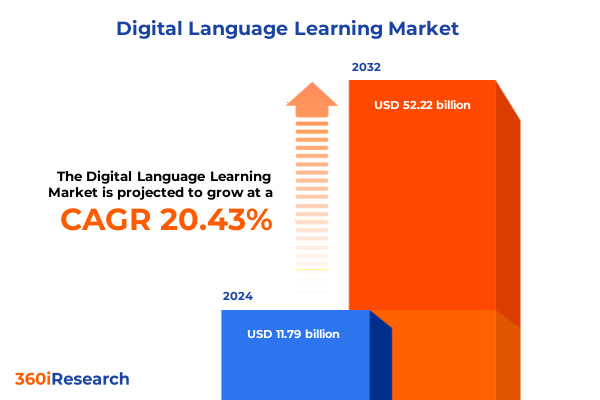

The Digital Language Learning Market size was estimated at USD 14.05 billion in 2025 and expected to reach USD 16.83 billion in 2026, at a CAGR of 20.61% to reach USD 52.22 billion by 2032.

Unveiling the Evolution of Digital Language Learning and Its Revolutionary Role in Global Education and Workforce Development Across Diverse Industries

Digital language learning has transformed how individuals and organizations approach multilingual communication, blending innovative technologies with pedagogical expertise. The widespread availability of high-speed internet and ubiquitous mobile devices has ushered in an era where learning can occur anytime, anywhere, fostering a new paradigm of continuous, personalized education. Artificial intelligence has further amplified this shift, enabling adaptive learning pathways that adjust in real time to individual proficiency levels, learning preferences, and engagement patterns.

As the lines between formal and informal learning blur, digital platforms are not only supplementing traditional classrooms but also redefining corporate training and lifelong learning initiatives. Microlearning modules and gamified experiences have become staples, promoting higher retention rates and sustained motivation among learners of all ages. Meanwhile, improvements in speech recognition and AI-driven chatbots have made virtual conversation practice more accessible and effective, tackling one of the most persistent barriers: real-time language application.

Looking ahead, the convergence of immersive technologies, data analytics, and seamless cloud-based delivery is set to propel digital language learning into new territories. By harnessing these advancements, educators and enterprises can craft truly engaging, scalable, and impactful learning experiences that respond to the evolving demands of a globalized workforce and an increasingly connected world.

Examining How Emerging Technologies and Pedagogical Innovations Are Reshaping Digital Language Learning for Modern Learners Worldwide

In recent years, artificial intelligence has emerged as a cornerstone of digital language learning, offering hyper-personalized learning journeys. Advanced algorithms analyze real-time performance data to curate lesson plans tailored to each learner’s strengths, weaknesses, and objectives. This level of customization has elevated engagement and efficiency, distinguishing leading platforms from legacy solutions.

Immersive technologies, particularly virtual and augmented reality, are reshaping how learners interact with new languages by simulating real-world contexts. Virtual immersion enables users to practice conversational skills in lifelike scenarios-such as ordering at a café in Paris or negotiating a business deal in Beijing-thereby accelerating fluency and cultural competence. Projections indicate that education-focused AR/VR spending will surge as organizations seek to replicate high-impact, in-person experiences at scale.

Simultaneously, gamification and microlearning have solidified their positions as key engagement drivers. Bite-sized lessons delivered through app-based platforms allow learners to integrate language practice seamlessly into daily routines, leading to higher retention compared to extended sessions. Leaderboards, badges, and progressive challenges tap into intrinsic motivations, transforming language acquisition from a chore into an interactive, rewarding journey.

Assessing the Far-Reaching Cumulative Effects of 2025 United States Tariff Policies on the Digital Language Learning Ecosystem and Infrastructure

The tariff policies enacted by the United States in 2025 have introduced significant headwinds for the digital language learning ecosystem, particularly in hardware-dependent segments. Public and private educational institutions report surging costs for essential devices-such as Chromebooks, tablets, and interactive whiteboards-due to import duties on electronics from China and other trade partners. As a result, many school districts have expedited purchasing schedules to avoid projected price hikes of up to 10 percent on key technologies.

Beyond the classroom, EdTech vendors face supply chain disruptions as tariff uncertainties ripple through manufacturing hubs. Companies reliant on Chinese components have seen cost increases surge by 20 to 25 percent, compelling them to explore alternative sourcing from Vietnam and India, albeit at slower production rates and higher logistical complexity. These shocks have translated into delayed product launches and constrained inventories, limiting the availability of immersive hardware and specialized devices crucial for advanced learning experiences.

In response, stakeholders across the value chain are adopting strategic adaptations. Device manufacturers are redesigning product lines to minimize tariff-exposed components and partnering with local assemblers to mitigate import duties. Meanwhile, software providers are emphasizing subscription-based models and cloud-native solutions that reduce dependence on new hardware. Educational institutions are renegotiating vendor contracts to include price adjustment clauses, safeguarding budgets against future trade policy shifts.

