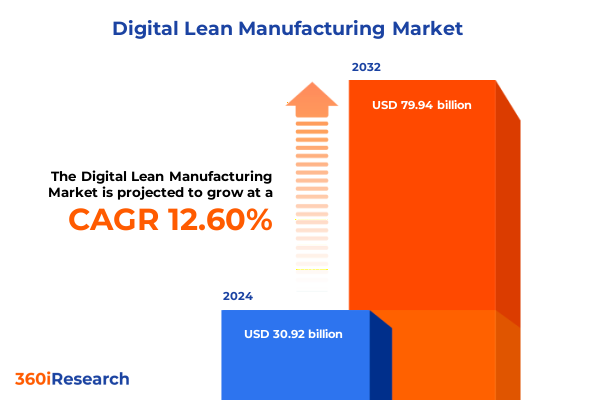

The Digital Lean Manufacturing Market size was estimated at USD 30.92 billion in 2024 and expected to reach USD 34.66 billion in 2025, at a CAGR of 12.60% to reach USD 79.94 billion by 2032.

Digital lean manufacturing is redefining enterprise competitiveness by fusing Toyota‑inspired principles with Industry 4.0‑scale intelligence

Digital lean manufacturing combines the discipline of classical lean with the instrumentation, compute, and orchestration of modern industrial software. Instead of treating kaizen workshops, value‑stream mapping, and standard work as isolated practices, leaders are building a continuously learning operating system that measures flow in real time, eliminates waste with software‑guided decisions, and stabilizes processes through closed‑loop control. The emphasis has shifted from local optimization to end‑to‑end value and from historical reporting to forward‑looking detection and response.

The foundation is data continuity. Plants are extending sensing across machines and material handling, unifying machine, operator, and quality signals at the edge, and normalizing them into models that business systems can consume. With that fabric in place, teams can move beyond point dashboards toward coordinated actions: scheduling adjusts automatically to disruptions, quality rules adapt as conditions drift, maintenance windows are synchronized with takt, and energy setpoints are tuned to cost and emissions constraints. Just as importantly, workforces are equipped with guidance at the moment of need-work instructions, changeover steps, and troubleshooting are all contextualized by the actual state of the line.

Crucially, this approach reframes transformation risk. Rather than multi‑year monoliths, manufacturers stitch together a portfolio of narrowly defined use cases that share a common data backbone and governance. Each deployed capability feeds the next: a computer vision model improves scrap containment; those insights inform line balancing; the resulting stability makes predictive maintenance more reliable; and the entire system becomes robust to demand and supply variability. The outcome is not technology for its own sake, but a plant that learns faster than the problems it encounters.

From isolated pilot projects to orchestrated value streams, digital lean shifts from point solutions to platform‑enabled, AI‑augmented operations

Several shifts define the current landscape. First, architectures are moving from siloed pilots to platform‑enabled operations. Instead of bespoke integrations for each new use case, manufacturers are adopting common industrial data models, edge runtimes that normalize signals from legacy controllers, and cloud services that standardize storage, feature engineering, and model lifecycle management. This reduces the cost and time to onboard additional lines and sites, and it transforms continuous improvement from a manual hunt for waste into a steady cadence of software releases that embed best practices in workflows.

Second, the edge‑to‑cloud continuum has matured. Latency‑sensitive control remains at the cell or line, while analytics that benefit from scale-such as fleetwide anomaly detection, spare‑parts forecasting, and supplier risk profiling-run in elastic compute. Digital twins are no longer static 3D visualizations; they synchronize with live telemetry to simulate what‑if scenarios and provide guardrails for changeovers, parameter sweeps, and material substitutions. When coupled with generative AI, these twins help engineers navigate complex parameter spaces and explain the trade‑offs between yield, cycle time, and energy.

Third, cyber resilience has become inseparable from operational excellence. As more assets are connected, zero‑trust segmentation, secure‑by‑design controllers, and anomaly detection specific to industrial protocols are now table stakes. The governance conversation also extends to data rights and model provenance, particularly when AI is used for quality decisions. Finally, workforce augmentation is reshaping deployment economics. Augmented reality for operator guidance, AI copilots for root‑cause analysis, and low‑code configuration of workflows let smaller teams operate more complex systems, closing skill gaps while preserving accountability. Together, these shifts move the industry from experimentation to compounding returns.

