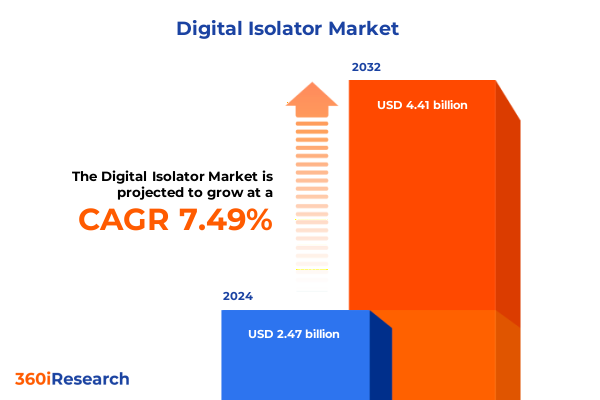

The Digital Isolator Market size was estimated at USD 2.65 billion in 2025 and expected to reach USD 2.84 billion in 2026, at a CAGR of 7.54% to reach USD 4.41 billion by 2032.

Understanding the Critical Role of Digital Isolators in Modern Electronics and Their Pivotal Function in Ensuring System Integrity

Modern electronic architectures demand robust solutions to ensure safety, signal integrity, and high-performance data exchange across system boundaries. Digital isolators have emerged as a critical enabler for achieving galvanic isolation while supporting ever-increasing data rates and stringent electromagnetic compatibility requirements. By replacing legacy optocouplers with advanced semiconductor-based isolators, designers can leverage superior speed, lower power consumption, extended lifespan, and enhanced reliability. These devices are pivotal in applications ranging from industrial drives to consumer electronics, where precise isolation reduces noise coupling, mitigates ground loop issues, and enhances overall system robustness.

In light of proliferating applications such as electric vehicles, renewable energy inverters, and next-generation medical diagnostics, the role of digital isolators has expanded beyond basic isolation. Innovations in materials, process technologies, and circuit architectures now allow isolation voltages exceeding 5,000 volts, data throughput into the hundreds of megabits per second, and bidirectional communication across multiple channels. This introduction sets the stage for a comprehensive exploration of market drivers, transformative trends, regulatory influences, and competitive dynamics that collectively shape the digital isolator landscape.

Examining the Convergence of High-Speed Data Demands and Energy Efficiency Requirements Driving Transformative Shifts in Digital Isolation Technology

The digital isolator ecosystem is undergoing a paradigm shift driven primarily by the convergence of high-speed data demands with imperatives for energy efficiency and miniaturization. As applications proliferate in sectors such as industrial automation, electric mobility, and telecommunications infrastructure, the need to transmit large volumes of data securely across isolated domains has never been more pressing. This transformation is underscored by the development of multi-channel isolators that support parallel data streams, ultra-low power variants optimized for battery-operated devices, and integrated modules combining isolation with signal conditioning and monitoring functions.

Moreover, the push for compact form factors and reduced bill of materials has galvanized innovation in package architectures, enabling surface-mount designs that occupy mere millimeters of board real estate. Advanced isolation techniques now incorporate reinforced insulation within monolithic silicon, providing simplified certification pathways for safety-critical applications. These technological breakthroughs are enabling system designers to rethink the conventional trade-offs between footprint, performance, and compliance, thereby unlocking new opportunities in sectors ranging from aerospace and defense to smart grids and consumer wearables.

Unraveling the Ripple Effects of 2025 United States Tariff Measures on Supply Chains, Pricing Structures, and Innovation in Digital Isolator Markets

In early 2025, new United States tariffs targeting a broad range of semiconductor components introduced heightened complexity into global supply chains. Although digital isolators were not always explicitly named, tariff classifications encompassing mixed-signal and specialized isolation devices led to increased import duties, compelling distributors and OEMs to reassess sourcing strategies. The ensuing ripple effect drove some manufacturers to negotiate alternative tariff codes, while others accelerated nearshoring initiatives to mitigate cost uncertainties and potential delays.

These tariff measures also prompted a renewed focus on value engineering, as procurement teams sought design alternatives that maintained isolation performance without incurring prohibitive tariffs. Consequently, some industry players invested in local assembly and testing capabilities to preserve margin profiles. Innovation initiatives pivoted toward the development of cost-optimized isolator variants that could leverage domestic supply base advantages while adhering to stringent safety certifications. The cumulative impact of these policies has reshaped competitive positioning and underscored the importance of agile supply chain management in the digital isolator sector.

Deciphering Key Segmentations Including Channel, Data Rate, Voltage, Supply, Package, End User, and Application Dynamics Shaping Digital Isolator Adoption

A nuanced understanding of segmentation dynamics is essential for stakeholders aiming to tailor solutions to specific performance and application requirements. Based on channel count, product offerings range from single-channel devices optimized for understated control scenarios to quad-channel isolators that facilitate parallel high-speed communication. Meanwhile, differentiation by data rate spans low-speed variants suitable for monitoring and control loops, as well as high-speed isolators engineered for demanding applications such as industrial Ethernet and motor drives.

