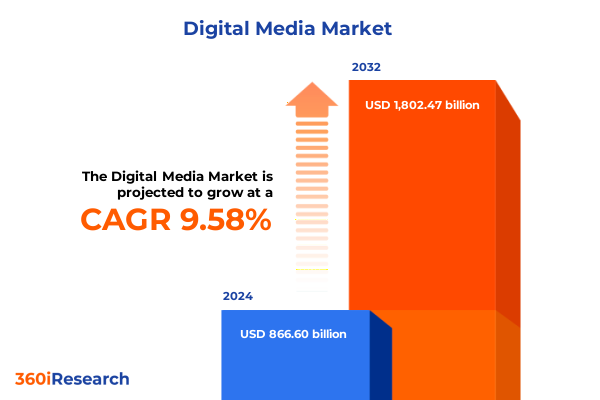

The Digital Media Market size was estimated at USD 947.72 billion in 2025 and expected to reach USD 1,037.09 billion in 2026, at a CAGR of 9.61% to reach USD 1,802.47 billion by 2032.

A concise orientation to the contemporary digital media landscape highlighting content, platforms, and business model convergence that shape executive priorities

The digital media landscape is evolving at pace, driven by shifts in consumer behavior, platform innovation, and cross-industry convergence. This introduction frames the contemporary environment by highlighting how content types, delivery mechanisms, and monetization models are intersecting to reshape how audiences discover, consume, and pay for media. It emphasizes the imperative for executives to synthesize signal from noise and prioritize investments that enable agile responses to shifting user expectations.

Across the digital experience, audio formats such as music streaming and podcasts are deepening engagement, while interactive formats invite two-way participation and gamified retention. Text-based formats remain vital for long-form engagement and thought leadership, and visual and video content continue to dominate attention economies. These content dynamics are inextricably linked to mobile and web delivery layers, and to business models that range from advertising and subscription to pay-per-content models. This introduction sets the stage for a structured exploration of transformative shifts, tariff impacts, segmentation intelligence, and regional and competitive implications that follow in the ensuing sections.

How technological innovation, privacy shifts, and changing attention patterns are realigning content creation, distribution, and monetization dynamics across the industry

The digital media landscape is undergoing transformative shifts that are simultaneously technological, regulatory, and behavioral. Technological advances in content production and delivery have lowered barriers to entry and enabled more immersive formats, while AI-driven personalization is fundamentally altering discovery pathways and the economics of attention. Emerging standards for interoperability and richer metadata are improving content portability, which in turn changes how rights holders, platforms, and advertisers negotiate value.

On the consumer side, attention fragmentation and shorter session windows are prompting publishers and platforms to optimize for modularized content experiences that can be assembled across contexts. Advertisers are reallocating budgets toward measurable, outcome-based channels, pressuring legacy CPM-driven inventory to evolve. Meanwhile, privacy regulations and platform policy shifts are catalyzing new identity and measurement solutions that balance compliance and targeting effectiveness. These forces are converging to make speed, data architecture, and ecosystem partnerships decisive sources of competitive advantage for organizations that can execute across content, delivery, and monetization dimensions.

Analyzing the broader operational and infrastructure consequences of 2025 tariff changes and how organizations can mitigate cost and supply chain volatility

Tariff policies announced for 2025 have introduced new considerations for supply chains and cost structures that ripple through digital media ecosystems, particularly where hardware, hosting, and cross-border services are involved. While digital content itself travels at negligible marginal cost, the infrastructure that enables creation, distribution, and consumption-such as devices, edge compute, and specialized production hardware-faces upward pressure when tariffs alter import dynamics. This in turn affects capital allocation for studios, independent creators, and distribution platforms that depend on scalable hardware and studio technologies.

Moreover, tariff-induced adjustments to vendor pricing and procurement strategies influence the economics of third-party service providers, including CDNs, cloud partners, and production equipment suppliers. Organizations are responding by diversifying supplier networks, prioritizing regional sourcing for critical components, and accelerating cloud-native production workflows that reduce reliance on high-cost physical infrastructure. Strategic contracting and longer-term supplier relationships are emerging as tools to mitigate volatility, while localized content production and region-specific partnerships are being pursued to preserve margin and speed to market amidst changing trade conditions.

A granular segmentation framework that links content formats, platform delivery, monetization models, applications, and industry verticals to practical product and commercial decisions

Segmentation provides the analytical granularity needed to prioritize investments and to tailor product and commercial strategies across content types, delivery platforms, monetization frameworks, functional applications, and industry verticals. By dissecting digital media into Audio Content categories such as music streaming, podcasts, and radio/audio advertising alongside Interactive Content, Text-based Content including articles, eBooks, and newsletters, Visual Content spanning graphics, infographics, and web design, and Video Content, leaders can align creative, editorial, and technical roadmaps to format-specific consumption patterns. Delivery platform segmentation underscores the distinct experience and performance expectations between mobile platforms and web-based platforms, which should influence UX design, latency tolerance, and ad formats.