Tariff realignments in 2025 reshape cost structures and sourcing strategies, compelling digital lean to emphasize resilience and total landed cost

Tariff actions in 2025 are changing how manufacturers think about resilience, sourcing, and the business case for digital lean. The four‑year review of Section 301 measures concluded with targeted increases to strategic sectors, including a move to raise duties on semiconductors to 50% in 2025 and earlier increases on steel, aluminum, solar cells, and electric vehicles. This escalation has reinforced the need to model total landed cost dynamically, not just purchase price, and to use digital twins and scheduling tools to reoptimize supply routes and production sequences as duties shift. These tariff adjustments are not abstract; they directly influence the cost of controllers, sensors, machine vision optics, and compute modules that underpin digital lean deployments, making procurement analytics and multi‑sourcing strategies essential parts of the operating model.

For clean‑energy and electronics inputs, additional measures took effect at the start of the year. Tariffs on certain solar wafers and polysilicon increased to 50%, while specified tungsten products rose to 25%, effective January 1, 2025. These steps, taken to align trade measures with strategic industrial policy, ripple through capital projects such as panel assembly and advanced sensing, where material inputs face new cost profiles. Manufacturers evaluating retrofit schedules and capex for energy monitoring should incorporate these effective‑date changes into budget phasing and supplier allocations to avoid late‑stage surprises.

A pivotal development for consumer‑bound and spare‑parts logistics has been the elimination of duty‑free treatment for low‑value packages from China and Hong Kong, effective May 2, 2025, following executive orders that conditioned the suspension on the government’s ability to collect duties at scale. This change increases landed costs for e‑commerce replenishment, MRO spares, and small‑lot components frequently routed through parcel networks, and it raises the bar for inventory planning and local safety‑stock policies in North American plants.

Later in the year, policy expanded beyond country‑specific measures. The administration announced steps to suspend duty‑free de minimis treatment more broadly, moving toward a permanent end to the exemption for all countries with a transition period for postal shippers, fundamentally altering small‑parcel economics and compliance processes. For manufacturers, this means treating even low‑value cross‑border shipments as duty‑bearing by default and embedding tariff logic into procurement and fulfillment systems.

Despite tighter measures, certain product exclusions under Section 301 were extended into late 2025, underscoring the need for granular classification and vigilant monitoring of Federal Register updates. Operations teams should maintain a living mapping between harmonized tariff codes and bill‑of‑materials items across product families so that scheduling, sourcing, and pricing algorithms respond immediately when an exclusion is extended or expires.

Component, technology, application, deployment, organization, industry, and channel patterns reveal where digital lean value concentrates

Component choices determine how quickly digital lean compounds value. On the hardware side, portfolios that blend IoT sensors with edge gateways create the telemetry needed to stabilize flow, while industrial controllers and industrial robots-including collaborative models-translate decisions into motion without sacrificing safety. Machine vision cameras, increasingly paired with specialized lighting and optics, extend human capability for real‑time inspection and enable steady upgrades in first‑pass yield without adding headcount. Services remain the multiplier. Consulting accelerates value‑stream redesign and program governance; installation practices standardize edge adoption across brownfield and greenfield sites; and support and maintenance shift performance from reactive break–fix to predictive contracts built on shared KPIs. Software is the control room where lean becomes digital: analytics and AI platforms enable feature generation and model governance; manufacturing execution systems orchestrate operations and traceability; digital scheduling and advanced planning and scheduling establish the tempo of the plant; quality management software enforces standards and lead‑to‑cash feedback; enterprise resource planning aligns financial cadence with production reality; and visualization and HMI provide operators with the right context at the right time.

Technology patterns reveal where differentiation is emerging. Artificial intelligence and machine learning are moving from pilots to production, with model registries and edge deployment pipelines making updates repeatable. Cloud computing supplies elastic scale for fleet analytics, while digital twins simulate process windows and stress‑test line changes before they hit the floor. The Internet of Things continues to expand addressable data, and robotics and automation close the loop with consistent execution. Cybersecurity is no longer a separate track but intrinsic to architecture. Additive manufacturing compresses lead times for tooling and service parts, augmented and virtual reality elevate training and assistive guidance, blockchain preserves chain‑of‑custody for regulated products, and cognitive computing helps translate complex plant signals into human‑interpretable recommendations.

