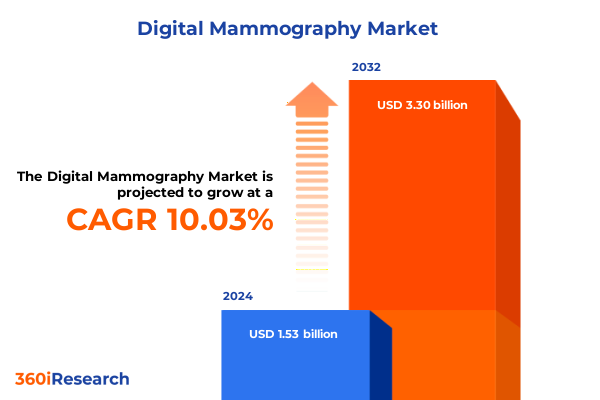

The Digital Mammography Market size was estimated at USD 1.68 billion in 2025 and expected to reach USD 1.84 billion in 2026, at a CAGR of 10.12% to reach USD 3.30 billion by 2032.

Embracing the Digital Transformation in Mammography to Elevate Early Breast Cancer Detection and Revolutionize Imaging Workflows Across Healthcare Settings

Digital mammography has emerged as a cornerstone of modern breast imaging, reshaping how clinicians detect and diagnose breast abnormalities. By transitioning from conventional film-based systems to full field digital modalities, healthcare providers can leverage enhanced image quality, streamlined workflow, and greater diagnostic confidence. The advent of digital mammography has reduced the margin for error in interpreting subtle tissue contrasts and microcalcifications, while also offering advanced image manipulation tools that enable radiologists to zoom, rotate, and adjust contrast without degrading image fidelity. This shift toward digital platforms has paved the way for sharper, more reproducible imaging outcomes and facilitated telemammography, which extends expert review capabilities to remote and underserved regions.

Moreover, digital mammography aligns with the broader healthcare digitalization trend, integrating seamlessly with picture archiving and communication systems, electronic health records, and centralized imaging repositories. As a result, multidisciplinary care teams can collaborate in real time, enriching patient consultations with immediate access to prior imaging studies and enhanced visualization tools. In addition, the reduction in consumable costs and the elimination of darkroom processes support more sustainable imaging practices, contributing to operational efficiencies and smaller environmental footprints. Together, these developments underscore the critical role of digital mammography in elevating the standard of breast cancer screening and diagnosis across diverse clinical settings.

Unpacking Pioneering Technological Breakthroughs and AI Integration That Are Redefining Precision and Accessibility in Diagnostic Mammography

The digital mammography landscape has witnessed a series of transformative shifts, driven in large part by breakthroughs in imaging hardware, the integration of sophisticated artificial intelligence algorithms, and the increasing emphasis on patient-centric care models. Tomosynthesis, also known as three-dimensional digital mammography, has redefined tissue visualization by capturing multiple low-dose images at varying angles, effectively reducing the masking effect of overlapping breast tissue. This advancement has led to improved detection rates for invasive cancers and a reduction in recall rates, thereby enhancing patient outcomes and streamlining clinical workflows.

In parallel, the rise of AI-driven computer-aided detection and diagnostic support tools has empowered radiologists to identify subtle anomalies with greater speed and accuracy. Deep learning frameworks now assist in prioritizing cases, quantifying lesion morphology, and even predicting malignancy risk scores. Meanwhile, cloud-based platforms and secure, encrypted data channels facilitate remote reading, quality control, and collaborative case review, further democratizing access to expert interpretation. Together with evolving reimbursement policies that recognize the clinical value of advanced mammography technologies, these shifts underscore a new era in breast imaging where precision, efficiency, and enhanced patient experience converge.

