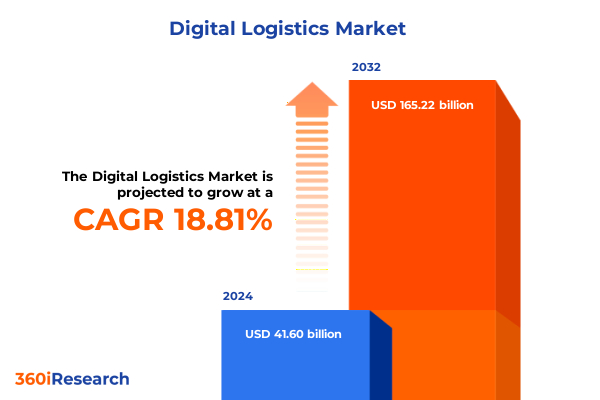

The Digital Logistics Market size was estimated at USD 49.37 billion in 2025 and expected to reach USD 57.84 billion in 2026, at a CAGR of 18.83% to reach USD 165.22 billion by 2032.

Embracing the Future of Logistics Through Digital Innovation to Drive Resilience, Visibility, and Efficiency Across Global Supply Chains

The logistics industry is undergoing a profound transformation as digital technologies reshape how goods move across global networks. Rising customer expectations for rapid delivery, seamless tracking, and real-time visibility have elevated the role of digital logistics platforms from optional tools to strategic imperatives for enterprises of all sizes. As supply chains grow increasingly complex, organizations seek comprehensive solutions that integrate hardware sensors, advanced software, and managed services to deliver end-to-end transparency and efficiency.

In parallel, emerging technologies such as the Internet of Things, artificial intelligence, and blockchain are converging to enable predictive analytics, secure data sharing, and autonomous operations that once seemed aspirational. This fusion of innovation is driving logistics providers and end users alike to reevaluate legacy processes, invest in new digital architectures, and forge partnerships that span tier-1 carriers to last-mile delivery providers. These shifts are not merely incremental; they represent a step-change in how supply chain ecosystems function, offering unprecedented agility to respond to market volatility and regulatory changes.

Against this backdrop, your organization must establish a clear roadmap for digital logistics maturity. By understanding the evolving landscape, assessing the impact of recent policy measures, and aligning segmentation strategies with regional nuances, decision-makers can craft a coherent strategy that balances immediate operational needs with long-term innovation goals.

How Emerging Technologies and Sustainability Imperatives Are Shaping the Next Wave of Digital Logistics Transformation Across Industries

Across the digital logistics landscape, three transformative trends stand out for their capacity to redefine operational paradigms. First, the proliferation of Internet of Things devices and edge computing is accelerating real-time data collection across transport fleets, warehouse operations, and yard management zones. This capability shifts organizations from reactive problem-solving to proactive issue prevention, where intelligent sensors detect anomalies and trigger automated interventions without human delay.

Secondly, artificial intelligence and machine learning are revolutionizing demand forecasting, route optimization, and capacity planning. By leveraging vast historical data and external signals-from weather patterns to geopolitical shifts-AI-powered engines can identify risks, suggest alternative routing, and optimize resource allocation. In doing so, they enhance service levels, minimize carbon footprints, and reduce operational costs. Meanwhile, blockchain-based platforms are providing immutable ledgers for document exchanges, enabling secure provenance tracking for high-value shipments and simplifying compliance with cross-border regulations.

Finally, sustainability mandates and consumer preferences are catalyzing the adoption of low-emission vehicles, energy-efficient warehouses, and circular supply chain models. Logistics leaders are integrating carbon tracking modules into their digital platforms to monitor emissions at the shipment level and support decarbonization goals. These collective shifts underscore a broader movement: digital logistics is no longer a back-office enabler but a strategic differentiator that underpins brand reputation, customer loyalty, and regulatory compliance.