Applications are coalescing into a repeatable playbook. Computer vision for defect detection spans dimensional inspection, OCR and barcode verification, and surface defect detection to capture loss at the source. Digital twins of production lines shorten ramp‑up and de‑risk changeovers. Digital work instructions and standard operating procedures reduce variability. Energy monitoring and optimization align cost and sustainability. Line balancing and cell design remove time traps. OEE and performance management keep attention on constraints. Operator guidance and augmented‑reality assistance unlock autonomy. Predictive maintenance converts unplanned downtime into planned interventions. Process mining and value‑stream mapping uncover invisible queues and rework loops. Quality SPC and nonconformance management close deviations quickly. Root‑cause analysis distills signals across data silos. SMED and changeover management reclaim capacity. Traceability and serialization satisfy regulators and brand promises.

Deployment preferences reflect risk tolerance and compliance. Cloud‑based models speed innovation and collaboration across sites, while on‑premise remains necessary where data residency, latency, or validation requirements dominate. Organization size shapes approach: large enterprises invest in platform governance and reusable components, whereas small and medium enterprises demand pre‑integrated bundles with fast time to value. End‑use requirements further segment the journey: aerospace and defense value digital thread continuity and configuration control; automotive leans on line balancing, cobots, and traceability; electronics prioritizes machine vision and high‑mix scheduling; food and beverage focuses on hygiene, throughput, and energy; pharmaceuticals and healthcare require validated systems, strict quality, and serialization. Finally, sales channels influence adoption speed. Direct engagements enable co‑development and long‑horizon roadmaps; OEM and automation vendor partnerships embed capabilities into equipment; system integrators translate strategy into plant‑specific designs; and value‑added resellers provide regional coverage and lifecycle support that keep programs moving after go‑live.

This comprehensive research report categorizes the Digital Lean Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- Deployment Mode

- Organization Size

- End Use Industry

- Sales Channel

Regional dynamics across the Americas, Europe, Middle East and Africa, and Asia‑Pacific redefine adoption pathways, risk profiles, and collaboration models

In the Americas, adoption is propelled by the need to reconcile productivity with reliability under evolving trade rules. United States plants have accelerated edge retrofits, MES standardization, and computer vision as they localize more sourcing and buffer against tariff‑driven volatility. Mexico’s role in nearshoring continues to expand, with greenfield sites designed around modular cells and standardized work that can be mirrored across campuses. Canada’s process industries are pushing hard on energy optimization and predictive maintenance, with AI pilots increasingly promoted to production once cybersecurity readiness is confirmed. Across the region, a common theme is the blending of operational and financial signals so that energy, scrap, and overtime are visible in the same decision frame as service level and inventory.

In Europe, the Middle East, and Africa, regulatory pressure and energy exposure have shaped a distinctive path. European manufacturers are embracing digital twins for debottlenecking and for validating changeovers under stringent quality regimes, while connecting factory data spaces to enterprise platforms to comply with transparency and sustainability requirements. The Middle East is building new facilities with edge‑to‑cloud architectures from day one, using robotics for repeatability and designing cybersecurity controls into processes rather than retrofitting them later. In parts of Africa, investments concentrate on leapfrogging to reliable automation in food, beverage, and basic materials, where digital work instructions and operator assistance elevate consistency despite variable input quality.

In Asia‑Pacific, the conversation centers on scale and speed. High‑tech clusters are pushing advanced scheduling and yield analytics to sustain competitiveness in complex assembly and packaging. Japan’s legacy of lean underpins a pragmatic approach to AI, focusing on explainability and stable operations. Southeast Asia and India are attracting capacity with supplier ecosystems that support robotics, machine vision, and modern controllers, giving new plants a cost‑effective base for digital lean from the outset. Meanwhile, organizations with exposure to China are recalibrating parcel‑based imports and spare‑parts strategies, relying more on regional distribution hubs and supplier development programs to maintain service levels amid shifting duty structures.

Across all three regions, the operational thread is convergence. Leaders are moving from project‑based digitalization to an operating system that travels with the product and the line, enabling learning to compound from one site to the next even as local constraints and compliance regimes differ. This is as much about governance and people as it is about technology, and it is redefining how global networks balance central standards with local freedom to operate.