Assessing How Recent United States Tariff Policies Introduced in 2025 Are Reshaping Supply Chains and Cost Structures in Digital Mammography Equipment

In 2025, the United States introduced a set of tariffs targeting select medical imaging components, fundamentally altering cost structures and procurement strategies for digital mammography equipment. These measures, implemented under revised harmonized tariff schedules, impose additional duties on imported detectors, sensors, and x-ray tubes-key hardware elements integral to both two-dimensional and three-dimensional full field mammography systems. As a result, original equipment manufacturers have had to navigate significant increases in input costs, prompting a reexamination of global supply chains and sourcing practices.

Consequently, many suppliers have accelerated efforts to diversify their manufacturing footprint, seeking partnerships with domestic and regional suppliers to mitigate exposure to steep import duties. Although these strategic adjustments aim to preserve equipment affordability for end users, the transition has entailed short-term disruptions in component availability and an uptick in lead times. Additionally, passing on incremental costs has placed budgetary pressures on healthcare facilities, particularly ambulatory surgical centers and specialty clinics that operate on leaner capital reserves. Ultimately, the cumulative impact of the 2025 tariff regime underscores the importance of flexible procurement strategies and collaborative industry dialogues to ensure continued access to cutting-edge imaging technologies.

Illuminating Diverse Product, Component, Application, and End-User Segmentation That Drive Nuanced Adoption Patterns in Digital Mammography Markets

The digital mammography market exhibits a rich tapestry of product and component modalities, each tailored to evolving clinical requirements. On the product front, two-dimensional full field digital mammography continues to serve as a reliable baseline screening tool, offering high-resolution grayscale images that detect microcalcifications and architectural distortions. In contrast, three-dimensional full field digital mammography tomosynthesis has gained momentum for its superior capability to render volumetric tissue slices, enabling radiologists to identify lesions obscured by overlapping anatomy. Clinicians often weigh factors such as image clarity, radiation dose, and interpretation time when determining the optimal modality for individual patients.

Component segmentation further reveals nuanced market dynamics, with hardware innovations-spanning high-sensitivity detectors, next-generation sensors, and robust x-ray tubes-underpinning system performance and durability. Complementary software platforms now incorporate advanced algorithms for image reconstruction, workflow management, and quality assurance, creating a synergistic ecosystem that enhances overall diagnostic reliability. In terms of applications, digital mammography finds widespread use not only in routine breast cancer screening programs, but also in diagnostic imaging for symptomatic patients, follow-up imaging to monitor treatment response, and research and development initiatives focused on algorithm validation and dose optimization.

Diverse end-user environments-from high-volume hospital radiology departments to specialized breast imaging clinics and ambulatory surgical centers-drive adoption patterns based on patient throughput, workflow integration needs, and capital investment considerations. Hospitals often leverage comprehensive digital mammography suites to manage broad case mixes and integrate with multidisciplinary oncology teams, whereas ambulatory surgical centers and specialty clinics prioritize compact systems that deliver rapid turnaround times and streamlined scheduling.

This comprehensive research report categorizes the Digital Mammography market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Application

- End-User

Exploring Distinct Regional Dynamics and Adoption Drivers That Define Growth Trajectories in the Americas, EMEA, and Asia-Pacific Digital Mammography Sectors

Regional dynamics strongly influence the trajectory of digital mammography adoption and innovation. In the Americas, advanced healthcare infrastructure and favorable reimbursement frameworks have created fertile ground for the uptake of both two-dimensional and tomosynthesis modalities. The United States market, in particular, benefits from mature screening guidelines and private‐sector investments in state-of-the-art imaging facilities, while select Latin American nations are gradually expanding national breast cancer screening initiatives to improve early detection rates.

Across Europe, the Middle East, and Africa, a spectrum of market maturity exists. Western European countries continue to harmonize screening protocols at the pan-EU level and invest in cross-border healthcare collaborations. Meanwhile, select Middle Eastern hubs are channeling capital into specialized breast centers, driving demand for premium imaging solutions. In parts of Africa, budget constraints and infrastructure gaps have prompted innovative public-private partnerships that deploy mobile digital mammography units, extending reach to rural populations and underserved communities.

