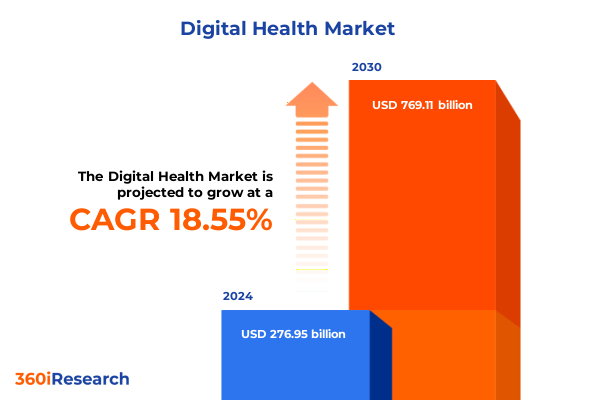

The Digital Health Market size was estimated at USD 276.95 billion in 2024 and expected to reach USD 327.19 billion in 2025, at a CAGR of 18.55% to reach USD 769.11 billion by 2030.

Navigating the Digital Health Revolution by Exploring Key Market Drivers, Technological Innovations, and Strategic Opportunities for Unprecedented Growth

The digital health landscape has undergone a remarkable transformation in recent years, driven by rapid technological innovation and evolving patient expectations. What was once a niche segment centered around electronic health records and basic telemedicine offerings has exploded into a diverse ecosystem encompassing advanced sensors, artificial intelligence platforms, and patient engagement tools. This revolution is underpinned by an unprecedented convergence of healthcare, information technology, and consumer electronics, creating opportunities for stakeholders across every segment of the value chain.

As regulatory bodies worldwide work to accommodate new models of care delivery, organizations are tasked with not only adopting new tools, but also driving cultural and operational change to fully realize their potential. Executive leadership teams must understand the multifaceted drivers-including shifting reimbursement structures, mounting cost pressures, and the increasing demand for personalized care-that are shaping market dynamics. By aligning strategic priorities with emerging digital health trends, companies can position themselves to capitalize on long-term growth while improving patient outcomes and operational efficiency.

Unveiling the Transformative Shifts Reshaping the Digital Health Landscape Through AI, Telemedicine, Interoperability, and Patient-Centric Models

A series of transformative shifts is redefining the competitive landscape for digital health solutions, ushering in new paradigms of care delivery and interoperability. The proliferation of cloud-native architectures and open data standards has accelerated the adoption of application programming interfaces, enabling seamless data exchange between disparate systems. Meanwhile, the integration of predictive analytics and machine learning into clinical workflows is empowering providers with actionable insights that enhance decision-making and resource allocation.

Simultaneously, telehealth has evolved beyond simple video consultations to encompass remote patient monitoring and virtual therapy programs, fundamentally altering patient engagement models. Consumer expectations have also shifted, with individuals seeking more control over their health data and greater transparency from providers. In response, industry leaders are developing patient-centric platforms that support continuous engagement through mobile apps, wearables, and virtual coaching. These shifts are reshaping the industry’s structure, demanding agility, and fostering deeper collaboration among stakeholders.

Assessing the Cumulative Impact of United States 2025 Tariffs on Digital Health Supply Chains, Device Pricing, Service Delivery, and Strategic Sourcing

The cumulative impact of United States tariffs introduced in 2025 has created significant ripple effects across digital health supply chains, influencing both hardware and software costs. In particular, increased levies on imported sensors, networking devices, and medical device integrators have prompted manufacturers to reassess their sourcing strategies. Many organizations are exploring onshore assembly or diversifying supplier portfolios to mitigate exposure to tariff-related cost inflation, but these initiatives can require substantial capital investment and extended lead times.

On the software and services front, new duties on offshore consulting and implementation services have led to incremental pricing adjustments for end users. Providers reliant on remote monitoring software and patient engagement platforms from non-domestic vendors are now weighing the trade-offs between maintaining established partnerships and shifting to domestic or tariff-exempt solutions. As a result, procurement teams are engaging more deeply with legal and compliance functions to navigate the evolving regulatory framework and optimize total cost of ownership.