This comprehensive research report examines key regions that drive the evolution of the Digital Lean Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic moves by automation, software, cloud, and robotics leaders signal convergence around open architectures, AI cores, and service‑centric value

A clear pattern is emerging among industrial technology leaders: convergence around open architectures, AI‑first capabilities, and service‑centric value. Automation companies are expanding from controllers and drives into complete software stacks, offering MES, advanced scheduling, and analytics that are pre‑integrated with their hardware portfolios. Software‑native players are moving in the opposite direction, partnering with robotics and sensor vendors to ensure that their data platforms and AI models can activate decisions at the edge. Cloud hyperscalers are strengthening industrial offerings with reference architectures for secure connectivity, time‑series storage, and MLOps, while GPU leaders enable real‑time inference for vision and simulation.

Robotics vendors are broadening collaborative portfolios to address ergonomics, small‑batch flexibility, and quality inspection, while machine vision providers are embedding deep‑learning tools that shorten the path from data collection to deployable models. In parallel, industrial PC and edge gateway suppliers are standardizing hardened runtimes that simplify orchestration across thousands of nodes, allowing IT and OT to share deployment pipelines without sacrificing determinism or safety. Systems integrators, once focused on one‑off projects, are codifying reusable templates and governance kits so that global programs adopt good patterns from the start.

What differentiates the leaders is not just technology breadth but operating model. They champion open standards for interoperability, invest in developer ecosystems, and support customers with outcome‑based services that put skin in the game. Many are aligning roadmaps around explainable AI, domain‑specific copilots, and digital twin fidelity, recognizing that customer trust hinges on transparent decisions and repeatable results. The winners are those who can simplify complexity: hide integration toil, elevate data quality, and give practitioners tools that make better work the easiest work to do.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Lean Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Autodesk, Inc.

- Caterpillar Inc.

- Dassault Systèmes S.E.

- Deere & Company

- Emerson Electric Co.

- GE Vernova

- Hitachi, Ltd.

- Honeywell International Inc.

- InSource Solutions

- Leansuite.com Corp

- Mevisio AB

- Omron Corporation

- Oracle Corporation

- Parker-Hannifin Corporation

- Robert Bosch GmbH

- Rockwell Automation Inc.

- SAP SE

- Schneider Electric SE

- Siemens AG

- SMART LEAN SOLUTIONS S.L.

- Snowflake Inc.

- Stratasys Ltd.

- Textron Inc.

- Tulip Interfaces, Inc.

- WITTI Technology Limited

What leaders should do next to turn digital lean into measurable advantage across quality, throughput, energy, and workforce capability

Set the foundation with an operating model that treats data as a production asset. Standardize edge connectivity, data modeling, and security controls across sites so every new use case drops into a known pattern. Build a cross‑functional governance team that includes operations, quality, maintenance, IT, and finance, and give it the authority to prioritize use cases by measurable outcomes. Start with a small number of high‑leverage capabilities-such as vision‑based defect detection, energy optimization, and scheduling-and insist on standard work for model lifecycle, change management, and operator training.

Design for tariff and compliance resilience. Embed harmonized tariff code logic and preference rules into procurement, configure digital twins to simulate cost under different duty scenarios, and maintain supplier scorecards that reflect geopolitical risk and cyber posture. Adjust inventory and spares strategies to the new parcel‑duty reality, and invest in regional distribution that can buffer demand without locking up excess working capital. For validated environments, build automation around electronic records, audit trails, and deviation workflows so that scaling does not compromise compliance.

Elevate the workforce with augmentation, not substitution. Provide role‑based guidance at the moment of need, blend skills matrices with scheduling so teams learn by doing in low‑risk contexts, and use AI to accelerate root‑cause analysis while preserving human oversight. Establish a clear cybersecurity path-micro‑segmentation, identity‑aware access, and anomaly detection for industrial protocols-so that every new connection raises capability without raising risk. Above all, treat transformation as a compounding system: retire technical debt as you add features, convert lessons learned into reusable assets, and tie financial visibility directly to operational improvements so momentum feeds on itself.