In the Asia-Pacific region, surging healthcare expenditure, growing breast cancer awareness campaigns, and expanding government screening programs are propelling demand for both hardware and software solutions. Countries such as China and India are investing heavily in localizing manufacturing and service networks to reduce lead times, while regional technology partnerships are emerging to co-develop AI-enhanced diagnostic tools. These initiatives underscore the region’s pivotal role in shaping global digital mammography trends.

This comprehensive research report examines key regions that drive the evolution of the Digital Mammography market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Industry Innovators and Strategic Collaborations That Are Spearheading Breakthroughs in Digital Mammography Solutions Worldwide

Leading industry participants are charting the course of digital mammography’s evolution through substantive R&D investments, strategic alliances, and focused portfolio expansions. Established system suppliers have introduced next-generation tomosynthesis platforms featuring high-resolution detectors, proprietary reconstruction algorithms, and ergonomically optimized gantries. These companies are simultaneously forging partnerships with software developers to integrate artificial intelligence modules capable of lesion detection, segmentation, and risk stratification, thereby augmenting radiologist productivity and diagnostic consistency.

At the same time, technology firms with expertise in medical imaging informatics are strengthening their presence in the breast imaging segment by offering cloud-native PACS solutions, secure data exchange networks, and teleimaging capabilities. These collaborations have given rise to comprehensive digital mammography ecosystems that seamlessly connect image acquisition, interpretation, and follow-up workflows. Furthermore, several key players are pursuing targeted acquisitions of smaller imaging software specialists and AI start-ups to bolster their competitive positioning and accelerate time-to-market for novel features.

In addition to product innovation, after-sales service and training programs have become crucial differentiators. Top-tier vendors now provide remote performance monitoring, predictive maintenance analytics, and virtual training modules for radiologists and technologists. This holistic approach to solution delivery underscores a broader industry shift toward value-based partnerships that extend beyond equipment procurement and emphasize long-term clinical and operational excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Mammography market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allengers Medical Systems Ltd.

- Analogic Corporation

- Barco NV

- Bayer AG

- Canon Medical Systems Corporation

- Carestream Health, Inc.

- CMR Naviscan Corp.

- CooperSurgical, Inc.

- EIZO Corp.

- Esaote SPA

- Fujifilm Holdings Corporation

- GE Healthcare Technologies Inc.

- General Medical Merate S.p.A.

- Hologic Inc.

- iCAD, Inc.

- Idetec Medical Imaging

- Konica Minolta Inc.

- Koninklijke Philips NV

- Merck & Co., Inc.

- Metaltronica S.p.A

- Planmed Oy

- Shenzhen Lanmage Medical Technology Co., Ltd

- Siemens Healthineers GmbH

- TRIVITRON Healthcare

- Vannin Healthcare Global

Strategic Imperatives and Tactical Recommendations to Empower Industry Leaders in Capitalizing on Emerging Opportunities and Mitigating Supply Chain Vulnerabilities

To navigate the evolving digital mammography landscape successfully, industry leaders must adopt a series of strategic imperatives. First, prioritizing end-to-end research and development initiatives that integrate hardware improvements and software intelligence will ensure differentiation in a competitive marketplace. Allocating resources to refine detector sensitivity, optimize x-ray tube performance, and advance deep learning algorithms can unlock new frontiers in image quality and diagnostic accuracy.

Concurrently, diversifying supply chains by establishing relationships with multiple component vendors and exploring regional manufacturing partnerships will mitigate risks associated with import tariffs and geopolitical disruptions. Emphasizing modular system designs can further enhance production agility and reduce dependency on single-source suppliers. In parallel, engaging proactively with payers and regulatory bodies to demonstrate the clinical efficacy and cost-effectiveness of advanced mammography offerings will facilitate favorable reimbursement pathways.

Finally, investing in comprehensive training programs for radiologists and technologists will accelerate technology adoption and maximize return on investment for end users. Designing patient-centric service models-such as mobile mammography units and telemammography platforms-can broaden access in underserved areas. By weaving these tactical recommendations into their strategic roadmaps, organizations can capitalize on emerging opportunities while fortifying resilience against supply chain and policy-related vulnerabilities.

