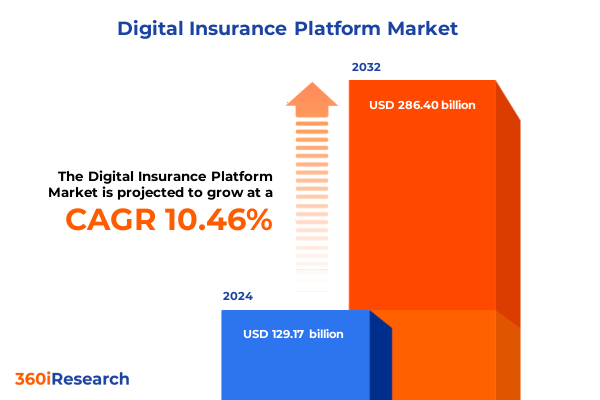

The Digital Insurance Platform Market size was estimated at USD 141.96 billion in 2025 and expected to reach USD 156.23 billion in 2026, at a CAGR of 10.54% to reach USD 286.40 billion by 2032.

Setting the Stage for the Digital Insurance Revolution Across Emerging Technologies, Customer Expectations, and Competitive Dynamics

In an era defined by rapid technological progress and evolving customer expectations, the digital insurance platform has emerged as a cornerstone of competitive differentiation. Insurers are shifting from traditional, legacy systems to agile, cloud-enabled architectures that facilitate seamless customer interactions and end-to-end automation. As a result, policyholders now expect intuitive, self-service capabilities, lightning-fast claims processing, and personalized coverage recommendations delivered through mobile and web channels.

This executive summary encapsulates the critical themes shaping this transformation, highlighting how strategic integration of advanced analytics, artificial intelligence, and open data ecosystems is rewriting the rules of risk underwriting and customer engagement. It underscores the stakes for incumbents and challengers alike, illuminating the investments required to modernize infrastructure, cultivate talent, and forge partnerships with insurtech innovators.

Moreover, the introduction emphasizes the growing regulatory focus on data privacy, systemic resilience, and consumer protection, challenging insurers to balance innovation velocity with compliance rigor. As digital distribution channels proliferate and new market entrants emerge, established carriers must adopt forward-looking strategies to protect margins, sustain growth, and reinforce brand loyalty. With this foundation in place, the subsequent sections explore the transformative shifts, segmentation insights, regional dynamics, and practical recommendations that define the contours of the digital insurance marketplace today.

Uncovering the Pivotal Shifts in Consumer Behavior, Technology Adoption, and Regulatory Frameworks Driving Digital Insurance Transformation

The insurance landscape is undergoing a profound metamorphosis fueled by converging technological breakthroughs, shifting consumer behaviors, and a tightening regulatory environment. First, the acceleration of artificial intelligence and machine learning capabilities has transformed underwriting models. Carriers now harness predictive analytics to assess risk with unprecedented precision, automating policy issuance and enabling dynamic pricing structures tailored to individual profiles.

Concurrently, the proliferation of Internet of Things devices, telematics, and smart home sensors is generating vast streams of real-time data. Insurers leverage this information to shift from loss compensation to proactive risk prevention, offering usage-based premiums and incentivizing safer behaviors. In parallel, the rise of open application programming interfaces fosters a collaborative ecosystem where fintechs, healthtech firms, and mobility providers co-create value. This shift from product silos toward platform-based models facilitates cross-industry partnerships that expand service offerings.

Regulatory shifts are equally transformative. Data sovereignty requirements and evolving capital adequacy standards are compelling carriers to rearchitect their data governance frameworks and enhance resilience protocols. At the same time, growing consumer demand for transparency and ethical AI use is prompting insurers to embed fairness and explainability in every algorithmic process. Taken together, these transformative forces are redefining the competitive rules of engagement, demanding a holistic rethink of product design, distribution strategies, and operational capabilities.