Business model segmentation-spanning advertising-based, pay-per-content, and subscription-based approaches-illuminates divergent lifetime value profiles, churn dynamics, and acquisition economics. Application-driven segmentation, which encompasses use cases such as communication and social networking, education and eLearning, entertainment, events and live streaming, marketing and advertising, news and information, and training and simulation, clarifies where content utility intersects with user intent and where analytics investments will yield the greatest returns. Finally, vertical segmentation across automotive, education, finance and banking, government and public sector, healthcare, media and entertainment, real estate, and retail and eCommerce identifies regulatory, procurement, and adoption nuances that determine go-to-market tactics and partnership priorities. Together, these segmentation lenses enable precision in product feature roadmaps, pricing experiments, and sales enablement initiatives by mapping content formats and delivery choices to the specific needs and constraints of each application and industry vertical.

This comprehensive research report categorizes the Digital Media market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Digital Media Type

- Delivery Platform

- Business Model

- Application

- Vertical

Regional strategic imperatives that reconcile global platform standards with localized execution across the Americas, Europe Middle East & Africa, and Asia-Pacific

Regional dynamics exert a pronounced influence on consumer preferences, regulatory frameworks, and infrastructure investments, and the regional view is indispensable for companies with international ambitions. The Americas continue to demonstrate rapid adoption of new content formats and monetization experiments driven by large-scale platform penetration and an advertising ecosystem that values performance and measurement. In contrast, Europe, Middle East & Africa present a mosaic of regulatory regimes and language-driven content markets where privacy rules and localized distribution partnerships shape product design and compliance roadmaps. Asia-Pacific exhibits intense competition on mobile-first experiences, fast adoption of short-form video and live commerce, and varying degrees of platform dominance and payment preferences that require tailored localization and monetization strategies.

These regional distinctions compel different approaches to content licensing, partnerships, and infrastructure. Companies must weigh centralized platform capabilities against the need for regional customization, language support, and local data residency. Cross-border rights management and regional marketing operations will determine how quickly global content can be adapted to local tastes. Ultimately, a regional strategy that harmonizes global standards with local execution capabilities will enable organizations to capture diverse audience segments while maintaining operational efficiency and regulatory compliance.

This comprehensive research report examines key regions that drive the evolution of the Digital Media market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insights into competitive positioning and strategic moves among platforms, specialists, and aggregators that determine long-term differentiation and margin capture

Competitive dynamics within the digital media ecosystem reflect a mix of incumbent platforms, niche specialists, aggregator services, and vertically integrated content owners. Market-leading platforms continue to scale by bundling content types, leveraging data to refine personalization, and experimenting with hybrid monetization models. At the same time, specialist providers are winning on depth of expertise in areas such as podcast production, interactive content design, or enterprise training simulations, offering higher-margin services to targeted client segments. Aggregators and channel partners play a crucial role in discovery and distribution, and they increasingly act as intermediaries that shape how creators monetize content across advertising, subscription, and direct-pay channels.

Strategic partnerships, mergers, and technology licensing are common responses to the need for faster time-to-market and richer feature sets. Successful companies are investing in modular architectures to enable rapid experimentation, building proprietary data assets to sustain personalization advantages, and expanding content ecosystems through creator-friendly revenue shares and developer APIs. Talent investment in production, data science, product management, and platform engineering is also differentiating winners, especially where product roadmaps hinge on low-latency delivery and cross-format interoperability. For clients and investors, the critical question is how different players can sustain growth through diversification of revenue streams while keeping customer acquisition costs and churn under control.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Media market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc

- Amazon Web Services, Inc.

- Apple, Inc.

- AT&T Inc.

- ByteDance Ltd.

- Charter Communications Inc.

- Comcast Corporation

- Forbes Media LLC

- Fox Corporation

- Fuji Media Holdings, Inc.

- Google LLC by Alphabet Inc.

- Kaltura, Inc.

- Meta Platforms, Inc.

- Microsoft Corporation

- Netflix, Inc.

- Paramount Digital Media Services Private Limited

- Pinterest, Inc.

- Snap Inc.

- Sony Corporation

- Spotify AB

- Tencent Holdings Limited

- The Walt Disney Company

- Thomson Reuters Corporation

- Verizon Communications Inc.

- Warner Digital Media Design LLC

- WebMD LLC

- X Corp.