Detailing Rigorous Mixed-Method Research Methodology That Ensures Comprehensive, Valid, and Actionable Insights for Digital Mammography Market Analysis

This research initiative adopted a rigorous mixed-method approach to ensure the validity, reliability, and actionability of its findings. The study began with extensive secondary research, encompassing peer-reviewed journals, white papers, regulatory filings, patent databases, and corporate disclosures. This phase established a foundational understanding of technological advances, policy landscapes, and historical market dynamics.

Building on this groundwork, a series of primary research activities were conducted, including in-depth interviews with key opinion leaders-radiologists, clinical directors, supply chain executives, and policy advisors. These conversations yielded qualitative insights into adoption drivers, implementation challenges, and strategic priorities. Quantitative data gathered through structured surveys provided statistical support for segmentation analysis, facilitating triangulation with secondary sources.

Finally, all data underwent a multi-layered validation process, combining consistency checks, cross-referencing, and expert review workshops. This ensures that the report’s conclusions and recommendations rest on a robust evidentiary base, empowering stakeholders with high-confidence insights into digital mammography’s current landscape and future trajectory.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Mammography market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Mammography Market, by Product Type

- Digital Mammography Market, by Component

- Digital Mammography Market, by Application

- Digital Mammography Market, by End-User

- Digital Mammography Market, by Region

- Digital Mammography Market, by Group

- Digital Mammography Market, by Country

- United States Digital Mammography Market

- China Digital Mammography Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Key Insights from Technological, Regulatory, and Market Dynamics to Chart the Future Outlook of Digital Mammography Innovation and Care Delivery

This comprehensive analysis illuminates the transformative forces shaping digital mammography, from technological breakthroughs and AI integration to evolving policy frameworks and complex supply chain dynamics. By examining product modalities, component innovations, application areas, and end-user environments, the report offers a panoramic view of the factors influencing adoption and performance. Regional comparisons underscore the contrasting drivers at play in the Americas, EMEA, and Asia-Pacific, highlighting the interplay of infrastructure maturity, reimbursement models, and government initiatives.

Key industry players have demonstrated a commitment to advancing image quality, workflow efficiency, and diagnostic accuracy through strategic partnerships and purposeful M&A activity. Yet, the ripple effects of the 2025 tariff regime reveal the necessity for agile supply chain strategies and proactive stakeholder engagement. As healthcare systems worldwide aim to balance cost containment with clinical excellence, the insights presented here serve as a roadmap for informed decision-making.

Looking ahead, the convergence of high-resolution tomosynthesis, AI-powered analytics, and patient-centric service models promises to elevate breast cancer detection and care delivery. By acting on the strategic recommendations, organizations can position themselves at the forefront of this dynamic market, driving innovation while ensuring sustainable, quality-focused outcomes.

Unlock Comprehensive Digital Mammography Market Intelligence by Connecting Directly with Associate Director of Sales & Marketing for Tailored Insights and Bespoke Solutions

In today’s fast-paced healthcare environment, ensuring access to precise and actionable market intelligence can be the difference between leading the curve and falling behind. To equip your organization with the insights needed to navigate the complex landscape of digital mammography, the latest research report offers comprehensive analysis, in-depth segmentation, and foresight into evolving technological, regulatory, and regional dynamics. Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, grants you the opportunity to discuss bespoke solutions tailored to your strategic priorities. Whether you aim to deepen your understanding of advanced tomosynthesis modalities, assess component supply chain considerations under new tariff regimes, or explore regional expansion strategies in the Americas, EMEA, and Asia-Pacific, personalized guidance will ensure you extract maximum value from every insight. Reach out to Ketan Rohom through the official inquiry portal or via LinkedIn to schedule a private briefing, explore flexible licensing options, and secure your organization’s competitive advantage with the definitive digital mammography market research report

- How big is the Digital Mammography Market?

- What is the Digital Mammography Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?