Isolation voltage segmentation highlights devices rated below 1,500 volts for consumer and low-voltage industrial tasks, models in the 1,500 to 5,000-volt band for mainstream power electronics, and above 5,000 volts for reinforced insulation in medical and high-voltage energy infrastructure. Supply mode distinctions cover unidirectional isolators that simplify design for one-way signaling, and bidirectional products that support complex control schemes. In terms of package types, the market encompasses compact surface-mount isolators that underpin densely populated PCBs, as well as through-hole variants favored in ruggedized or prototyping environments.

Looking at end-user categories, automotive applications such as advanced driver assistance systems and onboard charging platforms leverage isolators for safety and performance, while consumer electronics rely on these devices for USB interfaces and battery management. The healthcare sector employs digital isolation in diagnostic imaging and patient monitoring, industrial automation integrates isolators in PLCs and robotic controls, and telecommunications infrastructure mandates isolation to safeguard base station electronics. Application-driven segmentation further unpacks aerospace and defense use cases, subdivides automotive into ADAS, electric vehicle subsegments such as battery management systems and drive inverters, and explores energy and power segments including renewable energy converters and smart grid interfaces, as well as the industrial segment’s focus on factory automation, process control, and the evolving domain of collaborative robots.

This comprehensive research report categorizes the Digital Isolator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Channel Count

- Data Rate

- Isolation Voltage

- Supply Mode

- Package Type

- Application

Mapping Regional Growth Patterns and Technological Adoption Trends Across Americas, Europe Middle East Africa, and Asia-Pacific in the Digital Isolator Landscape

Regional market trajectories illustrate how varying end-user priorities and regulatory ecosystems drive distinct adoption patterns. In the Americas, the push for resilient power infrastructure and the rapid deployment of electric vehicle charging stations have fueled demand for isolators capable of withstanding harsh operating environments and high-voltage transients. Concurrently, industrial modernization efforts across manufacturing hubs have accelerated integration of digital isolation in motor control systems and smart factory deployments.

Across Europe, the Middle East, and Africa, stringent safety directives and harmonized standards have elevated the importance of certified isolation solutions in medical devices and renewable energy installations. Governments in several EU member states have enacted incentive programs for energy storage and grid stabilization, prompting local and international suppliers to enhance their product portfolios accordingly. In the Middle East, investments in utility-scale solar and smart city initiatives underscore the role of isolation technology in ensuring reliable, secure power distribution.

The Asia-Pacific region remains a focal point for both high-volume production and advanced application development. Rapid expansion of 5G networks and the concomitant upgrade of base station electronics have increased throughput requirements, while domestic automotive OEMs continue to embed isolators in electric mobility platforms. Moreover, strong semiconductor manufacturing ecosystems in key markets such as China, Japan, and South Korea have enabled localized innovation, driving cost efficiencies and accelerating product roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Digital Isolator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovative Offerings of Leading Manufacturers Driving the Digital Isolator Industry Forward With Cutting-Edge Solutions

Leading semiconductor companies have adopted diverse strategies to reinforce their position in the digital isolator domain. One prominent manufacturer has leveraged a robust portfolio extension approach by introducing isolators with integrated diagnostic functions, enabling predictive maintenance in critical power systems. Another global supplier focused on high-speed, low-power products that cater to emerging 5G and datacom applications, while simultaneously forging partnerships with network infrastructure providers to streamline design-in processes.

Strategic acquisitions have also reshaped the competitive landscape. A notable merger between a mixed-signal specialist and a power management powerhouse created synergies in insulated gate drivers and isolated gate driver modules. This consolidation facilitated cross-selling opportunities and broadened the combined entity’s reach in industrial and automotive channels. Meanwhile, several mid-tier players have carved out niches in applications such as medical instrumentation and on-board electric vehicle chargers by tailoring isolation voltages and channel counts to specific regulatory and performance requirements.

Innovation competition remains intense as companies race to introduce next-generation isolation technologies. Efforts include embedding galvanic isolation within multi-chip modules, developing novel process technologies to enhance creepage and clearance characteristics, and optimizing core architectures for lower propagation delay. These competitive maneuvers underscore the dynamism of the digital isolator industry and highlight the imperative of a differentiated product roadmap.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Isolator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantech Co. Ltd.

- Analog Devices, Inc.

- Broadcom Inc.

- HALO Electronics, Inc.

- Infineon Technologies AG

- IXYS Corporation

- Murata Manufacturing Co., Ltd.

- National Instruments

- NOVOSENSE Microelectronics

- NVE Corporation

- NXP Semiconductors N.V.

- One River Electronics Limited

- Renesas Electronics Corporation

- Rhopoint Components Ltd.

- ROHM Semiconductor

- Semiconductor Components Industries, LLC

- Silicon Laboratories, Inc.

- Skyworks Solutions, Inc.

- STMicroelectronics International N.V.

