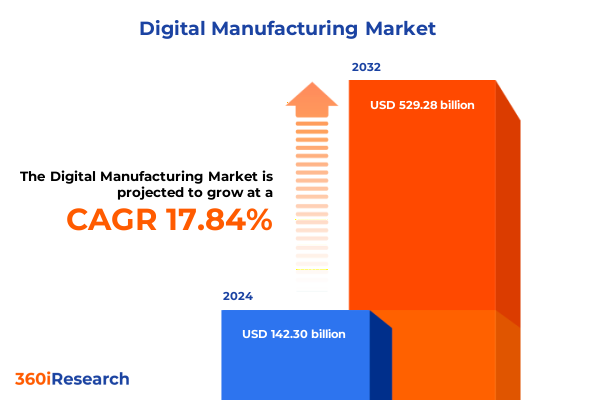

The Digital Manufacturing Market size was estimated at USD 167.51 billion in 2025 and expected to reach USD 195.81 billion in 2026, at a CAGR of 17.86% to reach USD 529.28 billion by 2032.

Exploring the Evolution and Strategic Imperatives of Digital Manufacturing in an Era of Accelerated Technological Integration and Competitive Disruption

In an era marked by unprecedented technological acceleration, digital manufacturing has emerged as a transformative force reshaping traditional production paradigms and redefining the competitive landscape. By integrating advanced digital tools and data-driven methodologies, manufacturers are unlocking new levels of agility, efficiency, and innovation. The convergence of additive manufacturing, industrial Internet of Things, artificial intelligence, and cloud computing platforms is facilitating a seamless digital thread that extends from product ideation to delivery and after-sales service. As the industry transitions toward smart, connected factories, stakeholders must navigate complex ecosystems where software-defined operations and real-time analytics become core competencies rather than supplementary capabilities.

Consequently, this executive summary delves into the strategic imperatives driving digital manufacturing adoption, highlighting key shifts across technologies, segments, and regions. It examines the cascading effects of recent policy changes, notably the United States tariffs enacted in mid-2025, and synthesizes critical insights from component and technology segmentation frameworks. Moreover, it offers actionable recommendations designed to empower industry leaders with the knowledge required to capitalize on emerging opportunities, mitigate risk, and align organizational structures with next-generation operational models. This report’s findings serve as a strategic compass for decision-makers seeking to harness digital manufacturing’s full potential and drive sustainable, long-term growth.

How Emerging Technologies and Ecosystem Collaborations Are Redefining Operational Efficiency and Value Creation Across Digital Manufacturing Environments

The landscape of industrial production is undergoing a fundamental metamorphosis driven by a suite of emerging technologies that collectively elevate both precision and productivity. Additive manufacturing methods such as powder bed fusion and material extrusion are moving beyond prototyping to high-volume production, enabling complex geometries and lightweight structures previously unattainable with conventional techniques. Simultaneously, AI and advanced analytics platforms are optimizing design iterations, predictive maintenance, and quality assurance by mining sensor data for insights that reduce unplanned downtime and scrap rates. Cloud computing infrastructures are centralizing data repositories, promoting cross-site collaboration, and accelerating time to market through on-demand scalability.

Moreover, the industrial IoT ecosystem is expanding its reach with wired and wireless connectivity solutions that underpin smart factory environments. Embedded cybersecurity frameworks are becoming indispensable as the attack surface widens in connected operations, prompting investments in robust threat detection and response capabilities. Simulation tools are integrating digital twins with real-time operational data to forecast performance under varying conditions and guide strategic decisions. Across these converging shifts, manufacturers are forging collaborative ecosystems with technology providers, research institutions, and supply chain partners to co-innovate and adapt at the speed of digital transformation.

Assessing the Multidimensional Effects of United States Tariffs Implemented in 2025 on Supply Chains Manufacturing Costs and Sector Resilience

The United States imposed a series of tariffs on critical industrial imports in July 2025 in an effort to bolster domestic manufacturing and recalibrate global supply chain dependencies. These measures, targeting key components and subassemblies, have reverberated across production networks by elevating input costs for both hardware and software-enabled systems. In turn, manufacturers are reassessing supplier portfolios, accelerating nearshoring initiatives, and intensifying dialogues with regional partners to ensure continuity of critical materials. Consequently, an emergent theme is the acceleration of automation investments, as companies seek to offset increased labor and material costs by boosting throughput and operational resilience.

Yet, the ramifications extend beyond cost structures. The tariffs have catalyzed a shift toward modular, adaptable manufacturing cells that can rapidly pivot in response to further policy adjustments. Financial stakeholders are demanding greater transparency into total landed cost and risk exposure, prompting stronger governance frameworks and scenario-based planning. Looking ahead, organizations with agile digital infrastructures and diversified sourcing strategies will be best positioned to thrive amid ongoing geopolitical uncertainties. This emergent paradigm underscores the pivotal role of integrated digital manufacturing platforms in safeguarding competitiveness and fueling innovation in a tariff-influenced environment.