Assessing the Ripple Effects of 2025 United States Tariff Policies on Cost Structures, Supply Chain Resilience, and Strategic Sourcing Decisions in Logistics

The 2025 United States tariff framework has introduced new duties on select imported components and finished goods, prompting logistics executives to reevaluate cost structures and sourcing strategies. Increased tariff rates on electronics, machinery parts, and certain consumer goods have elevated landed costs for many supply chains, compelling companies to explore nearshoring and local distribution centers to mitigate duties and shorten transit times. Transportation management systems now incorporate tariff calculators and scenario modeling, enabling planners to simulate duty impacts on routing decisions and total landed costs.

For organizations that rely on just-in-time inventory, the tariff changes have accentuated the need for buffer stock and dynamic order management to avoid supply disruptions. Digital platforms are responding by layering tariff compliance modules with real-time trade lane visibility, automating classification codes, and updating duty rates across regional trade agreements. This integration ensures that compliance teams can rapidly adapt to evolving regulations without manual intervention, reducing the risk of customs delays and penalties.

Moreover, the tariff environment has intensified collaboration between logistics service providers, customs brokers, and technology vendors. Shared digital ecosystems facilitate visibility into tariff exposures at each stage of the supply chain, enabling stakeholders to adjust procurement strategies, negotiate with carriers, and deploy alternative routes. In sum, the cumulative impact of the 2025 tariffs is driving greater reliance on digital tools to preserve supply chain resilience, optimize costs, and maintain competitive delivery performance in a dynamic regulatory landscape.

Unpacking Essential Segmentation Insights to Illuminate Component, Solution Type, Deployment Mode, Enterprise Size, and End User Industry Dynamics

An insightful examination of the digital logistics market reveals the importance of analyzing hardware, services, and software components in concert. Hardware platforms, which include tracking sensors, connectivity devices, and edge computing units, form the operational backbone that captures location and condition data. Yet these physical assets depend on cloud-native and on-premise software solutions to transform raw telemetry into actionable insights. Managed services complement this framework by providing implementation, customization, and ongoing support, ensuring that technology investments yield measurable operational gains.

Moving to solution types, organizations leverage an array of digital tools spanning freight tracking, inventory management systems, order management systems, transportation management systems, warehouse management systems, and yard management systems. Freight tracking solutions deliver basic shipment visibility across transport modes, while inventory control platforms integrate with dock management and labor management functionalities to optimize warehouse throughput. Order management modules orchestrate fulfillment across channels, and transportation systems align carrier selection and route planning. The successful deployment of these solutions underscores the need for integrative architectures that break down data silos and facilitate cross-functional workflows.

When considering deployment mode and enterprise size, public cloud adoption has surged among small and medium enterprises seeking rapid implementation and lower capital expenditure, whereas large enterprises frequently opt for hybrid architectures that balance scalability with on-premise control. Finally, examining end-user verticals such as healthcare, manufacturing, retail and e-commerce, and transportation highlights how varying compliance requirements, fulfillment expectations, and cargo characteristics drive divergent priorities in digital logistics investments.

This comprehensive research report categorizes the Digital Logistics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Solution Type

- Deployment Mode

- Enterprise Size

- End User Industry

Revealing Regional Nuances in Digital Logistics Adoption Across the Americas, Europe Middle East & Africa, and Asia Pacific Markets for Strategic Growth

Regional markets exhibit distinct digital logistics maturity profiles shaped by infrastructure capabilities, regulatory frameworks, and industry concentrations. In the Americas, North American markets prioritize cross-border trade facilitation, leveraging transportation management systems infused with customs compliance modules and real-time tracking dashboards. Latin American corridors are rapidly modernizing port operations and deploying yard management systems to address congestion, while e-commerce growth fuels investments in automated sortation and last-mile visibility platforms.