- Texas Instruments Incorporated

- Toshiba Corporation

- Vicor Corporation

Empowering Industry Leaders With Tactical Recommendations to Capitalize on Emerging Opportunities and Navigate Challenges in the Evolving Digital Isolator

To gain a sustainable competitive advantage, industry leaders should prioritize the development of ultra-high-speed isolators that address the throughput demands of next-generation Ethernet and wireless backhaul. Investing in research collaborations with standards bodies can accelerate certification cycles and foster early design wins in safety-critical markets such as automotive and healthcare. Simultaneously, organizations must diversify their supply chains by establishing dual sourcing agreements and regional manufacturing partnerships to mitigate tariff-related risks and logistical disruptions.

Developing modular product families that allow scalable channel counts and variable isolation voltages can streamline customer adoption and reduce design complexity. By integrating advanced health-monitoring capabilities, vendors can move up the value chain from component suppliers to solution partners, offering predictive analytics that enhance system uptime. In parallel, marketing strategies should emphasize customization options and application-specific performance benchmarks, enabling original equipment manufacturers to differentiate their end products in increasingly crowded marketplaces.

Finally, fostering a unified platform strategy that aligns isolator development with evolving semiconductor process nodes and packaging innovations will ensure long-term cost competitiveness. Executives should allocate resources to cultivate cross-functional teams spanning R&D, supply chain, and sales to drive alignment on roadmap priorities, reinforce collaborative decision-making, and embed a culture of continuous improvement across the digital isolation portfolio.

Detailing the Robust Research Methodology Incorporating Primary Interviews, Secondary Data Sources, and Rigorous Validation Processes for Insightful Analysis

This analysis is underpinned by a rigorous research framework combining both primary and secondary methodologies. Secondary research encompassed an exhaustive review of publicly available sources, including regulatory filings, technical white papers, patent databases, and corporate disclosures from key semiconductor manufacturers. These insights were validated against archival data, industry standards, and regulatory guidelines to ensure accuracy and relevance.

Primary research involved in-depth interviews with senior executives, product managers, design engineers, and procurement specialists across diverse end-user industries. These conversations provided contextual understanding of real-world challenges, supply chain constraints, and adoption drivers not always evident in published literature. Triangulating these qualitative inputs with quantitative data enabled a multidimensional view of the market.

Data synthesis employed statistical validation techniques and cross-referencing among multiple information sources to mitigate bias. The methodology also incorporated a peer review stage, where draft findings were scrutinized by an external panel of industry experts. This holistic approach ensures that the insights presented are both comprehensive and actionable, reflecting the latest technological innovations and competitive dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Isolator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Isolator Market, by Channel Count

- Digital Isolator Market, by Data Rate

- Digital Isolator Market, by Isolation Voltage

- Digital Isolator Market, by Supply Mode

- Digital Isolator Market, by Package Type

- Digital Isolator Market, by Application

- Digital Isolator Market, by Region

- Digital Isolator Market, by Group

- Digital Isolator Market, by Country

- United States Digital Isolator Market

- China Digital Isolator Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Key Takeaways and Strategic Imperatives to Provide a Comprehensive Wrap-Up on the State and Future Trajectory of the Digital Isolator Industry

This report distills the critical drivers, challenges, and strategic imperatives influencing the digital isolator landscape. By examining the interplay between technological advancements, regulatory frameworks, and economic policies, stakeholders gain clarity on how to navigate an increasingly complex environment. Key takeaways emphasize the imperative of agility in supply chain management, the prioritization of high-speed, energy-efficient isolators for emerging applications, and the importance of differentiated product roadmaps to sustain competitive positioning.

Additionally, regional nuances reveal how end-user demands and certification requirements shape adoption trajectories, underscoring the value of localized strategies. The competitive overview highlights how innovation ecosystems, driven by mergers, partnerships, and organic R&D, are accelerating the pace of product development. Finally, actionable recommendations outline pathways for industry participants to leverage these insights, optimize their portfolios, and capture market share in both established and emerging application domains.

In conclusion, stakeholders equipped with a deep understanding of segmentation dynamics, regional trends, and the forces reshaping supply chains will be best positioned to capitalize on the transformative potential of digital isolation technology. The future of this industry hinges on continuous innovation, regulatory alignment, and strategic collaboration across the value chain.

Connect Directly With Ketan Rohom to Secure Exclusive Access to the In-Depth Digital Isolator Market Research Report and Propel Strategic Decision-Making

To explore the full breadth of insights into the rapidly evolving digital isolator space and gain a competitive edge, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing) to secure exclusive access to the comprehensive market research report. Engage in a personalized consultation that will empower your organization with rich, bespoke data and strategic foresight. Elevate your planning process and accelerate decision-making with an in-depth understanding of emerging technologies, supply chain dynamics, and application trends shaping the future of isolation technology. Don’t miss the opportunity to partner with a trusted sales and marketing expert who will guide you through the report’s actionable insights tailored to your specific needs and objectives. Connect today to transform your approach to digital isolation and drive impactful outcomes for your business.

- How big is the Digital Isolator Market?

- What is the Digital Isolator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?