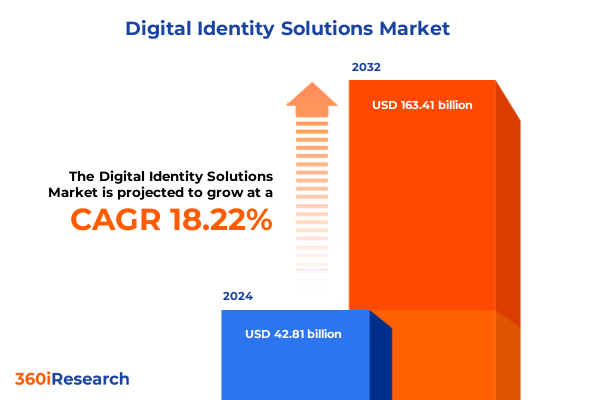

The Digital Identity Solutions Market size was estimated at USD 50.24 billion in 2025 and expected to reach USD 58.97 billion in 2026, at a CAGR of 18.34% to reach USD 163.41 billion by 2032.

Exploring the Foundations and Collaborative Forces Driving Modern Digital Identity Solutions for Secure and Seamless User Experiences

The rapid proliferation of digital services has transformed how organizations and individuals interact, collaborate, and transact. At the heart of this shift lies digital identity-a dynamic construct that verifies and authorizes users, safeguards sensitive data, and underpins trust in online ecosystems. As digital channels expand into every facet of daily life, from finance and healthcare to retail and government services, the imperative for secure and seamless identity management has never been greater. Moreover, the convergence of emerging technologies such as artificial intelligence, decentralized architectures, and advanced encryption techniques has ushered in a new era of innovation. These developments are redefining the very notion of identity, enabling adaptive authentication, real-time risk assessment, and privacy-preserving credential exchange.

Stakeholders across industries recognize that a robust digital identity strategy is foundational to both growth and resilience. Enterprises seeking to streamline user journeys must integrate versatile solutions that balance security with usability, while regulators and standards bodies strive to harmonize frameworks that protect consumers without stifling innovation. Furthermore, the evolution of consumer expectations-demanding instantaneous access, transparent data handling, and frictionless interactions-drives the quest for identity platforms that can deliver personalized experiences at scale. By establishing a clear vision that aligns technological capabilities with organizational goals, decision makers can navigate the complexities of identity management and future-proof their digital ecosystems.

Unveiling the Transformative Technological Shifts and Emerging Paradigms Reshaping Digital Identity Management Across Industries Worldwide

The digital identity landscape is undergoing profound transformation driven by breakthroughs in biometrics, distributed ledger technologies, and machine learning–powered anomaly detection. In recent years, facial recognition and fingerprint scanning have moved from niche applications to core components of multi-factor authentication schemes. Simultaneously, decentralized identity frameworks, leveraging blockchain or other distributed networks, are empowering users with self-sovereign credentials that reduce reliance on centralized repositories and mitigate single points of failure. These shifts herald a departure from static username-password combinations toward dynamic, context-aware security postures that continuously validate trust in real time.

In parallel, the integration of behavioral analytics and AI-driven risk engines is enabling organizations to detect and respond to threats before they materialize. By analyzing patterns in device usage, transaction flows, and even keystroke dynamics, these systems can flag anomalous activity with precision, minimizing false positives and enhancing user experience. Moreover, the emergence of privacy-enhancing technologies-such as zero-knowledge proofs and secure multi-party computation-facilitates data sharing and verification without exposing personal information. This paradigm shift not only addresses stringent data protection regulations but also cultivates greater consumer confidence. As these transformative technologies coalesce, they are reshaping the strategic priorities of CIOs, CISOs, and identity architects around the globe.