Gleaning Actionable Insights from Component, Technology, Application, and End-User Segmentation to Drive Strategic Decisions in Digital Health

Examining the market through the lens of component, technology, application, and end-user segmentation yields nuanced insights into growth pockets and competitive pressures. From a component perspective, hardware elements such as networking devices and sensors have gained prominence due to the proliferation of remote patient monitoring initiatives, while software offerings like electronic health records and patient engagement platforms continue to evolve with embedded analytics capabilities. Service segments, encompassing consulting, implementation, and training, remain critical as organizations require expertise to integrate and optimize complex digital ecosystems.

The technology segmentation further refines the picture, revealing that health IT infrastructure forms the backbone of enterprise deployments, whereas mHealth applications and devices cater to consumer-driven monitoring and wellness programs. Telecare solutions focusing on remote medication management and activity tracking are converging with telehealth services that offer long-term care monitoring and virtual consultations. Application segmentation underscores growing demand for workflow automation solutions that streamline communication, resource scheduling, and care coordination, alongside specialized disease management programs for cardiovascular, diabetes, and mental health. Government health agencies, payers, providers, patients, and pharmaceutical companies each represent distinct end-user profiles with unique priorities and budget cycles, driving tailored value propositions across the market.

This comprehensive research report categorizes the Digital Health market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Therapeutic Area

- Connectivity

- Healthcare Setting

- Application

- End-User

Comparing Regional Dynamics across the Americas, Europe Middle East & Africa, and Asia Pacific to Inform Regional Strategies in Digital Health

Regional dynamics play a pivotal role in shaping digital health adoption and investment patterns, with each geography exhibiting unique regulatory and infrastructural characteristics. In the Americas, the United States leads with robust private and public funding for telehealth expansion, digital therapeutics trials, and value-based care initiatives, while Canada’s provincial systems focus on interoperability frameworks to enable cross-jurisdictional data sharing. In Latin America, governments are increasingly embracing mHealth platforms to extend coverage to underserved populations, though infrastructure constraints and uneven reimbursement policies present ongoing challenges.

Europe, the Middle East, and Africa comprise a diverse constellation of markets, where the European Union’s comprehensive data privacy regulations and the Digital Health and Care Programme drive standardization, whereas the Middle East and Africa emphasize rapid adoption of remote monitoring and mobile health services to address resource limitations. In the Asia-Pacific region, nations such as China, India, South Korea, and Australia are deploying large-scale smart hospital programs, leveraging AI for diagnostic support, and fostering public-private partnerships to scale digital health solutions. These regional nuances necessitate differentiated market entry strategies and value propositions.

This comprehensive research report examines key regions that drive the evolution of the Digital Health market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Movements and Competitive Insights of Industry-Leading Digital Health Innovators and Their Emerging Market Strategies

Leading organizations have adopted diverse approaches to secure competitive advantage in the digital health space. Large EHR vendors are integrating advanced analytics modules and interoperability services to bolster platform stickiness, while medical device manufacturers are embedding connectivity features into next-generation sensors and monitors to capture real-time patient data. Technology companies that historically focused on cloud infrastructure and enterprise software are now forging partnerships with healthcare incumbents to co-develop telehealth and remote monitoring offerings.

Moreover, market leaders are pursuing targeted acquisitions to augment their capabilities in niche segments such as chronic disease management, mental wellness, and women’s health. Strategic alliances with payers and government agencies are enabling pilot programs that demonstrate improved outcomes and cost savings, thus building momentum for broader adoption. These competitive moves underscore the importance of an integrated go-to-market strategy that aligns product innovation with regulatory compliance and end-user needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Health market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ada Health GmbH

- Advanced Data Systems Corporation

- American Well Corporation

- Aptar Digital Health

- athenahealth, Inc.

- Cantata Health, LLC

- Cisco Systems, Inc.

- Click Therapeutics, Inc.

- Cognizant Technology Solutions Corporation

- ConcertAI LLC

- DNAnexus, Inc.

- eClinicalWorks, LLC

- Epic Systems Corporation

- GE HealthCare Technologies Inc.