Research methodology grounded in primary interviews, standards analysis, and triangulated secondary sources ensures objective, actionable insights

This analysis follows a disciplined methodology designed to convert a complex vendor and technology ecosystem into practical guidance for decision‑makers. Primary research included structured interviews and roundtables with plant managers, operations excellence leaders, CI practitioners, maintenance heads, IT architects, and systems integrators across discrete and process industries. These conversations focused on current deployment patterns, integration pain points, cybersecurity posture, and the cultural and organizational factors that determine whether pilots scale. To minimize confirmation bias, interviews included both programs that succeeded and those that stalled, with attention to the reasons behind each outcome.

Secondary research triangulated regulatory developments, standards, and vendor materials. Trade policy shifts were verified against official notices and press releases, while industrial standards bodies provided the technical underpinnings for interoperability and governance. Company disclosures, investor presentations, technical documentation, and product roadmaps were analyzed to understand positioning, openness, and services maturity. Academic and practitioner literature supplied evidence on where AI, digital twins, and robotics deliver the most reliable outcomes in production contexts, and where they still require human‑in‑the‑loop oversight. All sources were evaluated for recency, authorship, and the risk of embedded marketing claims.

Quantitative insights were framed through process‑level metrics-yield, cycle time, mean time between failures, energy per unit-and mapped to use cases such as scheduling, vision inspection, and predictive maintenance. However, this work deliberately avoids sizing estimates, share calculations, or long‑range forecasts and, instead, prioritizes decision structures that executives can use immediately. The research reflects developments through November 7, 2025, and emphasizes practical, verifiable actions that reduce risk while accelerating results.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Lean Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Lean Manufacturing Market, by Component

- Digital Lean Manufacturing Market, by Technology

- Digital Lean Manufacturing Market, by Application

- Digital Lean Manufacturing Market, by Deployment Mode

- Digital Lean Manufacturing Market, by Organization Size

- Digital Lean Manufacturing Market, by End Use Industry

- Digital Lean Manufacturing Market, by Sales Channel

- Digital Lean Manufacturing Market, by Region

- Digital Lean Manufacturing Market, by Group

- Digital Lean Manufacturing Market, by Country

- United States Digital Lean Manufacturing Market

- China Digital Lean Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Digital lean now anchors operational strategy, translating continuous improvement into scalable, software‑defined manufacturing excellence

Digital lean has evolved from an aspiration into an operating discipline that blends time‑tested principles with modern software. By unifying sensing, control, analytics, and human guidance, manufacturers can respond to volatility without sacrificing stability. The organizations that lead are not those with the most pilots, but those that can repeatedly move from concept to scaled capability while protecting safety, quality, and security. They make architecture decisions that simplify the next hundred deployments, not just the next one.

The cumulative effect of recent tariff changes underscores this need for resilience. When duties and parcel rules shift, plants that model total landed cost in near real time and maintain multi‑sourced designs can avoid costly disruptions. When workforce skills are uneven, AR‑enabled work instructions and AI‑assisted diagnostics standardize performance. And when energy, scrap, and overtime are visible in the same decision frame as service level, teams can trade off intelligently rather than react from the gut. This is not a one‑time transformation but a continuous loop in which each improvement funds the next.

Looking ahead, the winning posture is pragmatic and compounding. Invest in a robust data backbone, choose platforms and partners that are open by default, and equip teams to learn faster than the problems they encounter. Digital lean done well becomes a strategic moat: a living system that makes excellence the path of least resistance and turns volatility into a source of advantage.

Secure your competitive edge today by engaging Ketan Rohom to access the complete digital lean manufacturing market intelligence report

The competitive window for modern manufacturers is narrowing, and the organizations that act decisively will set the operating benchmarks others will chase. To accelerate that journey, connect with Ketan Rohom, Associate Director, Sales & Marketing, and secure the full market research report that underpins this executive summary with deeper solution mapping, vendor landscapes, and decision frameworks tailored to your priorities.

By engaging directly, you gain structured guidance on which use cases to scale first, how to align technology roadmaps with tariff and compliance realities, and where to unlock the fastest cash-on-cash returns from digital lean deployments. Beyond the report, you can request customized briefings for your leadership team, along with facilitation materials to help convert strategy into a focused 90‑day execution plan.

Do not wait for another cycle of pilot purgatory to erode momentum. Request your copy of the report today, coordinate a short scoping call with Ketan to align on desired outcomes, and accelerate your path to resilient, software‑defined operations that compound advantages across quality, throughput, energy, and workforce capability.

- How big is the Digital Lean Manufacturing Market?

- What is the Digital Lean Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?