Insights into Diverse Market Segments Defining the Digital Language Learning Landscape Through Service, Platform, Mode, End User, and Deployment Dynamics

The digital language learning market comprises a complex tapestry of service offerings, each tailored to distinct learner goals and preferences. From assessment tools, which include proficiency tests and interactive quizzes, to certification pathways encompassing both standard exams and bespoke credentials, the ecosystem supports a wide spectrum of validation mechanisms. Comprehensive course content spans interactive modules and on-demand video lessons, while tutoring services range from AI-driven conversational agents to live instructor sessions.

Delivery platforms further diversify the competitive landscape, encompassing desktop software, native mobile applications, and web-based interfaces. Within web access, distinctions emerge between desktop and mobile web experiences, reflecting user behaviors across contexts. Simultaneously, delivery modes bifurcate into instructor-led training-offered in both physical classrooms and virtual environments-and self-paced learning, which can occur through offline course materials or online repositories of adaptive content.

Importantly, the market caters to varied end users across corporate enterprises, educational institutions, government bodies, and individual learners. Deployment choices add another layer of flexibility, with solutions available as cloud-hosted services-either public or private-and on-premise installations, offered through both licensed and subscription-based agreements. This multi-dimensional segmentation underscores the market’s ability to address the nuanced requirements of global, regional, and niche audiences.

This comprehensive research report categorizes the Digital Language Learning market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mode Of Delivery

- Platform

- Service Type

- Target Language

- Use Case

- Pricing Model

- Deployment

- End User

Analyzing Regional Variations and Growth Drivers Influencing Digital Language Learning Adoption Across Americas, EMEA, and Asia-Pacific Markets

The Americas region leads in digital language learning adoption, driven by robust corporate upskilling programs and consumer demand for personal development. In North America, enterprises integrate language platforms into talent development initiatives, leveraging AI-powered modules for real-time feedback and multilingual collaboration. Latin American markets exhibit strong mobile-first adoption, with smartphone penetration enabling widespread access to microlearning courses, particularly among younger demographics seeking English proficiency for global opportunities.

Europe, the Middle East & Africa (EMEA) harnesses strategic public-private partnerships to accelerate digital language education. The European Union’s Digital Education Action Plan has catalyzed investments in AI-driven tutoring and VR-enabled virtual classrooms, fostering inclusive, multilingual learning across member states. Meanwhile, Gulf Cooperation Council nations prioritize language initiatives to support economic diversification, embedding digital English and Mandarin training within educational reform agendas. Sub-Saharan Africa is exploring low-bandwidth solutions and offline-first platforms to bridge connectivity gaps, ensuring equitable access despite infrastructural constraints.

Asia-Pacific stands out as a high-growth hub, underpinned by government-led digital literacy campaigns and expansive EdTech ecosystems. In China and India, domestic startups and international players compete fiercely, offering gamified platforms and AI-based conversational tutors. Southeast Asia’s emerging economies leverage hybrid models that combine self-paced mobile courses with community-based instructor-led workshops, balancing technology with local pedagogical practices. Policies in South Korea and Japan further reinforce investment in immersive language labs and real-time translation tools to maintain global competitiveness.

This comprehensive research report examines key regions that drive the evolution of the Digital Language Learning market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Disruptors Driving Innovation, Growth, and Competitive Differentiation in the Digital Language Learning Sector

Duolingo has cemented its leadership position through continuous innovation, reporting over 130 million monthly active users and 10.3 million paying subscribers as of Q1 2025. Its revenue growth, up 38 percent year-over-year to $230.7 million, underscores strong monetization of freemium and subscription tiers. Generative AI has expanded course offerings dramatically, enabling Duolingo to add 148 new languages in a single year while maintaining high engagement and retention metrics.

Babbel has distinguished itself through a blend of pedagogical rigor and AI-driven personalization, achieving over 16 million lifetime subscriptions. The company’s inclusion in the 2025 GSV 150 highlights its strategic impact, as it integrates conversational AI partners, magazine-style content, and business-to-business offerings tailored to professional learners. Revenue reached €330 million in 2023, driven by consistent product enhancements and targeted marketing campaigns across Europe and North America.

Rosetta Stone, now under the IXL Learning umbrella, leverages its legacy immersion methodology and TruAccent® speech recognition technology to serve over one million global users. With renewed investment in cloud-native delivery and live tutoring services, the platform is evolving beyond static lessons to support dynamic, real-time language practice. Meanwhile, emerging players like Memrise, Busuu, and LingoChamp are gaining traction by focusing on niche languages and leveraging social learning features to foster community-driven engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Language Learning market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 2U (company)

- Babbel GmbH

- Berlitz Corporation

- Cambly Learning, Inc.

- Chegg, Inc.