Analyzing the Comprehensive Effect of 2025 United States Tariff Measures on Operational Costs, Supply Chains, and Risk Underwriting

The introduction of new United States tariffs in early 2025 has reverberated across multiple facets of the insurance value chain. Product underwriters face increased material and labor costs as tariffs on imported metals and automotive components elevate repair and replacement expenses. Consequently, property and motor insurers must recalibrate their risk models to account for these cost pressures, which ripple into broader claims inflation.

Meanwhile, insurers reliant on global supply chains for specialized equipment and software face extended lead times and higher procurement prices. This dynamic is particularly acute for digital transformation initiatives, where hardware dependencies for data centers and edge devices are subject to cross-border duties. In turn, technology budgets are squeezed, compelling carriers to explore alternative sourcing strategies, renegotiate vendor contracts, or accelerate migration to cloud service models that minimize capital-intensive hardware investments.

From an underwriting perspective, the tariffs have introduced volatility in catastrophe exposure analytics, as the replacement cost curves for damaged assets shift upward. To preserve margin integrity, insurers are exploring parametric coverages and layered reinsurance structures that hedge against sudden cost escalations. These adjustments underscore the necessity for real-time data integration, adaptive pricing engines, and scenario-based stress testing frameworks to navigate the evolving tariff landscape with agility.

Deriving Strategic Insights from Product, Distribution, End User, Payment Mode, Policy Type, and Technology Segmentation Dynamics

A nuanced understanding of customer segments underpins strategic differentiation in this dynamic market environment. When viewed through the lens of product type, distinct demands emerge: policyholders seeking health coverage prioritize telemedicine access and wellness incentives, while life insurance customers value flexible premium schedules and integrated estate-planning tools. Motor insurance buyers increasingly demand real-time telematics feedback and usage-based pricing models, contrasted with property insurance clients who focus on smart home integration and expedited repair services. Travel insurance subscribers look for modular trip cancellation and medical evacuation provisions that adapt to evolving global risk profiles.

Shifting focus to distribution channels reveals further complexity. Bancassurance partnerships continue to deliver high-volume, cost-efficient acquisition in mature markets, whereas broker networks excel in delivering advisory-based, high-touch solutions for complex corporate risks. Direct channels have gained traction among digitally native consumers seeking low-friction onboarding, while online platforms powered by embedded insurance capabilities are carving out niches in ecosystems ranging from e-commerce to ride-hailing.

Examining end-user segmentation highlights divergent expectations. Individual policyholders demand hyper-personalized engagement journeys and on-demand support, whereas large enterprises require scalable risk-management platforms capable of integrating across global operations. Small and medium enterprises strike a middle ground, balancing affordability with sufficient customization. Payment mode preferences also vary: some customers opt for annual payments to maximize savings, while others choose monthly or quarterly installments to smooth cash flow. Semi-annual options appeal to those seeking compromise between cost efficiency and installment flexibility. Finally, when policy type differences are considered, new policy buyers look for intuitive comparison tools and rapid issuance, whereas renewal customers expect loyalty benefits, simplified claim filing, and auto-renewal conveniences. Underlying all segments, technology preferences diverge along cloud-based and on-premises lines: cloud solutions offer rapid scalability and continuous innovation, while on-premises deployments provide data sovereignty and legacy integration continuity. Understanding these multidimensional segment nuances enables insurers to tailor product design, channel strategies, and service models to resonate with each cohort.

This comprehensive research report categorizes the Digital Insurance Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Insurance Type

- Payment Mode

- Policy Type

- Deployment Type

- Distribution Channel

- End User

Exploring Unique Regional Trends and Market Drivers Shaping the Digital Insurance Landscape across Americas, EMEA, and Asia-Pacific

Regional dynamics exert a profound influence on digital insurance adoption and innovation trajectories. In the Americas, high smartphone penetration and advanced digital infrastructure facilitate mobile-first experiences, leading to increased adoption rates for app-based claims submissions and virtual consultations. Carriers in North America are investing heavily in fraud detection AI and blockchain-enabled policy registries, while in Latin America, microinsurance solutions delivered via mobile money platforms are expanding coverage among underserved populations.

