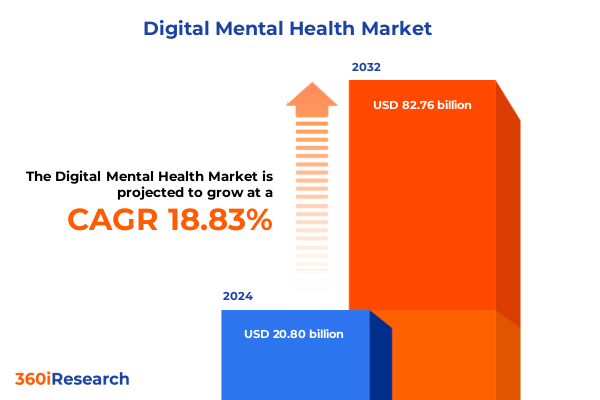

The Digital Mental Health Market size was estimated at USD 24.44 billion in 2025 and expected to reach USD 28.82 billion in 2026, at a CAGR of 19.02% to reach USD 82.76 billion by 2032.

Exploring the Evolving Landscape of Digital Mental Health Technologies and Strategic Imperatives for Stakeholder Engagement

The digital mental health arena is experiencing an unparalleled convergence of technology, clinical innovation, and user engagement. In recent years, advances in artificial intelligence, expanded broadband connectivity, and increased societal focus on mental well-being have catalyzed a seismic shift in how care is delivered, accessed, and experienced. These developments have not only democratized access to therapeutic resources but also introduced novel modalities of care that transcend traditional clinical settings. The acceleration of virtual platforms and mobile interventions has challenged providers and stakeholders to rethink care pathways, reimbursement models, and data governance frameworks.

Against this dynamic backdrop, organizations across the public and private sectors are seeking actionable intelligence to inform strategic planning and investment decisions. The demand for comprehensive insight spans from C-suite executives-tasked with sculpting organizational road maps-to clinical leaders and technology innovators striving to align patient outcomes with digital tools. As the market matures, an in-depth understanding of emerging technologies, user adoption patterns, and regulatory pressures becomes indispensable. This report provides that foundational analysis, offering a synthesis of market drivers, disruptive forces, and practical implications that will empower decision-makers to navigate complexity and unlock sustainable growth.

Understanding Pivotal Transformations Catalyzed by Artificial Intelligence and Remote Care Innovations in the Mental Health Sector

The landscape of digital mental health is undergoing transformative revolutions driven by artificial intelligence, data analytics, and the normalization of remote care. At the forefront of this change are AI-driven chatbots and virtual assistants that offer personalized, on-demand support through natural language processing and machine learning. These tools not only augment traditional therapy by facilitating continuous symptom tracking but also enhance patient engagement by delivering tailored interventions outside clinical hours. Simultaneously, consumer-facing software and mobile applications continue to proliferate, incorporating gamification and cognitive behavioral therapy frameworks to support self-guided wellness journeys.

Furthermore, the proliferation of teletherapy and telemedicine platforms has dismantled geographical barriers, enabling individuals in rural and underserved regions to access licensed clinicians and specialized care. Interoperability standards have improved, allowing seamless integration between electronic health records and virtual care portals. Meanwhile, wearable devices equipped with biometric sensors are becoming integral to holistic therapy paradigms by providing real-time insights into sleep, stress markers, and activity levels. These converging developments underscore a shift from episodic interventions to continuous care models and necessitate a recalibration of clinical protocols, reimbursement structures, and data security measures.

Evaluating the Multifaceted Consequences of 2025 United States Tariff Measures on Digital Mental Health Technology Supply Chains

In 2025, the United States introduced targeted tariff measures affecting imported technology components and digital devices, a policy shift with multifaceted repercussions for digital mental health solution providers. Components essential to wearable health trackers and remote monitoring devices increased in cost, leading some manufacturers to reevaluate global supply chains. As a consequence, organizations relying on hardware-enabled interventions faced pressure to absorb elevated production expenses or seek alternative vendors capable of maintaining rigorous quality and certification standards.

Moreover, these tariffs influenced pricing strategies for software licensing and cloud-based mental health platforms. Service providers have grappled with balancing margin preservation against the imperative to keep digital therapy affordable for end users, particularly within subscription-based and freemium models. Interim solutions have included renegotiating contracts for data center services and on-premise deployments to mitigate escalated infrastructure outlays. In turn, some vendors have accelerated domestic manufacturing partnerships and invested in local assembly hubs to circumvent long-term tariff exposure. This dynamic underscores the importance of strategic procurement planning and the cultivation of resilient supply networks to safeguard service continuity and cost competitiveness.

Illuminating Critical Segmentation Perspectives Across Therapeutic Applications Offerings Demographics Pricing Models and Deployment Approaches

The digital mental health market exhibits nuanced layers of segmentation driven by technology offerings, patient demographics, pricing schemes, deployment architectures, therapeutic focus areas, and end-user contexts. Within the spectrum of offerings, solutions range from advanced AI-powered chatbots and virtual assistants designed to engage users around the clock to sophisticated software platforms and mobile applications that deliver interactive coping exercises. Teletherapy and telemedicine solutions bridge the gap between remote patients and licensed clinicians, while wearable devices capture physiological data to inform personalized treatment pathways.