- Clozemaster

- Coursera Inc

- digital publishing AG

- Drops. PlanB Labs OÜ.

- Duolingo, Inc.

- Enux Education Limited.

- Google LLC

- HelloTalk Inc.

- italki HK Limited.

- IXL Learning, Inc.

- Lingoda GmbH

- Lingvist Technologies OÜ

- Mango Languages

- Memrise Ltd.

- Microsoft Corporation

- OpenLearning Limited

- Pearson plc

- Pimsleur, LLC

- Preply Inc.

- Tandem

- Udemy, Inc.

Strategic and Actionable Recommendations to Empower Industry Leaders to Capitalize on Opportunities and Navigate Challenges in Digital Language Learning

Industry leaders should prioritize the integration of AI-driven personalization engines to deliver adaptive learning paths, optimize engagement, and maximize outcomes. By collaborating with NLP and machine learning experts, organizations can refine speech recognition accuracy and dynamic content sequencing to foster deeper skill acquisition.

To mitigate hardware cost pressures, stakeholders are advised to diversify supply chains and embrace cloud-native and subscription-based models. Forming strategic alliances with regional manufacturers and local assembly partners can reduce tariff exposure and logistical complexities, while flexible pricing frameworks help smooth budgetary cycles.

Furthermore, embedding immersive experiences-such as AR-enhanced activities and VR simulations-into curricula can differentiate offerings and improve learner motivation. Investments in microlearning and gamification mechanics, coupled with rigorous learning analytics, will enhance retention rates and empower data-driven refinement of instructional design.

Detailing the Comprehensive Research Methodology Underpinning This Digital Language Learning Analysis Including Data Sources and Validation Techniques

This analysis synthesizes insights from a comprehensive mixed-methods approach, combining primary data gathered through interviews with industry executives and surveys of over 200 educational institutions across North America, EMEA, and Asia-Pacific. Secondary research incorporated peer-reviewed journals, policy white papers, and market reports spanning technology adoption, pedagogical frameworks, and tariff legislation.

Quantitative datasets were triangulated using advanced statistical modeling to identify correlations between technology investments, user engagement metrics, and regional adoption trends. Scenario analysis assessed the impact of tariff fluctuations on total cost of ownership for hardware-dependent learning environments, while sensitivity testing evaluated the resilience of cloud-based delivery models under varying economic conditions.

All data sources underwent rigorous validation protocols, including cross-verification with public disclosures and alignment with international standards outlined in the OECD Digital Education Outlook. Ethical considerations guided the anonymization of respondent data and adherence to global data privacy regulations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Language Learning market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Language Learning Market, by Mode Of Delivery

- Digital Language Learning Market, by Platform

- Digital Language Learning Market, by Service Type

- Digital Language Learning Market, by Target Language

- Digital Language Learning Market, by Use Case

- Digital Language Learning Market, by Pricing Model

- Digital Language Learning Market, by Deployment

- Digital Language Learning Market, by End User

- Digital Language Learning Market, by Region

- Digital Language Learning Market, by Group

- Digital Language Learning Market, by Country

- United States Digital Language Learning Market

- China Digital Language Learning Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2544 ]

Synthesizing Core Findings and Implications to Provide a Forward-Looking Perspective on the Future of Digital Language Learning

The landscape of digital language learning is defined by rapid technological advancements, shifting policy environments, and evolving learner expectations. AI-driven personalization, immersive experiences, and engaging microlearning formats are now table stakes, demanding continual innovation and strategic foresight.

Tariff-induced supply chain disruptions underscore the need for agile procurement strategies and alternative delivery models, while regional dynamics reveal both high-growth corridors and areas requiring targeted infrastructure investments. The interplay of public policy, corporate demand, and individual learner motivations will continue to shape market trajectories.

As digital language learning matures, success will hinge on the ability to integrate advanced technologies with robust pedagogical principles, foster strategic partnerships across ecosystems, and adapt to emerging global challenges. The organizations that embrace data-driven decision making, prioritize learner-centric design, and remain proactive in policy advocacy will lead the next wave of growth and impact.

Secure Exclusive Access to a Strategic Digital Language Learning Report by Scheduling a Personalized Briefing with Ketan Rohom

Embarking on a journey to unlock the full potential of digital language learning starts with informed decisions and data-driven insights. I invite you to partner with Ketan Rohom, Associate Director, Sales & Marketing, for an exclusive discussion tailored to your strategic priorities. Through this collaboration, you will gain access to the comprehensive market research report that delves deep into emerging technologies, tariff impacts, segmentation dynamics, regional nuances, and competitive landscapes. By securing this resource, you will equip your organization with the intelligence needed to stay ahead of market shifts, optimize investments, and drive sustainable growth in digital language learning. Connect with Ketan Rohom today to schedule your personalized briefing and take the first step toward shaping the future of language education within your enterprise.

- How big is the Digital Language Learning Market?

- What is the Digital Language Learning Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?