Analyzing the Cumulative Impact of New Tariff Measures on Digital Identity Supply Chains and Service Delivery Models in the United States in 2025

In 2025, cumulative tariff measures imposed by the United States have introduced new complexities for manufacturers and integrators of digital identity hardware and components. Tariffs targeting imported authentication devices, biometric sensors, and related semiconductor materials have elevated procurement costs and disrupted established supply chains. As a result, solution providers have been compelled to reevaluate sourcing strategies, diversify supplier portfolios, and absorb increased overheads to maintain competitive pricing. Consequently, organizations that previously relied on cost-effective imports from key manufacturing hubs have faced pressure to negotiate localized assembly arrangements or to invest in alternative production capacities within allied regions.

Beyond direct hardware expenses, the ripple effects of tariff adjustments extend to the ecosystem of services that support identity deployments. Specialized installation teams, consulting firms, and integration partners have encountered variable labor and transportation fees, further complicating project budgeting. In response, many service providers are adopting hybrid delivery models that blend remote expertise with on-site support, thereby optimizing resource allocation and mitigating tariff-driven cost inflation. Moreover, the evolving regulatory environment has underscored the importance of transparent vendor compliance practices and proactive risk assessments. Organizations that embrace these measures are better positioned to withstand market volatility, preserve implementation timelines, and sustain the integrity of their digital identity frameworks.

Revealing Key Segmentation Insights by Component, Identity Type, Deployment Method, Enterprise Size and Industry Verticals for Tailored Strategic Alignment

A nuanced understanding of market segmentation reveals how diverse requirements shape the adoption of digital identity solutions. When considering the component landscape, organizations often balance the merits of managed services against the flexibility of professional offerings. Within professional services, consulting engagements provide strategic roadmaps, while integration and implementation efforts ensure technical deployment aligns with existing infrastructures. Equally, solutions spanning access management, identity verification, authentication, compliance management, and governance play critical roles in enforcing policy, safeguarding assets, and facilitating user interactions.

Turning to identity types, the choice between biometric and non-biometric approaches hinges on factors such as user demographics, security mandates, and environmental conditions. Facial recognition, fingerprint, and iris scanning deliver high confidence levels, whereas traditional passwords, PINs, and security questions remain prevalent for segments with lower risk thresholds. Deployment decisions further refine these strategies: cloud-based platforms offer agility and rapid scalability, while on-premises implementations retain granular control over data residency and system customization. Moreover, enterprise size influences solution architecture, as large organizations demand centralized governance and cross-domain interoperability, while small and medium-sized enterprises often prioritize streamlined, cost-effective integrations.

Finally, vertical considerations underscore the importance of tailored capabilities. Industries such as banking, financial services, and insurance emphasize regulatory compliance and fraud prevention, while sectors like energy, utilities, government, and defense require robust identity assurance and revocation mechanisms. Healthcare entities focus on patient privacy and interoperability, whereas retail, eCommerce, travel, and hospitality seek seamless consumer journeys balanced with fraud detection. By aligning solution attributes with the unique needs of each industry vertical, stakeholders can optimize user trust and operational efficiency.

This comprehensive research report categorizes the Digital Identity Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Identity Type

- Deployment

- Organization Size

- Vertical

Illuminating Regional Dynamics and Growth Drivers Across the Americas, the Europe Middle East and Africa Region, and the Asia Pacific for Technology Advancement

Regional dynamics in digital identity adoption reflect diverse regulatory frameworks, economic drivers, and technological priorities. In the Americas, mature financial markets and progressive privacy legislation propel demand for user-centric authentication models. Organizations across banking, retail, and healthcare are advancing integrations that emphasize consent management and data portability. Moreover, strategic alliances between technology vendors and service providers are accelerating the rollout of innovative biometrics solutions for both enterprise and consumer use cases.

Conversely, the Europe Middle East and Africa region presents a tapestry of regulatory regimes and digital maturity levels. The implementation of stringent data protection standards has galvanized investment in compliance management and identity governance platforms. At the same time, governments in the Middle East and North Africa are launching national ID initiatives, leveraging digital credentials to streamline citizen services. Meanwhile, African markets are leapfrogging traditional infrastructure by embracing mobile-first identity verification and digital wallet solutions to enhance financial inclusion.