- Harris Computer Corporation

- iHealth Labs Inc.

- International Business Machines Corporation

- InterSystems Corporation

- Johnson & Johnson Services, Inc.

- Kasha Global Inc.

- Koninklijke Philips N.V.

- Lupin Limited

- Lyra Health, Inc.

- Medtronic PLC

- NextGen Healthcare, Inc.

- Oracle Corporation

- Qualcomm Incorporated

- Siemens AG

- UnitedHealth Group Incorporated

- Veradigm LLC

Presenting Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Digital Health Trends and Market Disruptions

To thrive in an increasingly complex landscape, industry leaders should prioritize investments in AI-driven interoperability platforms that facilitate seamless data exchange across care settings. Simultaneously, diversifying supply chains to mitigate the impact of tariff fluctuations will be essential for stabilizing hardware and service costs. Embracing cloud-native architectures and containerized deployments can accelerate time to market, while robust cybersecurity frameworks will safeguard patient data and maintain regulatory compliance.

Organizations should also double down on patient engagement initiatives by leveraging mobile and telecare solutions that offer personalized preventive health programs and continuous monitoring. Collaborating with regional stakeholders, including government bodies and payers, can unlock new reimbursement models and expand market access. Finally, fostering a culture of innovation through dedicated centers of excellence and cross-functional agile teams will enable rapid prototyping and iterative improvement of digital health solutions.

Detailing the Comprehensive Research Methodology and Analytical Frameworks Underpinning the Digital Health Market Analysis for Robust Insights

This analysis draws upon a rigorous mixed-methods research methodology that integrates primary and secondary data sources to ensure comprehensive and reliable insights. Primary research encompassed in-depth interviews with C-level executives, healthcare providers, payers, and technology vendors, as well as surveys targeting end-users across multiple regions. Secondary research included an extensive review of regulatory filings, industry white papers, corporate presentations, and peer-reviewed publications to validate market trends and emerging use cases.

To enhance analytical robustness, data triangulation techniques were employed, cross-verifying findings from different sources and methodologies. The segmentation framework was designed to capture the multifaceted nature of digital health adoption by combining component-level analysis with technology, application, and end-user perspectives. A proprietary scoring model assessed vendor capabilities, solution maturity, and market readiness, thereby facilitating a nuanced evaluation of competitive positioning and strategic opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Health market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Health Market, by Component

- Digital Health Market, by Therapeutic Area

- Digital Health Market, by Connectivity

- Digital Health Market, by Healthcare Setting

- Digital Health Market, by Application

- Digital Health Market, by End-User

- Digital Health Market, by Region

- Digital Health Market, by Group

- Digital Health Market, by Country

- United States Digital Health Market

- China Digital Health Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding with Strategic Synthesis and Forward-Looking Perspectives to Illuminate the Future Trajectory of the Digital Health Market

The digital health market stands at an inflection point characterized by rapid technological innovation, shifting regulatory landscapes, and evolving patient expectations. The convergence of advanced sensors, AI-enabled analytics, and cloud infrastructure is transforming care delivery models, while tariff pressures and regional dynamics underscore the need for agile supply chain and go-to-market strategies. A segmentation-driven approach reveals distinct growth trajectories across components, technologies, applications, and end users, highlighting areas of high potential and competitive intensity.

These insights point to a future where collaboration across public and private stakeholders will be paramount to overcoming interoperability and reimbursement challenges. Companies that adopt a patient-centric mindset, invest in digital infrastructure, and proactively manage geopolitical and regulatory risks will be best positioned to capture value. As the industry continues to evolve, this summary provides strategic clarity and actionable intelligence to inform decision-making and guide sustainable growth initiatives.

Secure Exclusive Access to In-Depth Digital Health Market Insights by Connecting with Ketan Rohom for Your Comprehensive Report Today

Unlock unparalleled strategic insights and stay ahead of market shifts by acquiring the full in-depth digital health market report. Connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure comprehensive data, rigorous analysis, and tailored recommendations that will empower your organization to navigate evolving industry dynamics with confidence and precision.

- How big is the Digital Health Market?

- What is the Digital Health Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?