Europe, the Middle East, and Africa reveal a heterogeneous landscape where advanced economies integrate carbon monitoring and green logistics modules into their platforms, while emerging markets focus on connectivity and intermodal coordination. Within the European Union, stringent data privacy directives and sustainability mandates compel logistics providers to adopt blockchain and analytics tools that balance transparency with regulatory compliance. The Middle East’s strategic logistics hubs emphasize digital trade facilitation, investing in unified platforms that blend order orchestration with warehouse control towers. In Africa, mobile-first tracking solutions address infrastructure gaps and provide SMEs with affordable access to freight visibility.

Asia-Pacific stands at the forefront of digital logistics innovation, with established hubs in Southeast Asia and East Asia pioneering AI-driven route optimization and predictive maintenance services. Rapid urbanization and high e-commerce volumes in countries such as China and India have accelerated the deployment of warehouse management modules with advanced labor management and dock scheduling capabilities. By aligning solution portfolios with regional nuances, logistics leaders can tailor their strategies to extract maximum value from digital investments across geographies.

This comprehensive research report examines key regions that drive the evolution of the Digital Logistics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Visionary Companies Driving Competitive Advantage and Technological Innovation in the Digital Logistics Ecosystem

Leading technology and service providers are driving differentiation through strategic partnerships, targeted acquisitions, and continuous innovation across the digital logistics landscape. Cloud platform giants have strengthened their offerings by integrating AI-based analytics and IoT services, collaborating with logistics specialists to develop turnkey visibility solutions. Meanwhile, pure-play visibility providers have expanded their reach by partnering with global carriers and warehouse operators, creating interoperable ecosystems that deliver seamless data exchange from dock to final mile.

Traditional enterprise software vendors are embedding transportation and warehouse management modules into broader supply chain suites, offering unified dashboards for order orchestration, inventory control, and transportation planning. These integrated solutions appeal to large end users seeking a single pane of glass for end-to-end operations. At the same time, innovative startups are capturing market share with specialized solutions for last-mile routing, automated document processing, and blockchain-enabled trade finance platforms.

In addition, third-party logistics service providers are investing in digital capabilities to transition from asset-heavy models to platform-enabled services. By leveraging real-time data feeds and advanced analytics, these providers can offer dynamic pricing, predictive capacity allocation, and performance benchmarking to shippers. This convergence of technology and service expertise underscores the competitive intensity of the digital logistics sector and the imperative for incumbents and challengers to continually evolve their value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Logistics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 4flow AG

- Amazon Web Services Inc.

- Blue Yonder Group Inc.

- Bosch Software Innovations GmbH

- Cisco Systems Inc.

- Descartes Systems Group Inc.

- DHL Group

- FedEx Corp.

- Flexport Inc.

- HCL Technologies Ltd.

- Honeywell International Inc.

- IBM Corporation

- Infosys Ltd.

- LogiNext Technologies Pvt Ltd.

- Manhattan Associates Inc.

- Oracle Corporation

- SAP SE

- Tech Mahindra Ltd.

- Trimble Inc.

- WiseTech Global Ltd.

Actionable Strategies and Tactical Recommendations to Bolster Operational Resilience, Spur Innovation, and Enhance Visibility in Modern Logistics Networks

Organizations should embark on a phased digital logistics transformation by first establishing clear visibility across core transport and warehouse operations. Implementing real-time tracking sensors and connecting them to integrated dashboards creates a foundational layer of transparency, which then informs process optimization and predictive modeling efforts. From this vantage, executives can prioritize high-impact use cases such as dynamic route planning, dock scheduling, and inventory replenishment alerts to reduce delays and improve service levels.

Next, leveraging artificial intelligence and machine learning to analyze historical performance and external indicators-such as weather forecasts and trade policy updates-enables proactive decision-making. Predictive analytics tools should be calibrated to anticipate bottlenecks, forecast maintenance needs, and recommend alternative carriers or modes. Concurrently, embedding carbon footprint tracking into platform workflows supports sustainability targets and enhances stakeholder reporting.