Age group considerations further differentiate solution applicability, with platforms tailored to adult users emphasizing workplace stress management or mood regulation, applications for children and adolescents incorporating gamified learning to build resilience, and geriatric-focused interfaces addressing cognitive decline and social isolation. Pricing model innovation spans freemium access to facilitate low-barrier entry, one-time license purchases for enterprise deployments, pay-per-use frameworks for episodic interventions, and subscription-based models that ensure predictable revenue streams and ongoing feature enhancements.

From a deployment standpoint, cloud-native services offer rapid scalability and remote update capabilities, while on-premise implementations appeal to entities with stringent data residency and compliance mandates. Therapeutic applications cover a breadth of mental health conditions, including anxiety and stress management, depression and mood disorder treatment, eating disorder support, obsessive-compulsive disorder therapy, post-traumatic stress disorder programs, schizophrenia care, and substance abuse recovery tools. Finally, the end-user landscape spans large corporations integrating mental wellness into employee benefit plans, educational institutions embedding digital coping resources into student services, governments and NGOs deploying community outreach platforms, hospitals and clinics augmenting traditional care pathways, and individuals seeking self-guided support solutions.

This comprehensive research report categorizes the Digital Mental Health market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offerings

- Age Group

- Pricing Model

- Deployment

- Therapeutic Application

- End User

Examining Regional Dynamics and Diverse Growth Drivers Shaping the Expanding Digital Mental Health Ecosystem across Key Global Markets

Regional market dynamics are shaped by diverse regulatory frameworks, healthcare infrastructures, and technology adoption rates across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, robust private-sector investments and established reimbursement pathways have accelerated the uptake of subscription-based mental health apps and teletherapy platforms. North American stakeholders benefit from cohesive data privacy legislation and collaborative pilot programs between payers and digital providers, fostering rapid iteration of integrated care models.

Across Europe, Middle East & Africa, digital mental health initiatives are propelled by government-supported mental wellness strategies and cross-border interoperability standards. The European Union’s Digital Health and Care Innovation initiative has catalyzed harmonization efforts, enabling regional vendors to scale solutions across member states. In the Middle East, public-private partnerships have facilitated the deployment of mobile counseling apps in urban centers while non-profit organizations address mental health stigma through educational platforms.

Meanwhile, Asia-Pacific markets exhibit immense heterogeneity, with advanced economies such as Japan and South Korea leading in wearable-enabled therapy integration, whereas emerging economies in Southeast Asia prioritize cost-effective mobile interventions to bridge mental health professional shortages. Strategic collaboration between telecom operators and digital health startups has fostered rural outreach, and government mandates emphasizing telemedicine reimbursement have further bolstered platform adoption. These regional variances underscore the necessity for market entrants to tailor go-to-market strategies in alignment with local policy environments and cultural considerations.

This comprehensive research report examines key regions that drive the evolution of the Digital Mental Health market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives Competitive Positioning and Innovation Trajectories of Leading Digital Mental Health Market Players

Leading organizations within the digital mental health domain continue to refine strategic initiatives by leveraging core competencies in technology, clinical validation, and user experience design. Prominent teletherapy providers have forged partnerships with major health systems to integrate virtual counseling as a standard of care, while subscription-based mental wellness applications have differentiated themselves through proprietary content libraries and AI-facilitated personalization engines. Companies specializing in AI-driven chatbots have expanded their algorithms to detect linguistic indicators of crisis, enabling real-time escalation to human clinicians when necessary.

Several market players have pursued acquisitions to bolster their therapeutic portfolios, integrating gamified cognitive behavioral therapy modules or biometric data analytics into existing platforms. Others have invested heavily in cross-platform interoperability, ensuring seamless data exchange between wearable devices, mobile applications, and electronic health record systems. To address demographic segments with unique needs, customized interfaces and culturally adapted content libraries have been introduced for youth and geriatric cohorts.

Innovation trajectories also reveal an increased focus on enterprise solutions, with workforce mental health platforms embedding digital triage tools into employee assistance programs. Collaborative ventures with pharmaceutical firms are underway to assess digital therapeutics as adjuncts to medication regimens. These strategic maneuvers illustrate how competitive positioning is increasingly defined by clinical partnerships, data intelligence capabilities, and the ability to deliver holistic user journeys that combine prevention, intervention, and long-term monitoring.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Mental Health market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Well Corporation by Avel eCare, LLC

- Anise Health

- Big Health, Inc.

- Calm.com, Inc.

- Cerebral Inc.

- Eleos Health, Inc

- Even Healthcare Private Limited

- Fini LLC

- Headspace, Inc.

- HealthRhythms

- INVI MindHealth Inc

- Iron Bow Healthcare Solutions

- Koa Health, Inc.

- Kooth Group PLC

- LifeStance Health, Inc.

- Likeminded GmbH

- Little Otter

- Lyra Health, Inc.

- Mantra Health, Inc.

- Medea Mind

- Meru Health, Inc.