Within Europe, Middle East, and Africa, regulatory harmonization efforts such as Solvency II revisions and emerging digital ID frameworks are shaping market entry strategies. In Western Europe, unified data protection regulations and stringent environmental underwriting guidelines are prompting carriers to integrate ESG considerations into product design. The Middle East insurance sector is witnessing the emergence of family-owned fintech alliances targeting tailored health and motor products, and in Africa, insurtech startups are leveraging agent-assisted digital tools to reach customers in remote regions.

The Asia-Pacific region exhibits a duality of fast-maturing markets and massive emerging opportunities. In markets like Japan and Australia, insurers incorporate robotics process automation and advanced biometrics for seamless onboarding. Conversely, in Southeast Asia and South Asia, partnerships between global reinsurers and local digital platforms are unlocking new microcredit insurance and peer-to-peer coverage models. These regional variations underscore the need for insurers to adopt geocentric strategies that balance global best practices with localized execution nuances.

This comprehensive research report examines key regions that drive the evolution of the Digital Insurance Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Digital Insurance Ecosystem Advancement and Competitive Differentiation

Leading incumbents and nimble insurtech challengers are defining competitive dynamics through differentiated capabilities and collaborative ventures. Established carriers are accelerating their digital roadmaps by acquiring or partnering with specialized startups in areas such as claims automation, customer engagement chatbots, and advanced fraud analytics. These collaborations allow traditional insurers to leverage design-driven user interfaces and agile development practices without discarding core policy administration systems.

Digital natives are carving out distinct market niches by deploying microservices-oriented architectures that enable rapid product experimentation. They leverage usage-based and parametric coverage models to appeal to specific customer cohorts, such as freelancers, gig-economy workers, and adventure travelers. Their API-first mindset fosters integration into third-party ecosystems, embedding insurance seamlessly into consumer journeys.

At the same time, cross-industry partnerships are reshaping distribution paradigms. Technology giants are entering the insurance domain via embedded propositions, bundling coverage with consumer electronics warranties or subscription services. Reinsurers are developing venture arms to invest in early-stage insurtech ventures, aligning their risk capital with innovative solutions. These evolving partnerships illustrate that the future of insurance hinges on orchestration across a broad ecosystem of financial, technology, and distribution players.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Insurance Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Acko General Insurance Limited

- Cogitate Technology Solutions

- Coherent, Inc.

- Comarch SA

- EIS Software Limited

- FINEOS Corporation

- Guidewire Software, Inc.

- Haven Life Insurance Agency, LLC

- Infosys Limited

- iPipeline, Inc.

- Lemonade, Inc.

- LTIMindtree Limited

- Next Insurance, Inc.

- Policybazaar Insurance Brokers Private Limited

- Prima Solutions SA

- RGI Group

- Root Platform ZA (Pty) Ltd.

- Salesforce, Inc.

- SAP SE

- Sapiens International.

- Shift Technology

- Software Group

- Tata Consultancy Services Limited

- TIBCO Software Inc.

- Vertafore, Inc.

- Wipro Limited

Implementing Forward-Looking Strategies for Industry Leaders to Accelerate Digital Transformation and Sustain Competitive Advantage in Insurance

To thrive amid intensifying competition and accelerating disruption, industry leaders must adopt a structured approach to digital transformation. It begins with establishing a clear vision tied to measurable business outcomes, supported by executive sponsorship and cross-functional governance. Prioritizing customer-centric design principles ensures that every technology investment translates into tangible improvements in user experience and operational efficiency. For instance, leveraging AI-driven chatbots for claims triage can reduce cycle times while delivering consistent service quality.

Investments in advanced analytics should focus on building a unified data platform that integrates internal policy and claims data with external sources, including telematics, social media, and public records. This data convergence enables predictive risk scoring and hyper-personalized product recommendations at scale. To navigate regulatory complexities, insurers must implement agile compliance frameworks that embed regulatory checkpoints into development sprints, ensuring that innovation does not compromise data privacy or capital adequacy standards.

Finally, cultivating a culture of continuous learning and experimentation is critical. Pilot initiatives launched in collaboration with insurtech incubators or academic institutions can de-risk large-scale rollouts, while upskilling programs in data science and design thinking empower in-house teams to lead transformation efforts. By executing these recommendations in parallel threads, carriers can accelerate time to value, reinforce competitive moats, and deliver differentiated digital experiences.