Finally, industry leaders must cultivate a collaborative ecosystem mindset by forging partnerships across carriers, customs brokers, technology vendors, and academic institutions. Shared digital data streams and open APIs facilitate cross-organizational innovation, enabling rapid prototyping of new services and quicker adoption of emerging standards. By aligning people, processes, and technology through these strategic actions, organizations can build resilient, adaptive logistics networks that sustain competitive advantage.

Detailing a Robust Mixed Methodology Leveraging Primary Expertise and Secondary Research to Ensure Rigor and Validity in Logistics Market Insights

This research integrates both primary and secondary methods to ensure a comprehensive understanding of the digital logistics ecosystem. Primary data were gathered through in-depth interviews with senior executives at leading logistics service providers, software vendors, and end-user organizations across multiple industries. These conversations uncovered firsthand insights into technology adoption drivers, implementation challenges, and prioritization frameworks used by decision-makers.

Secondary research involved a systematic review of industry publications, regulatory filings, company white papers, and academic journals to validate emerging trends and identify macroeconomic influences on digital logistics. Data triangulation techniques were employed to cross-verify information from diverse sources, ensuring the reliability and validity of the findings. This iterative approach minimized bias and provided a robust evidentiary basis for the segmentation framework and regional analyses.

Furthermore, an expert advisory panel composed of supply chain professors, technology consultants, and trade analysts reviewed the methodology and key findings to offer critical feedback. Their guidance refined the analytical models, confirming that the research approach aligns with best practices in market intelligence and delivers actionable, trustworthy insights for logistics leaders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Logistics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Logistics Market, by Component

- Digital Logistics Market, by Solution Type

- Digital Logistics Market, by Deployment Mode

- Digital Logistics Market, by Enterprise Size

- Digital Logistics Market, by End User Industry

- Digital Logistics Market, by Region

- Digital Logistics Market, by Group

- Digital Logistics Market, by Country

- United States Digital Logistics Market

- China Digital Logistics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesis of Strategic Imperatives Validating the Critical Role of Digital Logistics in Enhancing Efficiency, Visibility, and Competitive Differentiation

The synthesis of strategic imperatives presented in this summary underscores the critical role of digital logistics as a catalyst for operational excellence and competitive differentiation. By harnessing advanced sensors, real-time connectivity, and predictive analytics, organizations can transition from reactive firefighting to strategic planning, enhancing visibility across global supply chains and mitigating disruption risks.

Crucially, the integration of AI-driven tools and blockchain-enabled platforms fosters an ecosystem where stakeholders collaborate seamlessly, share trusted data, and optimize resource allocation. These collaborative networks empower companies to respond swiftly to market dynamics-whether regulatory shifts, demand surges, or sustainability mandates-while maintaining cost efficiency and service quality.

Ultimately, the collective insights from segmentation, regional nuances, technology trends, and company strategies offer a coherent roadmap. This roadmap guides logistics leaders in aligning digital investments with strategic priorities, ensuring that transformation initiatives yield measurable improvements in resilience, agility, and customer satisfaction.

Take the Next Step by Collaborating with Ketan Rohom to Access Comprehensive Digital Logistics Market Research and Drive Informed Strategic Decisions

To unlock the full potential of digital logistics solutions and secure your competitive edge, reach out to Ketan Rohom, Associate Director, Sales & Marketing. By partnering directly, you’ll gain tailored insights into how advanced visibility tools, AI-driven analytics, and integrated supply chain platforms can address your organization’s unique challenges. Engaging with Ketan ensures you receive personalized guidance on navigating regulatory headwinds, optimizing operational workflows, and capitalizing on emerging technology trends. Act now to transform your logistics strategy, access an in-depth market research report, and empower stakeholders with data-backed recommendations that drive measurable results and sustainable growth

- How big is the Digital Logistics Market?

- What is the Digital Logistics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?