insights That Illuminate Diverse Digital Gift Card Use Cases and Market Niches

The digital gift card market exhibits a multilayered segmentation landscape that traverses issuance format, purchase triggers, transaction flows, acquisition channels, end-use applications, and end-user cohorts. When examining issuance formats, there exists a clear bifurcation between closed-loop cards designed for redemption at specific retail locations and open-loop cards that operate on broader payment networks. Purchase occasions further delineate the market, with distinct demand surges observed during corporate milestones such as employee anniversaries and performance awards, cultural festivals and holidays that drive mass gifting, and personal events including birthdays, weddings, and special celebrations.

Transaction flows underscore the importance of both business-to-business engagements-where enterprises procure cards in bulk for incentive and loyalty programs-and business-to-consumer channels that cater to individual gift-givers. Acquisition modalities play a critical role, as direct purchases through corporate websites and mobile applications offer high-margin opportunities, while third-party platforms extend reach and enhance discoverability. Within end-use applications, gift cards serve as flexible tender across consumer goods, health and wellness services, media and entertainment subscriptions, dining experiences at restaurants and bars, and travel and tourism packages. Finally, end-user segmentation distinguishes between corporate clients-further segmented into large enterprises and small-to-medium-sized enterprises with divergent procurement cycles and customization needs-and individual consumers seeking convenience and personalization in their gifting experiences.

This comprehensive research report categorizes the Digital Gift Card market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Card Type

- Purchase Occasion

- Transaction Type

- Purchase Method

- Application

- End User

Revealing Regional Disparities in Digital Gift Card Adoption Patterns and Strategic Market Priorities Across Global Territories

Regional dynamics in digital gift card adoption reveal contrasting maturities and growth drivers across the Americas, Europe, Middle East & Africa, and the Asia-Pacific. In the Americas, established infrastructure and high smartphone penetration have fostered robust demand for open-loop virtual cards, with consumer preference gravitating toward universal acceptance and seamless integration with loyalty ecosystems. Corporate programs in North America have evolved to incorporate digital cards as foundational elements of employee engagement and customer acquisition strategies, driving advanced platform capabilities such as bulk issuance and real-time analytics.

Across Europe, the Middle East & Africa, market heterogeneity is more pronounced, as varying regulatory frameworks and payment preferences shape differentiated adoption rates. Western Europe demonstrates strong uptake in closed-loop solutions bolstered by mature loyalty schemes, while emerging markets within the region are rapidly embracing mobile-only issuance models to bypass legacy infrastructure constraints. Meanwhile, the Asia-Pacific region is characterized by accelerated growth in peer-to-peer gift card exchanges facilitated by super-app ecosystems and social commerce innovations. Here, local e-wallet providers and messaging platforms have embedded digital gift card offerings directly into consumer touchpoints, unleashing new opportunities for viral gifting use cases and cross-border digital remittances.

This comprehensive research report examines key regions that drive the evolution of the Digital Gift Card market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Innovators Shaping the Competitive Landscape of Digital Gift Card Offerings and Alliances

The competitive landscape of the digital gift card ecosystem is anchored by a blend of global payment network providers, specialized gift card issuers, and innovative fintech entrants. Leading payment network operators have leveraged extensive merchant partnerships to amplify open-loop card acceptance, while technology-first players have differentiated through API-driven issuance and white-label platform services. Several high-profile retailers have vertically integrated digital gift card solutions within their proprietary mobile applications, driving enhanced customer retention through bundled loyalty rewards and gamification features.

Fintech companies specializing in corporate gifting have carved out niche segments by streamlining bulk procurement, custom branding, and real-time redemption tracking. Partnerships between software vendors and point-of-sale integrators have produced turnkey solutions tailored for small-to-medium enterprise adoption, reducing time-to-market and operational complexity. In addition, cross-industry collaborations-such as those between entertainment streaming services and retail conglomerates-have introduced co-branded digital gift card offerings that bundle subscription access with merchandise credits. Collectively, these strategic alliances and technology innovations are reshaping competitive dynamics, forcing incumbents to continuously enhance platform flexibility, security protocols, and user experience design to maintain market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Gift Card market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbnb, Inc.

- Amazon.com, Inc.

- American Express Company

- Apple Inc.

- Best Buy Co., Inc.

- Blackhawk Network Holdings, Inc.

- Block, Inc.

- eBay Inc.

- Fiserv, Inc.

- Google LLC by Alphabet Inc.

- H&M Group

- InComm Payments

- Inditex, S.A.

- Inter IKEA Holding B.V.

- J Sainsbury PLC

- Klarna Holding AB

- Lowe's Companies, Inc.

- LVMH Group

- Macy's, Inc.

- Majid Al Futtaim Holding

- Mastercard Incorporated

- Meta Platforms, Inc.

- PayPal Holdings, Inc.

- Pentland Group

- Prezzee, Inc.

- Rakuten Group, Inc.

- Starbucks Corporation

- Synchrony Financial

- Target Corporation

- The Home Depot, Inc.

- The Kroger Co.

- Uber Technologies, Inc.