- MindDoc Health GmbH by Schön Klinik SE

- Mindset Health

- Modern Health, Inc.

- NeuroFlow Inc.

- Oliva Health Ltd.

- Ontrak Inc

- Personify Health

- Plumm Ltd

- Prosoma sp. z o. o.

- Sanctus

- Self Space LTD.

- Spill

- Spring Care, Inc.

- Surgo health

- Syra Health Corp.

- Talkspace, Inc.

- Teladoc Health, Inc.

- Twill Inc. by DarioHealth Corp.

- Unmind Inc

- Woebot Labs, Inc.

- Wysa Inc.

- Youper, Inc.

Formulating Actionable Strategic Guidance to Drive Sustainable Growth and Stakeholder Value in the Digital Mental Health Industry

To effectively capitalize on the accelerating demand for digital mental health solutions, industry leaders should prioritize a dual approach that balances technology innovation with stakeholder alignment. Emphasizing research partnerships with academic institutions and healthcare systems will validate therapeutic efficacy and support regulatory approvals, thereby enhancing market credibility. Concurrently, investing in advanced analytics and predictive modeling can refine personalization engines to deliver contextually relevant interventions, improving engagement and clinical outcomes over time.

Operational resilience demands proactive supply chain diversification, particularly in light of recent tariff-driven cost pressures on hardware components. Establishing strategic alliances with domestic manufacturers and exploring regional production hubs can mitigate disruption risks and control margin erosion. Furthermore, designing flexible pricing structures that address the affordability needs of underserved demographics will expand market reach while sustaining revenue growth.

Finally, fostering interoperability through adherence to emerging data exchange standards and privacy frameworks will expedite integration with existing healthcare infrastructures. By aligning product road maps with payer reimbursement models and employer wellness initiatives, vendors can secure favorable coverage policies and embed digital solutions as core elements of organizational mental health strategies.

Outlining Rigorous Research Frameworks Data Collection Methodologies and Validation Processes Employed Throughout the Study

This study leverages a robust multi-stage research design combining secondary data analysis with primary qualitative inquiries to ensure comprehensive coverage and analytical depth. The secondary research phase included an exhaustive review of peer-reviewed publications, policy documents, patent filings, and publicly available corporate disclosures to map technological innovations, regulatory trends, and competitive landscapes.

Subsequently, in-depth interviews were conducted with clinical experts, mental health practitioners, technology developers, and industry executives to validate assumptions, gauge user adoption dynamics, and uncover nascent market opportunities. These primary insights were triangulated with market transaction data and usage metrics to enhance reliability.

Data segmentation employed rigorous categorization across offerings, age demographics, pricing approaches, deployment models, therapeutic applications, and end-user contexts. Regional analyses were informed by local market intelligence to capture jurisdiction-specific drivers and barriers. Throughout the analytical process, methodological rigor was maintained via cross-validation, peer reviews by subject matter specialists, and adherence to standardized protocols for data integrity and transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Mental Health market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Mental Health Market, by Offerings

- Digital Mental Health Market, by Age Group

- Digital Mental Health Market, by Pricing Model

- Digital Mental Health Market, by Deployment

- Digital Mental Health Market, by Therapeutic Application

- Digital Mental Health Market, by End User

- Digital Mental Health Market, by Region

- Digital Mental Health Market, by Group

- Digital Mental Health Market, by Country

- United States Digital Mental Health Market

- China Digital Mental Health Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Drawing Comprehensive Conclusions That Synthesize Insights and Reinforce Strategic Opportunities within the Digital Mental Health Market

The convergence of AI, telehealth platforms, and wearable technologies is redefining the contours of mental healthcare, creating unprecedented opportunities for scalable, personalized interventions. As tariff policies reshape supply chain configurations and cost architectures, successful market participants will exhibit agility through diversified sourcing strategies and adaptive pricing models. Segmentation insights reveal that tailoring solutions to specific therapeutic applications, demographic cohorts, and end-user settings enhances engagement and clinical impact.

Regional variances underscore the importance of aligning market entry strategies with local regulatory regimes and cultural preferences, while competitive mapping highlights the significance of innovation partnerships and enterprise integration. By synthesizing these findings, leaders can formulate targeted approaches that balance clinical validation with technological differentiation and stakeholder value creation. The imperative now is to translate this comprehensive understanding into strategic action plans that address evolving patient needs, regulatory landscapes, and technological frontiers.

Engaging Decision Makers with a Responsive Invitation to Explore In Depth Findings and Connect with Lead Associate Director for Report Acquisition

The insights outlined throughout this executive summary highlight the immense potential within the digital mental health sphere and underscore the necessity for informed decision making. To delve deeper into the comprehensive report and access proprietary data, strategic analyses, and tailored recommendations designed to drive your organization’s success, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise and personalized guidance will ensure your team secures the critical intelligence required to capitalize on emerging trends, navigate regulatory complexities, and implement growth strategies that resonate with key stakeholders. Engage today to transform high-level insights into actionable plans that deliver measurable outcomes and secure a competitive edge in the rapidly evolving digital mental health landscape

- How big is the Digital Mental Health Market?

- What is the Digital Mental Health Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?