Uncovering Critical Insights From Component Technology Deployment Industry Applications and Service Models Driving Momentum in Digital Manufacturing Segments

A nuanced understanding of component, technology, industry, deployment model, organization size, and service segmentation reveals the intricate architecture of the digital manufacturing ecosystem. Within the component dimension, hardware investments remain foundational, complementing an expanding services portfolio and software solutions encompassing CAD/CAM, CNC control, ERP, MES, PLM, and SCADA modules that orchestrate end-to-end workflows. Technological segmentation highlights additive manufacturing methods-binder jetting, directed energy deposition, material extrusion, material jetting, powder bed fusion, and sheet lamination-that coexist with artificial intelligence and analytics engines, cloud computing platforms, cybersecurity frameworks, industrial IoT deployments wired and wireless, and advanced simulation environments.

End-use industries further contextualize adoption patterns, with aerospace and defense demanding stringent certification controls, automotive prioritizing just-in-time flexibility, electronics and semiconductor sectors requiring micro-level precision, and energy and utilities focusing on durability and compliance. Food and beverage operations underscore hygiene and traceability imperatives, whereas healthcare and medical device manufacturers emphasize validation and regulatory rigor. Deployment models range from fully on-premise systems for maximum data sovereignty to cloud-based architectures for rapid scalability. Meanwhile, organizational size influences solution scope, as large enterprises pursue enterprise-wide implementations and digital standardization, while small and medium enterprises leverage modular services for targeted improvements. Finally, service segmentation spans consulting interventions, implementation roadmaps, and support and maintenance agreements that ensure sustained system performance.

This comprehensive research report categorizes the Digital Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- End Use Industry

- Deployment Model

- Organization Size

- Service

Comparative Regional Dynamics Shaping Adoption Growth and Strategic Priorities for Digital Manufacturing Across the Americas EMENA and Asia-Pacific Economies

Regional dynamics play a pivotal role in shaping digital manufacturing trajectories, reflecting distinct economic priorities, policy frameworks, and industrial maturity levels. In the Americas, robust investments in smart factory initiatives coexist with ongoing logistics optimization efforts. The United States leads with comprehensive digitization roadmaps and incentives for advanced manufacturing zones, while Canada emphasizes collaborative innovation clusters and Latin American markets are exploring targeted deployments to modernize legacy production assets. North American providers are at the forefront of integrated supply chain visibility solutions that enhance cross-border coordination and resilience.

Across Europe, the Middle East, and Africa, digital manufacturing adoption is influenced by the European Union’s industrial decarbonization agenda and regulatory compliance mandates. Germany’s Industrie 4.0 leadership continues to inspire smart factory benchmarks, whereas Middle Eastern economies are investing in digital infrastructure to diversify from hydrocarbon dependency. In Africa, pilot programs test industrial IoT applications in resource extraction and agricultural processing. Meanwhile, the Asia-Pacific region presents a mosaic of maturity stages: China aggressively scales additive manufacturing and AI-enabled automation, Japan focuses on precision robotics and five-axis machining, India accelerates competency-building for small and medium enterprises, and Australia and New Zealand pursue digital twin initiatives to enhance resource management. These regional distinctions underscore the necessity of localized strategies aligned with regulatory, economic, and operational contexts.

This comprehensive research report examines key regions that drive the evolution of the Digital Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Innovators and Strategic Partnerships That Are Defining Competitive Benchmarks in the Global Digital Manufacturing Ecosystem

The digital manufacturing arena is defined by a cohort of innovative enterprises that are driving the sector’s trajectory through technology leadership, strategic alliances, and service excellence. Global incumbents are continuously expanding their portfolios, integrating AI-driven analytics into PLM suites and reinforcing cybersecurity offerings within industrial control systems. At the same time, specialized providers are forging niche leadership positions in additive manufacturing hardware, industrial IoT connectivity modules, and advanced simulation platforms. Strategic partnerships between software vendors and machinery manufacturers are streamlining data interoperability, enabling customers to deploy end-to-end solutions from a single orchestrated environment.

Mergers and acquisitions are reshaping competitive benchmarks, with larger conglomerates absorbing agile startups to gain proprietary intellectual property in areas such as digital twins, edge computing, and augmented reality-guided maintenance. Collaborations between industry leaders and academic research centers are accelerating innovation cycles for next-generation materials and process controls. Furthermore, service partners are bundling consulting, implementation, and managed services into comprehensive offerings that de-risk digital transformation roadmaps. This dynamic interplay of technology development, ecosystem integration, and strategic consolidation underscores the increasingly collaborative nature of the digital manufacturing ecosystem, and illustrates how leading companies are positioning themselves as orchestrators of industrial innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Altizon Systems Private Limited

- Caterpillar Inc.

- Cisco Systems, Inc.

- Dassault Systèmes SE

- Ecolibrium Energy Private Limited

- Embridge Solutions Private Limited

- Entrib Analytics Private Limited

- General Electric Company

- Honeywell International Inc.

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- Mitsubishi Electric Corporation

- Plutomen Technologies Private Limited

- Rockwell Automation, Inc.