In the Asia Pacific region, high-growth economies and robust consumer adoption of mobile applications drive rapid deployment of cloud-based identity architectures. Governments and private enterprises are piloting self-sovereign identity frameworks underpinned by distributed ledger protocols, aiming to reconcile security, privacy, and interoperability. Partnerships with global technology leaders facilitate knowledge transfer and ecosystem expansion. Collectively, these regional insights highlight how localized strategies and cross-border collaborations are shaping the future of digital identity innovation.

This comprehensive research report examines key regions that drive the evolution of the Digital Identity Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategies, Innovations, and Collaborative Partnerships of Leading Digital Identity Providers Steering Industry Transformation

Leading providers in the digital identity domain are demonstrating strategic agility through targeted acquisitions, product innovation, and alliance formation. A prominent cloud identity specialist has expanded its portfolio with advanced risk analytics and passwordless authentication modules, integrating machine learning capabilities to anticipate threat vectors. Another established incumbent in enterprise access management has partnered with a biometric hardware manufacturer to deliver seamless biometric onboarding and continuous identity verification across mobile and desktop platforms.

Emerging challengers are carving niches by focusing on specialized verticals and compliance-centric offerings. One vendor that originated in the healthcare sector now provides a unified identity orchestration layer capable of reconciling disparate credential sources and aligning them with industry-specific regulatory requirements. Meanwhile, a fintech-rooted provider has scaled its identity verification engine by incorporating real-time data verification with trusted third-party databases, catering to both financial institutions and insurance carriers.

Furthermore, strategic alliances between technology innovators and global system integrators are bolstering end-to-end solution delivery. These collaborations facilitate rapid deployment, co-innovation of AI-driven capabilities, and comprehensive managed services. By continually refining their go-to-market strategies and investing in research partnerships, these companies are steering industry transformation and setting benchmarks for interoperability, usability, and security.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Identity Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- ACI Worldwide, Inc.

- Affinidi Pte. Ltd.

- Amazon Web Services, Inc.

- Atos SE

- Au10tix Ltd.

- Cognizant Technology Solutions Corporation

- Daon, Inc.

- DXC Technology Company

- Experian PLC

- GB Group PLC

- IDEMIA Group

- International Business Machines Corporation

- iProov Limited

- Jumio Corporation

- London Stock Exchange Group PLC

- Microsoft Corporation

- Mitek Systems, Inc.

- NEC Corporation

- NTT DATA Group Corporation

- Okta, Inc.

- OneSpan Inc.

- Oracle Corporation

- Ping Identity Corporation

- Samsung SDS Co., Ltd.

- Signicat AS

- Smartmatic Corporation

- Tata Consultancy Services Limited

- TECH5 SA

- TELUS Communications Inc.

- TESSI SAS

- Thales Group

- Utimaco Management Services GmbH

- VÍNTEGRIS, S.L.

- Worldline SA

Outlining Actionable Recommendations and Strategic Imperatives to Empower Stakeholders in Navigating the Evolving Digital Identity Landscape

Industry leaders should prioritize a multi-layered security posture that incorporates both biometric and behavioral authentication approaches. By integrating adaptive risk engines into existing infrastructure, organizations can dynamically adjust authentication requirements based on contextual signals. In addition, fostering vendor ecosystems through open APIs and standardized protocols enhances interoperability across devices, cloud platforms, and compliance management systems.

Moreover, stakeholders must invest in privacy-enhancing technologies that align with evolving regulatory mandates while preserving user control over personal data. Implementing decentralized identity frameworks can reduce reliance on centralized repositories, mitigating breach risks and boosting consumer trust. At the same time, decision makers should cultivate cross-functional teams that encompass security, compliance, and customer experience to ensure holistic solution design and continuous improvement.

Finally, forging partnerships with academic institutions, standards bodies, and industry consortia accelerates innovation and consensus building. Collaborative research initiatives and pilot programs enable early evaluation of emerging techniques, from zero-knowledge proofs to secure enclave computing. By embracing this collaborative mindset, organizations can navigate the complexities of the digital identity ecosystem, unlock new growth opportunities, and maintain resilience in the face of evolving threat landscapes.