- Virgin Red Limited

- Visa Inc.

- Walgreens Boots Alliance, Inc.

- Walmart Inc.

Strategic Recommendations Empowering Industry Leaders to Capitalize on Emerging Opportunities in the Digital Gift Card Sector

To capitalize on emerging growth avenues within the digital gift card market, industry leaders must adopt a multifaceted strategy that emphasizes innovation, partnerships, and customer-centric design. Prioritizing seamless omnichannel experiences is paramount; organizations should integrate digital card issuance, distribution, and redemption workflows across e-commerce, mobile apps, and in-store environments, ensuring frictionless interactions at every touchpoint. Leveraging advanced analytics and machine learning algorithms will unlock predictive insights into gifting behaviors, enabling hyper-personalized offers and dynamic incentive structures that resonate with both corporate clients and individual consumers.

Strategic alliances with payment networks, loyalty program operators, and social commerce platforms can broaden distribution reach while enriching card use cases. Security and compliance must remain top priorities; implementing robust tokenization, multi-factor authentication, and real-time fraud monitoring will safeguard customer trust. For corporate segments, tailored solutions that support bulk issuance, custom branding, and centralized reporting will drive enterprise adoption. Simultaneously, consumer-oriented innovations such as instant micro-gifting through messaging apps and AI-driven recommendation engines will enhance user engagement. By balancing technological investments with collaborative ecosystem play, industry participants can unlock sustainable competitive advantages and position themselves at the forefront of the evolving digital gift card frontier.

Detailing a Robust Multimethod Research Framework Ensuring Comprehensive and Reliable Digital Gift Card Market Insights

This report’s findings are underpinned by a rigorous multimethod research framework that synthesizes secondary and primary data sources. The secondary research phase entailed exhaustive reviews of industry publications, regulatory filings, company collateral, and trade association reports to identify key market drivers, regulatory dynamics, and competitive developments. Complementing this desk research, primary interviews were conducted with a diverse cohort of participants, including payment network executives, gift card platform providers, retail and e-commerce decision-makers, and corporate procurement specialists.

Quantitative data was triangulated through a combination of expert validation workshops and a bespoke online survey targeting both corporate gift card purchasers and individual gift givers. Advanced statistical techniques, including cross-tabulation and regression analysis, were employed to verify segment interdependencies and regional adoption patterns. The research methodology adheres to stringent quality assurance protocols, encompassing data verification, respondent credibility checks, and iterative peer reviews. This robust approach ensures that the insights articulated herein are comprehensive, reliable, and reflective of the current trajectory of the digital gift card landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Gift Card market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Gift Card Market, by Card Type

- Digital Gift Card Market, by Purchase Occasion

- Digital Gift Card Market, by Transaction Type

- Digital Gift Card Market, by Purchase Method

- Digital Gift Card Market, by Application

- Digital Gift Card Market, by End User

- Digital Gift Card Market, by Region

- Digital Gift Card Market, by Group

- Digital Gift Card Market, by Country

- United States Digital Gift Card Market

- China Digital Gift Card Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Concluding Perspectives on the Evolutionary Trajectory of Digital Gift Cards and Imperatives for Future Market Leadership

In conclusion, the digital gift card market stands at an inflection point where consumer expectations for convenience, personalization, and security converge with enterprise imperatives for data-driven engagement and operational efficiency. The accelerated shift toward virtual issuance, underpinned by mobile and cloud-native technologies, has rendered physical gift cards secondary in strategic importance, even as new tariff regimes reinforce the digital migration trend. Segmentation analysis underscores the breadth of use cases-from corporate incentives to consumer celebrations-while regional insights reveal differing maturity curves and innovation vectors.

Competitors are vying to differentiate through seamless omnichannel experiences, API-first architectures, and strategic partnerships that extend reach into social commerce and super-app ecosystems. Industry leaders that invest in predictive analytics, robust security frameworks, and customizable solution suites will be best positioned to capture emerging value pools. As digital gift cards continue to evolve beyond transactional instruments into dynamic engagement platforms, stakeholders must remain agile, data-focused, and collaborative. The insights outlined in this report provide a roadmap for navigating the complexities of this vibrant market and seizing growth opportunities in the years to come.

Connect with Associate Director Ketan Rohom to Secure Comprehensive Digital Gift Card Market Intelligence and Drive Strategic Growth

To unlock the full potential of the digital gift card market and harness the insights detailed in this report, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy today. Engaging directly with Ketan will provide you personalized guidance on how these findings align with your strategic objectives and growth initiatives in the digital gifting space. Whether you seek deeper analysis on consumer behavior shifts, segmentation strategies, or regional dynamics, Ketan’s expertise will ensure that you receive tailored recommendations to drive market leadership. Don’t miss the opportunity to transform these comprehensive insights into actionable plans that will position your organization at the forefront of the rapidly evolving gift card ecosystem. Contact Ketan Rohom now to accelerate your decision-making process and capitalize on emerging opportunities before your competitors do.

- How big is the Digital Gift Card Market?

- What is the Digital Gift Card Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?