Detailing the Rigorous Methodology Combining Qualitative and Quantitative Approaches Ensuring Robust Digital Insurance Insights

The insights presented in this report are underpinned by a rigorous methodology that synthesizes both qualitative and quantitative research techniques. Primary data was gathered through in-depth interviews with senior executives, product managers, and technology architects across a representative cross-section of insurers, reinsurers, and insurtech startups. These dialogues provided nuanced perspectives on strategic priorities, technology roadmaps, and partnership models.

Complementing these firsthand insights, extensive secondary research was conducted, encompassing industry publications, regulatory filings, investor presentations, and open-source intelligence. Data triangulation ensured that emerging trends were validated through multiple independent channels, strengthening the robustness of the conclusions. Proprietary frameworks were applied to map segmentation dimensions against company capabilities and regional variables, enabling a structured comparison of strategic postures across the competitive landscape.

Finally, all findings were subjected to peer review by subject-matter experts in risk underwriting, claims operations, and digital experience design. This iterative validation process confirmed the report’s accuracy and relevance, culminating in actionable recommendations grounded in real-world feasibilities and designed to drive tangible business impact.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Insurance Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Insurance Platform Market, by Component

- Digital Insurance Platform Market, by Insurance Type

- Digital Insurance Platform Market, by Payment Mode

- Digital Insurance Platform Market, by Policy Type

- Digital Insurance Platform Market, by Deployment Type

- Digital Insurance Platform Market, by Distribution Channel

- Digital Insurance Platform Market, by End User

- Digital Insurance Platform Market, by Region

- Digital Insurance Platform Market, by Group

- Digital Insurance Platform Market, by Country

- United States Digital Insurance Platform Market

- China Digital Insurance Platform Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Summarizing Key Takeaways and Future Pathways for Innovation in Digital Insurance Platforms Amid Technological Advancement and Consumer Expectation Shifts

In summary, the digital insurance landscape is at an inflection point where technology, consumer demands, and regulatory forces converge to redefine value creation. Insurers that embrace data-driven underwriting, modular platform architectures, and seamless omnichannel experiences will gain a sustainable edge. The detailed segmentation analysis underscores the importance of tailoring offerings across product types, distribution channels, and payment preferences, while regional insights affirm that global strategies must be tempered by local execution nuances.

Moreover, the cumulative impact of recent tariff measures highlights the need for dynamic risk-modeling capabilities and adaptive procurement strategies to protect margin integrity. Leading carriers and emerging insurtech players are demonstrating that collaborative ecosystems-spanning fintechs, mobility providers, and technology firms-unlock new revenue opportunities and reinforce customer loyalty.

As the report’s recommendations illustrate, a balanced investment in advanced analytics, AI, and agile compliance frameworks, coupled with a rigorous change management approach, is essential to translating strategic intent into measurable outcomes. With this foundation, industry leaders can chart a clear pathway to future innovation, positioning themselves at the forefront of a deeply transformed digital insurance economy.

Engage with Ketan Rohom to Unlock Tailored Insights and Secure Your Digital Insurance Platform Market Research Report Today for Strategic Advantage

If you’re ready to transform your strategic approach and harness the latest insights in the digital insurance arena, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the comprehensive research report’s unique depth, showing you how the findings can inform your decision making, drive innovation roadmaps, and maximize operational efficiencies.

By engaging directly with Ketan Rohom, you gain personalized access to executive briefings and tailored service packages that align precisely with your organizational goals. His expertise ensures that your team fully understands the granular analyses, segmentation deep-dives, and actionable recommendations contained within the study, empowering you to accelerate your digital transformation journey.

Seize this opportunity to secure a competitive edge. Contact Ketan Rohom to explore customizable delivery formats, enterprise site licensing options, and expert consultation sessions that will catalyze the execution of your strategic initiatives. Elevate your market positioning and future-proof your digital insurance offerings by investing in this indispensable intelligence today

- How big is the Digital Insurance Platform Market?

- What is the Digital Insurance Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?