Practical strategic initiatives that leaders can deploy to transform content roadmaps, fortify supply chains, and unlock monetization across platforms and regions

Industry leaders should prioritize a set of actionable strategies to convert insight into market advantage. First, align product roadmaps to format-specific consumption behaviors by investing in lightweight creation tools for audio and short-form video while preserving long-form editorial quality for text-based content. Second, adopt modular platform architectures that enable rapid A/B testing of monetization models across advertising, subscription, and pay-per-content offerings, and ensure measurement frameworks can attribute value across those channels. Third, accelerate partnerships with regional distributors and local creators to secure culturally relevant content and to navigate regulatory and payment idiosyncrasies effectively.

Additionally, strengthen supply chain resilience by diversifying hardware and service vendors and by accelerating migration to cloud-native production and delivery stacks that reduce dependence on tariff-exposed equipment. Invest in privacy-first identity and measurement approaches that preserve targeting efficacy while honoring evolving regulatory requirements. Finally, prioritize talent acquisition in data engineering, content ops, and creator relations to sustain product innovation and to optimize unit economics across segments. Executives who couple these strategic moves with disciplined pilot frameworks and clear success metrics will be best positioned to scale offerings while managing risk and return.

A transparent and reproducible research methodology combining executive interviews, comparative benchmarking, and scenario-based analysis to support pragmatic decision-making

The research underpinning this analysis synthesizes qualitative and quantitative inputs to present a defensible view of industry dynamics and actionable implications for decision-makers. Primary research included structured interviews with senior executives across content creators, platform operators, advertising and subscription businesses, and infrastructure providers, complemented by case studies of successful product launches and partnership models. Secondary research drew on publicly available regulatory guidance, technology white papers, and reputable industry reporting to ensure contextual accuracy and to triangulate findings.

Analytical approaches leveraged thematic coding of interview transcripts to surface recurring pain points and opportunity areas, and scenario-based planning to explore implications of regulatory and tariff shifts. Comparative benchmarking across delivery platforms and business models helped isolate drivers of engagement and revenue resilience. Where appropriate, sensitivity analyses examined the operational levers organizations can manipulate to protect margins and accelerate adoption. The methodology emphasizes transparency in assumptions, reproducibility of key findings, and the provision of data segments that support tailored decision-making for product, commercial, and regional teams.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Media market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Media Market, by Digital Media Type

- Digital Media Market, by Delivery Platform

- Digital Media Market, by Business Model

- Digital Media Market, by Application

- Digital Media Market, by Vertical

- Digital Media Market, by Region

- Digital Media Market, by Group

- Digital Media Market, by Country

- United States Digital Media Market

- China Digital Media Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

A strategic synthesis outlining how platform agility, localized execution, and disciplined monetization experimentation create durable competitive advantage in digital media

In conclusion, the digital media landscape is defined by accelerating format innovation, evolving monetization experiments, and regional heterogeneity that together create both opportunity and complexity. Organizations that succeed will couple creative agility with robust technology platforms and disciplined commercial experimentation. They will focus on building interoperable content architectures, resilient supply chains, and privacy-compliant measurement systems that sustain personalization without sacrificing regulatory alignment. Moreover, successful market participants will adopt a regional mindset that balances centralized capabilities with localized execution to capture diverse audience preferences and payment behaviors.

The implications for leadership are clear: invest in modular platforms that support multiple content formats and delivery channels, develop flexible monetization strategies that can be tested and scaled, and build partnerships that reduce time-to-market while securing localized expertise. By integrating these elements into a coherent strategy, institutions can navigate tariff pressures, regulatory change, and evolving consumer attention to create enduring value and competitive differentiation.

Connect directly with our Associate Director for a consultative purchase process that aligns the research report to your strategic imperatives and stakeholder priorities

If you are preparing to make a decisive investment in a digital media market research report, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure tailored insights and an enterprise-ready delivery that aligns with your strategic priorities.

Ketan will help you evaluate the report scope, identify the segments and regions most relevant to your growth plans, and arrange a customized briefing that surfaces implications for product, platform, partnership, and pricing strategies. Engage with a consultative session to translate research findings into action plans, obtain executive summaries for stakeholder briefings, and request bespoke data slices by content type, delivery platform, business model, application, and vertical.

To initiate the purchase process, request a proposal that outlines licensing options, report deliverables, and available add-ons such as custom deep dives or analyst Q&A hours. The purchase pathway is designed to be consultative: it starts with a diagnostic conversation and proceeds to a tailored recommendation that maps research outputs to your commercial KPIs and implementation timeline.

- How big is the Digital Media Market?

- What is the Digital Media Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?