Detailing Rigorous Research Methodology and Analytical Frameworks Employed to Generate Insightful Findings on Digital Identity Technologies

This research synthesis draws upon a rigorous, multi-phase methodology combining qualitative and quantitative approaches. Primary insights were collected through in-depth interviews with CISOs, identity architects, and senior IT leaders spanning diverse sectors and organizational sizes. These conversations explored real-world implementation challenges, strategic priorities, and emerging adoption patterns. Complementing interviews, a structured survey captured the perspectives of over one hundred decision makers, enabling identification of prevalent technology preferences and deployment models.

Secondary research involved a comprehensive review of regulatory filings, industry white papers, and technology vendor documentation to map the evolving compliance landscape and innovation trajectories. Analytical frameworks such as use-case mapping, vendor benchmarking matrices, and value chain analysis were employed to distill core capabilities and strategic differentiators. In addition, scenario planning exercises were conducted to assess the potential impact of geopolitical factors, including tariff policy changes, on supply chains and service delivery models.

Data triangulation techniques ensured the validity and reliability of findings, while iterative review cycles with subject-matter experts refined the final recommendations. This blended methodology provides a transparent, replicable foundation for understanding the complexities of digital identity solutions and equips stakeholders with actionable insights for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Identity Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Identity Solutions Market, by Component

- Digital Identity Solutions Market, by Identity Type

- Digital Identity Solutions Market, by Deployment

- Digital Identity Solutions Market, by Organization Size

- Digital Identity Solutions Market, by Vertical

- Digital Identity Solutions Market, by Region

- Digital Identity Solutions Market, by Group

- Digital Identity Solutions Market, by Country

- United States Digital Identity Solutions Market

- China Digital Identity Solutions Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Takeaways and Strategic Imperatives Derived from the Comprehensive Analysis of Digital Identity Ecosystem Dynamics

The convergence of advanced biometrics, AI-driven analytics, and decentralized frameworks is driving a fundamental redefinition of digital identity. Organizations that embrace adaptive, context-aware authentication will gain a pivotal advantage in mitigating fraud and improving user experience. Meanwhile, regional nuances in regulatory regimes and digital maturity underscore the need for flexible architectures that can align with both global standards and local mandates. Furthermore, the recent United States tariff adjustments have highlighted supply chain vulnerabilities, prompting stakeholders to diversify sourcing strategies and adopt hybrid deployment models.

Key segmentation insights demonstrate that tailoring solutions according to component type, identity modality, deployment method, enterprise size, and vertical requirements is critical for delivering differentiated value. Leading providers are capitalizing on strategic partnerships, specialized offerings, and co-innovation initiatives to navigate this complexity. To remain competitive, industry leaders must prioritize interoperability, privacy preservation, and continuous risk assessment while fostering collaborative ecosystems with academic, standards, and vendor partners.

Ultimately, the path forward lies in adopting a holistic identity strategy that unites security imperatives, operational efficiency, and user-centric design. By leveraging the research findings and recommendations presented herein, decision makers can chart a course toward resilient, future-ready identity frameworks that underpin trust and drive digital transformation.

Empowering Decision Makers to Secure Competitive Advantage by Engaging Directly with Ketan Rohom for Exclusive Access to the Digital Identity Solutions Report

To gain an in-depth understanding of emerging trends, critical insights, and strategic pathways within the digital identity landscape, reach out to the dedicated Associate Director of Sales & Marketing, Ketan Rohom. By engaging directly, decision makers receive privileged guidance on how to leverage the comprehensive research findings for competitive advantage. Schedule a personalized briefing to explore how the report’s actionable recommendations can be tailored to your organization’s objectives and challenges. Secure exclusive access today and position your enterprise at the forefront of innovation and security in the digital identity domain by partnering with Ketan Rohom to obtain the complete Digital Identity Solutions Report.

- How big is the Digital Identity Solutions Market?

- What is the Digital Identity Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?