- SAP SE

- Schneider Electric SE

- Siemens AG

- Vegam Solutions Private Limited

Strategic Roadmap and High-Impact Recommendations to Empower Industry Leaders to Navigate Disruption and Capitalize on Digital Manufacturing Opportunities

Industry leaders seeking to excel in digital manufacturing must embrace a multifaceted strategy that spans technology adoption, workforce development, and ecosystem collaboration. Initially, executives should prioritize the establishment of a clear digital vision that aligns with corporate objectives, supported by a governance structure that balances autonomy and centralized oversight. Investment in upskilling programs is crucial to cultivate talent versed in data analytics, system integration, and cybersecurity, thereby ensuring that the human capital underpinning digital initiatives remains robust and agile.

Simultaneously, organizations should develop standardized integration frameworks to facilitate seamless interoperability across legacy and emerging systems. Cultivating strategic partnerships with technology vendors, research institutions, and system integrators will accelerate innovation and reduce time to value. Leaders are encouraged to deploy pilot programs focused on high-impact use cases-such as predictive maintenance, additive manufacturing scaling, and digital twin testing-to generate quick wins and build organizational momentum. Furthermore, establishing a cross-functional center of excellence can institutionalize best practices, foster continuous improvement, and provide a platform for iterative experimentation. Finally, proactive engagement with policymakers and industry consortia will help shape favorable regulatory environments and unlock incentives for sustainable, digitized operations.

Comprehensive Research Methodology Highlighting Data Sources Analytical Frameworks and Validation Protocols Underpinning the Digital Manufacturing Study

The methodology underpinning this digital manufacturing analysis combined rigorous secondary research, primary stakeholder engagement, and multi-layered validation protocols to ensure robustness and credibility. Secondary research encompassed the review of peer-reviewed journals, industry whitepapers, regulatory filings, corporate disclosures, and publicly available data on technology adoption trends. Information gleaned from these sources provided a foundational understanding of market dynamics, segmentation criteria, and policy landscapes.

Primary research involved structured interviews with senior executives, technology architects, and operational managers across diverse industry verticals. These qualitative insights were complemented by quantitative data collected through targeted surveys, enabling a triangulation of perspectives on technology deployment, investment drivers, and adoption barriers. Data synthesis was guided by a proprietary analytical framework that segmented the market by component, technology, industry, deployment model, organization size, and service categories. Throughout the process, findings were subjected to iterative validation involving cross-referencing with external subject matter experts and calibration against real-world case studies. This comprehensive approach ensured that the conclusions presented herein reflect both depth and breadth of understanding.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Manufacturing Market, by Component

- Digital Manufacturing Market, by Technology

- Digital Manufacturing Market, by End Use Industry

- Digital Manufacturing Market, by Deployment Model

- Digital Manufacturing Market, by Organization Size

- Digital Manufacturing Market, by Service

- Digital Manufacturing Market, by Region

- Digital Manufacturing Market, by Group

- Digital Manufacturing Market, by Country

- United States Digital Manufacturing Market

- China Digital Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesis of Key Findings and Forward-Looking Perspectives on Digital Manufacturing Trends Strategic Priorities and Transformative Pathways for Stakeholders

The convergence of additive manufacturing, AI, industrial IoT, cloud platforms, and cybersecurity is redefining the contours of modern production systems. As organizations grapple with the cumulative effects of the 2025 tariff environment, the imperative for digital resiliency and operational agility has never been more pronounced. Segmented analysis reveals that success hinges on the seamless integration of hardware, software, and services tailored to specific industry needs, organizational scales, and regional contexts. Notably, regional priorities vary significantly, underscoring the need for localized strategies that align with regulatory frameworks and economic objectives.

Looking ahead, the digital manufacturing ecosystem will be characterized by heightened collaboration among technology providers, service partners, and end users. Companies that invest in scalable, interoperable infrastructures and cultivate a data-centric culture will be best positioned to capture emerging opportunities. As leaders implement the actionable recommendations outlined herein and leverage the comprehensive insights, they will be equipped to navigate uncertainty, optimize resource utilization, and drive transformative change across the value chain. This synthesis of findings offers a strategic lens through which stakeholders can chart a course toward a more connected, resilient, and innovative manufacturing future.

Drive Strategic Decisions and Unlock Growth in Digital Manufacturing by Engaging With an Expert to Acquire the Full Market Research Report Today

Elevate your decision-making through comprehensive insights and expert consultation with Ketan Rohom, Associate Director, Sales & Marketing who can guide you to the precise segments and strategies aligned with your organizational goals. Gain access to a meticulously curated market research report that encompasses in-depth analyses across technological innovations, regulatory impacts, and regional dynamics. Initiate a conversation to explore tailored research deliverables, custom data slices, and strategic frameworks designed to support your investment and operational initiatives. Harness this opportunity to secure a competitive advantage by deploying actionable intelligence on digital manufacturing trends, best practices, and emerging opportunities. Contact our team today to schedule a customized briefing and chart a data-driven roadmap for future growth.

- How big is the Digital Manufacturing Market?

- What is the Digital Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?